If you’re a bookkeeper or small business owner looking to enhance your financial operations, automated bookkeeping could be the game-changer you've been waiting for.

With over a decade of experience as a treasurer, bookkeeper, and staff accountant, I've witnessed firsthand how modern technology has revolutionized the financial sector, making it more efficient and successful.

The key is to ensure that you choose the right tools and services and that your automation strategy aligns with your business’s needs and goals. Automated software can significantly streamline bookkeeping and accounting tasks, making your operations more efficient.

What is automated bookkeeping?

Automated bookkeeping is when computers complete the tasks that would otherwise be performed manually by financial professionals.

Automated bookkeeping mimics manual data entry using technology and artificial intelligence through accounting software, automated services, and financial tools. Proper setup and implementation of automated software can optimize and streamline bookkeeping and accounting processes for small businesses.

Using one or a combination of these, you can streamline your accounting team’s financial operations and make your business run much more efficiently.

How to choose the right automated bookkeeping software

There is no one-size-fits-all automated bookkeeping solution.

Proper setup and implementation of automated software are crucial for small businesses to optimize and streamline their bookkeeping and accounting tasks.

That’s why you must consider several key elements when choosing your software.

Step 1. Determine your company's needs

The first step in choosing the right bookkeeping automation solution is determining your business’s needs and accounting processes.

Your software should align with your accounting process as closely as possible, and implementing automated software can help streamline these processes to meet your business’s goals.

Step 2. Consider only the accounting software that is appropriate for the size of your business

Automated bookkeeping solutions cater to businesses of various sizes. Automated software can scale to meet the needs of different business sizes, from small startups to large enterprises.

Some are designed for small to mid-sized or medium to large businesses, while other accounting software caters to all three.

Ensure the software you consider is appropriate for your company’s size, number of employees, users, and business transactions.

Step 3. Narrow the software down based on the features that support and streamline your financial operations

Consider the features needed to support and streamline your financial operations with automated software.

Do you need any or all of the following features in your accounting software?

Project management

Time tracking

Accounts receivable

Accounts payable

Expense tracking

Payroll system

Inventory management system

App integration

Certain reporting features

Cloud-based

Step 4. Make sure the software will grow with your business

One thing that bookkeeping and accounting professionals often need to remember to consider is the scalability of their software.

Will the software, including automated software, grow with your business as you add more employees, users, and business accounts? Rest assured, the right software will adapt to your needs.

If not, you may start over again when choosing a software option catering to larger businesses.

Step 5. Make sure the accounting automation is affordable based on your budget

Before you get carried away with all the bells and whistles, which is easy to do, make sure the bookkeeping software fits within your budget. Affordable automated software can significantly streamline bookkeeping and accounting tasks for small businesses.

There’s nothing worse than spending time on extensive research only to find out that it’s out of your price range.

What are the best practices for implementing automated bookkeeping software?

Automated bookkeeping can easily be integrated into your existing business operations by using the following practices.

1. Assign the finance professional with the most technology experience to oversee the automation process

Assigning one person to oversee the implementation of automated software gives everyone in the company a designated individual to go to for questions or help.

It also gives the representative with the automated bookkeeping platform a contact for communication between the two.

2. Prioritize features needed in your automated bookkeeping solution

While every business has different priorities, there are features when you use automated software for bookkeeping that I have found essential for financial professionals.

These include the following:

Bank reconciliation

Billing and invoicing

Payments and collections

Accounts payable/Accounts receivable

Payroll

Cash flow management

Expense tracking

Revenue recognition

Fixed asset management

Reporting

Transaction categorization

File management

Accounting app

3. Thoroughly educate your team on the software tools and bookkeeping processes

When you first begin using automated bookkeeping, it can seem overwhelming. But remember, it’s designed to make your life easier and your work more efficient.

So, take the time to thoroughly and patiently educate team members on the automated software.

It will pay off in the long run!

What are ways to integrate automation with existing practices?

Automated software plays a crucial role in improving the efficiency of small businesses' bookkeeping and accounting tasks. Many tasks can be automated to improve the efficiency of any business.

