Managing expenses effectively is crucial for independent contractors who need to keep track of their business expenses for tax purposes. While numerous digital tools can help with this, starting with a free, simple independent contractor expenses spreadsheet is a great way to get organized.

What is an independent contractor expenses spreadsheet?

An expense tracker spreadsheet is a tool for recording and managing expenses systematically. It's primarily used by individuals, small business owners, freelancers, and anyone needing to monitor their spending for personal finance, business accounting, or tax purposes. The spreadsheet helps organize expenses into categories, making it easier to see where money is spent.

What are the key features of an expense tracker spreadsheet?

An independent contractor expenses spreadsheet should include the following:

Categories

Expense categories are divided into rent, utilities, groceries, transportation, and business expenses. This categorization helps in analyzing spending patterns and budgeting more effectively.

Date and description

Each entry typically includes a date and a brief expense description, providing clarity and context for each transaction.

Amount

The amount spent on each transaction is recorded, allowing for tracking of total expenditures and budget adherence.

Payment method

The spreadsheet may also track how each expense was paid (e.g., cash, credit card, debit card, check), which can help manage cash flow and financial planning.

Receipts

Some business expense trackers also include a column to note whether a receipt was collected for the transaction, which is essential for business expenses and tax documentation.

Formulas

Spreadsheets can include formulas to automatically sum up total expenses, calculate averages, or compare spending against a budget, saving time and reducing errors in manual calculations.

Overall, an independent contractor expenses spreadsheet is a versatile and invaluable tool for financial management. It offers a straightforward method for monitoring and controlling expenses efficiently.

What are some free 1099 expense tracker spreadsheets?

Here are five free 1099 expense tracker spreadsheets that are great for small business owners:

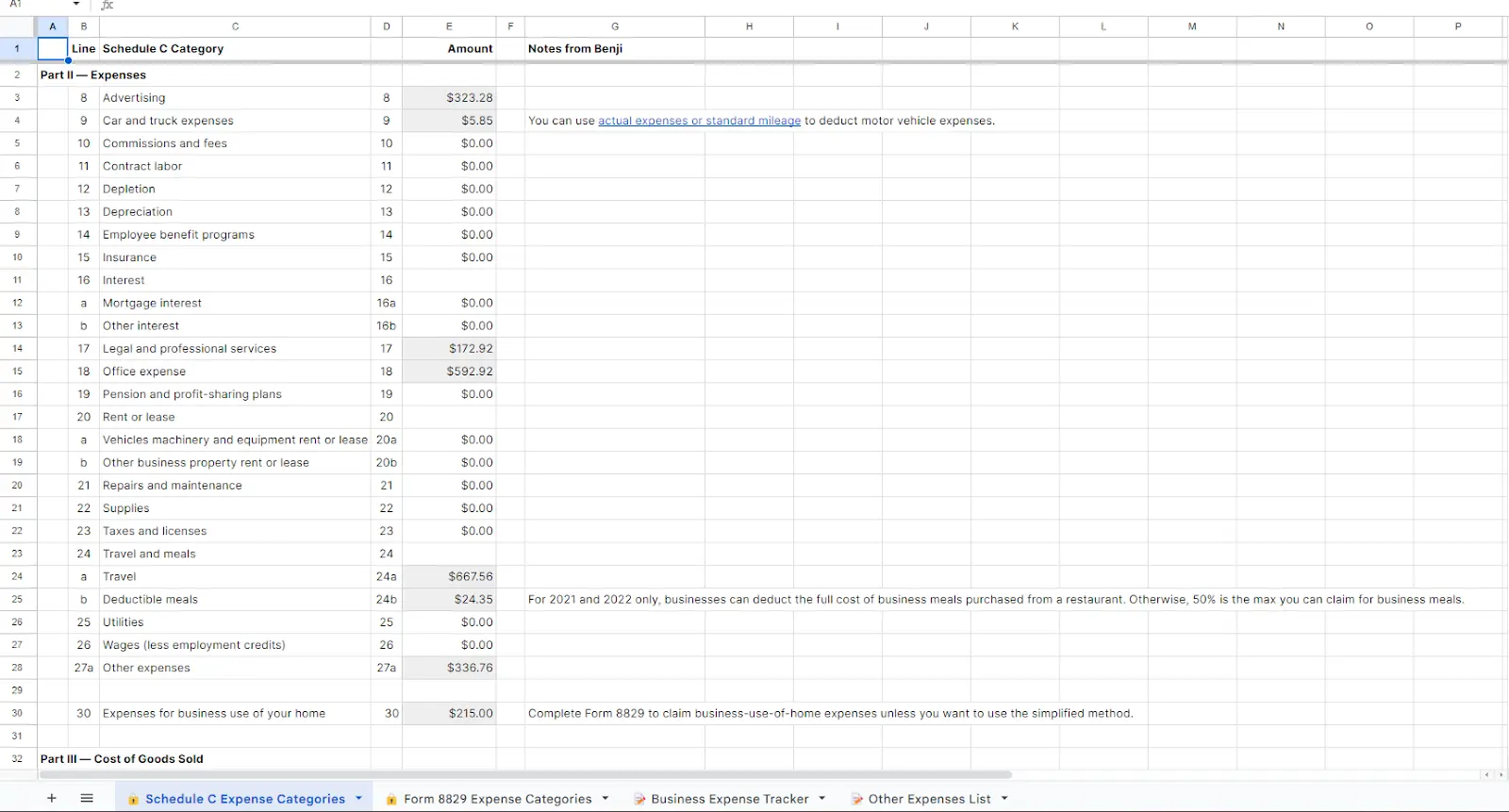

1. Benji — Expense Tracker for Creators (Schedule C)

Google Sheets offers several free templates for 1099 expense trackers. These templates are customizable, cloud-based, and can be accessed from any device, making them perfect for tracking on the go.

Sole proprietors in the United States use Schedule C (Form 1040) to report business income and expenses. This free independent contractor expenses spreadsheet by Benji helps you track business expenses using Schedule C expense categories.

2. Bonsai 1099 Template Excel.xlsx

Excel provides various free templates that are more detailed and suitable for those familiar with advanced features. These templates allow for complex calculations and can be tailored to specific needs.

This free Excel spreadsheet is perfect for 1099 expenses. It provides all the essential information needed to prepare a Schedule C and can quickly be passed along to your tax professional.

