Ready to take the stress out of managing your finances?

Google Sheets templates provide an efficient, user-friendly solution for visualizing complex financial data and organizing accounting processes. These templates can help you create and manage various financial statements, ensuring a clear view of your financial health.

Whether you manage a small business or work within a larger organization, Google Sheets templates help streamline financial management. They allow you to make data-driven decisions while improving productivity.

With Google Sheets accounting templates, you can streamline your financial tracking and make data-driven decisions easily—all without the hefty price tag of expensive software!

What are the benefits of using Google Sheets templates?

One of the most significant benefits of Google Sheets templates is their flexibility. These ready-to-use templates allow you to organize your data and analyze it quickly without having to start from scratch.

Here are the top benefits:

1. Visualize financial data at a glance

Google Sheets templates turn complex data into easy-to-read formats so you can see patterns and make decisions.

2. Save time

Templates save you time by providing pre-designed layouts that can be customized to fit your needs. No more designing accounting sheets from scratch.

3. Data-driven decision making

As a business owner, using templates means you'll rely on data for decisions and have a clear picture of your financials at all times. Accurate financials mean you can adjust strategies, manage budgets, generate and improve cash flow, and ultimately increase profitability.

4. Cost-effective and collaborative

Google Sheets is free and collaborative. Team members can work on financial documents simultaneously, with real-time updates and improved workflow.

5. Perfect for basic accounting needs

For small businesses or teams with straightforward accounting tasks, Google Sheets templates offer the right mix of structure and simplicity, with built-in tools like formulas and graphs.

What are essential accounting templates for Google Sheets?

To make the most of your financial management, you need specific accounting templates for Google Sheets.

Here are six must-have templates:

