In recent years, the popularity of Airbnb has grown exponentially, making it an attractive and potentially lucrative business venture for property owners and hosts.

Choosing the best accounting software for Airbnb businesses can make all the difference in streamlining financial tasks, ensuring accuracy, and maintaining a healthy cash flow.

Various accounting software options are available in the market, each with its unique features and benefits tailored to Airbnb hosts’ needs.

In this article, we will discuss some of the leading accounting software tools that vacation rental owners can consider to manage their business finances efficiently and effectively.

Why is accounting software essential for Airbnb hosts?

Managing finances is a crucial aspect of running a successful Airbnb business.

Vacation rental owners need to keep track of their income and expenses in order to maintain profitability and ensure business growth.

Accounting software offers numerous advantages in this regard, providing Airbnb hosts with the tools they need to effectively manage their finances.

1. Helps keep income and expense tracking accurate

One of the primary reasons for using accounting software is the ability to accurately track income and expenses.

With a streamlined platform, hosts can effortlessly record all financial transactions related to their Airbnb business, including rental income, cleaning fees, and any additional costs incurred.

This allows for a clear view of the financial performance of small business owners and enables them to make informed decisions about their operations.

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic award-winning approach to receipt tracking for tax season. Try free for 30 days!

Get Started Today2. Ensures tax compliance

In addition to tracking financial transactions, accounting software can also help with tax compliance.

As Airbnb hosts are required to report their earnings and pay taxes accordingly, having organized financial records is essential.

Accounting software can generate tax reports and provide valuable insights into deductions and potential tax savings, simplifying the process and ensuring compliance with tax regulations.

3. Accounting software saves hosts time

Another significant advantage of accounting software for Airbnb hosts is that it saves a lot of time.

Manual methods of bookkeeping can be labor-intensive and time-consuming, draining valuable resources that could be better spent on growing the business.

Accounting software automates many processes, allowing hosts to focus their attention on enhancing the guest experience, optimizing pricing strategies, and expanding their rental portfolio.

4. Gives a clear picture of the business’s financial health

An accounting software solution also allows hosts to monitor their business’s financial health.

Utilizing real-time data and up-to-date reports, hosts can identify trends and potential areas for improvement.

Hosts can also assess the profitability of each rental property, allowing for better decision-making and planning for future growth.

Incorporating accounting software into an Airbnb business is vital for maintaining accurate financial records, ensuring tax compliance, saving time, and monitoring the overall financial health of the business.

By leveraging these tools, Airbnb hosts can confidently manage their finances and focus on taking their vacation rental business to new heights.

Best Accounting Software for Airbnb in 2023 – Why do you need it? by 9to5Software

What features should you consider in accounting software for an Airbnb?

When selecting accounting software for the vacation rental industry, there are several key features to consider.

1. Ease of use

It’s important to choose software that’s user-friendly and easy to navigate.

A solution with a clear interface and intuitive design enables you to focus on managing your Airbnb finances rather than struggling to understand complicated features.

2. Financial reporting

Accounting software should offer comprehensive financial reporting capabilities.

This includes generating income statements, balance sheets, and cash flow reports, allowing you to create detailed reports and keep a close eye on your Airbnb business’s financial health.

3. Expense tracking

Accurate expense tracking is crucial for managing your Airbnb’s budget and tax obligations.

Look for software that automates this process and categorizes expenses for easy organization and analysis.

Never lose a receipt again 📁

Join over 1 million businesses organizing & scanning receipts, creating expense reports, and reclaiming multiple hours every week—with Shoeboxed.✨

Get Started Today4. Invoicing

Invoicing functionality is essential for keeping track of document payments from guests and other income sources.

Choose a software that provides customizable invoicing templates and features, such as payment reminders.

5. Integration with Airbnb and other platforms

Efficient Airbnb management requires seamless integration with Airbnb and other vacation rental platforms.

Good accounting software should offer integrations to automatically import income, fees, and expenses, ensuring your financial data is always up-to-date.

6. Mobile app support

Managing your Airbnb business on the go is made easier with a mobile app.

Look for software that offers a mobile app for both iOS and Android devices, enabling you to access your accounting information whenever and wherever you need it.

See also: Accounting Software for Amazon Sellers: Top 6 Picks for 2024

What are the best accounting software options for Airbnb hosts?

