A budget is an important planning tool for every business. A good budgeting approach can help you estimate future expenses, annual revenue, and profits. It can also help you better control your monthly spending and identify situations where your revenue may not be enough to cover your expenditures to increase your monthly income.

This article will look into 4 top and best budgeting methods popular with business owners and help you choose one that best suits your business:

Incremental budgeting method

Activity-based budgeting method

Value proposition budgeting method

Zero-based budgeting method

Keep reading below to learn more about the most common budgeting methods for businesses to assist with the financial planning process.

Popular budgeting methods

Budgeting method #1: Incremental budgeting

One of the most popular budgeting methods is incremental budgeting. There’s no fixed formula for incremental budgeting—you simply change last year’s budget by an increment or percentage to obtain this year’s figures without regard for external factors.

This method relies on small changes based on actual spending or budgeted results from the previous period. It’s a good option for businesses with cost-driving factors that don’t regularly change, such as a phone bill, electric bill, and other monthly expenses.

Without the need for complex calculations, incremental budgeting is the quickest of all budgeting strategies. There is no in-depth analysis completed with this method, moving all the bills, even debt payments, forward to the new year without the potential for cutting costs.

It’s important to note, however, that your company’s departments may overspend to avoid receiving a smaller spending limit the following fiscal year. It’s best to look into specific expenditures and spending habits to prevent any kind of budgetary slack.

See also: What Is Revenue Expenditure vs. Capital Expenditure?

Recommended for: Those who are limited on time but need a method that is effective and reasonable.

It’s also well-suited if you have an established business with predictable and consistent cash flow and financial activities which has discretionary income.

3 mistakes to avoid with incremental budgeting by Right Source.

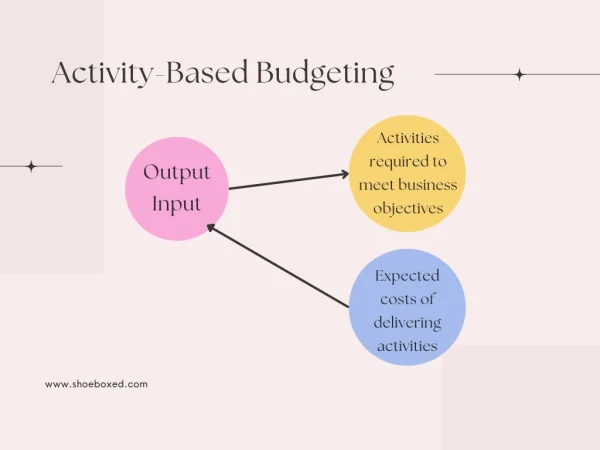

Budgeting method #2: Activity-based budgeting (ABB)

Another popular budgeting strategy is activity-based budgeting (ABB), which is a good budgeting method that tracks and analyzes every activity that incurs a cost to identify new cost-saving areas. You can then create a budget based on your findings.

Companies typically use this budgeting method to cut expenses, boost productivity, gain a competitive advantage, and improve overall efficiency. This method is good for reverse budgeting or a pay-yourself-first budget—a company can focus on cutting costs and saving in its bank account if it chooses.

Rather than just using past budgets to determine your new budget, the ABB system digs deeper into the company’s performance and gives you more control over the process. This helps you align your budget with your company’s goals much easier because your budget uses more precise data for its projections.

Essentially, this method is a top-down approach with the budget set, and then how funds are set throughout the company is determined from there. Each department has a budget set under the whole budget and gets to determine its own budget categories.

Due to its complexity, the ABB method is the more expensive and time-consuming method to implement and maintain.

Activity-Based Budgeting Method

Recommended for: New companies without historical budgeting data.

The ABB method is also popular in major industries like manufacturing, construction, and healthcare. It’s also useful for companies that are undergoing significant changes, such as new subsidiaries, large clients, business locations, or products.

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic approach to receipt tracking for tax season. Try free for 30 days!

Get Started TodaySee also: Bookkeeping Resources: 45+ Courses, Tools, Sites, and More!

Budgeting method #3: Value proposition budgeting (VPB)

Value proposition budgeting (VPB), or priority-based budgeting, is all about driving value. With this method, you go through every cost item to decide whether the value it brings justifies its cost. This allows your business to avoid wasteful spending and save money.

One of the main downsides of value proposition budgeting is that value is not easy to determine. This is because it can vary depending on factors such as politics or economic trends. If there isn’t a clear understanding of value, business owners may make short-term decisions that negatively influence long-term goals.

