As a DoorDash driver, are you maximizing your efficiency so that you can keep more of your hard-earned money in your pocket?

The goal of a DoorDash driver is to get from Point A to Point B in the shortest amount of time possible so that you can make as many deliveries as possible for the day while incurring the least expenses. (Note: Having a valid driver's license, a reliable vehicle, and passing a background check are crucial prerequisites for starting as a DoorDash driver.)

DoorDash delivery drivers who rely on efficient routing and accurate tax deductible expense tracking to maximize their earnings need to search for apps that offer a suite of features to support these goals.

What key features should you look for in apps for DoorDash earnings?

Here, we've listed features that we've found essential to Dashers.

Delivery driver apps enhance efficiency and earning potential for DoorDash drivers by offering functionalities like route planning and proof of delivery features.

1. Mileage tracking

GPS functionality is necessary, so get an app that can be used with your phone's GPS to calculate and track your trips. The app should start and stop recording accurately when calculating your mileage, thus logging all business-related drives. Additionally, optimizing the delivery process by creating efficient routes can significantly improve delivery efficiency, leading to smarter, more cost-effective logistics operations.

2. Categorization

The application should help classify the drives as personal or business trips and organize expenses into tax categories. Customizable categorization allows you to trace the trips and expenses to your preference. This will make bookkeeping and tax season much less stressful.

3. Detailed reporting

The application should include comprehensive reports containing details such as dates, times, distances, and tax purposes on all trips. The application should also allow you to export your mileage logs and reports into multiple formats (PDF, CSV) for easy integration with your tax software or share with your tax professional.

4. IRS compliance

Ensure the application maintains logs in conformity with the IRS. It should indicate every trip's date, mileage, and purpose.

5. Additional expense tracking

Some mileage tracker applications can keep other expense logs, including gas, maintenance, and meals.

6. User interface, in app navigation, and usability

The app should have a user-friendly interface, making it easy to navigate and use daily without frustration. It should run smoothly without excessively draining your phone’s battery.

7. Security and privacy

The app will track your movements and potentially handle sensitive financial information, so strong data security measures are necessary.

8. Cost vs. benefit analysis

Many mileage tracker apps offer free versions with limited features or require you to pay a subscription for full functionality. Weigh the cost against the benefits and features provided to see if it’s worth the investment for your DoorDash business.

9. Reviews and recommendations

Read reviews from other DoorDash users or delivery drivers to see how the app performs in real-world conditions. Check if any tax professionals, experienced delivery services, or drivers recommend the app based on its performance and reliability.

What are the best delivery driver apps for DoorDash drivers?

Here are the apps that we have found to be the best for DoorDash drivers because using the right tools and apps can enhance the delivery experience for DoorDash Drivers and customers alike!

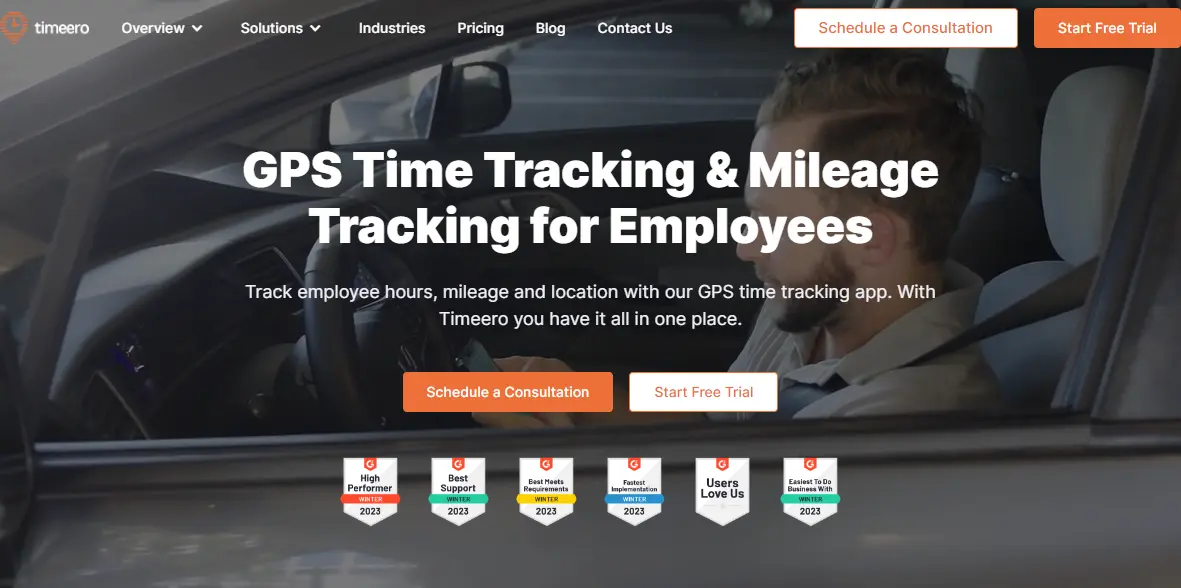

Timeero—best for time tracking

Timeero is a time and mileage tracking app.