Choosing the right accounting software can help streamline bookkeeping tasks and provide valuable insights into the financial health of your rental business.

Below are some of the best accounting and bookkeeping software options for Airbnb hosts, each with its unique strengths and features.

1. QuickBooks

QuickBooks is a great accounting software option for Airbnb hosts.

This comprehensive platform offers features such as income tracking, expense management, online payments, and GST and VAT tracking.

QuickBooks Online

Suitable for both small-scale and professional hosts, QuickBooks also provides integrations with other Airbnb management software tools.

Pros:

Robust inventory management in the upper-tiered plans.

More than 750 app integrations.

Comprehensive reporting starts with more than 50 reports.

Cons:

Monthly plans are more expensive than most alternatives.

Limited users with each plan.

Automatic time tracking is an additional cost.

Pricing:

Simple Start: $30/month

Essentials: $55/month

Plus: $85/month

Advanced: $200/month

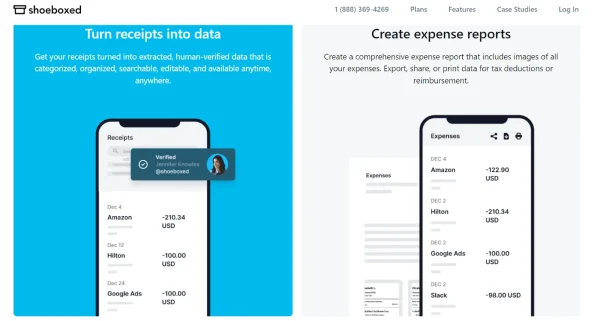

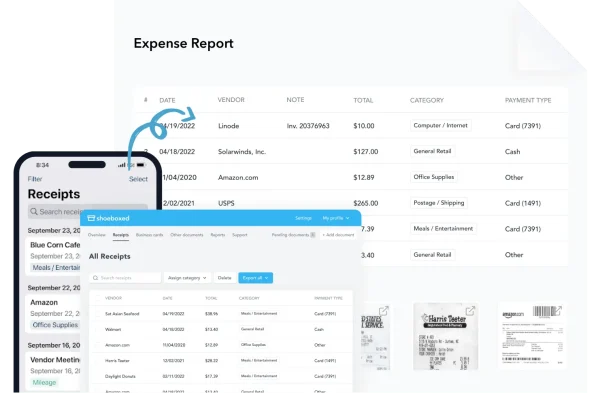

2. Shoeboxed

As an Airbnb host, you know the hassle of trying to juggle dozens of receipts from cleaning supplies, repairs, appliances, and furniture to make your guests feel at home.

Shoeboxed is the best accounting software for Airbnb hosts when it comes to managing receipts for expense reporting and tax time. Shoeboxed specializes in organizing and digitizing receipts, making it easier for vacation rental businesses to track their expenses.

Shoeboxed is a receipt scanner that digitizes and organizes your receipts and documents.

Using Shoeboxed’s mobile app, you simply scan your receipts, and the information will be processed, human verified, turned into digital data, and organized in your Shoeboxed account under 15 tax categories.

From there, you can edit the categories and vendors, add notes, and other details to further organize your expenses.

How does Shoeboxed work with accounting software?

Shoeboxed integrates with accounting software like Wave, QuickBooks, and Xero, which simplifies the accounting process for vacation rental owners.

Shoeboxed is an especially great add-on for QuickBooks and allows you to seamlessly digitize your paper receipts, categorize them, and transport the data over to QuickBooks to make tax time a breeze.

That said, Shoeboxed isn’t an automatic integration, so you’ll have to manually select the receipts you want to transfer over to QuickBooks.

How does Shoeboxed’s Magic Envelope benefit Airbnb hosts?

If you don’t have time to manually scan receipts, or you have too many paper receipts to handle, Shoeboxed offers a Magic Envelope service that allows vacation rental businesses to outsource their receipt scanning.

Shoeboxed’s Magic Envelope service

When you choose a plan that includes the Magic Envelope, you’ll be sent a postage-prepaid envelope that you can stuff your receipts into.

Mail the Magic Envelope to Shoeboxed’s scanning facility, and all of your paper receipts will be magically turned into concise digital data and uploaded to your account—all without you having to lift a finger.