When preparing for the VPB method, businesses have to answer these essential questions:

Why are we spending this amount of money?

What value does it bring to our customers and stakeholders?

Does the value outweigh the cost?

On the surface, the value proposition budgeting approach is one of the most flexible budgeting methods since it gives business owners and accounting departments the opportunity to review budget categories and ensure everything is included. Even debt payments fall into their own budget category.

Recommended for: Companies aiming to reduce unnecessary expenses and refocus on customer needs.

Government organizations also like this budgeting method because they often experience financial restructuring throughout the year. VPB can help them identify which services are most valuable and most needed within their communities.

Budgeting method #4: Zero-based budgeting (ZBB)

Zero-based budgeting (ZBB) is another common budgeting method. For a zero-based budgeting method, you assume that all departments have a zero-based budget, and the budget must be rebuilt from scratch. Your monthly income minus expenses should equal zero.

In other words, past budget numbers are not considered. Budget planners must justify every penny spent to build the current year’s budget.

Using this method means the business sets aside spending money for essential expenses, a savings account, and debt repayments. By putting money into a spending category, the business can lower costs to obtain its financial goals.

From the point of view of personal finances, this method would be equivalent to the envelope method, where funds get funneled into budget categories. Envelope budgeting takes all your money and helps determine where best to spend money without crippling any emergency funds or not paying committed expenses.

In the end, a zero-based budget is very strict, as it attempts to eliminate any expenses that do not contribute to the company’s profit. It’s a difficult and very time-consuming accounting cycle process to carry out a zero-based budget, so many companies only use this approach on occasion.

Recommended for: businesses that have an urgent need to reduce costs

Zero-based budgeting may be the right budgeting method for businesses that have an urgent need to reduce costs, for example, during a financial restructuring where the previous budget period will not have any meaning toward the new financial life of the company.

“What is a Zero-Based Budget?” #AskRachel

What are other types of budgeting methods for businesses?

Participative Budgeting

According to the Corporate Finance Institute, “participative budgeting is a budgeting process in which the people who are in the lower levels of management are involved in the budget preparation process.”

This method gives managers who are closer to and more knowledgeable about specific parts of the business the ability to share their input on a budget.

Not only is this more efficient, but it also improves employee morale because it provides them with a “sense of ownership” of the business.

Recommended for: Medium to large-sized businesses whose higher-level managers may not have direct experience with all departments.

Bottom-up Budgeting

According to the Corporate Finance Institute, ”bottom-up budgeting is a budgeting method that starts at the department level, moving up to the top level.”

This is very similar to participative budgeting. However, there are a few key differences since this budget delivers a sense of responsibility in the entire company.

Bottom-up budgeting relies on each department to submit its own budgets, which are then factored into the overall company budget. To do this, every department is first required to determine its cost projections, which are then used to create its budget.

The final budget combines all of these budgets. This is then submitted to upper management for approval.

Recommended for: Businesses that are looking to empower lower-level employees and create highly accurate and well-balanced budgets.

Budgeting types provided by Agata Kaczmarek

How to balance business and personal finances

Like oil and water, your business and personal finances don’t mix. Responsible financial management is crucial to surviving a volatile economy for any company. To keep stable finances, business owners need to be well versed in financial literacy, in their personal and professional lives.

1. The startup and growth phase

It’s easy to overstretch personal finances to support the startup costs of a business. Trying to compensate for the lack of revenues leads to mismanaging personal finances. Not saving, and borrowing against personal credit, are partly why 30 percent of small businesses fail in their first year.

When your business begins to generate cash flow, the business then supports you. It’s crucial to budget personal and business expenses separately or both will suffer during challenges of downturns in fluctuating markets. The ability to protect your personal assets from business debts and losses should be of the utmost importance for any business owner.

2. Establish a business credit profile

Putting your business on the map is the first step to separating your finances. As a business owner, you need to apply for an employer identification number (EIN) via the IRS website. The EIN is for tax and credit purposes. Obtaining one allows your business to build a credit profile and maintain a record of business transactions. Until you file your business as a separate legal entity, you are personally liable for all financial business activities.

The advantage to having an established business credit profile is increased borrowing power. Reports show 29 percent of small businesses fail because they run out of money. A strong business credit profile lets you qualify for small business loans with low interest rates, creating the ability to have access to cash without tying up your own working capital.

3. Finding the balance

So, where do you go from here? Once you’ve legally separated your personal finances from your business expenses, it’s time to open separate accounts. Out of the 65 percent of business owners who use credit cards for business expenses, only 50 percent of the cards are under the small business’ name. Having a business credit card and using it responsibly sends positive credit activity to business credit bureaus and legitimizes your business.

