Ecommerce business owners are likely to say that accounting is the least favorite part of their job. However, as a business continues to grow, so do the financial complications. Running a business, whether brick-and-mortar or e-commerce means getting involved in transactions involving sales, returns, payments, and even banking fees. All of this financial movement needs to be accounted for properly.

A proper accounting system will make all the difference when it comes to ecommerce bookkeeping and accounting. Ensuring all financial records are maintained in good order will only help you as the business grows.

Ecommerce accounting vs bookkeeping: What’s the difference?

First things first—let’s start with a quick discussion of the differences between accounting and bookkeeping so you get off on the right foot.

Bookkeeping is the most basic form of accounting which includes a record of all transactions and financial documents. In essence, it’s just organization on a financial scale. Bookkeeping tasks include the following:

Invoicing

Categorizing transactions

Reconciliation of accounts

Payroll

Balance sheet preparation

Accounts payable management

Accounts receivable management

Accounting, on the other hand, focuses on steps required to analyze all of the financial information recorded by the bookkeeper to help build various financial reports, advanced financial models, and forecasts. Some of the main tasks include:

Preparing adjusted entries

Tax planning and audits

Financial forecasting

Risk analysis

Financial information audits

Preparing financial statements and reports

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic approach to receipt tracking for tax season. Try free for 30 days!

Get Started TodayWhat are the types of accounting for ecommerce businesses?

A systematic approach is a key to good accounting. Your ecommerce business has two popular options to choose from cash basis accounting and accrual accounting.

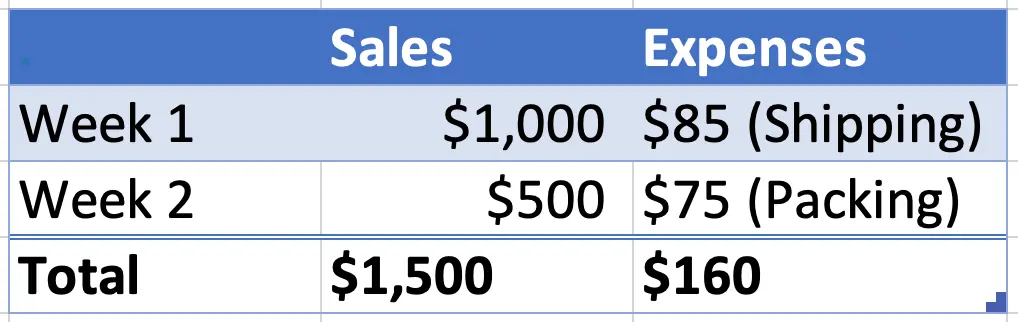

Cash basis accounting

Within cash basis accounting, as the name implies, a new transaction is notated every time cash lands in the business bank account or leaves it in the form of an expense.

Cash basis accounting spreadsheet example

For small business owners, this is a great starter option. Cash basis accounting is simple, easy to maintain, and reports on all cash flow as necessary. As an added bonus, when using this type of accounting method, when it comes time to pay taxes at the end of the year, you won’t end up paying tax on funds the business hasn’t received, thus lowering your tax bill.

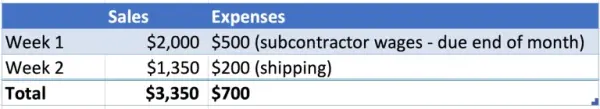

Accrual accounting

Unlike the cash basis method, accrual accounting has you record each sale and expense the instant it takes place, whether or not money changed hands (or banks).

Accrual accounting spreadsheet example

Often referred to as the traditional accounting method, since it’s what most financial institutions use—such as lenders, auditors, investors, and anyone else interested in learning about the financial health of the company.

At first glance, accrual accounting seems more complicated than cash basis accounting. Business owners have to account for funds they haven’t yet received (accounts receivable) and subtract costs which are yet to happen (accounts payable) making the process bigger than it is. However, it provides a more real representation of what happens within a business.

Another benefit to accrual accounting is more accurate financial projections. Seeing future account receivables and accounts payable helps businesses make sound financial decisions for the future of the company.

A con of this method is that it might make the business seem more profitable since the focus has shifted from how much cash there is to how much cash moves. Thus, it’s important to keep a close eye on financial reports.

What information is needed to start accounting for ecommerce businesses?

As you start your accounting journey, you’ll need to prepare three things.

1. Tax ID

As a corporation or partnership, you’ll need to make a request for an Employer Identification Number (EIN) from the IRS, which is a unique number used on tax documents and the application can be done immediately.Those who operate alone can use their Social Security Number.

2. Business bank account

The first rule of accounting states that business and personal accounts should always remain separate. Open a bank account dedicated solely to the ecommerce business, then set up popular payment options such as PayPal, and others.Remember never to use the business account to cover any personal expenses. Business expenses, however, can be covered with a personal account and later claimed as “out of pocket” expenses.

3. Accounting software

Purchasing the right accounting software may not always be a must, but it can simplify the process. The right software will help track sales, expenses, generate reports, and assist with other bookkeeping tasks.

Step-by-step ecommerce accounting tasks to start with

Though the beginning is important, ecommerce businesses should ensure to complete the following tasks on a weekly, or at the very least monthly basis.

Step 1. Categorize all your transactions

The task of categorizing transactions is the baseline practice in e-commerce accounting. All transactions should get marked on the cash flow statement as either an income or an expense. For those business owners using accounting software, the transactions are typically auto-sorted but should be reviewed to ensure the correct category is chosen, such as salaries, marketing, returns, and others.