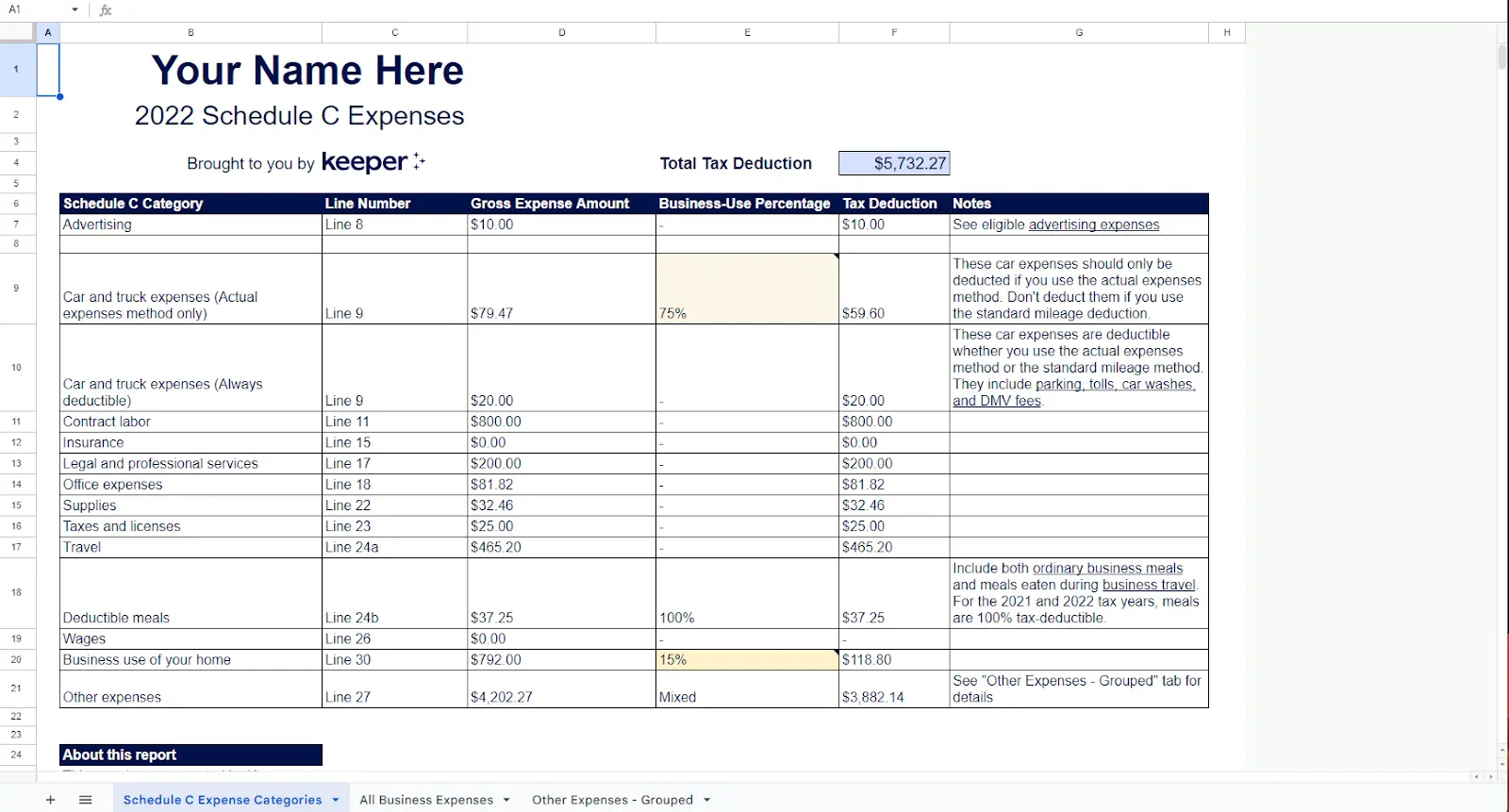

3. Keeper 1099 Expenses Spreadsheet

Here's another great free Excel spreadsheet. This free independent contractor expenses spreadsheet helps you track everything you buy for work and groups them according to their appropriate Schedule C expense categories. You can use it to lower your self-employed net income and save on your tax payments.