Opening a business credit card is an easy way to draw a clear line between business and personal transactions. Keeping business receipts can be a hassle. Whether you’re buying inventory, advertising, or going to a networking convention for your company, using a small business credit card is a simple way to document these expenses, without much effort.

4. Business bank accounts

Once your business is ready to start accepting or spending money a business bank account needs to be opened. A checking, savings, and merchant services account are typical business accounts to have. The merchant services account allows you to accept credit and debit card transactions from customers.

Business accounts afford business owners perks standard personal accounts don’t offer. For example:

Protection. Business bank accounts offer purchase protection for your customers and ensures that their personal information is secure, while personal accounts offer limited liability protection.

Professionalism. According to the IRS, only businesses can deduct business expenses. If the expenses incurred for your business are deducted from your personal bank account, the IRS will have the impression your business is a hobby. If you were to be audited, you will have a difficult time proving your business’ validity.

Relationships. As your business grows, having a good relationship with your bank will become increasingly important. The sooner you open the account, the sooner you begin establishing a relationship with the bank, which makes obtaining finances for future business expenses easier.

5. Managing personal finances

As a business owner, it is easy to lose sight of your personal finances in the day-to-day responsibilities of running a business. However, like a business, your bottom line for your personal finances should be attended to and defined. Are you putting money towards your retirement? Are you adding to your savings with each paycheck? Have you cut out expenses that aren’t adding value to your life? Do you have adequate health or life insurance?

While it seems like a basic concept, many people lose sight of maintaining a positive cash flow, and preparing for the future. Always spend less than you make. Remember some months will be better than others. When revenue doubles or triples create a flexible account after you:

Pay taxes

Put away for retirement

Set aside for an emergency fund

Pay yourself a salary

Never lose a receipt again 📁

Join over 1 million businesses scanning receipts, creating expense reports, and reclaiming multiple hours every week—with Shoeboxed.✨

Get Started TodayFrequently asked questions

What are the best free budgeting tools for small business owners?

A budgeting app can help start the process since it involves tracking as a way to find out where the company’s finances stand. Some allow you to create a bar graph or pie chart to see your budget on weekly or monthly basis.

GnuCash.org—This is an open-source accounting information software that not only helps you with budgeting but also with other areas of accounting management, such as invoicing, customer management, and more. This software can be a little tricky to get started, but there are plenty of online tutorials and a manual that you can refer to.

Capterra.com offers a comprehensive budget template that works with Excel. This template can be used to create both your monthly and annual budgets, as well as compare numbers and view overall performance. They also offer guides to help you through the process.

Excel fans will love PDFConverter.com’s list of 15 Excel Templates for Small Business Budget Management. The list includes templates for everything from business trip budgeting to expense budgeting.

Google Sheets has its own budget template, developed by Intuit Quickbooks, which can be found in its Templates Gallery.

Microsoft Office has an expense-focused budget template that also does some basic reporting by generating charts and graphs based on the information you input.

Where can I find free online resources for budgeting?

Budgeting can be stressful, especially if you’re doing it on your own. As a small business owner or freelancer, you don’t have the luxury of relying on your finance team to create your budget or find the best budgeting standards to work with.

We’ve compiled a list of guides you can reference to improve your business budgeting skills.

Budgeting Pie Chart: How to Create, Benefits, and Strategies

We recommend keeping track of your expenses with receipt software that allows you to digitize your receipts, invoices, and other financial documents. Shoeboxed has put together a complete guide to receipt organizing and management.

Lastly, knowing what you can safely write off will mean more cash in your budget for other necessary or variable expenses.

Check out these commonly missed tax write offs!

In closing

Employing a suitable budgeting method for your business is an effective way to save costs, increase productivity, and bring in more profits.

By understanding the basics of commonly-used budgeting methods among businesses, you can gain a deeper insight into your own business’s situation to improve your financial performance and even plan for a large unexpected expense.

In order to determine your ideal budgeting method, it’s important that you have accurately recorded expenses. Shoeboxed can help with that.

Shoeboxed is a well-trusted receipt tracker tool to help businesses, freelancers, and DIY accountants store and organize their receipts.

Turn your receipts into data and deductibles!

The app automatically extracts, verifies, and categorizes important data from your receipts, then stores them securely in the cloud. Most importantly, scanned documents from Shoeboxed are accepted by the IRS.

You might also like:

About Shoeboxed!

Shoeboxed supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!