As an Amazon seller, you need to keep your accounting up-to-date and efficient to track your performance and make informed business decisions.

This article looks at the best accounting software for Amazon sellers, which can help you become more efficient and streamline your financials.

Why does accounting matter for Amazon sellers?

Accounting helps Amazon sellers to monitor their financials, find profitable products and plan for growth. It ensures tax compliance and prevents financial discrepancies that can lead to big losses and penalties.

Not keeping records of your business transactions can lead to overpayment or underpayment of taxes, inventory mismanagement and poor business decisions that can harm the profitability and sustainability of your Amazon business.

What are the challenges of Amazon's business finances?

Managing Amazon's business finances involves tracking multiple transactions, including Amazon sales, fees, taxes, and returns. This can be complicated and time-consuming, especially if you have a large inventory or are in international markets.

What should you look for in accounting software for Amazon sellers?

We have found some key features to look for in the best Amazon accounting software.

Inventory management and tracking: Helps to keep stock levels accurate and reduces the chance of overselling or stockouts.

Sales tax calculations and tracking: Ensures tax compliance and simplifies the filing process.

Integration with Amazon Seller Central account: Automates data import and syncs sales data, reduces manual entry and errors.

Multi-currency: For sellers with international markets.

Automated accounting and reconciliation: Saves time and gets your financials accurate.

What are the benefits of connecting Amazon Seller Central account to accounting software?

Connecting your Amazon Seller Central to accounting software can give you:

Accurate and automated accounting: Reduces manual data entry and errors by connecting your Amazon Seller account.

More efficiency and productivity: Streamlines financials.

Better financial visibility and decision making: Real time financial insights.

What are the top accounting software options for Amazon sellers?

After reviewing Amazon accounting software, we have narrowed down the top choices to the following:

1. Shoeboxed: Best accounting software for Amazon sellers looking for receipt organization

Automated receipt management

Mobile app

Shoeboxed allows Amazon sellers to scan and digitize their physical receipts using a mobile app.

Users digitize receipts by taking photos with their mobile device's camera and Shoeboxed's app, which automatically uploads essential data from each receipt directly into your designated Shoeboxed account. No more manual data entry.

Mail-in service

Sellers can also use Shoeboxed’s mail-in service, where they send physical receipts to Shoeboxed in a Magic Envelope, and the company digitizes and categorizes them.

Amazon sellers can also forward receipts from their email inbox directly to their Shoeboxed account, use a custom Gmail plug-in to auto-import e-receipts in their inbox and send them to their Shoeboxed account or drag and drop receipts into the cloud using a desktop or laptop.

Expense tracking and management

Automated data extraction

The software extracts key data, such as name, total amount, date, and payment method, and organizes them into a searchable digital archive.

Shoeboxed automatically extracts and categorizes data from receipts and invoices, helping sellers keep track of business expenses effortlessly.

Expense reporting

The software generates detailed expense reports, which can be customized and exported for accounting purposes.

Integration with accounting software

Seamless integration:

Shoeboxed integrates with major accounting software such as QuickBooks, Xero, and Wave. This integration allows Amazon sellers to synchronize their digitized receipts and expenses directly with their accounting platforms, ensuring accurate and up-to-date financial records.

Tax preparation

Tax deductions:

Shoeboxed helps sellers organize receipts and track expenses that qualify for tax deductions, simplifying the tax preparation process.

IRS compliance:

The digital copies of receipts stored in Shoeboxed are IRS-accepted, ensuring that sellers have compliant records for audits.

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic award-winning approach to receipt tracking for tax season. Try free for 30 days!

Get Started TodayMileage tracking

Mileage log:

Shoeboxed includes a mileage tracking feature that allows sellers to log business travel miles, which can be claimed as a tax deduction.

Mobile app accessibility

On-the-go access:

The Shoeboxed mobile app allows sellers to scan receipts and manage expenses from anywhere, providing flexibility and convenience.

Pros:

Time savings: By automating the receipt scanning and expense tracking process, Shoeboxed saves Amazon sellers significant time that can be better spent on growing their business.

Improved accuracy: Automated data extraction reduces the risk of manual entry errors.

Enhanced organization: A well-organized digital archive of receipts and expenses makes it easier to find and manage financial documents.

