Due to its illegal status at the federal level and as the business is growing fast with various emerging sub-industries, cannabis jobs and companies face more complex issues than ever.

These issues are unique to the industry and require their operators to be extra careful when keeping their books accurate and organized.

Hence, following best practices is crucial for businesses in this field.

In this article, we cover everything you ought to know about bookkeeping for the cannabis industry in the U.S.!

Banking

Not many federally regulated financial institutions welcome cannabis businesses, as it is still classified as an illegal drug in many states.

This lack of banking options subjects cannabis businesses to multiple issues, including internal and external theft, misallocation of funds, payroll, and insurance paid in cash.

However, you may still be able to find a bank that can work with your cannabis business.

Be ready to deal with application procedures in which regular financial statements must go through reviews.

Banks often do this quarterly, but monthly financial records should be ready for submission at any time.

Banks will also pay attention to fluctuations in your report, and you don’t want your account to be shut down because you can’t account for such inconsistencies, so keep that in mind as you proceed.

Cash flow control

Cash-only businesses can be challenging to manage, and those in the cannabis business are no exception. Cash transactions can become a mess without a proper tracking system.

In the case of cannabis, a federally controlled substance, every piece of inventory matters.

Any suspicious activity may lead to loss of licenses or even criminal charges against concerned individuals.

Anti-money laundering

To prevent money laundering, marijuana companies must meet strict requirements regarding accounting and keeping records of every activity and transaction during the business, “from seed to sales” and from suppliers, distributors, and retailers to customers.

Moreover, for any transaction or a series of transactions that total $10,000 or more in cash, cannabis businesses have to prepare Form 8300 for tax purposes, the filing of which can be confusing with errors resulting in serious fines and audits.

Taxes

According to Internal Revenue Code Section 280E, “No deduction or credit shall be allowed for any amount paid or incurred during the taxable year in carrying on any trade or business if such trade or business (or the activities which comprise such trade or business) consists of trafficking in controlled substances (within the meaning of Schedule I and II of the Controlled Substances Act) which is prohibited by federal law or the law of any state in which such trade or business is conducted.”

In compliance with this, cannabis-related businesses follow strict limitations when reporting taxable income, with the cost of goods sold being the only deductible expense.

Cannabis accounting processes, as a result, must implement complete record-keeping to ensure a compliant inventory environment.

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic approach to receipt tracking for tax season. Try free for 30 days!

Get Started TodaySeed-to-sale tracking

Cannabis businesses and accountants working in the industry do not often talk about seed-to-sale tracking with much enthusiasm.

Every state has its seed-to-sale system to monitor the production and distribution of cannabis plants, causing a great deal of confusion for growers, distributors, and other stakeholders involved who need to adhere to changing rules of each local government.

Specifically, depending on its preference, each state may require a different software system to trace and monitor the plants and finished products from inventory to the point of sale.

However, the three popular seed-to-sale software, Biotrack, MJ Freeway, and METRC, tend to have unreliable reporting.

It cannot be easy to integrate them with existing accounting systems.

Bookkeeping for the cannabis business: fundamentals

With all the federal and state regulations that make accounting for cannabis extremely complex, anyone who deals with keeping the books must do it right.

In particular, bookkeepers should know the ins and outs of Section 280E in the tax code because of its major implications on the business’s income and profit.

Unlike those working for most small-to-medium-sized businesses, accountants and bookkeepers in cannabis companies must get used to concepts such as cost accounting, accrual accounting, generally accepted accounting principles (GAAP), and absorption accounting.

Since many of these principles are not required for everyday small business accounting, a generalist accountant may not be familiar with them.

Therefore, finding a person with the necessary skill set to keep good records for your cannabis business is important in several ways.

1. Getting ready

Whether outsourcing professional bookkeeping services or hiring an internal bookkeeper, cannabis businesses benefit greatly from having their books handled by people who have experience in the industry.

Get your accounting system set up to organize and control your expenses, including tracking annual revenue, before opening your doors.