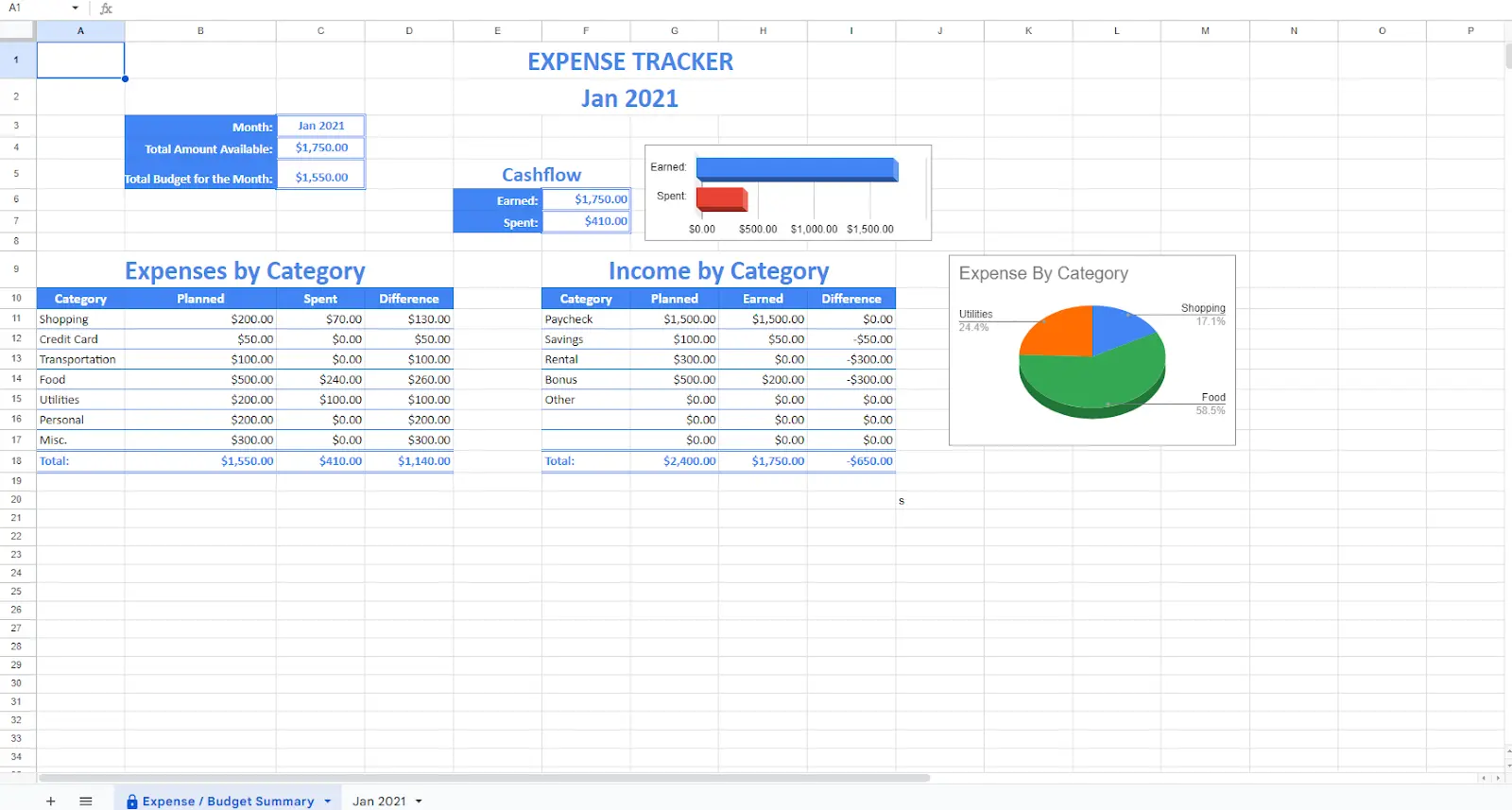

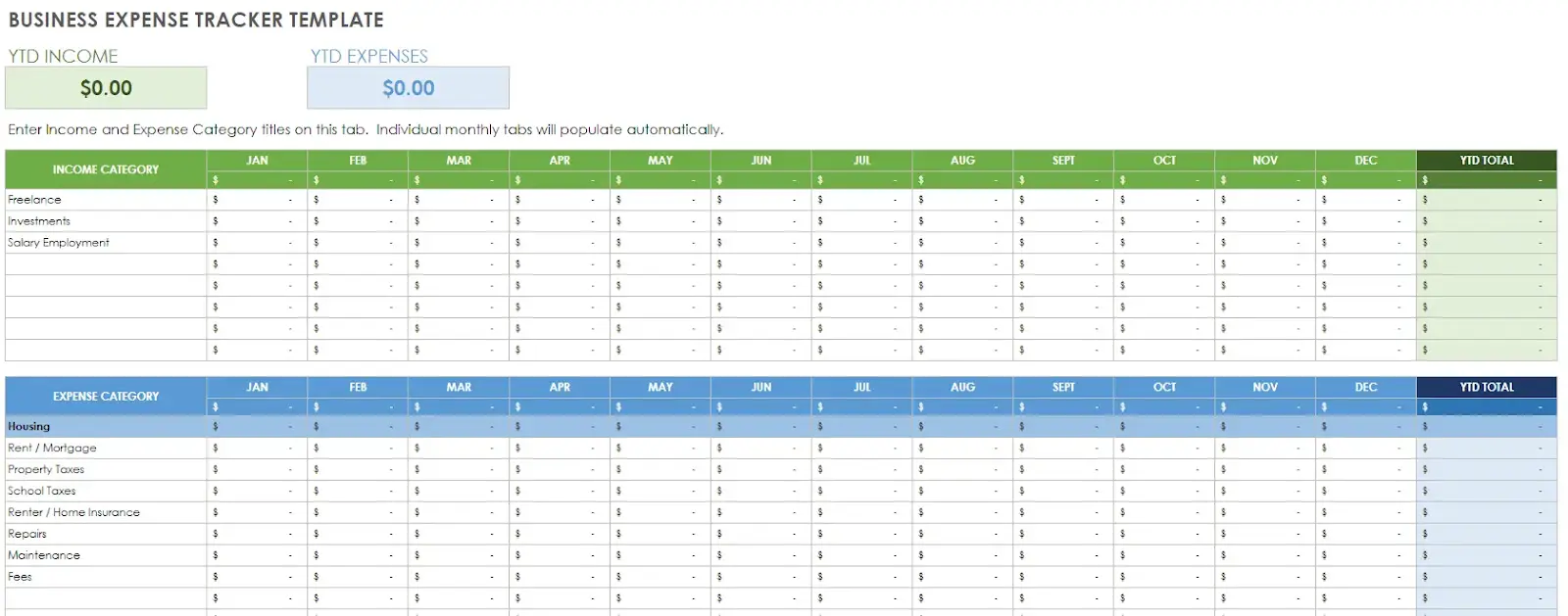

4. Spreadsheetpoint Google Sheets Expense-Income Tracker

Spreadsheetpoint's Google Sheets Expense-Income Tracker is an income and expenses spreadsheet that makes your income and Schedule C expense categories very transparent. This free template can be used for sole proprietors and personal or other expenses.