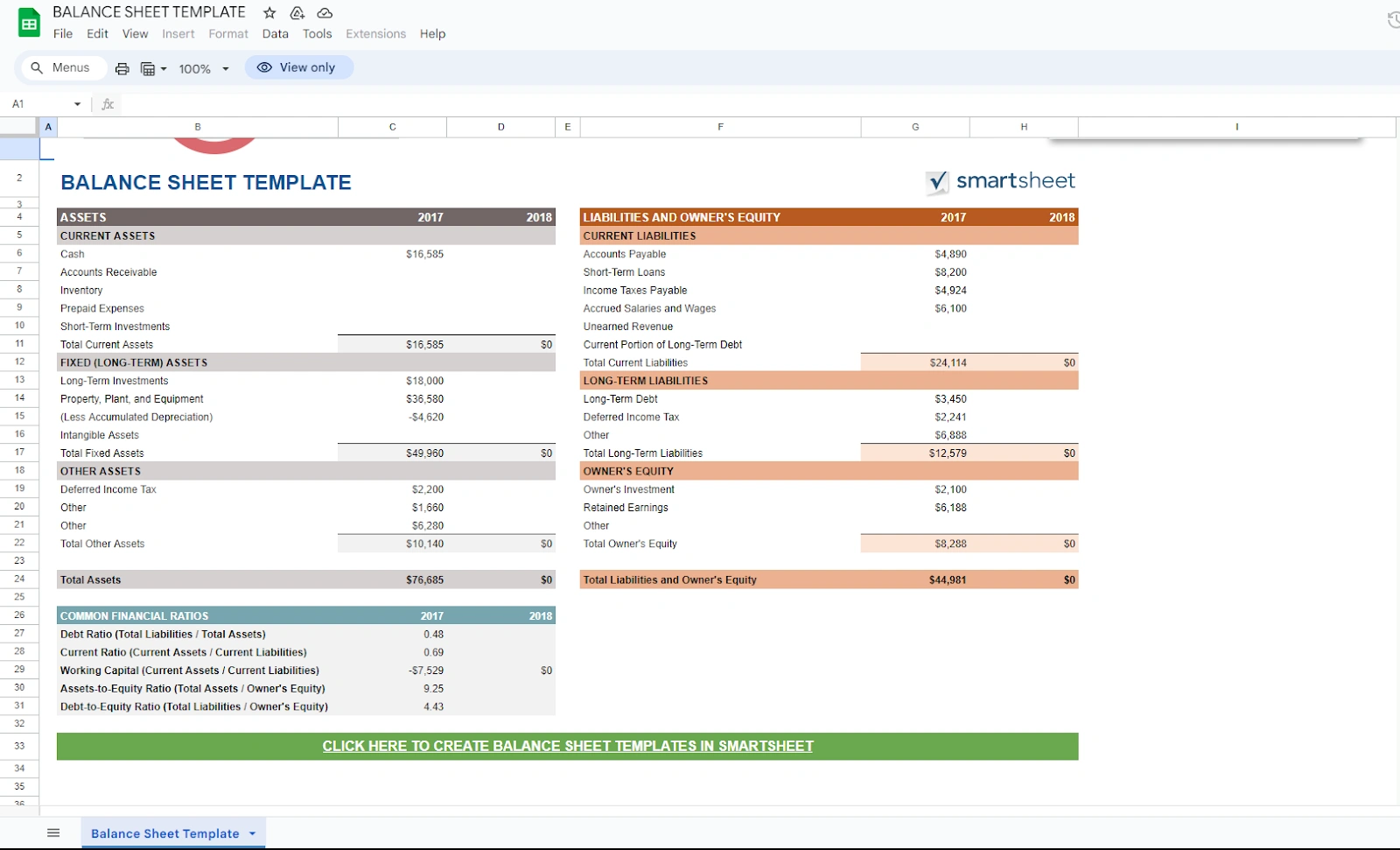

1. Balance sheet template

The balance sheet template gives you a snapshot of your business's financials by breaking down assets, liabilities, and equity. This is key to knowing your business's net worth at any given time.

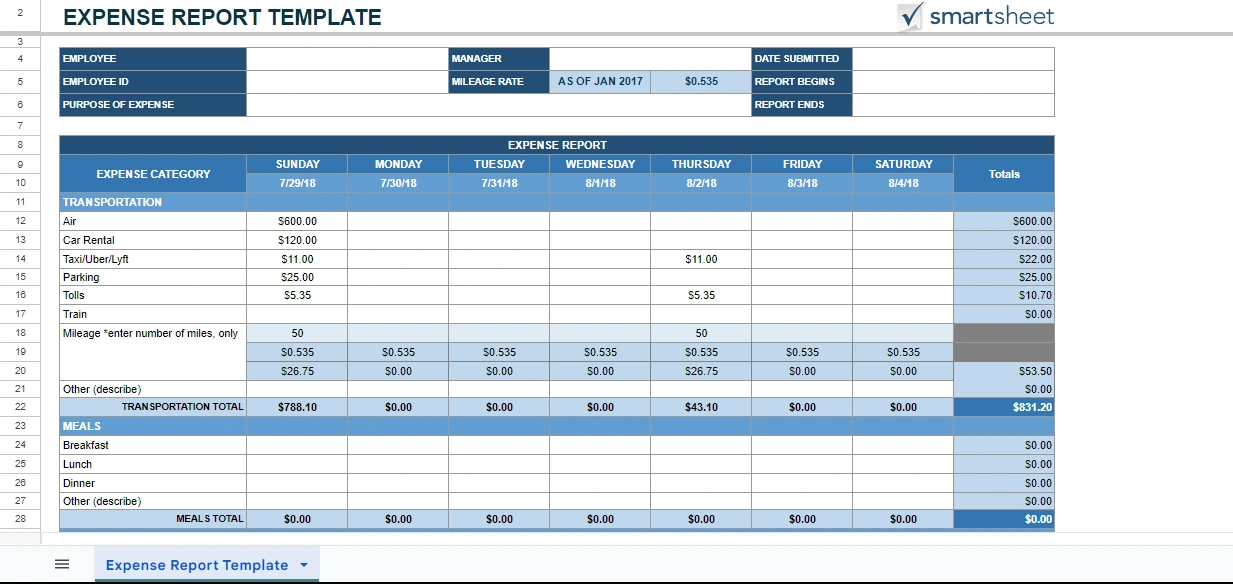

2. Expense report template

The expense report template organizes accounts and tracks business expenses by employee or department. It makes the reimbursement process easier and helps you manage cash flow better.

