Expense audits, a cornerstone of effective financial management, provide businesses and individuals with the assurance that their financial records are accurate, tax-compliant, and conducive to their budgetary goals.

An expense audit reviews, verifies, and analyzes financial transactions to find errors, inefficiencies, or fraud.

This proactive approach by financial teams keeps organizations healthy.

What is an expense audit?

An expense audit reviews and analyzes company expenses to ensure accuracy and company policy compliance.

It checks expense reports, receipts, and other documentation to find errors, discrepancies, or fraudulent activity.

Why are expense audits necessary in financial management?

Expense audits, a necessary financial management component, ensure an organization's accountability, compliance, and transparency.

They ensure company expenses are reasonable, accurately recorded, and efficient.

Here are some reasons expense audits are essential:

1. Errors

Audits find discrepancies in financial records, such as duplicates, incorrect amounts, or misclassified expenses.

2. Fraud

Regular expense audits prevent fraud by holding people accountable and detecting unauthorized transactions.

3. Budget accuracy

By reviewing spending habits, audits show how expenses match budget forecasts and how organizations can adjust.

4. Compliance

Audits check compliance with tax laws, regulatory requirements, and company policy to reduce the risk of fines or legal issues.

5. Decision-making

Precise financial data is needed to decide on cost control, resource allocation, and operational efficiency.

What is the expense report audit process?

The expense report audit process reviews and verifies employee expense reports.

Here are the steps in the process:

1. Planning

When planning an expense audit, consider the following:

What is the scope and purpose of the audit?

What records will be reviewed (e.g., receipts, invoices, financials)?

What are the timelines, and who is responsible?

2. Gathering documents

Here are the documents you will need to gather for the audit:

Expense reports.

Receipts and invoices.

Bank and credit card statements.

Payroll records.

3. Reviewing transactions

During the audit, the following will be reviewed:

Check to see if the amounts are correct.

Expenses are correctly classified.

Supporting docs are present and valid.

4. Trends and patterns

Auditors will look for unusual patterns, such as unexplained increases or repeated mistakes in certain areas.

5. Policy compliance

Are expenses aligned with internal policies and external regulations (e.g., tax laws, industry standards)?

6. Notes

Auditors will list any errors, irregularities, areas for improvement, and suggestions for fixing errors or strengthening controls.

7. Action

One of the following will be done:

Fix issues by updating policies, processes, or staff training.

Gather all expense reports, receipts, and documentation.

Check for accuracy, completeness, and compliance with company policies and procedures.

Investigate and resolve any discrepancies or errors found during the audit.

Record and report the audit results, including any recommendations for improvement.

What are the common challenges in expense auditing?

Like anything else, expense auditing has its own challenges.

1. No expense policy

Some companies do not have an expense policy, which can lead to inconsistencies, incorrect expenses, and errors in expense reports.

It is best to have a clear company expense policy that outlines what’s allowed, how much, and how to get reimbursed.

2. No expense controls

No expense policy and controls mean overspending, inaccurate reports, inflated claims, or fraud.

Be sure to have expense controls like spending limits, vendor restrictions, company charges, or corporate credit cards.

3. Unorganized or incomplete documentation

Unorganized or incomplete documentation on expenses makes it hard for auditors to verify them.

You can prevent this by encouraging employees to keep expenses organized and complete by using expense management software.

What are the best expense management practices?

Here are some tips that I have found to be extremely helpful when managing business or personal expenses myself:

1. Automate expense management

Automate the expense management process using expense management software.

This can help streamline the process, reduce errors, and improve compliance.

2. Implement budget limits and policies

Set budget limits and apply them automatically to keep finances under control.

Implement spending limits, vendor restrictions, and company charges on corporate credit cards.

3. Maintain transparency and setting time-frames

Consistently inform stakeholders of deadlines for expense report submissions and regular audits.

You should have a travel manager and a clear policy to manage business travel efficiently.

How to identify and prevent fraudulent claims

To spot and stop fraud, you need to know the types of expense fraud, the red flags, and the strategies.

1. Types of fraud claims

Identify false, duplicate, fictitious, and misclassified expenses.

2. Red flags

Watch for unusual or excessive expenses, missing receipts, and unapproved expenses.

3. Strategies

Automate expense management, budget limits, and policies.

How to overcome expense auditing challenges

When trying to avoid expense auditing challenges, first look at streamlining the audit process.

Simple strategies are to automate the expense management system, set budget limits, make sure there are no complicated expense policies, make everything transparent, and establish time-frames.

When it comes to automating expense management, one tool stands out among the rest.