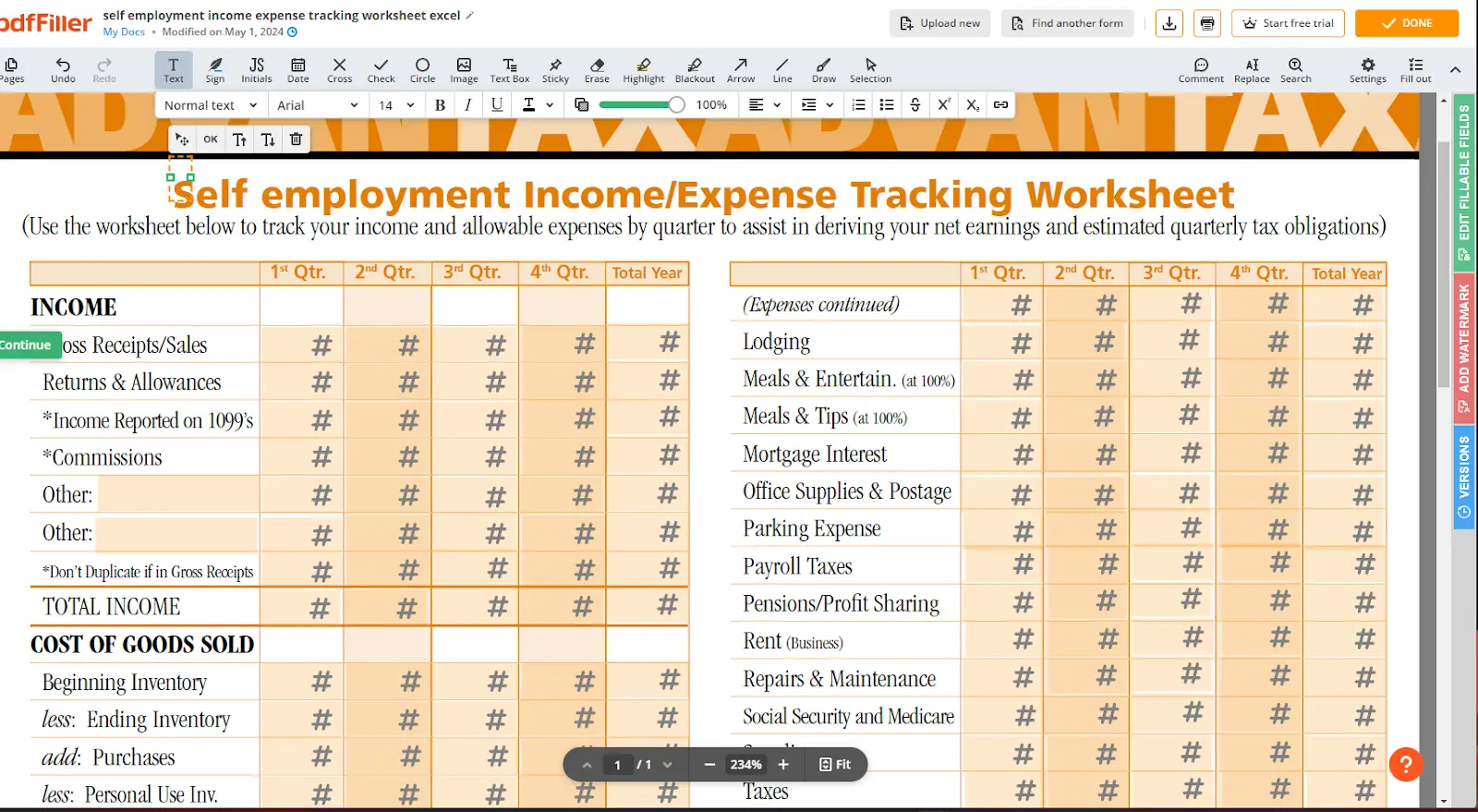

5. Self-employment income/expense tracking worksheet

This self-employment income/expense tracking worksheet makes transferring data to the appropriate tax forms easy. This free template is an Excel spreadsheet that tracks income, self-employment tax, costs incurred, personal expenses, Schedule C expenses, and other expenses.

While these spreadsheets provide a good starting point, they require manual entry and maintenance, which can be time-consuming and prone to human error.

Bonus: Shoeboxed - Best alternative to manual independent contractor expenses spreadsheets

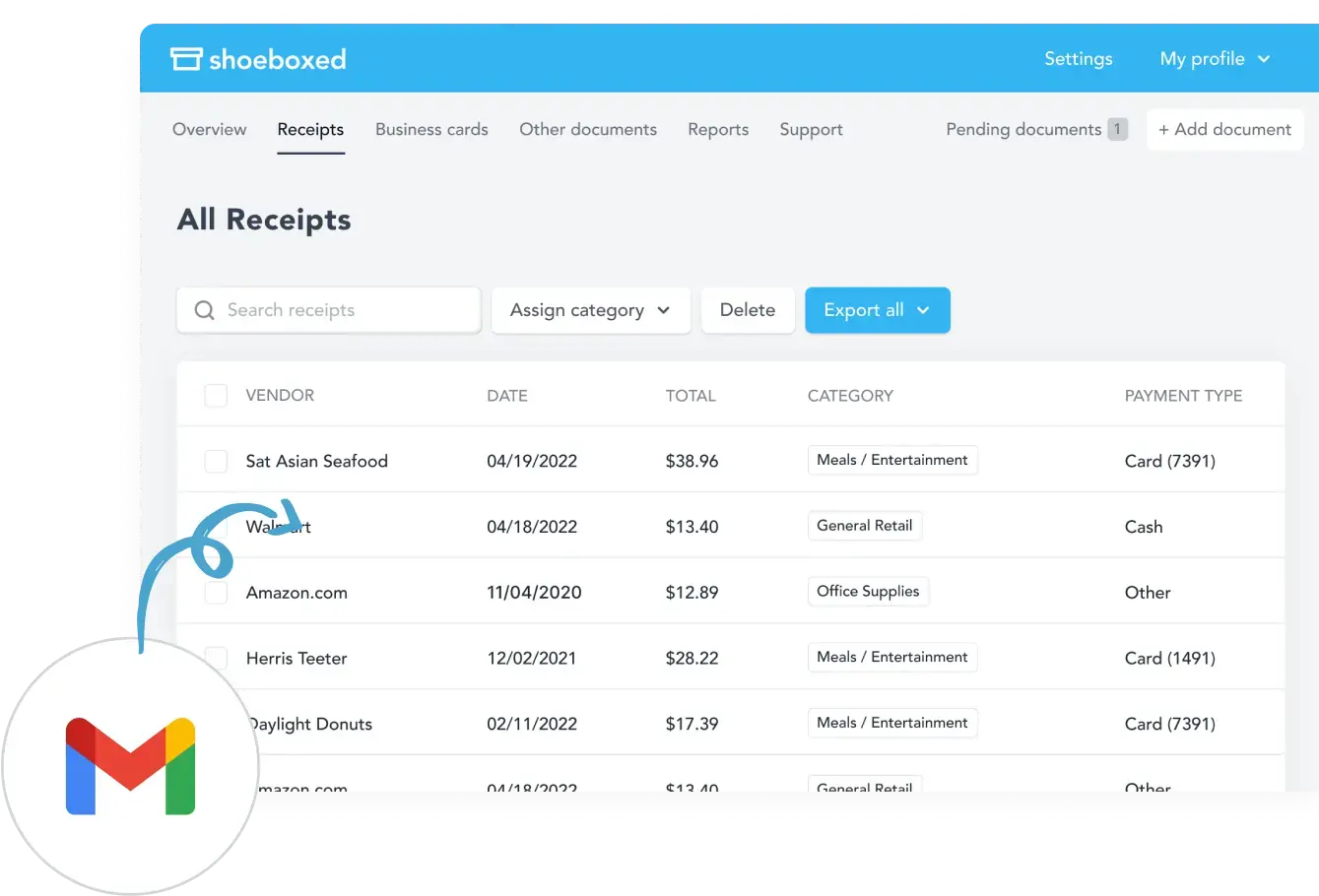

For those looking for an alternative to manual independent contractor expenses spreadsheets for tracking income and expenses, Shoeboxed is a powerful tool for tracking expenses, receipts, pay stubs, and other documents. It is an excellent alternative to manual spreadsheets.

Break free from paper clutter ✨

Use Shoeboxed’s Magic Envelope to ship off your receipts and get them back as scanned data in a private, secure cloud-based account. 📁 Try free for 30 days!

