Managing an Airbnb property involves various operational tasks and financial management.

An Airbnb expense spreadsheet is a practical tool for hosts to monitor their cash flow and profit margins to make informed financial decisions. By meticulously recording all revenue streams and expenditures, Airbnb hosts can better understand their business performance.

Many AirBnB spreadsheets have prices attached to them, but we've managed to find 4 free templates that you can start using right away, along with 1 excellent service you won't want to miss.

Top free templates for Airbnb expense tracking

For Airbnb hosts seeking better financial management, several free templates are available to track expenses efficiently. The following templates help maintain a clear record of income and ongoing costs and provide financial insights essential for profitable property management.

1. Airbnb spreadsheet for financial tracking by BnB Duck

This Microsoft Excel template offered by BNB Duck is a robust option for tracking revenue from multiple rental platforms. It includes columns for check-in/check-out dates and space to record various income streams. Expense categories are customizable, so you can add items like property taxes, utility bills, etc. It's a versatile choice if you're a property manager or a landlord.

To download the Excel spreadsheet for expenses incurred, follow the link below and enter your email and your first and last name.

2. Airbnb expenses spreadsheet by Danny Seeum

Danny Seeum provides a free spreadsheet dedicated explicitly to tracking rental property costs. It ensures hosts stay on top of income and expenses through a practical and straightforward layout.

Expense categories include cleaning services, supplies, repair services, furniture, appliances, decorations, cable, Internet, utility costs, lawn care, insurance, and other expenses.

To download the Google spreadsheet, follow the link, enter your email and add the promo code SUBSCRIBE, and you can download it for free.

3. Short-term rental expense spreadsheet by Lodgify

Users can download a free template from Lodgify, designed to minimize the effort in keeping a tally of rental business finances. Designed for Airbnb hosts or vacation rental hosts with multiple properties.

To download the file, enter your name, email, number of rentals, and phone number. The template will then be sent to your email address.

4. Spreadsheet template for short-term rentals by Stessa

Stessa provides a simple template for tracking key metrics of your Airbnb profits and expenses.

Available as an Excel spreadsheet or a Google Spreadsheet, the template is customizable, tailored to each host's needs, and covers all aspects of Airbnb income and expenses.

5. Bonus: Shoeboxed’s expense management service for Airbnb owners

As an Airbnb host, you know the hassle of juggling dozens of receipts from cleaning supplies, repairs, appliances, and furniture to make your guests feel at home.

Shoeboxed is the solution for Airbnb hosts when it comes to managing receipts for expense reporting and tax time.

Shoeboxed has been voted as the best receipt scanner app for tax season by Hubspot and given the Trusted Vendor and Quality Choice awards by Crozdesk.

The service specializes in organizing and digitizing receipts, making it easier for vacation rental businesses to track their expenses.

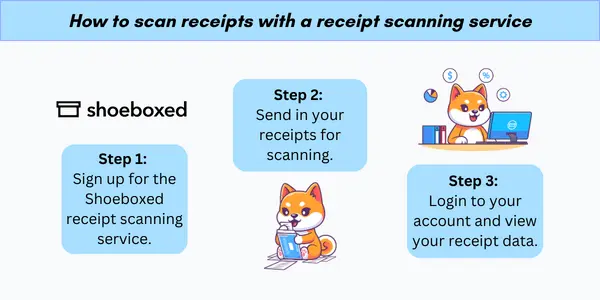

Shoeboxed is a receipt scanner that digitizes and organizes your receipts and documents.

Using Shoeboxed’s mobile app, you simply scan your receipts, and the information will be processed, human verified, turned into digital data, and organized in your Shoeboxed account under 15 tax categories.

From there, you can edit the categories and vendors, add notes, and add other details to organize your expenses further.

How does Shoeboxed’s Magic Envelope benefit Airbnb hosts?

If you don’t have time to scan receipts manually, or you have too many paper receipts to handle, Shoeboxed offers a Magic Envelope service that allows vacation rental businesses to outsource their receipt scanning.

Shoeboxed’s Magic Envelope service

When you choose a plan that includes the Magic Envelope, you’ll be sent a postage-prepaid envelope that you can stuff your receipts into.

Mail the Magic Envelope to Shoeboxed’s scanning facility, and all of your paper receipts will be magically turned into concise digital data and uploaded to your account—all without you having to lift a finger.

Pros

Scans documents and receipts directly from the app. Alternatively, you can use the drag and drop method to bring documents, invoices, warranties, and other important documents into your account.

Importing e-receipts to your Shoeboxed account is as easy as syncing your Gmail with Shoeboxed, using Shoeboxed's special Gmail Receipt Sync feature.

Categorize expenses such as cleaning, upgrades, and other Airbnb expenses.

Magic Envelope gives hosts a hands-off approach to receipt scanning and organization.

Integrates with QuickBooks for seamless accounting and tax reporting.

Cons

Plans purchased through Shoeboxed’s mobile app do not include the Magic Envelope service.

Pricing

Plans with the Magic Envelope start at $18/month up to $54/month and are available for purchase on desktop only.