Better financial insights: Detailed expense reports and seamless integration with accounting software provide Amazon sellers with better insights into their financial health.

Cons:

Mileage tracker: The mileage tracker is manual only, so the app won’t automatically log your drives. However, this makes it easier to separate personal from business trips on your mileage log.

Pricing:

Shoeboxed has plans for you, each offering a different set of features and benefits at varying price points:

Startup plan: $18/month (billed annually)

Professional plan: $36/month (billed annually)

Business plan: $54/month (billed annually)

Shoeboxed provides Amazon sellers with a powerful tool for managing receipts and expenses efficiently. Its features help streamline the financial management process, ensuring accuracy, saving time, and providing valuable insights into the business's financial health.

Integrating Shoeboxed with your existing accounting software can significantly enhance your financial management capabilities and boost overall business efficiency.

Never lose a receipt again 📁

Join over 1 million businesses organizing & scanning receipts, creating expense reports, and reclaiming multiple hours every week—with Shoeboxed.✨

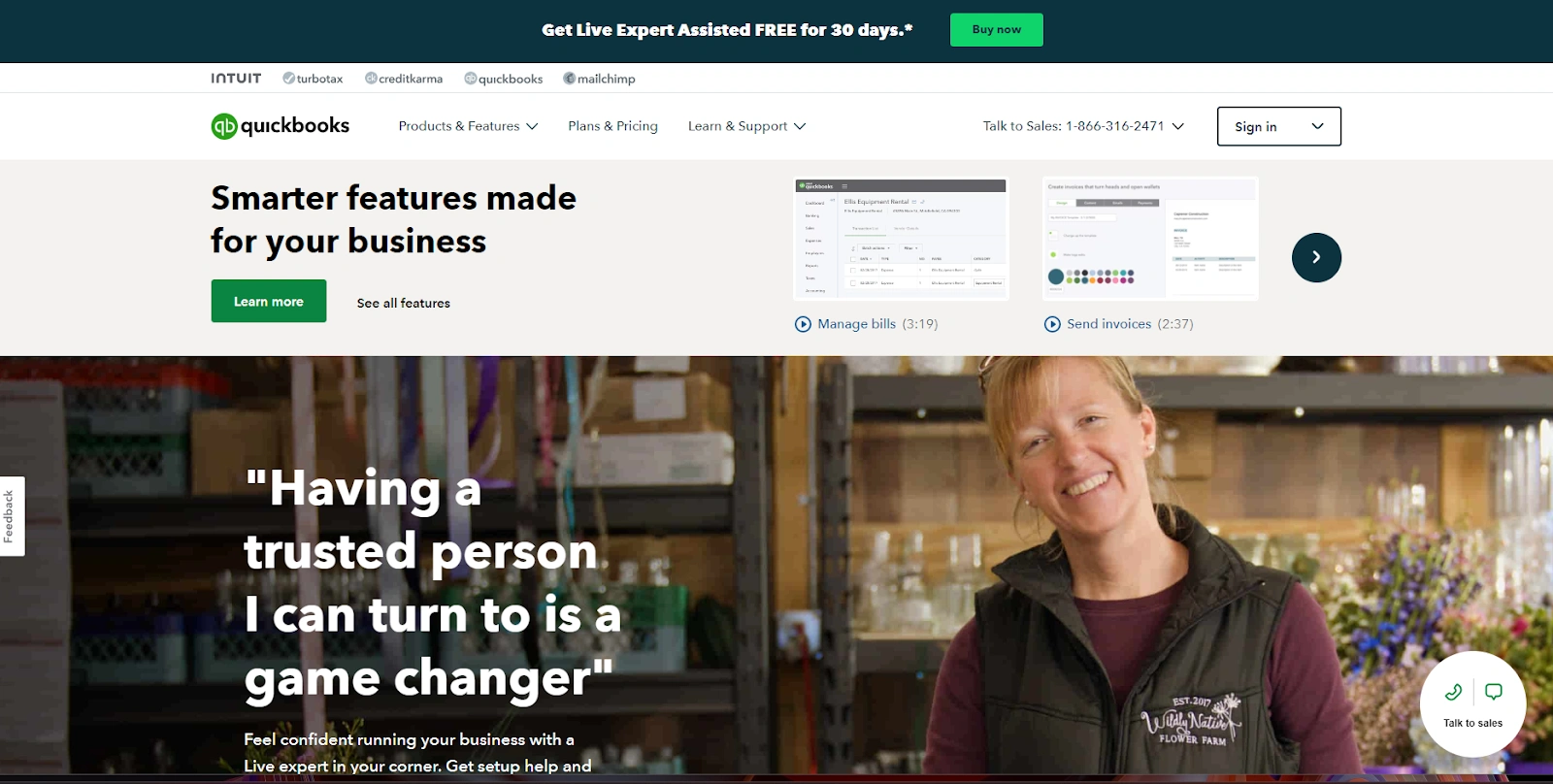

Get Started Today2. QuickBooks Online: Best accounting software for Amazon sellers looking for comprehensive features

QuickBooks Online has features that are specifically designed for Amazon sellers. These features streamline financial management, automate tasks, and give you better insights into your Amazon business.

Automating tasks like inventory management, sales tax calculation, and transaction reconciliation saves time and reduces manual data entry and errors so financial records in QuickBooks Online are more accurate.

QuickBooks Online offers real-time insights and detailed reports to give you a clear view of your business.

With QuickBooks Online, streamlining financial management allows Amazon sellers to focus on growing their business.

Pros:

Inventory management

Sales tax tracking

Amazon Seller Central integration

Multi-currency

Automated accounting and reconciliation

Cons:

Expensive for small business

Interface can be complex

Pricing:

Simple Start: $25/month

Essentials: $50/month

Plus: $80/month (Recommended for Amazon sellers)

Advanced: $180/month (Recommended for larger Amazon business)

QuickBooks Online has all the features Amazon sellers need to manage their finances better. Its integration with Amazon Seller Central, inventory management, automated accounting, and detailed reporting makes QuickBooks Online a must-have tool for ecommerce businesses.