Without proper tracking of day-to-day expenditures and transactions, your bookkeeping logs might become a nightmare with a higher tendency for errors.

Even for pre-revenue companies, having a comprehensive bookkeeping system in place is essential at the beginning of your journey, when you will need to know how much was spent on what.

2. Raising money

Cash-intensive businesses like cannabis companies rely on fundraising for initial startup costs.

Not to mention the difficulty of finding investors who understand the possible pitfalls of the industry, there are a host of components that business owners can’t overlook if they would like to attract investors to their business.

These components include providing organized books and accurate financial reports that show effective internal controls and accounting policies.

For marijuana businesses that wish to access capital, it is expected that they will be capable of good bookkeeping practices.

3. Taxes and deductibles

As mentioned earlier, under IRC 280E, cannabis companies cannot deduct business expenses such as rent, vehicle, and marketing like other companies because their business is related to a controlled substance.

Despite this tax limitation, professional accountants can help to legally reduce taxable income by allocating costs to inventory and the cost of goods sold, which is mandated by IRC 471.

Besides the IRC 280E, there are other tax requirements that cannabis businesses must fulfill to maintain their license and stay out of trouble with the IRS.

Bookkeeping and Reporting Tips for Cannabis4. GST/HST and provincial sales tax

Once a proper accounting system is set up with organized bookkeeping practices, cannabis companies can be at ease paying the correct sales tax they are supposed to.

Moreover, based on the tax collected, it will be easier for them to plan, using the expected tax refunds for business operations.

5. Excise duties

You must keep track of the duty rates and report the higher duty payable transaction-by-transaction basis.

Those who own a business in the industry must have a good grasp of the rules and regulations of the excise duty framework to know how to calculate duties, able to keep clients, and have a reliable accounting team to do this painstaking task.

Plus, they should do it early on before all the transaction receipts pile up or go missing!

Bookkeeping for the cannabis industry: best practices

1. Know the rules

Whether for medical use or adult purchases, businesses associated with marijuana are restricted by countless written and unwritten rules, the sheer number of which may repel anyone wishing to be engaged in this space.

Both federal and state laws have their specifications regarding cannabis businesses, and bookkeepers must know them like the back of their hands to stay compliant.

2. Go digital

As the foundation of good accounting and financial management, bookkeeping is all about being organized.

If you’re having trouble keeping up with paper receipts, use Shoeboxed to help store and keep your documents safe online and offline.

Still, there are more advantages to applying technology in bookkeeping than you might imagine.

With brilliant features, including:

verified data that is audit-ready and easily located

simply take a photo or upload receipts

store your business cards customized expense reports

actionable data tool.

Accurate scanning records and transparent accounting procedures are what a cannabis business needs to track its finance and enhance its credibility with financial institutions and potential investors.

Shoeboxed provides a digital, secured, and quick bookkeeping solution for businesses.

Shoeboxed, the best way to keep track of your receipts!Never lose a receipt again 📁

Join over 1 million businesses scanning receipts, creating expense reports, and reclaiming multiple hours every week—with Shoeboxed.✨

Get Started Today3. Software workarounds

A cannabis company is a complicated entity that involves several sub-industries (farming, chemical manufacturing, food production, and retail).

Each requires various reporting under the many legislations at the state and federal levels.

Another big headache for cannabis bookkeepers and accountants is the buggy seed-to-sale software requested by local regulations.

Unfortunately, cannabis accounting platform software designed to assist this complicated process is still lacking and doesn’t work well with widely used accounting systems.

While looking for more plausible solutions, specialists in the field suggest we use current software, combining their functions to serve our needs.

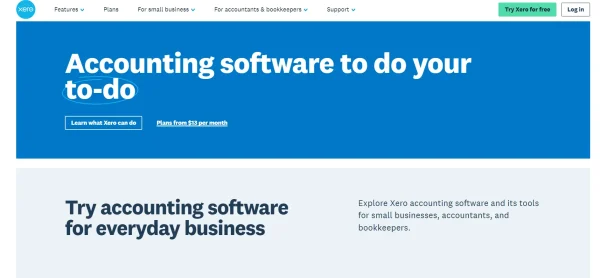

Quickbooks and Xero are popular choices for accounting, although some attempts must be made to create charts of accounts for each business stage.