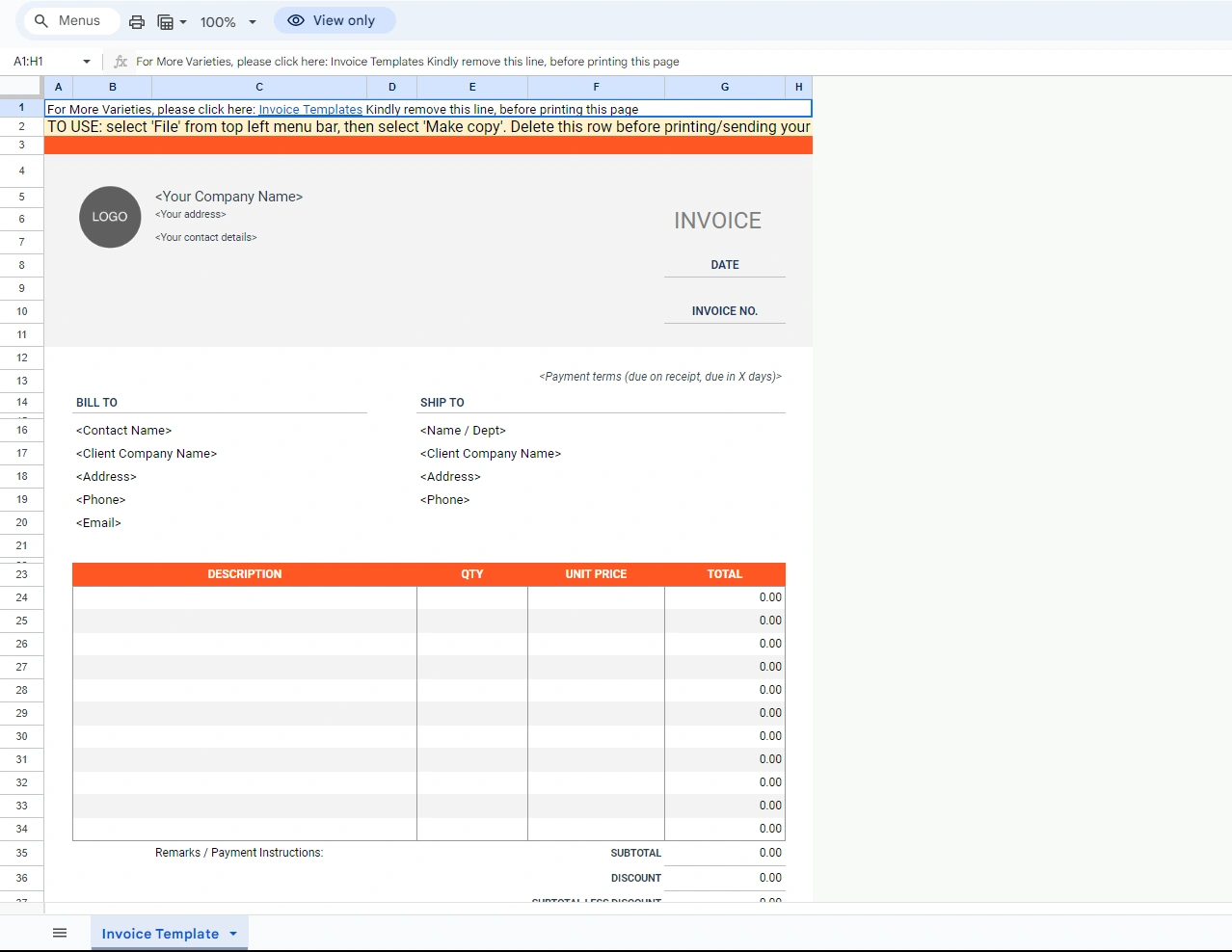

3. Invoice template

The invoice template creates professional and consistent invoices for your products or services. This template ensures timely payments and clear communication with clients.