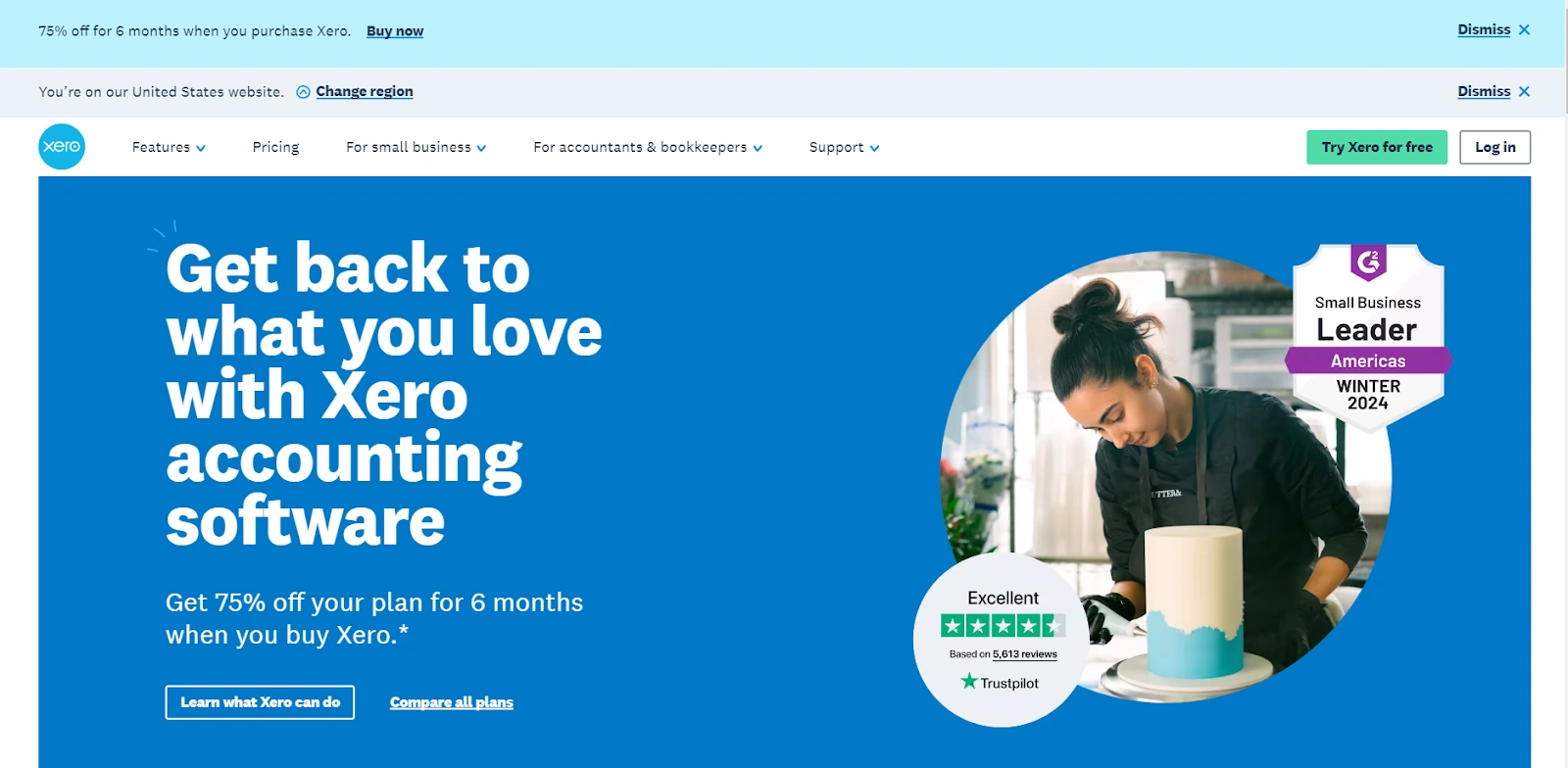

3. Xero: Best accounting solution for Amazon sellers looking to scale their business

Xero is a cloud-based accounting software that is scalable, so it’s good for small and large Amazon businesses. It grows with your business and has the tools you need as you grow.

Xero is easy to use and user friendly so Amazon sellers can navigate and use it easily.

By automating key accounting tasks, Xero saves time and reduces human error.

Xero gives you real time financial data and insights so you can make informed decisions and manage your cash flow.

The platform has customer support, 24/7 online support, and a help center so you get the help you need when you need it.

Pros:

Scalable for growing business

Inventory management and tracking

Sales tax calculation

Amazon Seller Central integration

Multi-currency

Cons:

Learning curve for new users

Limited support for lower tier plans

Pricing:

Starter: $13/month

Standard: $37/month (Recommended for Amazon sellers)

Premium: $70/month (Best for larger business with international operations)

Xero is a great accounting software for Amazon sellers because of its features, scalability, and ease of use. Its integration with Amazon Seller Central, real time inventory tracking, automated sales tax calculation, and detailed financial reporting makes it a powerful tool to manage the complex finances of an Amazon business.

4. Zoho: Best accounting software for sellers looking for free accounting software

Zoho is a free accounting software solution for small Amazon sellers.