Timeero is a time and mileage tracking app for DoorDash drivers.

Its benefits include the following:

Time tracking: Timeero allows DoorDash delivery drivers to accurately track their hours, ensuring they get paid for all the time spent on deliveries. Timeero's GPS tracking helps ensure timely deliveries by providing efficient routing.

GPS tracking: The app offers GPS tracking, which is crucial for DoorDash drivers to navigate efficiently to their delivery locations.

Geofencing: Timeero allows users to set up geofences, which are virtual boundaries around specific locations.

Employee management: For DoorDash delivery drivers who manage a team or work with other drivers, Timeero provides employee management features such as tracking their hours, managing schedules, and monitoring productivity.

Reporting and analytics: Timeero offers reporting and analytics tools that allow DoorDash drivers to gain insights into their performance, track mileage, and analyze their earnings.

Integration with payroll systems: The app integrates with various payroll systems, streamlining the payment process for DoorDash drivers.

Pros:

Excellent customer support

Nice design and easy to use

Reports are very detailed

Cons:

Sometimes crashes on iPhone

Integration with Gusto needs to be improved

Pricing:

Basic: $4/user/month

Pro: $8/user/month

Premium: $11/user/month

Enterprise: Request a quote

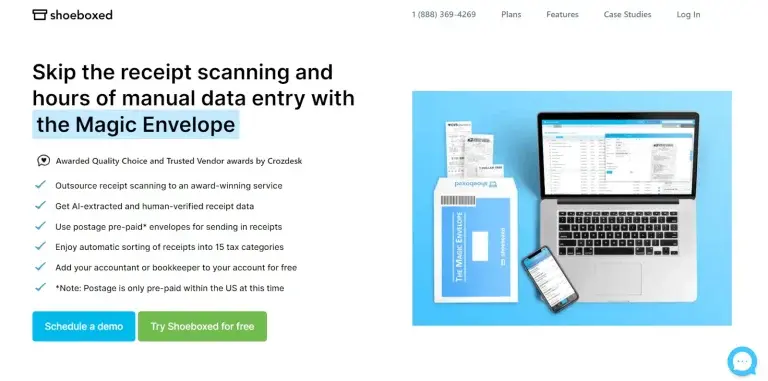

Shoeboxed—best for automated expense management

Shoeboxed is the best app for boosting your DoorDash earnings.

Shoeboxed is a top choice for DoorDash delivery drivers because it offers something the other apps don't, including a free version with basic features, which help Dashers manage business expenses.

Expense tracking

Shoeboxed excels in expense tracking. DoorDash drivers often have various business-related expenses, such as fuel, vehicle maintenance, and food purchases.