Step 2. Maintain your business budget

A part of running a sound business is financial management. Building a strong business budget will help the business meet financial obligations while maintaining regular revenue. Ecommerce business owners can use the total number to determine exactly how much cash needs to remain on hand. A budget can help with:

Understanding recurring and unplanned expenses

Monitoring cash flow

Knowing when to spend and when to hold back

Saving for a rainy day

Reducing or avoid debt

Focusing on long-term financial goals

To build such a budget, business owners need to review cash flow and form a weekly budget calculator.

a. Review cash flow

Understanding where money is coming from and where it is going is fundamental to building a budget. Keep a record of what is spent on:

Inventory purchases

Supplier payments

Salaries: employees and subcontractors

Shipping

Package and handling

Business banking

Software

Website

Advertising and marketing

Taxes

Refunds and returns

On top of these expenses, add in any unplanned or one-off expenses for a total budget baseline. This is the total amount your ecommerce business has to earn to break even at the end of the month.Of course, changes in demand and market pricing will have these numbers fluctuate from month to month, so there should be no surprise that certain months may have a negative cash flow, which is a good reason to budget and save.

b. Create a weekly budget calculator

Maintaining a positive cash flow, especially for starter businesses, means keeping track of every cent. A great way to accomplish this task is to make a weekly budget with separate “pockets of cash” for various expense categories throughout the week. This gives the business more visibility and the opportunity to cut down on non-essential spending.

Step 3. Stay on top of your taxes

Ecommerce business owners will have to keep in mind two taxes categories—business income taxes and sales taxes. Sales tax is tricky, with the following factors affecting it:

State-level sales tax (45 states and the District of Columbia)

Local sales tax (38 states)

a. Make sure your tax rates are correct for customers

How you apply this sales tax will depend upon the platform of your ecommerce business. The two options are to add sales taxes manually at the time of checkout or have them automatically calculated based on the customers’ shipping address.Automatic calculation is much more error-free.

b. Pay estimated quarterly business taxes

Ecommerce businesses, like other businesses, that owe more than $1,000 in taxes by the end of the year need to make quarterly estimated tax payments. The IRS uses the last tax return to calculate dues and expects payments based on their calculator.

c. File sales taxes

A record of all sales taxes collected needs to be maintained by your ecommerce business throughout the year. When the due date rolls around for your tax jurisdiction, that information will need to be filed—this varies from state to state.

Step 4. Categorize returns and chargebacks in your books

These two accounting and bookkeeping terms should never be used interchangeably in the case of a business.

a. Return

An ecommerce business can have different return policies in place which would affect accounting:

Store credit—where the original transaction gets recorded as an expense and is added to the accounts payable list.

Full refund—when the product arrives back, categorize the transaction as a “return and allowance,” then subtract it from revenue.

b. Chargeback

A chargeback starts with the customer when they file a dispute of the transaction with their bank claiming it as fraudulent. Unfortunately, for many businesses, such “friendly fraud” is around 40% to 80% of fraud losses.In this case, categorize the transaction as “returns and allowances.” If an extra fee is included, mark the transaction as a business expense. To save money in the future, work on applying ecommerce chargeback prevention methods such as a stronger refund policy.

Step 5. Reconcile bank statements

Reconciling your accounting software information with that of your bank account is one key step to finding potential errors, on both ends. Small business owners should add this as one of the most important accounting tasks at least once a month.

3 quick e-commerce accounting best practices

Keep in mind some best practices as you get underway.

1. Set money (and time) aside for taxes

The tax season will be undoubtedly hectic, so don’t put this off. Most business owners spend at least two weeks preparing their tax return so the more work done in the beginning, the better.Of course, aside from time, it’s important to keep at minimum 30% of the business income toward end-of-the-year tax payments.

2. Forecast major expenses

This goes back to a good budget—for those who keep one and stick to it, forecasting a major expense won’t be too difficult. Save over time as the budget allows to give your ecommerce business more wiggle room.

3. Supervise inventory management

Unmoving inventory causes many businesses to lose revenue. The key is not to be tempted to over-buy, instead, set the minimal and maximum volume of inventory needed throughout the year as allowed by the budget and cash flow statements.

Never lose a receipt again 📁

Join over 1 million businesses scanning receipts, creating expense reports, and reclaiming multiple hours every week—with Shoeboxed.✨

Get Started TodayFrequently asked questions

What are the key financial reports that eCommerce businesses should be looking at each month?

Ecommerce companies, like many other companies, should review the following financial statements:

Income statement

Cash flow statement

Shareholders’ equity statement

When should I hire a bookkeeper or an accountant for my ecommerce business?

There is no one right answer. Many business owners rely on accounting software to help with their ecommerce store. In the beginning, when the transactions are more manageable, and there aren’t many tax questions, that might work perfectly. As your ecommerce business grows, tasks related to financial statements, tax planning, and other ecommerce accounting-related aspects will grow as well. At that point, you may wish to consider hiring an accountant to help with tax preparation.

In closing

Don’t wait till the last minute to review financial statements or categorize expenses. As transactions build in number, so does the time it takes to do this type of revenue, causing you to lose countless hours. Automating accounting with a proper accounting software can help alleviate these concerns.

Good recordkeeping is an art form that helps tell the financial story of a business. Ecommerce companies must self-report to the tax authorities, which makes maintaining proof paramount. Here is a quick list of items to keep:

Receipts

Bills and invoices

Tax returns

W2 and 1099 forms

Bank account statements

Debit or credit card company statements

Account statement from online wallets

Revenue records from your ecommerce platform

These records should be retained at a minimum of 3 years. Thus, receipt management software might come in handy as the business grows.

Agata Kaczmarek has held a passion for writing since early childhood. A professional writer for many years, Agata specializes in writing articles and blogs focused on finance as someone who holds a Masters Degree in Accounting and Finance.

You might also like:

About Shoeboxed!

Shoeboxed is a receipt scanning service that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!