Get Started TodayAutomation

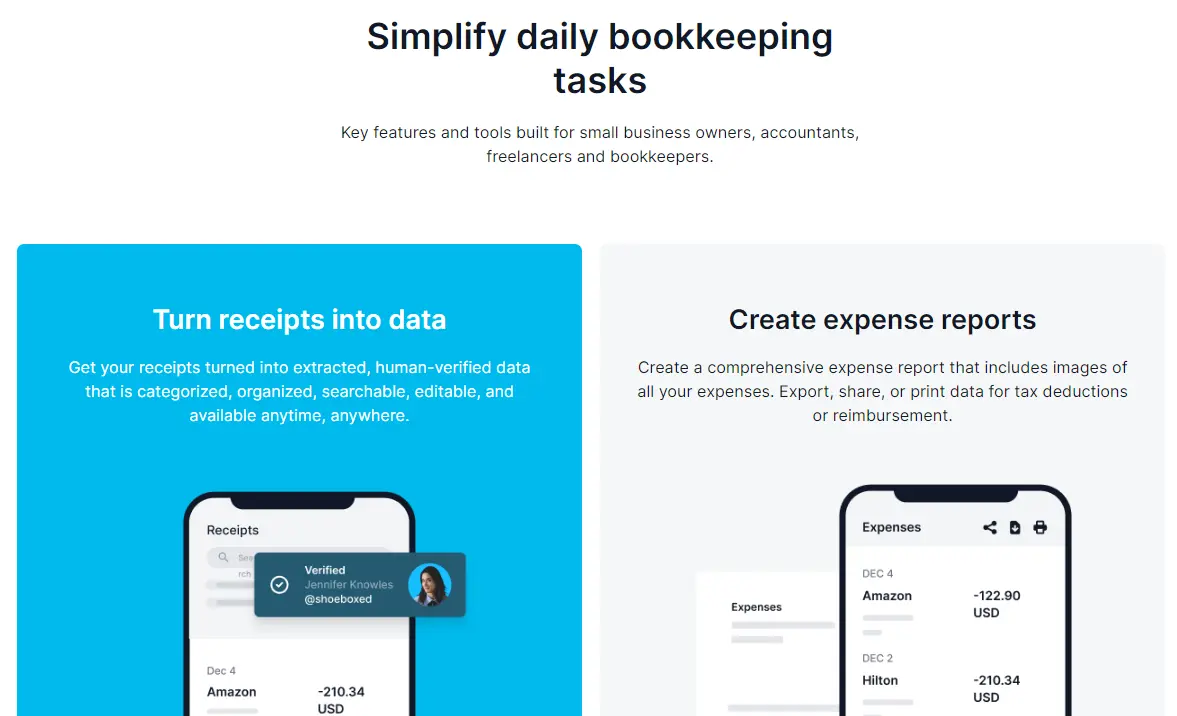

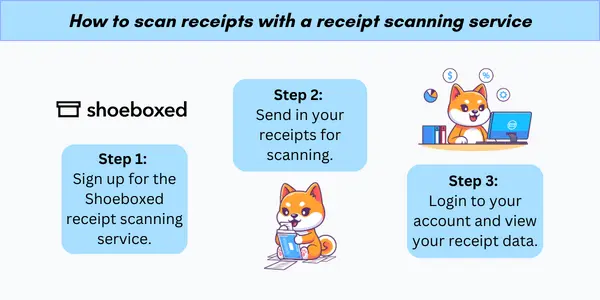

Shoeboxed offers many features to make expense tracking more efficient than manual independent contractor expenses spreadsheet tracking. It automates expense tracking by digitizing the data from your receipts to organize it for business reports, taxes, or even personal use. This process can be done in one of three ways.

You can use Shoeboxed's app and take pictures of receipts with your smartphone's camera. Shoeboxed then automatically extracts critical data from scanned receipts and business cards, including vendor, date, amount, and payment type.

This automation reduces the time and potential errors associated with manual data entry, making it much more efficient than maintaining a Google or Excel spreadsheet.

Or, if you don't want to use the app to scan those Schedule C expenses, Shoeboxed offers an expense-tracking service. With their service, customers are provided a postage-paid envelope or The Magic Envelope to mail their receipts to Shoeboxed's processing center. There, they scan your receipts for you, human-verify them, and upload them into your account.

Shoeboxed also offers a Gmail receipt sync feature for managing electronic receipts. This feature is designed to automatically extract receipt information directly from your Gmail account. Once you link your Gmail account to Shoeboxed, the system scans your emails to identify those containing receipts.

The software automatically pulls receipts from your emails and imports them into your Shoeboxed account. This includes receipts embedded in the subject line or body of the emails and those attached as PDFs, images, or other document formats.

Organization

Shoeboxed provides a cloud-based solution for organizing receipts and business documents, which can be accessed from anywhere. This contrasts with spreadsheets, where document management involves manual organization, and storage can be disjointed depending on how files are saved and backed up.

Expense reports

Generating expense reports with Shoeboxed is straightforward. Monthly expenses are auto-categorized, and users can easily create reports directly within the app. These reports can be exported to PDF, CSV formats, or accounting software like QuickBooks. With spreadsheets, for example, creating similar reports typically requires more complex manipulation of data and formulas.

IRS Acceptance

Shoeboxed ensures that all scanned receipts are compliant with IRS requirements. Knowing that the IRS accepts your digital receipts provides peace of mind during tax season or in the event of an audit. In contrast, maintaining physical receipts or using spreadsheets requires additional steps and time to ensure compliance and preservation.

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic award-winning approach to receipt tracking for tax season. Try free for 30 days!

Get Started TodayIntegration

Shoeboxed seamlessly integrates with significant accounting software and bookkeeping platforms, enhancing the overall workflow for financial management. This integration allows for real-time, monthly income and expense tracking and financial reporting, which can be more cumbersome when using spreadsheets that require manual updates and imports.

Accessibility

All receipts and expenses are stored in the cloud, accessible from anywhere, and completely secure. That means you can access your data from anywhere with the internet.

Shoeboxed offers a significant upgrade over traditional spreadsheet methods for freelancers and contract labor who need a robust system that saves time and ensures accuracy.

What 1099 expenses should you track?

Typically, self-employed or an independent contractor should track various expenses directly related to their business activities. These expenses are often tax deductions that can significantly reduce your taxable income when tax time rolls around if adequately documented.

Here's a rundown of common types of business costs that independent contractors should track for eligible deductions:

a. Home office expenses

If you use a portion of your home exclusively for business, you can deduct expenses related to the area of the house where business is conducted.

The home office deduction includes the following independent contractor expenses:

Rent, mortgage payments, or mortgage interest

Utilities like electricity and water

Home insurance

Property taxes

Repairs and maintenance specifically for the office area

See also: Home Expenses Template: Top 3 Free Templates + Bonus Service

b. Office supplies and equipment

All the expenses for items necessary to run your own business are considered a tax deduction, including:

Computers and software

Printers and ink

Paper, pens, and other office supplies

Furniture like desks and chairs

c. Communication expenses

Costs associated with independent contractor expenses incurred with business communications are considered tax deductions:

Business phone bills

Internet bills

Postage

d. Travel expenses

When travel is required for independent contractors, the following travel expenses can be deducted from the tax bill:

Airfare, bus, or train tickets

Hotel stays

Car rentals and mileage (using the standard mileage rate or actual expenses)

Business meals (subject to limitations)

e. Vehicle use

If you use your vehicle for business, you can deduct vehicle expenses and mileage using either the actual expense method or the standard rate method.