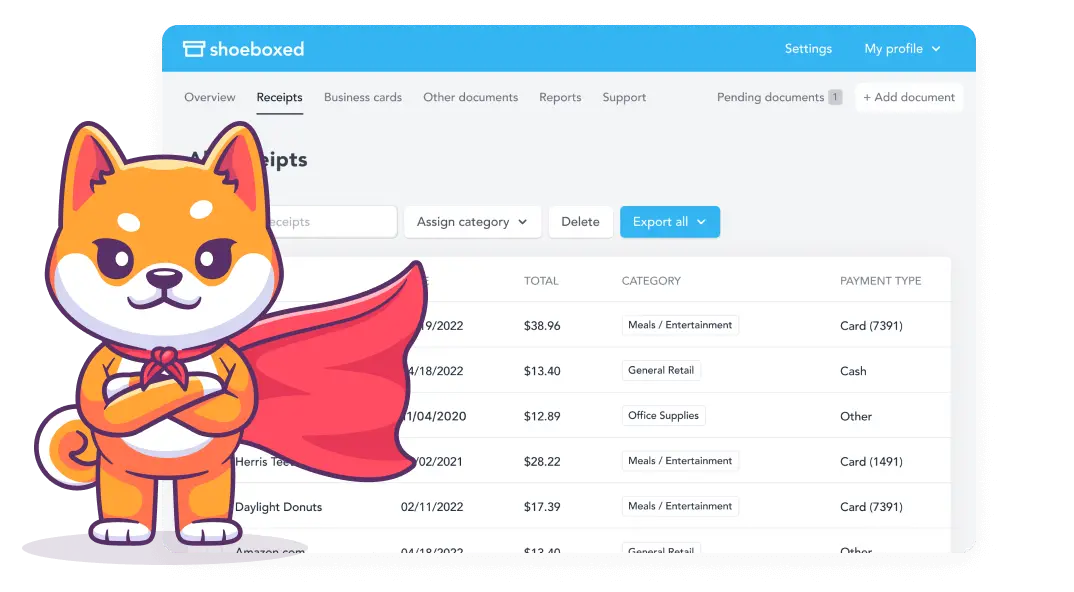

Shoeboxed is a comprehensive expense management app for DoorDash drivers.

Shoeboxed's app helps drivers track these expenses by allowing them to scan, digitize, and categorize their receipts while on the go. Drivers can snap a picture of the receipt with their phone's camera and upload it directly into their Shoeboxed account, which is then organized into categories.

The Magic Envelope service

Keep Shoeboxed's free Magic Envelope in the car for receipts while on the road.

The unique thing about Shoeboxed is its Magic Envelope.

Drivers can keep the Magic Envelope on the dashboard of their car, where they can fill it with receipts as expenses occur, such as gas, etc., and then mail the receipts in the postage-paid envelope to Shoeboxed. The receipts will be scanned, human-verified, and uploaded to your Shoeboxed account.

Hit the road with Shoeboxed ⛟

Stuff receipts into the Magic Envelope while on the road. Then send them in once a month to get scanned. 💪🏼 Try free for 30 days!

Get Started TodayMileage tracking app

Shoeboxed's mileage tracker and tracking app is simple and accurate.

Shoeboxed is also a mileage tracker app that uses your phone's built-in GPS.

Once you sign up for Shoeboxed, open the app, tap the 'Mileage' icon, click the 'Start Mileage Tracking' button, and start driving! After clicking 'Start Mileage Tracking,' Shoeboxed begins tracking your location and miles and saving your route as you go.

It’s a good idea to drop pins if you make stops along your trip. This helps keep the mileage tracking precise. For example, if you make any stops along the way and must pay for parking, you can still snap a photo and upload that receipt to your Shoeboxed account without stopping the mileage tracker.

Tap the 'End Mileage Tracking' button at the end of a trip. Shoeboxed will create a trip summary that includes the date, editable mileage and trip name, and tax-deductible and rate information. Click 'Done' to approve the summary and generate a receipt with your trip information, including a photo of your route on the map.

Shoeboxed will auto-categorize your trip under the mileage category for tax purposes.

Track mileage with Shoeboxed 🚗

Track mileage using your phone’s built-in GPS for unmatched ease and accuracy. 💪🏼 Try free for 30 days!

Get Started TodayOrganization and categorization

Shoeboxed digitizes and organizes receipts for DoorDash drivers.

Tracking paper receipts can be challenging and lead to clutter. Shoeboxed enables DoorDash delivery drivers to declutter their workspace by scanning and digitizing their receipts using their phone's camera or sending them off in a Magic Envelope.

Tax preparation

Shoeboxed boosts your DoorDash earnings by maximizing tax deductions.

Shoeboxed simplifies tax preparation for DoorDash drivers by providing them with accurate and organized expense records. During tax season, drivers can easily access their digitized receipts and generate expense reports for tax deductions. Shoeboxed means more money in your pocket during tax season.

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic award-winning approach to receipt tracking for tax season. Try free for 30 days!

Get Started TodayTime-saving for busy Dashers

Shoeboxed not only boosts your DoorDash earnings but also saves time.

Manually inputting receipts into an expense tracking system can be time-consuming. Shoeboxed saves DoorDash drivers time by allowing them to quickly capture and digitize receipts using their smartphones or sending them off to Shoeboxed in a Magic Envelope for Shoeboxed to scan for you.

One bookkeeper even stated that Shoeboxed saved her 900 hours a year by using Shoeboxed.

Integrations with accounting software

Shoeboxed imports expense data by integrating with other tools you already use to maintain consistency across all platforms.

Shoeboxed integrates with various accounting and financial management software, such as QuickBooks and Xero. This integration allows DoorDash drivers to seamlessly import their expense data into their preferred accounting software.

