Uber drivers' expenses can add up and significantly impact their net earnings.

Understanding these costs is crucial for Uber drivers who want to efficiently manage their finances so they're maximizing their profits.

This article provides a detailed look at Uber drivers' typical expenses, so that they can plan and budget more effectively and keep more of their hard-earned money.

What is the role of an Uber driver?

An Uber driver is an independent contractor who uses their vehicle to provide transportation services to passengers. They operate under the umbrella of Uber, which is a popular rideshare platform that connects drivers with riders through a mobile app.

Using the app

Uber drivers use the company’s mobile app to manage their rides. The app manages every aspect of the driving experience, from accepting ride requests to navigating to the passenger's location and, ultimately, to the destination. It also handles electronic payment transactions. This eliminates the need for cash exchanges.

Providing rides

Once a driver accepts a ride request, they pick up the passenger at the specified location and drive them to their desired destination. The app provides route guidance, fare estimates, and estimated arrival times.

Earnings and expenses

Uber drivers earn money based on the number of rides they complete, the distance of those rides, local fare rates, and sometimes tips. However, as independent contractors, drivers are responsible for all of their operating expenses, such as fuel, vehicle maintenance, insurance, and any other costs related to their vehicle.

What should be included on your Uber driver expenses list?

As an Uber driver, it’s important to keep up with all of your expenses. These expenses actually benefit you when tax season rolls around.

Here’s a list of Uber drivers' typical expenses:

Vehicle maintenance and repairs

Regular maintenance is essential to keep an Uber vehicle in good working condition. This includes oil changes, tire rotations, brake checks, and other periodic services, as the manufacturer recommends. Unexpected repairs, such as fixing broken parts, also fall under this category.

Fuel costs

Fuel is one of Uber drivers' most significant ongoing business expenses. The cost depends on the type of vehicle used, driving style, and local fuel prices.

Car insurance

Uber requires its drivers to have a comprehensive car insurance policy covering personal and ride-sharing use. The insurance cost varies based on factors such as the driver’s age, driving history, and the make and model of the vehicle.

Car payments

Many Uber drivers finance their vehicles through loans or leases. Monthly car payments can be a substantial financial burden, making it important to consider the affordability of a vehicle before purchasing or leasing specifically for Uber driving.

Depreciation

The value of a vehicle decreases over time and with increased mileage. For Uber drivers, who typically put more miles on their cars than average drivers, depreciation can significantly reduce their future resale value.

Licenses and permits

Depending on local regulations, Uber drivers may need to pay for specific licenses or permits to operate legally. These requirements can vary significantly from one city or state to another.

Smartphone and data plans

Uber drivers require a reliable smartphone with a data plan to accept ride requests and navigate to destinations. The phone and monthly data usage costs add to the operational expenses.

Health insurance and benefits

As independent contractors, Uber drivers must arrange and pay for their health insurance and retirement savings plans.

Cleaning and sanitization

Keeping the vehicle clean and sanitized is more important than ever. Regular cleaning supplies, and perhaps even professional cleaning services, are necessary expenses to ensure a pleasant and safe environment for passengers. Cleaning and sanitization is another eligible deduction.

Tolls, parking, and miscellaneous fees

Driving in certain areas may incur tolls, while parking fees apply when waiting for passengers in congested areas or airports. Tolls and parking fees are eligible as tax deductions.

Never lose a receipt again 📁

Join over 1 million businesses organizing & scanning receipts, creating expense reports, and reclaiming multiple hours every week—with Shoeboxed.✨

Get Started TodayWhat expenses are tax deductible for Uber Drivers?

Uber drivers must manage expenses efficiently and understand tax deductions to maximize their earnings and minimize their tax liabilities.

Here's a detailed breakdown of typical Uber driver expenses and the corresponding tax write-offs they can claim.

Vehicle expenses

Vehicle expenses, such as the business mileage deduction, will likely be the largest tax deduction. Drivers can choose between the standard rate mileage deduction or actual car expenses

Standard mileage deduction

The standard mileage deduction (as of 2024, 67 cents per business mile) simplifies record-keeping by covering depreciation, lease payments, maintenance and repairs, gasoline, oil, insurance, and vehicle registration fees.