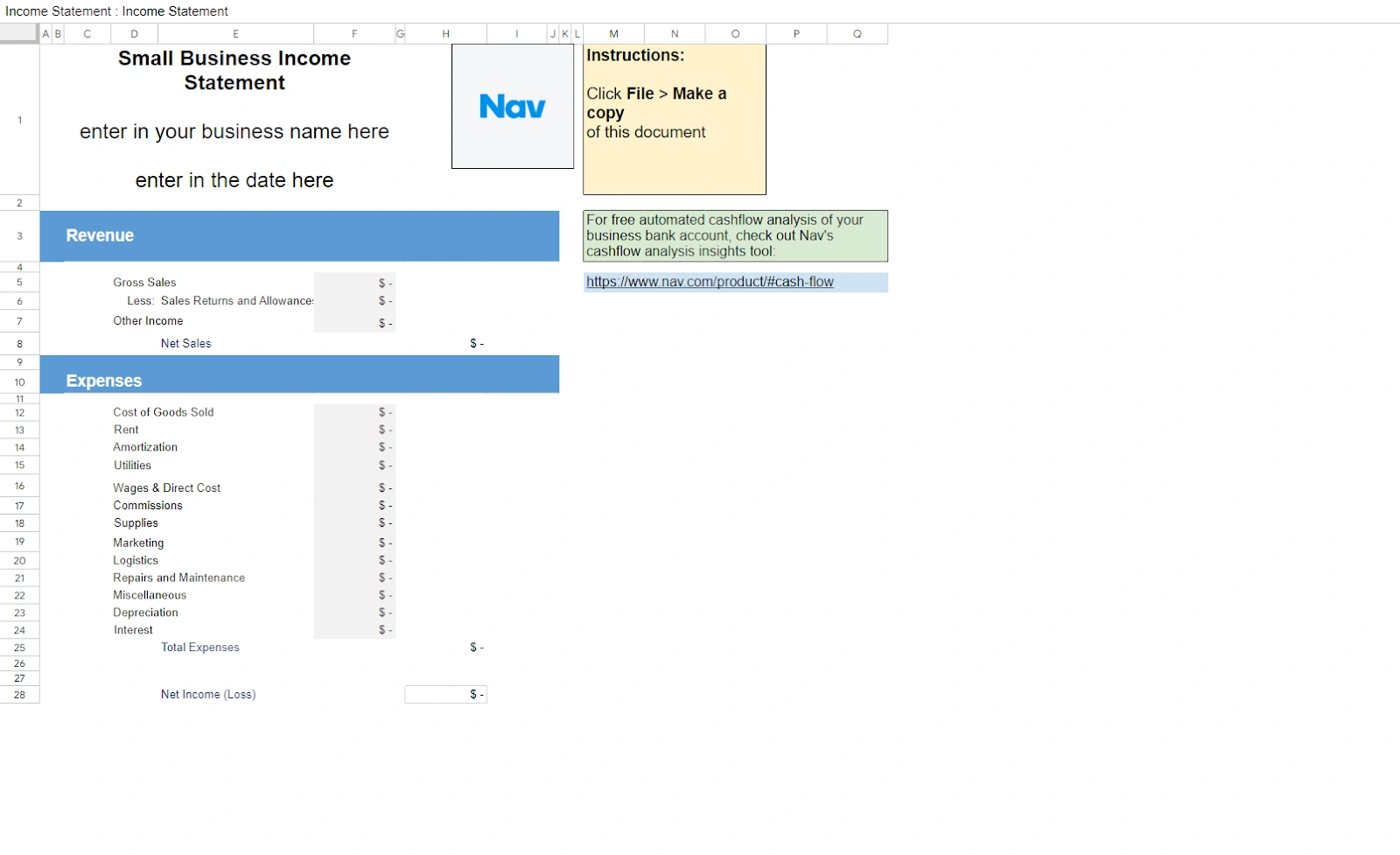

4. Income statement template

The income statement template tracks your income, expenses, and profit over a period. It helps you know whether your business is making or losing money and supports your budgeting process.