Advanced accessibility

Shoeboxed allows DoorDash drivers to access their data anytime, anywhere.

The Shoeboxed app is accessible anytime, anywhere, allowing DoorDash delivery drivers to manage their expenses on the go. Whether at home, on the road, or waiting for their next delivery, drivers can easily access their expense records and stay on top of their finances.

Shoeboxed is the ideal solution for DoorDash drivers.

Shoeboxed provides DoorDash drivers with a convenient and efficient solution for tracking and managing business expenses. Shoeboxed helps drivers save time, reduce paperwork, and maintain financial control over their business operations by digitizing receipts, organizing expense records, and simplifying tax preparation.

Pros:

Mileage tracker is easy to use.

You can edit the miles you drive after a trip.

Miles are turned into receipts for reporting and auto-categorized under mileage.

Filter your receipts for mileage, auto repairs, and other business expenses for tax time.

Comprehensive PDF and CSV file expense reports with receipts attached.

Integrates with accounting software like QuickBooks and Xero.

An unlimited number of free sub-users. This is good for adding your accountant or an auditor to your Shoeboxed account to review your expenses.

Cons:

Mileage tracker isn’t automatic. You’ll have to manually start and stop the tracking process.

Pricing:

Plans that include the Magic Envelope start at $18/month, up to $54/month.

30-day free trial.

Stop doing manual data entry 🛑

Outsource receipt scanning to Shoeboxed’s scanning service and free up your time for good. Try free for 30 days! ✨

Get Started TodayGridwise—best for data analysis

Gridwise is a rideshare and delivery driver app.

Gridwise is a valuable rideshare and delivery app that also benefits DoorDash drivers.

Data-driven insights: Gridwise collects and analyzes data from various sources, including driver activity, traffic patterns, and demand fluctuations.

Performance tracking: The app allows DoorDash drivers to track performance metrics, including earnings, mileage, and hours worked.

Real-time alerts: Gridwise sends real-time alerts and notifications to DoorDash delivery drivers about events such as surges in demand, traffic incidents, or changes in weather conditions.

Expense tracking: Gridwise helps DoorDash drivers track their business expenses, such as fuel costs, vehicle maintenance, and tolls.

Community insights: Gridwise fosters a community of drivers who share tips, strategies, and insights.

Integration with multiple platforms: Gridwise integrates with multiple delivery driver platforms, including DoorDash, Uber, and Lyft.

Pros:

Unlimited automatic mileage tracking

Insights into your income and expenses

Great if you have multiple side gigs

Cons:

App has a lot of features so there’s a bit of a learning curve.

The paid subscription isn’t really necessary for DoorDashers (better for rideshare drivers).

Only works with specific companies, so you can’t log miles for other businesses.

Pricing:

$6.99/month or $59.99/year (it’s tax-deductible!)

SherpaShare—best for automated mileage tracking

SherpaShare is a rideshare driver assistant.

SherpaShare is a valuable app due to its comprehensive features tailored to the needs of DoorDash drivers, especially those involved in ridesharing and delivery services.

Here are several reasons why it’s considered beneficial:

Comprehensive mileage tracking

Automated tracking: SherpaShare offers automatic mileage tracking, simplifying the process of logging every mile driven for DoorDash deliveries. This is helpful for claiming deductions at tax time.

IRS-compliant logs: The app ensures that your mileage log complies with IRS standards which key for avoiding issues during tax audits.

Multi-platform earnings aggregation

Earnings tracker across platforms: For drivers who work with multiple delivery or rideshare services, SherpaShare aggregates earnings in one place, providing a clearer view of total income and helping with financial planning.

Expense management

Track expenses and deductions: In addition to mileage, SherpaShare allows drivers to monitor other work-related expenses, ensuring they maximize their tax deductions and understand their net earnings.

Data insights and optimization

Driving insights: By analyzing your driving patterns and earnings, SherpaShare can offer insights that help optimize your driving strategies like identifying the most lucrative times and areas to work.

Earnings optimization: With data on how much you earn across different platforms, SherpaShare can guide you in making informed decisions about where and when to focus your driving efforts for maximum income.

Community and support

Access to a community of peers: SherpaShare connects you with other drivers, offering a platform to share experiences, tips, and advice, which can be incredibly valuable, especially for new drivers.

Resources for delivery drivers: The app provides resources and information tailored to independent contractors' needs, including tax tips and strategies for maximizing earnings.

User-friendly interface

Ease of use: The app's user-friendly interface makes it easy to track miles, log expenses, and view earnings reports.