An explanation of Shoeboxed’s Magic Envelope

Pros:

Scans documents and receipts directly from the app.

Categorize expenses such as cleaning, upgrades, and other Airbnb expenses.

Magic Envelope gives hosts a hands-off approach to receipt scanning and organization.

Integrates with QuickBooks for seamless accounting and tax reporting.

Cons:

Plans purchased through Shoeboxed’s mobile app do not include the Magic Envelope service.

Pricing:

The Digital Download Only Starter Plan is $4.99/month, up to $19.99/month for the Pro digital plan.

Plans with the Magic Envelope start at $18/month up to $54/month and are available for purchase on desktop only.

Free 30-day trial.

Break free from manual data entry ✨

Use Shoeboxed’s Magic Envelope to ship off your receipts and get them back as scanned data in a private, secure cloud-based account. 📁 Try free for 30 days!

Get Started Today3. Wave

Wave Financial is another reliable choice for managing Airbnb finances.

Wave is one of the best accounting software for Airbnb hosts on a budget, as it offers many essential features for free.

Wave accounting software.

With its user-friendly interface, the Wave accounting software gives hosts with or without any accounting knowledge an easy way to track income, expenses, and tax liabilities.

Pros:

User-friendly for non-accountants with its intuitive interface.

Excellent workflow and business automation tools.

Cost-effective with its many free essential features.

Accepts online payments.

Cons:

Limited scalability.

Mobile apps aren’t very comprehensive.

Pricing:

Invoicing: $0/month

Accounting: $0/month

Mobile receipt feature: $8/month

Payroll: $40/month

Advisors: $149/month

See also: What Is the Best Tax Preparation Software for Professionals?

Shoeboxed vs. Wave: A Comprehensive Guide to the Differences

4. FreshBooks

FreshBooks is a cloud-based accounting software that emphasizes user-friendly operation and exceptional customer support.

FreshBooks accounting software for business owners.

Suitable for small and medium-sized businesses, FreshBooks accounting software offers Airbnb hosts invoicing, time tracking, and expense management tools.

The platform’s mobile app makes it convenient for hosts to monitor their business receipt and other finances on the go.

Pros:

Time and mileage tracking are included in all plans.

Robust invoicing features such as getting paid upfront for Airbnb rentals with deposits.

Clean interface.

Accepts online payments.

Cons:

Limited users.

The lowest tier plan does not include double-entry accounting.

Pricing:

Lite: $8.50/month

Plus: $15/month

Premium: $27.50/month

Select: Customized pricing

5. Xero

Xero is another cloud-based accounting solution ideal for Airbnb hosts.

With its robust set of features, Xero allows hosts to easily manage multiple properties, income, expenses, and tax-related tasks.

Xero accounting software.

In addition to seamless integrations with other property management systems and tools, Xero provides user-friendly reports and insightful analytics that can help hosts make data-driven decisions.

Pros:

Easy to navigate with its intuitive interface.

Robust file-sharing functionality.

Hundreds of integrations.

Cons:

Poor customer service.

Restricted features in the lowest plan.

Pricing:

Early: $6.50/month

Growing: $18.50/month

Established: $35/month

6. Zoho Books

Zoho Books is a comprehensive accounting software that’s part of the larger Zoho ecosystem.

Its tools are designed to help Airbnb hosts efficiently manage their finances, including billing, invoicing, and expense tracking.

Zoho homepage

The platform offers excellent customer support and various integrations with other Zoho apps and third-party tools, making it a versatile option for managing an Airbnb business.

Pros:

Makes following up with customers easier with automated reminders and a customer portal.

Tools can be customized such as invoices and reports.

Minimal learning curve.

Cons:

The interface needs to be upgraded. It’s clunky and a little outdated.

Pricing:

Standard: $14/month

Professional: $23/month

Enterprise: $40/month

Ultimate: $52/month

Which software is best based on the different categories?

Here are the winners for each category.

What’s the best accounting software for receipt tracking?

Winner: Shoeboxed

Shoeboxed mobile app

Shoeboxed is ideal for Airbnb hosts who are trying to manage all the receipts generated from cleaning, repairs, and home necessities.