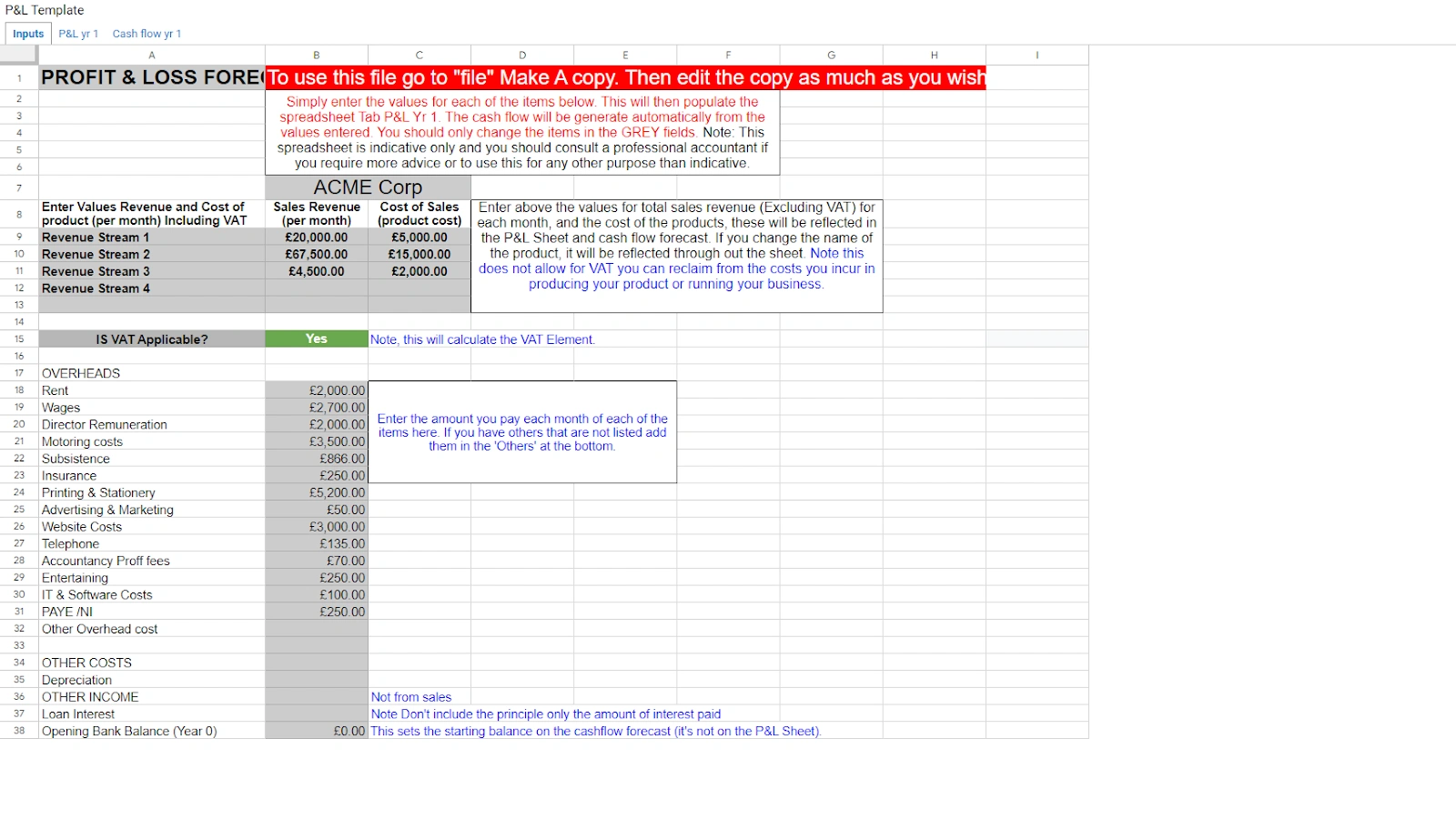

5. Profit and loss statement template

Profit and loss statements provide a detailed view of your company's financial performance, allowing you to see trends, opportunities for improvement, and areas for cost reduction.