All plans come with a free 30-day trial.

Shoeboxed is the only receipt scanner app that will handle both your paper receipts and your digital receipts—saving customers up to 9.2 hours per week from manual data entry!

Break free from manual data entry ✨

Use Shoeboxed’s Magic Envelope to ship off your receipts and get them back as scanned data in a private, secure cloud-based account. 📁 Try free for 30 days!

Get Started TodayKey components of an Airbnb expense spreadsheet

A meticulously crafted Airbnb expense spreadsheet is an indispensable tool for hosts to manage and track their property's financial performance effectively.

The spreadsheet essentially breaks down into sections for tracking rental income, operating expenses, maintenance costs, and professional services. Additionally, hosts will want to track occupancy rates to evaluate the financial health of their Airbnb venture.

a. Income tracking

Income Tracking is the first critical component of an Airbnb spreadsheet. It involves recording all earnings generated from property rentals.

A host can simplify this by listing various sources of income, such as nightly rates, cleaning fees, and special service charges. This section also typically documents the dates of income, helping hosts to correlate earnings with specific rental periods.

b. Expense categorization

Expense Categorization is vital for operational orderliness. An Airbnb spreadsheet should offer a detailed breakdown of expenses, separating fixed costs like mortgage or rent, from variable expenses such as repairs or restocking supplies.

Organizing expenses into categories like utilities, maintenance, and guest amenities affords clarity and aids in identifying areas for potential cost savings.

c. Occupancy rates

Occupancy Rates are key indicators of a property's performance. This portion of the spreadsheet tracks the frequency at which a property is rented out against available days.

It often utilizes a percentage to reflect occupancy levels, which can be pivotal for making informed decisions regarding pricing strategies or recognizing seasonal patterns.

Best practices for accurate record-keeping for hosts

Accurate record-keeping is crucial for Airbnb hosts to maintain financial clarity and comply with tax regulations. It requires diligence and consistency to ensure that income and expenses are meticulously tracked.

1. Update regularly

Frequency is key. Hosts should record transactions as they occur to prevent backlogs and ensure real-time accuracy.

A practical method is to set aside a regular weekly time for data entry, which will help you catch discrepancies early and keep your financial overview up to date.

Stop doing manual data entry 🛑

Outsource receipt scanning to Shoeboxed’s scanning service and free up your time for good. Try free for 30 days! ✨

Get Started Today2. Analyze financial data to optimize your rental’s performance

Efficient management of an Airbnb property hinges on the host’s ability to meticulously track and analyze their financial data. Hosts can optimize their performance and maximize profitability through thorough financial reviews.

Here's how one might breakdown financial data:

Revenue analysis: Track income from all sources, including nightly rates, cleaning fees, and special service charges.

Expense tracking: Categorize expenses by type, such as utilities, maintenance, and supplies.

Profit calculation: Subtract total expenses from total revenue to determine net profit.

By using a template, hosts can see a comprehensive overview of their finances at a glance, which might look like this:

Month |

Income |

Expenses |

Net Profit |

January |

$3000 |

$1500 |

$1500 |

February |

$2800 |

$1200 |

$1600 |

... |

... |

... |

... |

By applying the data from an organized spreadsheet, hosts can make informed decisions about their Airbnb business, such as scaling up operations, making budget adjustments, or even exploring new marketing strategies.

Frequently asked questions

What is an Airbnb expenses spreadsheet?

An Airbnb expenses spreadsheet is a tool that helps hosts track and organize their rental property finances. It records income and expenditure associated with managing an Airbnb listing.

How does one categorize transactions in the spreadsheet?

Transactions in the spreadsheet are generally categorized by type, such as rent received, cleaning fees, repairs, supplies, and service fees. Each category should have its own column to simplify tracking and analysis.

Is a template for an Airbnb expenses spreadsheet available online?

Templates are available online, such as the templates mentioned in this article, which can be customized according to individual needs.

Can spreadsheets help with tax preparation?

Spreadsheets can help hosts accurately report their income and expenses come tax season, making tax preparation more efficient. However, for anyone looking for an automated solution, consider expense management software instead.

What are some critical features of a good Airbnb spreadsheet?

Critical features of a good Airbnb spreadsheet include date-wise tracking of income (check-ins, check-outs), expense categorization (utilities, maintenance, supplies), summaries of monthly profits/losses, functionality for recording specific details like guest count or stay duration, etc.

Should the spreadsheet be shared with an accountant?

If a host works with an accountant, sharing the spreadsheet can improve the accuracy of financial records and aid in strategic financial planning.

In closing

Effectively managing finances is crucial for any Airbnb host aspiring to maintain a profitable venture.

A spreadsheet that is both comprehensive and customizable allows hosts to adapt to their varying needs and provides a clear snapshot of their financial health.

Alternatively, using an expense management solution like Shoeboxed frees up time and simplifies getting all your deductions during tax season.

Tomoko Matsuoka is managing editor for Shoeboxed, MailMate, and other online resource libraries. She covers small business tips, organization hacks, and productivity tools and software.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!