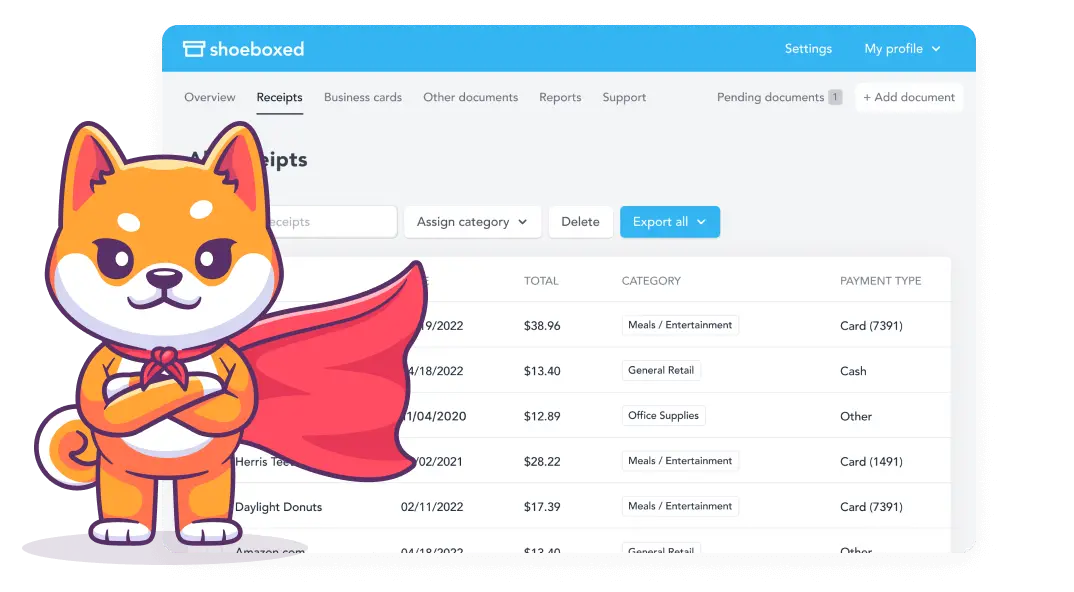

Shoeboxed - ideal for businesses looking to streamline the audit process by automating expense management

Shoeboxed is an expense management system and receipt tracking app that makes the audit process easier by digitizing and organizing financial documents.

Here’s how Shoeboxed can help during the expense audit process:

Digitized receipt management

The first step in auditing expenses is to identify and track them.

Therefore, scan and upload all of your receipts; Shoeboxed will digitize and store them for you.

You can snap a picture of your receipt or document using your smartphone, and Shoeboxed's app will automatically upload a digital copy to your designated Shoeboxed account.

This provides users with a comprehensive record of expenses all in one place.

If you prefer not to handle the scanning yourself, Shoeboxed offers an outsourcing option. You can mail your receipts or documents to Shoeboxed using their free pre-paid Magic Envelope. Their team will scan, human-verify, and upload them into your account for you.

Shoeboxed is the only receipt scanner app that will handle both your paper receipts and your digital receipts—saving customers up to 9.2 hours per week from manual data entry!

Stop doing manual data entry 🛑

Outsource receipt scanning to Shoeboxed’s scanning service and free up your time for good. Try free for 30 days!✨

Get Started TodayAutomatic expense categorization

With OCR technology, the app will automatically categorize expenses into pre-defined or tax categories for you, so your financial data is organized.

Add custom tags to receipts for easy searchability.

This digital archive means all your receipts are easily accessible and organized so that you can find them quickly during an audit.

This makes the audit process easier by giving you a clear picture of your expenses.

IRS compliance

Shoeboxed provides IRS-accepted receipt scans, so digital copies meet regulatory standards. This is important during audits as it verifies the electronic records are authentic.

Audit expense reports

Users can generate detailed audit expense reports with attached receipt images so everything is transparent and easy to review during audits.

Get organized. Audit ready. Simplify.

Expense report audit checklist

![Financial Audit Prep Checklist [PDF]](http://images.ctfassets.net/38kjycu662tu/1Hd1yAO1As47yAHErC5RaQ/92e5ed1c07827023b7db1c336efe8d50/FINANCIAL-AUDIT-PREPARATION-CHECKLIST-min-600x849.webp)

Financial Audit Preparation Checklist - Shoeboxed

A financial audit checklist can significantly aid in the expense audit process.

In addition to the checklist, be sure to do the following:

Verify compliance with company policies and procedures.

Check for accuracy and completeness of expense reports.

Ensure that all necessary documentation is attached to the expense report.

Verify that expenses are properly categorized and coded.

Never lose a receipt again 📁

Join over 1 million businesses organizing & scanning receipts, creating expense reports, and reclaiming multiple hours every week—with Shoeboxed.✨

Get Started TodayFrequently asked questions

How often should I do an audit of my expenses?

Internal audits are monthly or quarterly; external audits by finance teams are annual or as needed.

What tools can I use to streamline the audit process?

Accounting and expense management software like Shoeboxed can collect, categorize, and analyze expense data, making the audit process much easier.

In conclusion

Expense auditing is key to financial accountability and transparency in business.

Automate your expense audits with tracking tools like Shoeboxed to increase efficiency and accuracy, compliance and security, reporting, and analytics.

Caryl Ramsey has years of experience assisting in bookkeeping, taxes, and customer service. She uses various accounting software to set up client information, reconcile accounts, code expenses, run financial reports, and prepare tax returns. She is also experienced in setting up corporations with the State Corporation Commission and the IRS and is a contributing writer to SUCCESS magazine.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple receipt capture methods: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad, and Android) to snap a picture while on the go—auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports, including IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports, and more—with Shoeboxed.

Try Shoeboxed today!