Mileage (using the standard mileage rate)

Gas and oil

Repairs and maintenance

Insurance

Registration fees

f. Retirement contributions

Contributions to a self-employed retirement plan, such as a SEP IRA, SIMPLE IRA, or a solo 401(k), are tax deductions.

g. Education and training

Costs for education and training that maintain or improve skills required for your business or that are required by law or regulations for maintaining your license are considered a tax deduction.

h. Marketing and advertising

Expenses to promote your business name, including advertising costs:

Advertising in print or online

Business cards

Website development and maintenance

Social media marketing

i. Professional services

Fees for independent contractors professional services related to your business operations, such as:

Legal fees

Accounting, bookkeeping, or tax professional

Consulting

j. Licenses and permits

Costs for necessary business licenses and permits.

k. Business insurance

Premiums for business insurance policies, such as general or professional liability insurance.

l. Bank or merchant fees

Fees related to a business bank account or credit card include annual, interest, and transaction fees.

During tax season, 1099 contractors must keep detailed records and retain receipts or other proof of payment to substantiate deductible expenses when tracking these and other expenses. Proper documentation supports the tax deduction claimed on the tax return and protects it in case of an IRS audit.

See also: Income and Expense Worksheet: 4 Free Templates

Why should you track expenses?

Tracking expenses is fundamental for individuals and businesses, offering several crucial benefits that can significantly impact financial health and strategic decision-making.

Here are some of the key reasons why you should track expenses:

Budget management

Tracking expenses helps you understand where your money goes and ensures you spend only what you earn. It allows you to adjust your spending habits to stay within a budget, preventing overextension and helping you achieve financial goals more efficiently.

Financial awareness

Regularly monitoring your expenses increases your awareness of spending patterns. This awareness can reveal unnecessary expenditures or areas where you might save money, fostering more informed and deliberate spending decisions.

Tax preparation

Tracking Schedule C expenses is critical to maximizing deductions and lowering taxable income for individuals, primarily self-employed individuals. Many expenses can be tax-deductible, and meticulous record-keeping can maximize those deductions, potentially reducing your tax liability. It also makes filling out required tax forms much more manageable, such as your tax return.

Improves saving habits

With a clear understanding of spending, you can identify opportunities to save money. Setting aside funds for emergencies, retirement, or specific financial goals becomes more manageable when you know how much money you can allocate toward monthly savings.

Reduces financial stress

Knowing where your money is going can reduce financial anxiety and stress. It provides a sense of control and confidence in managing your money, leading to better financial decisions.

Helps in debt management

Tracking your business expenses can be particularly beneficial if you are working to pay down debt. It helps ensure you are allocating enough money toward debt repayment and can prevent additional debts by keeping spending in check.

Facilitates financial planning

Expense tracking provides valuable financial data that can inform your long-term financial strategies. Understanding your spending habits and financial commitments allows for more accurate forecasting and planning for future expenses like home purchases, education, travel, or retirement.

Ensures accurate financial reporting

For businesses, tracking expenses is essential for accurate financial reporting. It ensures that financial statements, such as profit and loss, balance sheets, and cash flow statements, reflect the true financial position of the business.

Aids in audit compliance

Properly documented expenses can simplify the audit process, whether internal or external. Detailed records and receipts support the legitimacy of transactions and tax deductions, which is crucial during tax audits or financial reviews.

Optimizes business spending

For independent contractors, tracking expenses can highlight areas where spending is excessive or could be optimized for better efficiency. This could involve negotiating better terms with suppliers, cutting costs on non-essential services, or reallocating budgets to more profitable areas.

How do you create an independent contractor expenses spreadsheet?

If you decide to go with spreadsheets, here’s a step-by-step guide to help you set up your own Schedule C expense tracker.