Effectively managing mileage, expenses, and earnings is crucial for maximizing profitability for DoorDash drivers. SherpaShare’s features address these needs directly, making it an excellent tool for optimizing efficiency and earnings.

Its focus on comprehensive mileage tracking, financial management, and operational insights can help DoorDash delivery drivers make more informed decisions and increase their earnings while staying compliant with tax regulations.

Pros:

Allows you to separate personal and business trips

Gives you a visual layout of busy areas

Includes a built-in chat function

Cons:

No free option available

Unlimited mileage tracking is only available for paid users

Does not track vehicle-related expenses like fuel or maintenance

Pricing:

Monthly plan: $5.99/month

Annual plan: $4.99/month

Super premium plan: $10.00/month

How can you maximize your tax deductions and keep more of your hard-earned money?

DoorDash drivers can benefit from deductions to lower their taxable income and, therefore, their tax liability.

Here's a basic overview of what you need to know about these deductions:

1. What are mileage deductions?

Mileage deductions are miles driven for business and are considered expenses that can be deducted from your tax return. For a DoorDash driver, the miles are tax-deductible during deliveries but not for personal use or commuting.

2. Standard mileage rate vs. actual expenses

The IRS offers two methods for calculating vehicle expenses: the standard mileage rate and actual expenses.

Standard mileage rate: This is the flat rate per mile driven for business use. It's set annually by the IRS. In 2023, it was established at 65.5 cents.

Actual expenses: This method allows you to deduct the actual expenses of operating your car for business. These would include gasoline, oil, repairs, insurance, and depreciation. You would need to be able to document these expenses.

3. Tracking and documentation

Regardless of which method you choose, meticulous record-keeping is crucial.

Here's what should be included in your mileage log:

The date of each driving activity

The purpose of the trip (e.g., DoorDash delivery)

The start and end locations

The miles driven

Receipts for all expenses if you're using the actual expense method

4. Qualifying miles

Only miles driven for business purposes can be deducted.

This includes:

Miles driven to pick up food from a restaurant.

Miles driven to deliver the food to the customer's location.

Miles driven between deliveries

Non-deductible miles include commuting between your home and the first pickup location or the route from the last drop-off location back to your home.

5. Filing your deductions

Mileage deductions for gas and other expenses are filed on Schedule C (Form 1040) or through free tax software that guides DoorDash drivers through the deduction process. It's often beneficial to consult with a tax professional, especially if you're new to filing as an independent contractor.

6. Benefits of deductions

By reducing your taxable income, deductions can significantly lower your tax bill. It's an essential aspect of financial planning for DoorDash drivers and other independent contractors.

7. IRS audit consideration

The IRS may audit taxpayers who claim deductions. Having detailed logs and records can help prove your claims in case of an audit.

Understanding and taking advantage of deductions can yield substantial tax savings as a DoorDash driver. The key is maintaining thorough records and choosing the most efficient method for your situation.

Frequently asked questions

What are the best mileage tracking apps for maximizing earnings as a DoorDash driver?

To maximize earnings while driving for DoorDash, you must use a combination of apps that help with route planning, schedule optimization, and financial and account management. We recommend Shoeboxed, SherpaShare, Timeero, Mileage Wise, and Gridwise to help keep more money in your pocket.

Which feature is the most beneficial to DoorDash drivers?

It's hard to beat Shoeboxed's Magic Envelope. With a plan that includes this postage-paid envelope, drivers can conveniently keep the Magic Envelope on their dashboard and fill it with receipts while on the go.

This keeps drivers from losing receipts and keeps the receipts all in one convenient place. Once the envelope is mailed back to Shoeboxed, the receipts will be scanned, human-verified, and uploaded into your account for you.

In conclusion

Each app offers unique features to address DoorDash delivery drivers' challenges. You'll need to explore these options and choose the best fit for your needs and preferences. Consider factors like expense accounting efficiency, IRS compliance, and delivery efficiency. After all, the goal is to keep more money in your pocket.

Incorporating a third-party app into your DoorDash operation simplifies record-keeping, enhances tax compliance, and maximizes your potential deductions, directly impacting your bottom line.

Caryl Ramsey has years of experience assisting in different aspects of bookkeeping, taxes, and customer service. She uses a variety of accounting software for setting up client information, reconciling accounts, coding expenses, running financial reports, and preparing tax returns. She is also experienced in setting up corporations with the State Corporation Commission and the IRS.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple receipt capture methods: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports, and more—with Shoeboxed.

Try Shoeboxed today!