Actual expense method

Actual expenses require detailed records such as a mileage log and receipts but can provide more significant deductions if substantial repairs or maintenance were needed during the year.

Mobile phone expenses

A portion of the mobile phone purchase and the monthly service charges are tax deductions, proportional to how much the phone is used for business.

License and regulatory fees

Any fees for maintaining legal status as an Uber driver are tax deductible.

Health insurance premiums

Health insurance premiums may be tax deductible if not otherwise eligible for an employer-sponsored health plan.

Tolls and parking

All tolls and parking fees paid while on the clock are considered deductible.

Interest on car loans

If you purchased your vehicle, the interest on the car loan is tax deductible based on the percentage of business use.

Depreciation

If using actual expenses, you can deduct vehicle depreciation. This method depreciates the vehicle's value over a specified amount of time.

Supplies and equipment

Any supplies bought for the business use of your vehicle (like cleaning supplies or passengers' protective equipment) are considered tax deductions.

Uber drivers can deduct these expenses from their gross income so that they pay taxes on their net income, which is the actual profit after costs are deducted. Again, Uber drivers are considered independent contractors, and no federal taxes are withheld from their pay by Uber. Therefore, drivers are responsible for self-employment taxes on their gross income.

Always remember, if you have any questions about these tax deductions, you can get tax advice on independent contractors from a tax accountant.

How do I keep track of all my Uber driving expenses for business tax deductions?

While Uber's app manages the basics of executing its rideshare services, it's not as effective at tracking expenses for tax deductions. Another app to consider using in addition to Uber is Shoeboxed. Shoeboxed is a document management and business expenses tracking tool that is incredibly helpful for Uber drivers in managing receipts and tracking expenses, especially for tax purposes.

Here’s how Shoeboxed helps Uber drivers keep business expenses organized:

Receipt capture and organization

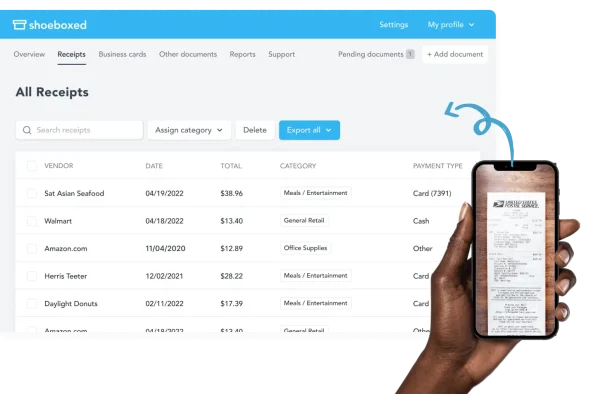

Shoeboxed's app captures and organizes receipts.

Shoeboxed's app lets you capture your receipts digitally using your smartphone camera. Simply take a photo of a receipt, and Shoeboxed will automatically process, categorize, and store it. This feature is extremely useful for Uber drivers who accumulate numerous receipts for fuel, maintenance, and other driving expenses.

Send your receipts in the Magic Envelope and have Shoeboxed scan them.

If you'd rather not do the scanning yourself, Shoeboxed provides an envelope unique to only Shoeboxed called the Magic Envelope. This envelope and its service are helpful, especially if drivers are backlogged with receipts.

Simply fill the pre-postage-paid Magic Envelope with your receipts or any other document and mail it to Shoeboxed. They will scan, human-verify, and upload your receipts to your account. In other words, mail your receipts to Shoeboxed, and they will do the rest.

Another great thing about the Magic Envelope is that Uber drivers can keep the envelope on their car dashboard and insert receipts as they incur. This makes it incredibly easy for those who are always on the go. It also prevents drivers from misplacing receipts and possibly losing them.

Hit the road with Shoeboxed 🚗

Stuff receipts into the Magic Envelope while on the road. Then send them in once a month to get scanned. 💪🏼 Try free for 30 days!