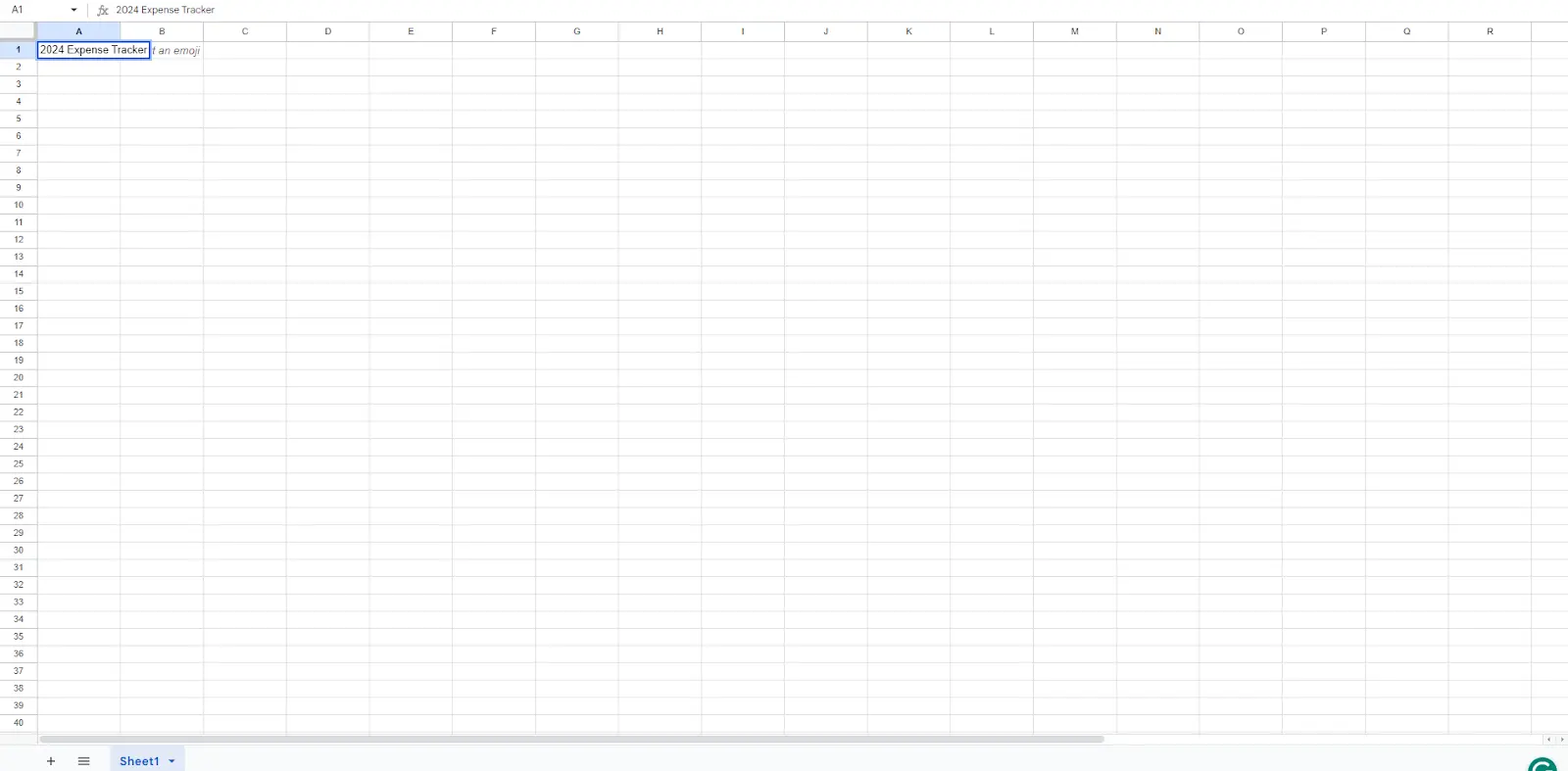

Step 1: Set up your Google Sheets document

Open Google Sheets: Go to Google Sheets in your web browser. If you're not already signed in to your Google account, you must do so.

Create a new spreadsheet: Click on the blank spreadsheet option or select a template if you prefer to start with a pre-designed layout.

Step 2: Design your expense tracker

Define categories: At the top of the first column, type “Date” to record the date of each transaction. In the following columns, add headings like “Description,” “Category,” “Amount,” and “Payment Method.” You can customize these categories based on your tracking needs (e.g., “Business,” “Personal,” “Utilities,” “Groceries”).

-

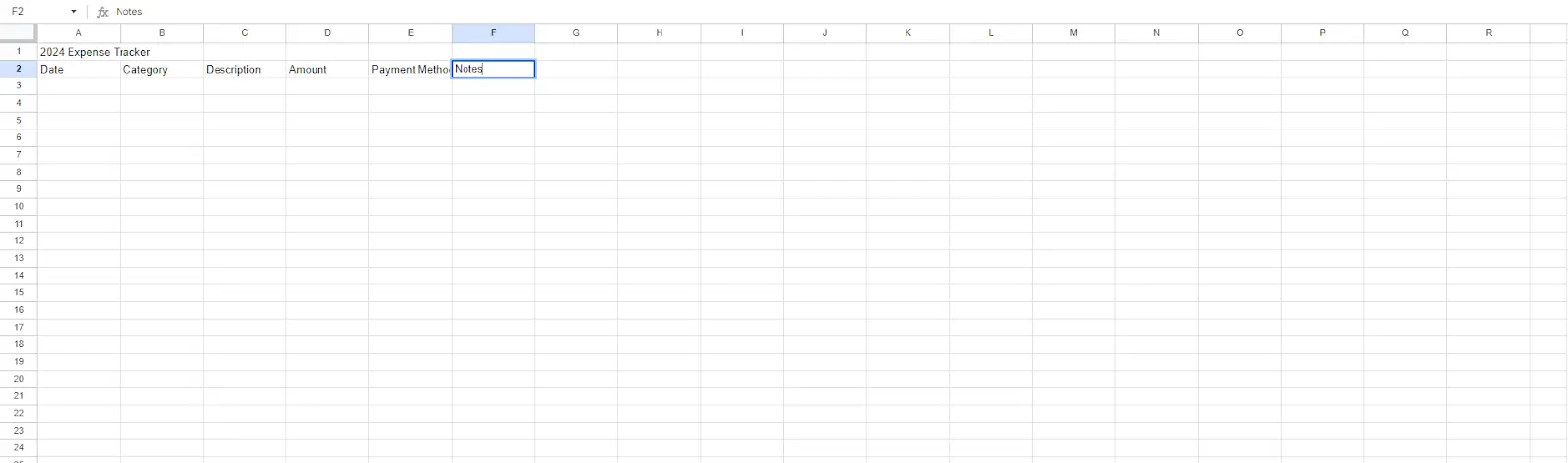

Create categories dropdown: You can create a dropdown list for the “Category” column to make data entry easier. To do this:

Select the cells in the “Category” column.

Go to Data > Data validation.

Choose “List of items” and enter your categories separated by commas.

Click “Save”.

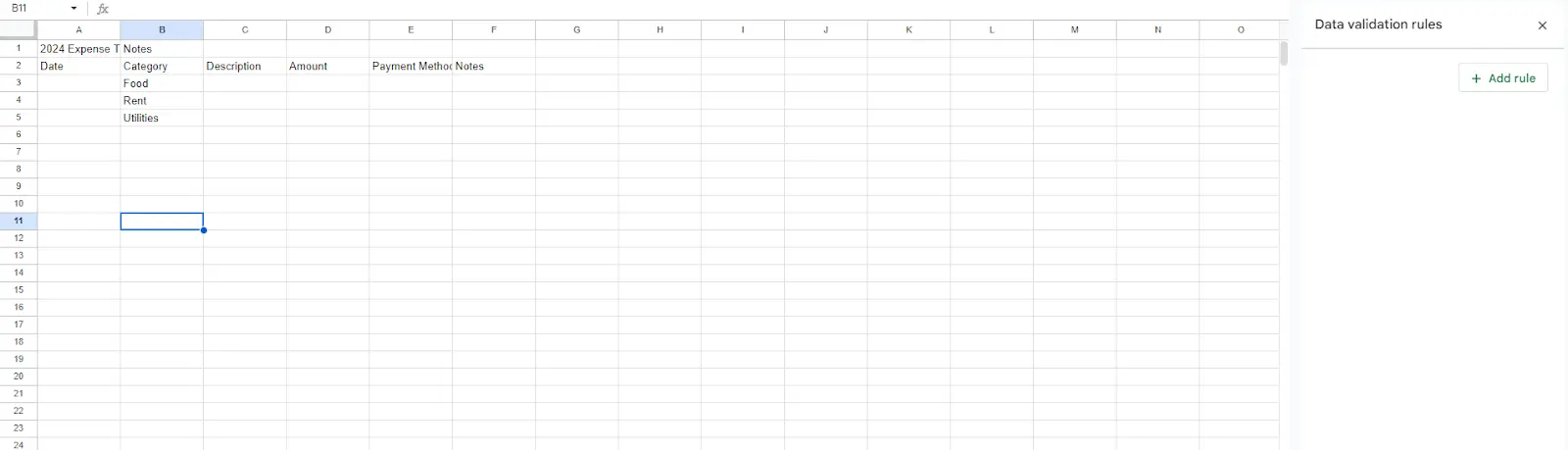

Step 3: Input and format data

Input your data: Start entering your expenses. For each expense, fill in the date, description, category, amount spent, and payment method.