It's very affordable, especially for small businesses, has a free plan, and low cost paid plans with advanced features.

Zoho has all the features you need for accounting from inventory management to financial reporting, so it’s a one-stop solution for Amazon sellers.

Zoho is scalable so it’s good for small and growing Amazon business. As your business grows, Zoho has more advanced features to support your growing needs.

Pros:

Free plan for small business

Good inventory management

Sales tax tracking

Amazon Seller Central integration

Cons:

Limited features in free plan

Free plan is only for small business with revenue under $50,000

Pricing:

Free Plan: For business with annual revenue of $50,000 or less

Standard: $12/month

Professional: $24/month

Zoho is a great accounting software option for Amazon sellers because of its affordability, features, and ease of use. By choosing Zoho, Amazon sellers can streamline their financials, reduce errors and get better insights into their business so they can grow and succeed in the ecommerce market.

5. Wave: Best accounting software for Amazon sellers looking for a user-friendly option

Wave is free to use so it’s perfect for small and new Amazon sellers who want to manage their finances without extra cost.

Additional services like payroll and payment processing are available on a pay-as-you-go basis so you have flexibility and cost control.

The platform features basic inventory management, automated sales tax calculation, financial reporting, and customizable invoicing.

Wave is user-friendly so Amazon sellers can navigate and use it easily.