The practices that are already in use are a good starting point.

1. Tracking cash flow and reconciling accounts

Automated bookkeeping should allow you to link your bank accounts and credit cards to your accounting software using automated software so that cash balances from bank statements and cash flow match and are constantly updated. This ensures you have an accurate picture of your company’s financial position.

This will always reflect an accurate picture of the company’s financial position so that sound strategic business decisions can be made anytime.

2. Running payroll

Trust me, doing payroll by hand is a royal pain.

Using manual bookkeeping to calculate wages, commissions, salaries, bonuses, state and federal taxes, and other deductions takes an unbelievable amount of time. With automated bookkeeping and software, you can save time and focus on more critical tasks.

There are also a lot of laws and regulations to follow and significant penalties for human oversight.

There are automated bookkeeping services and software that will take on this burden for you.

With automated payroll, the software tracks employee hours, calculates pay and deductions, and prints out paychecks.

Employees can also access their pay information and submit their timesheets via the web.

3. Managing accounts payable/receivable

Automated bookkeeping using automated software is a very efficient way of managing, paying, and tracking vendor and client invoices.

Accounting software can automatically issue and collect recurring payments and send reminders for upcoming and late payments.

4. Expense management

Tracking and categorizing transactions and expenses manually can be tedious, time-consuming, and often lead to human error.

Some services use automated software to track expenses, making employee reimbursements and tax time much more straightforward.

Shoeboxed—ideal for small business owners looking to simplify expense management

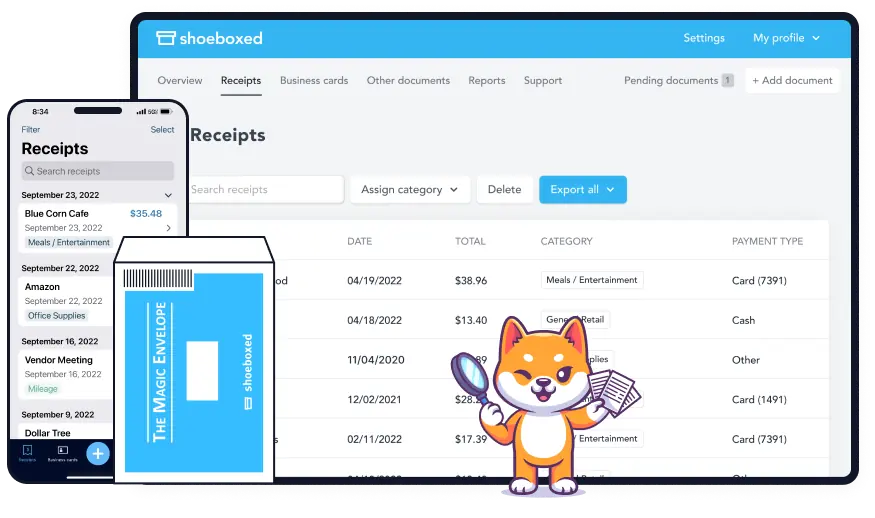

Shoeboxed provides digitized automation of expense management through receipt scanning.

Shoeboxed allows users to digitize receipts and other documents by taking photos with their mobile device’s camera and using the Shoeboxed app. The app automatically uploads the critical data from each receipt into a designated Shoeboxed account—no more data entry.

With the mobile app, users can capture and manage receipts on the go, which is more convenient and productive.

Shoeboxed has a mail-in service for physical receipts if you want to outsource the scanning. Users can send batches of receipts in pre-paid envelopes, or the Magic Envelope and Shoeboxed will scan, digitize, human-verify, and upload them into your account, where the receipts are stored in the cloud for easy access.

Users can also forward receipts from their email inbox directly to their Shoeboxed account, use a custom Gmail plug-in to auto-import e-receipts from their inbox, and send them to their Shoeboxed account or drag and drop a batch of receipts into the cloud using a desktop or laptop.

Break free from manual data entry ✨

Use Shoeboxed’s Magic Envelope to ship off your receipts and get them back as scanned data in a private, secure cloud-based account. 📁 Try free for 30 days!