From their mail-in receipt scanning service and mobile receipt scanning app to the categorization of expenses for expense reports and tax deductions, Shoeboxed has you covered when it comes to receipt management.

What’s the most comprehensive accounting software for Airbnb?

Winner: QuickBooks

Quickbooks offers the most comprehensive platform thanks to its detailed expense and inventory management, income tracking, online payments, comprehensive reporting, and large selection of app integrations (including Shoeboxed!).

Which software is the most budget-friendly?

Winner: Wave

Wave is hands down the most budget-friendly accounting software for Airbnb hosts due to all of its free essential features.

Its invoicing and accounting features are free with only a fee imposed for payroll or expert advisers.

Which accounting software offers the best invoicing features?

Winner: FreshBooks

FreshBooks accounting software is designed with the best invoicing features for vacation rentals.

Airbnb owners and hosts can request rental deposits directly on the invoice and get paid upfront.

And if you didn’t think it could get any better, FreshBooks’ invoices automatically calculate taxes, offer the preferred currency, and provide instant updates when the invoice has been viewed or paid.

What’s the best software for business analytics?

Winner: Xero

With Xero, hosts can track their cash flow by visually seeing the impact of bills and invoices, along with indications of which invoices are the most urgent.

They can get an overview of their financial performance with up-to-date data on their dashboard and hosts can also identify and compare trends for different time periods.

Which software is best for tax compliance?

Winners: Shoeboxed and Zoho Books

Shoeboxed

Example of a Shoeboxed CSV file expense report.

Though Shoeboxed isn’t a complete accounting software solution, it’s still a valuable tool during tax time.

With Shoeboxed’s expense reporting feature, you can create CSV files and PDFs of certain or all of your expenses with receipts attached in case you’re ever audited and need to show proof of your purchases.

Shoeboxed also allows you to add an unlimited number of sub-users to your account for free.

Add your accountant or bookkeeper to your Shoeboxed account to view your finances and help you get ready for tax time.

Zoho Books

Zoho Books offers everything that Airbnb businesses need to stay tax compliant.

Their tax features include tax-compliant transactions, automatic tax calculations, tax payments, sales tax reports, and 1099 reports.

Frequently asked questions

What is the best accounting software for Airbnb that manages income and expenses?

There are several accounting software options available, but some of the best accounting software for Airbnb hosts include FreshBooks and QuickBooks. These tools provide various features and functionalities that cater to the unique and complex accounting processes and needs of Airbnb hosts.

How do I choose the right financial tool for my Airbnb bookkeeping?

When choosing the best accounting software for your Airbnb business, consider factors like ease of use, compatibility with Airbnb’s platform, features specific to your requirements, and the software’s pricing. Evaluate different options and choose the one that best aligns with your business needs and budget.

Are there any free accounting software options for Airbnb hosts?

While most Airbnb accounting software requires a subscription, all of the ones we reviewed here offer free trials. Keep in mind that free options might lack the comprehensive features and functionalities necessary for managing your Airbnb business effectively.

What is the process of integrating an accounting system with Airbnb

Integration procedures might vary slightly between different accounting software. However, the general process involves connecting your Airbnb account to the chosen software, setting up rules for transactions, and synchronizing reservation data with your accounting system.

How do accounting software tools assist in tax preparation for Airbnb hosts?

Accounting software helps Airbnb hosts track their income, expenses, and tax liabilities. It generates detailed reports, automates tax calculations, and assists in preparing financial statements required for accurate tax filing. By having an organized financial record, hosts can ensure they’re meeting their tax obligations while taking advantage of deductions and credits available to them.

Conclusion

When choosing the best accounting software for your Airbnb business, consider factors such as ease of use, integrations, price, and reputation.

Be sure to analyze the software’s ability to track income, expenses, and other financial transactions to streamline your accounting processes.

If you ask us, our top 3 accounting options for Airbnb hosts are Shoeboxed for managing receipts, QuickBooks for its comprehensive platform, and Wave for Airbnb hosts on a budget.

Caryl Ramsey has years of experience assisting in different aspects of bookkeeping, taxes, and customer service. She uses a variety of accounting software for setting up client information, reconciling accounts, coding expenses, running financial reports, and preparing tax returns. She is also experienced in setting up corporations with the State Corporation Commission and the IRS.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!