-

Format cells: To make it easier to read, you can format the cells:

Highlight the “Amount” column and set the format to “Currency” to automatically display values in monetary format.

Adjust the width of the columns as needed by dragging the column borders in the header row.

Step 4: Add formulas

Total expenses: At the bottom of the “Amount” column, you can add a formula to total expenses. Click on the first empty cell below your amounts, type =SUM(, and then select all the cells above that contain your expense amounts. Close the parenthesis and press Enter.

-

Monthly breakdown: You can use the SUMIF formula to analyze your monthly expenses. For example:

Add a new sheet for summaries.

List months in one column.

Next to each month, use =SUMIF(range, criteria, sum_range). For example, =SUMIF(A2:A100, ">="&DATE(2023,1,1), C2:C100) - SUMIF(A2:A100, ">="&DATE(2023,2,1), C2:C100) to calculate January expenses.

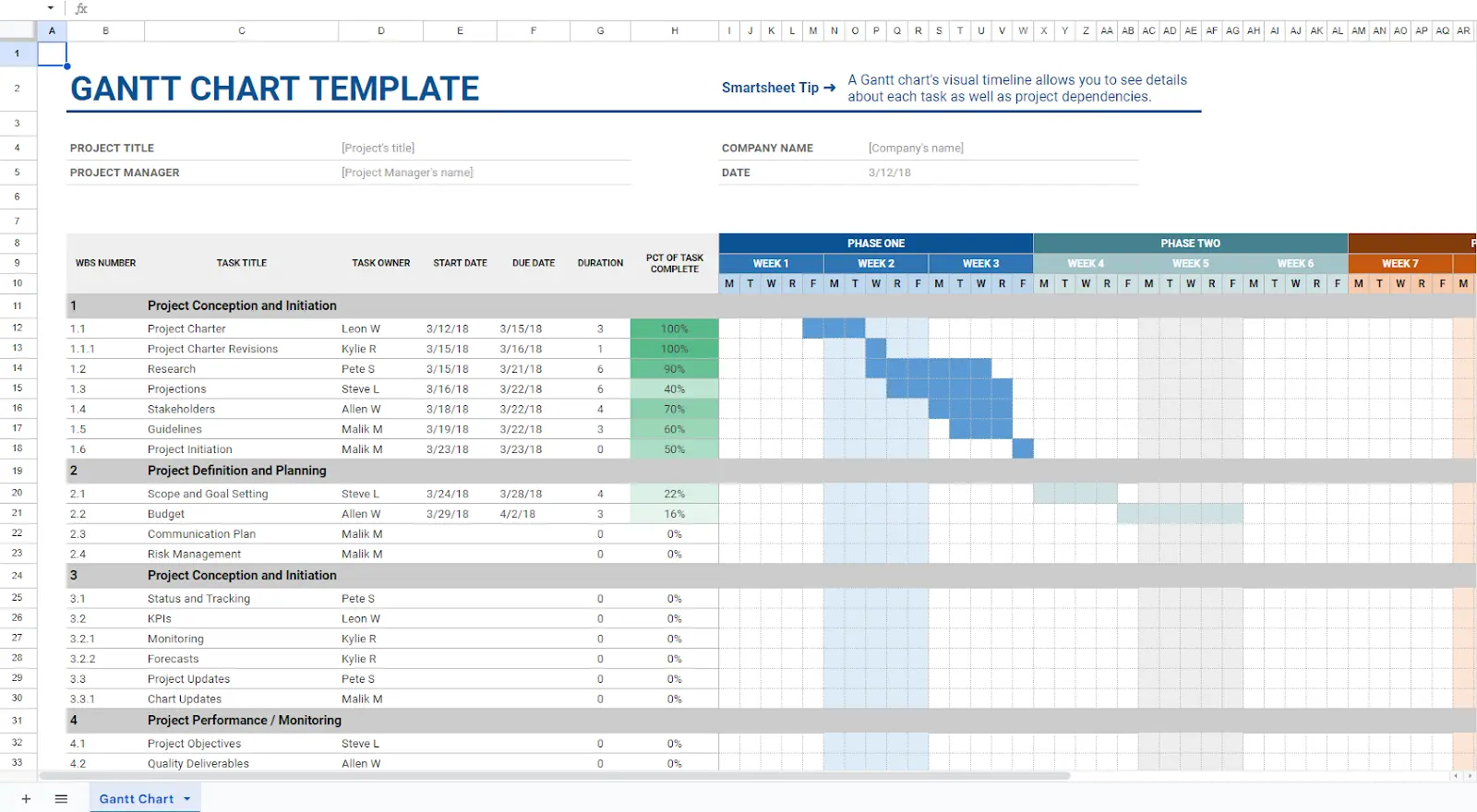

Step 5: Create charts

Visualize data: To create a chart, highlight the data you want to visualize (e.g., monthly totals).

Insert chart: Go to Insert > Chart to generate a chart automatically based on your selected data. Customize the chart type and options according to your preferences.

Step 6: Maintain and update

Regular updates: Consistently update your expense tracker with new data to keep your financial overview up-to-date.

Review periodically: Set a regular schedule to review your expense tracker to understand your spending habits and adjust your budget accordingly.

Frequently asked questions

What is the best way to maintain accurate records in an expense tracker?

Regular updates are crucial. Update your tracker with new expenses as they occur to avoid a backlog and potential errors. While spreadsheets provide a good starting point, they require manual entry and maintenance, which can be time-consuming and prone to human error. Digitizing receipts with a tool like Shoeboxed eliminates human errors and saves time by scanning and auto-categorizing expenses.

Can I use an expense tracker to submit tax returns?

An expense tracker can be a valuable tool for tax filing and preparation. It organizes your deductions and ensures you have the necessary documentation for your claims. Shoeboxed ensures that all scanned receipts are compliant with IRS requirements.

In conclusion

Whether you choose a manual spreadsheet or a digital service like Shoeboxed, keeping track of your expenses is essential for managing your business finances, whether as a freelancer or independent contractor. While spreadsheets are a great starting point and cost-effective, services like Shoeboxed offer greater efficiency, accuracy, and compliance with tax requirements, making them a worthwhile investment for serious professionals.

Caryl Ramsey has years of experience assisting in different aspects of bookkeeping, taxes, and customer service. She uses a variety of accounting software for setting up client information, reconciling accounts, coding expenses, running financial reports, and preparing tax returns. She is also experienced in setting up corporations with the State Corporation Commission and the IRS.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple receipt capture methods: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!