Get Started TodayData extraction

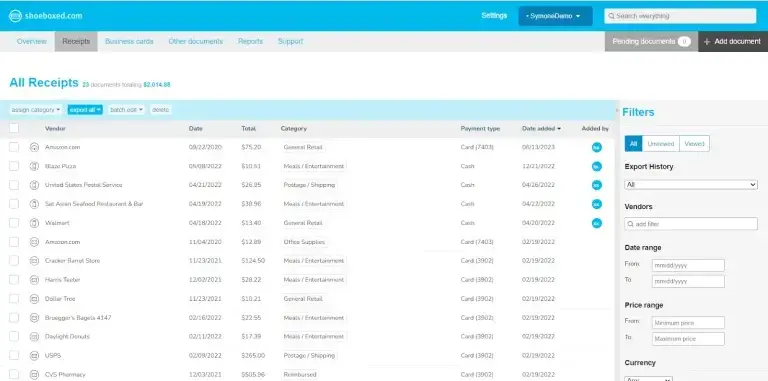

Once a receipt is uploaded, Shoeboxed extracts key data, such as vendor names, total amounts, dates, and payment types. This information is then digitally stored, eliminating the need for manual data entry and reducing the potential for errors.

Categorization

Shoeboxed categorizes receipts into tax and custom categories.

Shoeboxed allows users to categorize receipts according to IRS tax or custom categories that fit their needs. For Uber drivers, categorizing expenses helps streamline tax return preparation and accurately capture all deductions.

Mileage tracking

Shoeboxed's app also logs trips and tracks mileage.

Shoeboxed also offer mileage tracking, which is essential for Uber drivers. You can log trips and track mileage through the app. This feature usually integrates with the GPS on your mobile phone to record distances traveled, making it easier to claim the mileage deduction at tax time.

Track mileage with Shoeboxed 🚗

Track mileage using your phone’s built-in GPS for unmatched ease and accuracy. 💪🏼 Try free for 30 days!