It's so easy to set up that sellers can start using it quickly without extensive training.

Wave provides real time financial data and insights so Amazon sellers can make informed decisions and manage their cash flow.

Pros:

Free to use with limited features

User-friendly interface

Good inventory management

Sales tax tracking

Amazon Seller Central integration

Cons:

Limited advanced features

Customer support can be slow

Pricing:

Free plan: With limited features

Pay as you go for additional services (e.g. payroll, payment processing)

Wave is a great accounting software solution for Amazon sellers because of its affordability, features, and ease of use. Basic inventory management, automated sales tax calculation, financial reporting and customizable invoicing makes it a useful tool to manage the finances of an Amazon business.

See also: Shoeboxed vs. Wave: A Comprehensive Guide to the Differences

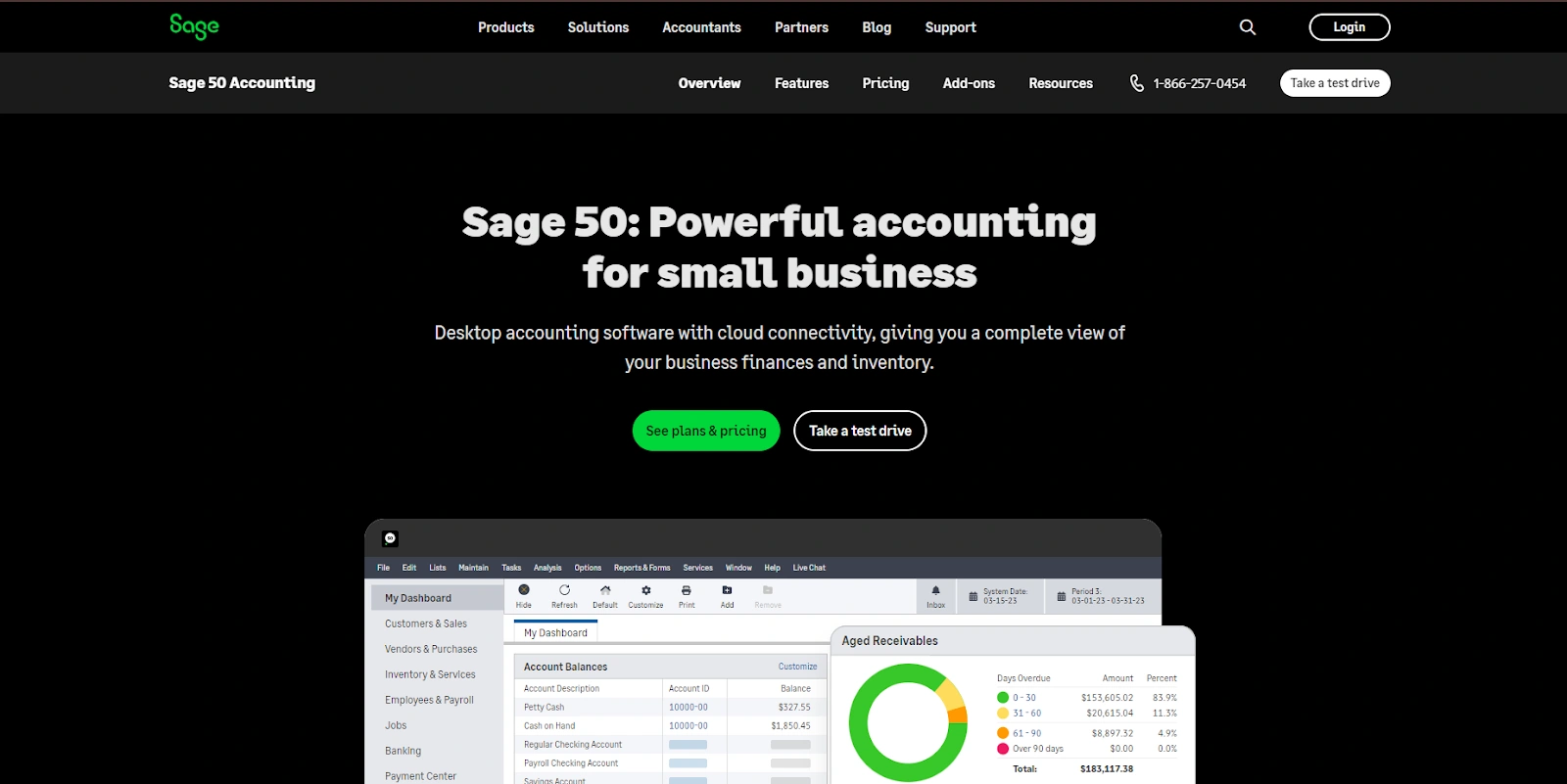

6. Sage: Best accounting software for sellers looking for advanced features

Sage has advanced accounting features for big ecommerce businesses.