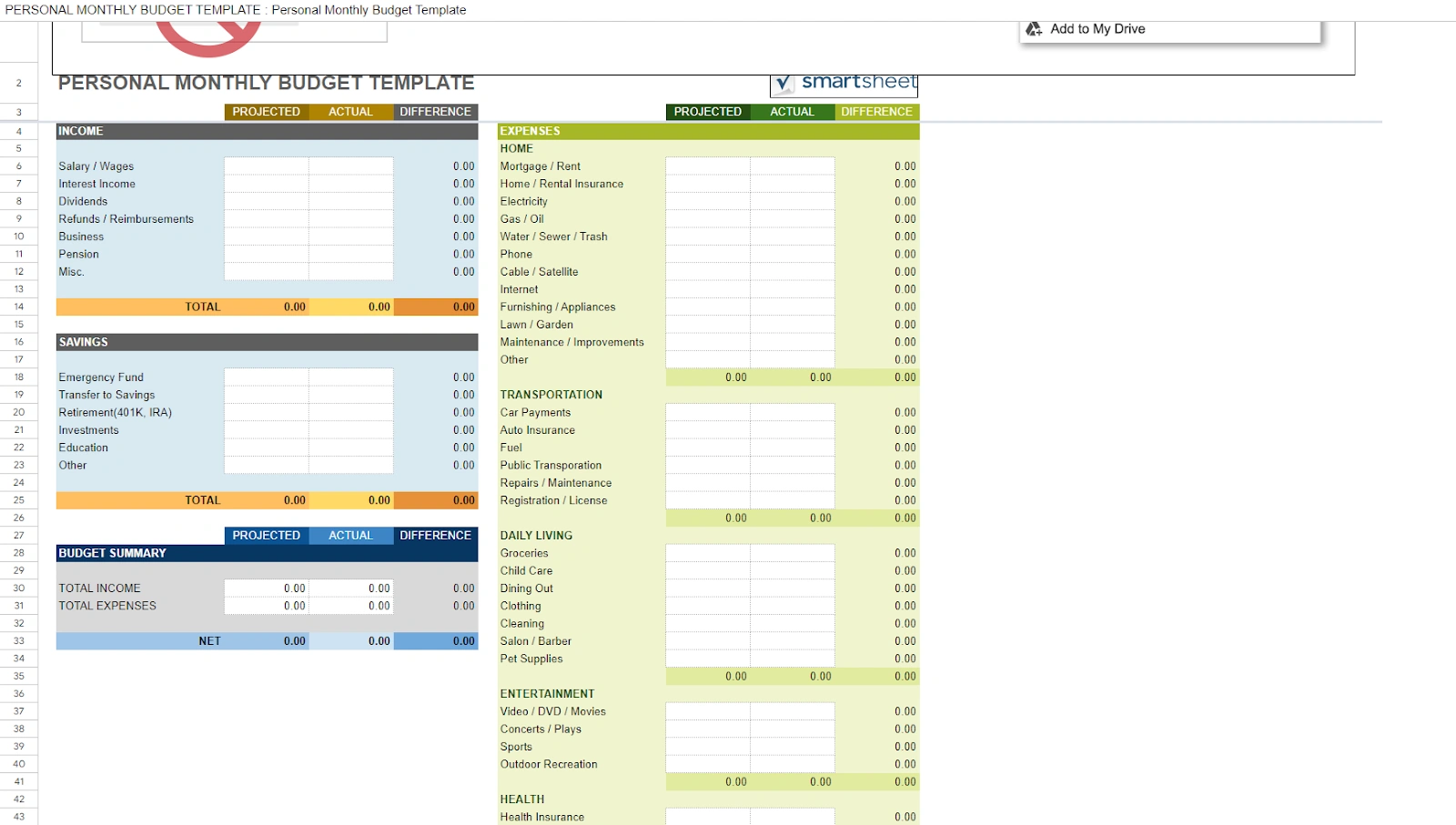

6. Budget template

The budget template helps you plan and track your business's income and expenses to stay within your limits.

Is there a better alternative to using Google Sheets accounting spreadsheet templates?

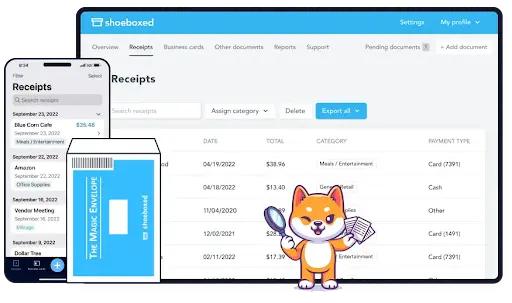

Instead of using accounting templates, I have found that Shoeboxed makes it even easier to organize and manage financial documents.

Shoeboxed - for business owners looking for a simpler alternative to Google templates

Shoeboxed is better for receipts, invoices, and financial documents because it’s more streamlined for specific tasks than Google Sheets. Google Sheets is versatile and good for data organization.

Shoeboxed has automation, ease of use, and features specifically for receipt and expense management that gives you several advantages over Google Sheets.