Get Started Today

Once the receipts are uploaded, critical data is extracted using OCR data extraction, and expenses are automatically categorized into 15 tax or customized categories.

Turn receipts into data with Shoeboxed ✨

Try a systematic approach to receipt categories for tax time. Try free for 30 days!

Get Started Today

The software auto-generates detailed expense reports, which can be used for financial analysis and sound decision-making.

Shoeboxed integrates with various accounting and practice management software to facilitate a smooth workflow and better financial management. This also ensures that data is auto-synced across platforms and up-to-date.

The platform organizes financial documents to make tax time more accessible, reduce the chance of missed deductions, and ensure tax compliance.

By organizing and making financial records accessible, Shoeboxed helps users be audit-ready by reducing stress and potential issues during audits.

Never lose a receipt again 📁

Join over 1 million businesses organizing & scanning receipts, creating expense reports, and reclaiming multiple hours every week—with Shoeboxed.✨

Get Started TodayWhat are the benefits of automation in bookkeeping?

There are several key benefits when it comes to automating your bookkeeping process. Implementing automated software can significantly optimize financial operations, streamlining bookkeeping and accounting tasks for small businesses.

1. Saves time

Most bookkeeping and accounting tasks, such as data entry, are time-consuming and repetitive, taking hours to complete.

Automated software minimizes the time spent on these menial tasks so that more time can be spent on the more high-valued tasks, such as data analysis, financial projections, business growth, and process optimization.

Automated bookkeeping saves time and makes for a more productive environment.

2. Provides real-time data

It takes time for bookkeepers to keep the various financial records updated manually constantly.

Automated software updates records when the data is available, so you always work with real-time data and insights.

3. Reduces human error

There is always room for human error when keeping records manually.

Implementing automated software in bookkeeping and accounting tasks minimizes errors in financial records, making data less likely to be recorded and distributed incorrectly.

This means that financial statements and records will be more consistent with accurate data.

Common mistakes to avoid in automated bookkeeping

Automated bookkeeping is not a replacement for human interaction and assessment.

Mistake #1. Ignoring the importance of human review

While computers are highly accurate, it doesn’t mean that the manual data entry was entered correctly.

Automated software for bookkeeping and accounting is also geared for repetitive tasks and not human judgment.

So, it’s still important for a financial professional to go back and review all data and reports.

Mistake #2. Overlooking software updates and upgrades

Since accounting laws and regulations change so frequently, keeping up with all software updates and upgrades, including implementing automated software, is imperative.

Mistakes from outdated information can lead to significant penalties.

Mistake #3. Inadequate security measures for financial data

Automated bookkeeping deals with personal and sensitive financial information, and clients want to be assured that their data is secure online.

That’s why it’s important to have the optimal security measures in place for your automated software solution so that none of their personal information is compromised.

Frequently asked questions

Is there a way to automate the bookkeeping process?

Implementing automated software and services are two of the best ways to automate the bookkeeping and business processes. For example, Shoeboxed automates expense management by scanning receipts or documents, auto-uploading critical data, auto-categorizing the data, and automatically generating expense reports.

What are the benefits of automated bookkeeping solutions?

Automated bookkeeping saves time, provides real-time data, and reduces human error.

In conclusion

Automated bookkeeping streamlines a business’s financial operations and optimizes its workflow by completing repetitive bookkeeping tasks, freeing up time for higher-valued tasks. Automated software plays a crucial role in efficiently managing and optimizing financial operations.

Even though many bookkeeping services and software tools enable individuals to work faster, better, and brighter, they do not replace the human bookkeepers in small businesses.

After all, automation can only exist with humans running the program, entering the data, or sometimes making professional judgment calls. The two need each other.

Caryl Ramsey has years of experience assisting in different aspects of bookkeeping, taxes, and customer service. She uses a variety of accounting software for setting up client information, reconciling accounts, coding expenses, running financial reports, and preparing tax returns. She is also experienced in setting up corporations with the State Corporation Commission and the IRS.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!