It's compliant with various tax regulations and accounting standards so less of a risk of penalties.

Sage’s solutions can scale with the growing complexity of financial management as an Amazon business, so it’s a long-term solution.

You can customize Sage to fit your business needs so Amazon sellers get the features and tools they need for their business.

Sage is highly recommended for complex accounting business.

Pros:

Advanced features for complex business

Good inventory management

Sales tax tracking

Amazon Seller Central integration

Multi-currency support

Cons:

More expensive than others

Can be complex to set up and use

Pricing:

Sage Accounting Start: $10/month

Sage Accounting: $25/month

Sage 50 Cloud: Custom pricing (Best for larger business with more complex needs)

Sage is a great accounting software for Amazon sellers because of its features, scalability and integrations. Advanced inventory management, automated sales tax calculation, Amazon Seller Central integration and customizable financial reporting makes it a powerful tool to manage the complex finances of an Amazon business.

What are the common mistakes to avoid in Amazon business accounting?

Mistakes can cost you a lot of time and money so it's important to know what to avoid.

1. Disadvantages of using spreadsheets for accounting

Using spreadsheets for accounting is time-consuming and prone to human error. They don’t have real time data or collaboration features, so it's not efficient for complex financials.

2. Understanding ‘Fulfilled by Amazon’ and its impact on accounting needs

FBA is a service that handles storage, packaging and shipping of products. Accounting software can manage FBA transactions and track sales tax, so it's important to understand its impact on Amazon business accounting.

Frequently asked questions

How does the best accounting software integrate with Amazon Seller Central?

Integration with Amazon Seller Central is a must-have feature for accounting software for Amazon sellers. For example, QuickBooks Online integrates via third-party apps like A2X, allowing seamless import of Amazon transactions.

Here’s how it works:

Automated data import: The software imports sales data, fees, refunds, and other transactions from Amazon Seller Central.

Real-time updates: Integration provides real-time updates so your financial data is always up-to-date and accurate.

Comprehensive order management: Integrates orders, returns, and refunds into the accounting system so you have a complete financial picture.

Reconciliation: Reconciles Amazon payouts with your bank transactions so all sales and fees are accounted for.

Sales tax compliance: Calculates sales tax based on transaction data and generates reports for tax filing.

What to look for in the best accounting software options to manage your business with Amazon?

When choosing accounting software for your business consider the following features:

Inventory management: Real-time inventory tracking, multi-warehouse integration, and automatic adjustment for returns and damages.

Sales tax automation: Automated sales tax calculation and tracking across multiple regions and detailed reporting for tax compliance.

Multi-currency support: Transactions in multiple currencies with automatic exchange rate updates for international sales.

Financial reporting and analysis: Customizable reports, real-time dashboards, and advanced analytics to see your financial health.

Automation and integration: Integration with Amazon Seller Central, automated data import, and bank reconciliation to reduce manual work and errors like with QuickBooks Online.

Expense management: Automated categorization and tracking of business expenses and expense reports like Shoeboxed's platform.

In conclusion

So, there you have it with the accounting software options. Choosing the right Amazon accounting software is key for sellers. Check out Shoeboxed, QuickBooks Online, Xero, Zoho, Wave, and Sage based on your business size and needs. Integrate your Amazon Seller Central with accounting software to automate, reduce errors, and make better financial decisions.

Caryl Ramsey has years of experience assisting in different aspects of bookkeeping, taxes, and customer service. She uses a variety of accounting software for setting up client information, reconciling accounts, coding expenses, running financial reports, and preparing tax returns. She is also experienced in setting up corporations with the State Corporation Commission and the IRS.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!

Copy link

Copy link