Here’s why Shoeboxed is better than Google for financial documents:

Automates receipt scanning and data entry

Shoeboxed automates the scanning and data extraction from receipts, invoices, and bills.

It does this by using your smartphone and the Shoeboxed app. Take a photo of the document with your smartphone’s camera and the app will extract the critical data and upload it to your designated account.

Outsourced scanning service

Or, if you want to outsource the scanning, you can use Shoeboxed’s prepaid postage-free Magic Envelope to send your receipts to their processing center. They will scan, human-verify, and upload the documents to your account for you. This is especially helpful when you have a lot of documents to scan.

Break free from manual data entry ✨

Use Shoeboxed’s Magic Envelope to ship off your receipts and get them back as scanned data in a private, secure cloud-based account. 📁 Try free for 30 days!

Get Started TodayOrganizes and automatically categorizes receipts

With its optical character recognition (OCR) technology, Shoeboxed reads the key details (date, vendor, amount) and categorizes the information. No manual data entry, no errors, no time wasted.

In Google Sheets, you’d have to manually enter each receipt’s details or create formulas, which is time consuming and prone to mistakes.

Auto generates expense reports

Shoeboxed allows you to generate expense reports from scanned documents. These reports are fully customizable and can be shared with clients, employees, or accountants. It’s expense management made easy.

In Google Sheets, you’d have to create and format expense reports manually, which can be more time consuming and less efficient.

Stores documents

Shoeboxed stores all your receipts in one digital place. You can categorize and access them by business expenses, personal expenses, or tax deductions. It also stores your documents safely so they are always available and properly categorized for future reference.

Google Sheets can store data but it doesn’t store or scan physical documents. You’d still need a separate system to manage your physical receipts and make sure they are filed and accessible.

Simplifies tax and compliance

Shoeboxed converts receipts into IRS-accepted digital copies and simplifies tax preparation. The platform categorizes and organizes receipts so you can export the necessary documents for tax filings or audits.

You can track expenses in Google Sheets but it doesn’t automate the process of extracting, categorizing, and turning physical receipts into IRS-accepted documents which is critical for compliance.

Integrates with accounting software

Shoeboxed processes receipts and expenses for you so you don’t have to do the tedious work. It integrates with accounting software like QuickBooks and Xero to transfer data seamlessly between platforms.

Google Sheets doesn’t have automation for these tasks so you’ll have to manually enter, categorize, and analyze the data which can slow down the process.

Mobile access and scanning on the go

Shoeboxed has mobile apps that allows you to snap photos of receipts while traveling or working remotely. These apps are perfect for business owners and professionals who need to track expenses on the go.

Google Sheets has mobile apps, but unlike Shoeboxed, it doesn’t have direct receipt scanning. You’d need to use additional tools or manually enter the information.

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic award-winning approach to receipt tracking for tax season. Try free for 30 days!

Get Started TodayWhat are some tips on creating and customizing an accounting template?

Want to design your own or customize premade templates?

Here's how:

Design your own

Google's template gallery: Google Sheets has many free templates for your business to browse or modify.

Know your numbers: Keep your template simple and organized, and focus on the data supporting your financial goals and analysis.

Advanced features: To make Google Sheets more functional and data-driven, you can use formulas, conditional formatting, and charts.

Customizing pre-made templates

Download pre-made templates: Many websites have bundles of accounting templates. These will save you time and give you all the structures you need.

Modify to your needs: Add or remove columns and rows to suit your business. Add your company logo or colors to keep it professional and branded.

How to set up your accounting spreadsheet

Setting up an accounting spreadsheet is key to managing your business’s finances. Open Google Sheets and click on the “Blank” template to create a new spreadsheet. Name your spreadsheet something meaningful. Then you’ll need to structure it by setting up columns and rows for your financial data.

Here are some tips for setting up your accounting spreadsheet:

Consistent naming: Use clear and consistent naming for your columns and rows so everyone on your team knows what’s being tracked and the layout.

Separate sheets: Organize your financial data by creating separate sheets for different types of info, like income statements, balance sheets, and expense reports. This keeps your data organized and easy to find.

Automate: Use formulas and functions to automate calculations. For example, the SUM function adds up expenses, and the AVERAGE function calculates average costs. This reduces manual entry and errors.