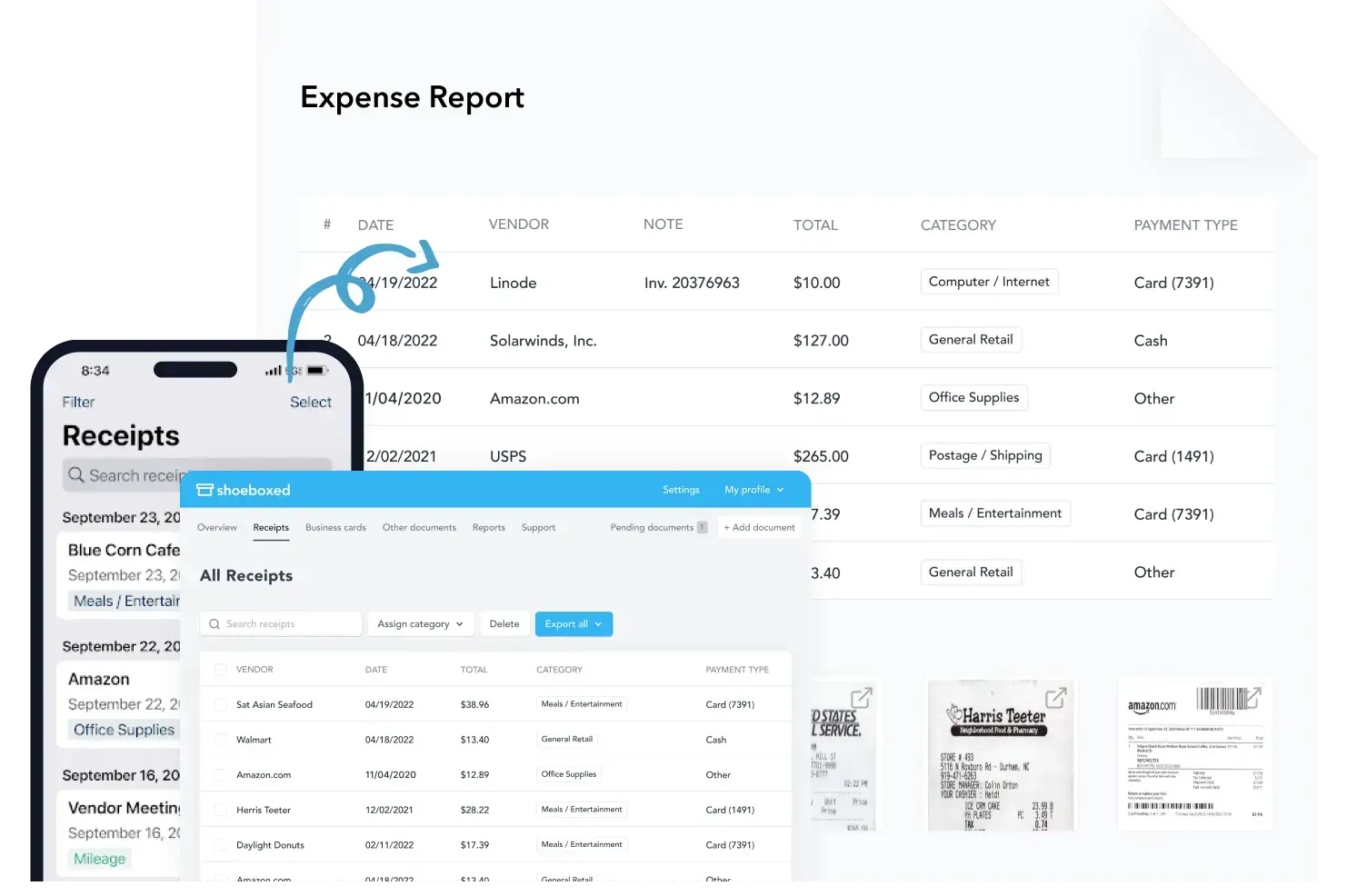

Get Started TodayReport generation

Shoeboxed creates expense reports with receipts attached, making it easier to claim all eligible tax deductions.

Shoeboxed provides the ability to create and export detailed reports. For Uber drivers, you can create expense reports for maintenance, gas, insurance, and other costs. Having these reports with receipts attached on hand makes it much simpler when filing your federal income tax return and if called up for an audit.

IRS compliance

The digital copies of receipts that Shoeboxed stores are accepted by the IRS and CRA, which means you don’t need to keep the original paper copies.

Integration with accounting software

Shoeboxed integrates with other popular accounting software that Uber drivers use.

Shoeboxed can integrate with accounting software like QuickBooks, Xero, and Wave. This integration helps streamline bookkeeping for Uber drivers, allowing real-time expense tracking and easier financial management.

Secure storage

All documents and data captured by Shoeboxed are stored securely in the cloud. This means that Uber drivers can access their financial information anytime from anywhere, which is ideal for those who are always on the go.

For Uber drivers, maintaining accurate and organized records of all business-related expenses is critical for maximizing tax deductions. Shoeboxed offers a range of features that simplify the documentation and reporting of these expenses, saving time and improving financial outcomes on your business taxes.

See also: 4 Best Uber Mileage Tracker Apps for Logging Business Miles

Stop doing manual data entry 🛑

Outsource receipt scanning to Shoeboxed’s scanning service and free up your time for good. Try free for 30 days! ✨

Get Started TodayFrequently asked questions

How do I keep track of all my Uber and Lyft driving expenses for tax deductions?

One of the best ways for Uber and Lyft drivers to keep track of their expenses is to use Shoeboxed. Shoeboxed is a document management and business expense tracking tool that can be incredibly helpful for Uber drivers in managing receipts and tracking expenses for tax purposes.

Can I deduct tolls and parking fees as an Uber and Lyft driver?

Driving in certain areas may incur tolls, while parking fees apply when waiting for passengers in congested areas or airports. These fees accumulate for Uber and Lyft drivers. All tolls and parking fees paid while on the clock are considered deductible.

In conclusion

Being an Uber driver involves various out-of-pocket business expenses that can reduce a driver's earnings if not managed efficiently. By understanding and planning for these costs, drivers can set realistic financial goals, choose the most cost-effective vehicle maintenance and operation strategies, and enhance their overall profitability.

Effective budgeting and expense tracking with tools like Shoeboxed are crucial for Uber drivers who aim to make a sustainable income. If you have any questions regarding tax deductions for Uber drivers, consult a tax professional.

Caryl Ramsey has years of experience assisting in different aspects of bookkeeping, taxes, and customer service. She uses a variety of accounting software for setting up client information, reconciling accounts, coding expenses, running financial reports, and preparing tax returns. She is also experienced in setting up corporations with the State Corporation Commission and the IRS.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple receipt capture methods: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports, and more—with Shoeboxed.

Try Shoeboxed today!