Conditional formatting: Highlight important info with conditional formatting. For example, set a rule to highlight cells that go over a certain value or show trends over time. This helps you spot anomalies or big trends in your data.

Using Google Sheets for financial management

Google Sheets integrates with other Google tools, such as Google Workspace and Google Docs, so financial management is efficient, collaborative, and accessible anywhere.

Use Google Sheets to identify trends and areas for improvement in your financial performance and make data-driven decisions to increase revenue and profit.

How to automate tasks with Google Sheets

Google Sheets is a powerful tool that automates some accounting tasks. By leveraging formulas, functions, and add-ons, you can streamline data entry, calculations, and reporting.

Here are some ways you can automate tasks with Google Sheets:

Formulas for calculations: Use formulas to automate calculations. For example, you can use the SUM formula to automatically total your expenses or the IF formula to create conditional statements that adjust based on your data.

Functions for data management: VLOOKUP and HLOOKUP can help you quickly find and organize data within your spreadsheet. These functions are handy for large datasets.

Add-ons for enhanced automation: Integrate add-ons to connect Google Sheets with other tools. For instance, you can set up workflows that automatically send emails or update other spreadsheets based on changes in your data.

Built-in automation features: Utilize Google Sheets' built-in features like conditional formatting and data validation. Conditional formatting can automatically highlight essential data, while data validation can prevent errors by ensuring that only valid data is entered into your spreadsheet.

What are some common accounting templates for small businesses?

Here are some standard accounting templates.

1. General ledger template

The general ledger template provides the following:

A detailed record of all financial transactions.

Helping you track your business's financial performance.

Cash.

Transaction history.

2. OKR template

The OKR template defines your objectives and key results, tracks your progress and performance metrics, and shows how you perform against key milestones.

3. Sheet template

A sheet template provides a pre-built sheet with sections for tasks, owners, start/end dates, durations, and notes, helping you manage projects and tasks.

4. Time-blocking template

Time-blocking templates help you visualize how you spend your time each day, breaking your day into 15-minute increments.

How to download and install a template

Google Sheets offers you access to a wide range of templates that can help you get started with your accounting spreadsheet quickly and easily. These templates are pre-built spreadsheets designed to perform specific tasks, such as creating an income statement or balance sheet.

Here are some tips for downloading and installing templates:

Access the template gallery: Go to the Google Sheets template gallery and search for the type of template you need. The gallery offers a variety of templates for different accounting tasks.

Download the template: Click on the template you want to use and then click the "Use this template" button. This will create a copy of the template in your Google Drive account.

Customize the template: Once the template is in your Google Drive, you can customize it to fit your business's specific needs. Add your data, adjust formulas, and modify the layout to suit your preferences.

Use as a starting point: Templates are great, but don't be afraid to make changes. Tailor the template to your business by adding additional columns, rows, or sheets.

Frequently asked questions

Are Google Sheets templates suitable for small businesses?

Yes, Google Sheets templates are suitable for small businesses as they are cost-effective, easy to use, and flexible. They can be customized to fit your accounting needs, allowing you to track finances without expensive software.

Why is Shoeboxed a better alternative than Google Sheets templates?

While Google Sheets is a flexible tool for organizing and analyzing data, Shoeboxed is a better alternative for financial documents, receipts, and expenses because of automation, receipt scanning, and integration.

By eliminating manual data entry, reducing errors, and offering mobile convenience, Shoeboxed saves time and simplifies financial document management, making it perfect for businesses and professionals who want to streamline their accounting processes.

In conclusion

Using Google Sheets templates is one way to streamline financial management and boost productivity in accounting tasks. These templates make financial processes more manageable and efficient.

Tools and services like Shoeboxed are an even easier way to streamline financial management. By leveraging these tools and templates, you can focus on making data-driven decisions, improving your profitability, and running a more efficient business.

Caryl Ramsey has years of experience assisting in different aspects of bookkeeping, taxes, and customer service. She uses a variety of accounting software for setting up client information, reconciling accounts, coding expenses, running financial reports, and preparing tax returns. She is also experienced in setting up corporations with the State Corporation Commission and the IRS and is a contributing writer to SUCCESS magazine.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!