Excel is a basic-but-good tool for cost accounting, reconciliations, consolidations, and so on.

If one realizes its versatility and puts decent effort into utilizing its functions, preparing monthly reports or creating accounting templates can become much easier.

Doing what we have seems to be the right strategy, at least for now.

Continue reading for a closer looks at these accounting tools to see which might benefit your business the most.

4. Checks and balances

Problems with bookkeeping in cannabis businesses are mostly due to the huge amount of cash being collected, which may lead to undesirable consequences ranging from careless mistakes to inaccuracies in bookkeeping to fraud.

However, many can be prevented by consistently implementing checks and balances during operations.

For example, daily and weekly cash counts can help identify discrepancies between actual cash on hand and the records in the books.

Likewise, sale receipts must be kept carefully compared to those listed regularly.

It is also a good idea to have two people do the cash collection and reconciliation separately to lower the chance of theft.

This way, professional bookkeepers and accountants are good for a reliable internal control system.

What type of bookkeeping systems are used in a cannabis business?

Though there aren’t many bookkeeping systems specifically designed for cannabis accounting firms or cannabis business owners, maintaining proper accounting records is still essential.

Many cannabis businesses stick with the basics such as QuickBooks, Xero, and Excel, but we’ll take a look at some industry-specific options below, as well.

1. QuickBooks

QuickBooks is the go-to solution for any business’s accounting and bookkeeping needs.

With 26 million businesses that use QuickBooks, it’s no wonder businesses in the cannabis industry are hopping on the bandwagon.

Features

Track your expenses across different accounts

Organize and pay your bills online

Job costing to see where you’re making the most money

Inventory tracking

Create invoices, send invoices, and receive payments

Track miles for yourself or employees

Integrate payroll and time tracking for employees

And more!

Pricing

Free 30-day trial

Simple Start – $15/month

Essentials – $27.50/month

Plus – $42.50/month

Advanced – $100/month

*Add payroll to plans for an additional cost.

2. Xero

This software has over 1,000 app integrations and is trusted by over 3.5 million subscribers worldwide.

Features

Capture bills and receipts through email

Scan files

Bank integration to sync financial information

Keep track of and pay bills

Accept payments through Stripe, GoCardless, and more

Keep track of costs and profitability from customers

Gusto for payroll

Bank reconciliation

Create financial reports

Track inventory

Future analytics based on past business

And more!

Pricing

30-day free trial

Early – $6.50/month

Growing – $18.50/month

Established – $35/month

*Add Gusto for payroll for an additional $40/month

3. Excel

Excel is a spreadsheet program designed to keep business-related information organized. It can be used for data entry, accounting, financial analysis, and more.

Excel can be integrated with QuickBooks and Xero.

Features

Excel Copilot identifies trends in business and suggests how to improve

Formulas for automatic calculations

Predict trends and analyze your data with charts, tables, and graphs

Chart of accounts

Lists of transactions

Income statement sheets

Pricing

Microsoft 365 Business Basic – $6.00/month per user

Microsoft 365 Apps for Business – $8.25/month per user

Microsoft 365 Business Standard – $12.50/month per user

Microsoft 365 Business Premium – $22/month per user

4. 365 Cannabis

This software has the same capabilities as other software options, and in its own words, 365 Cannabis will “replace QuickBooks and migrate your financial data into 365 Cannabis.”

365 Cannabis is one of the few software programs for cannabis entrepreneurs and any type of accounting professional in the cannabis space, including certified public accountants and bookkeepers.

Features

Insights into operations and inventory

Record and store financial information

Calculate the costs of supplies for orders

Built-in POS system

Partnered with Shopify, Leafly, CannabisOneFive, weedmaps, and more

Seed-to-sale software that tracks the growth of your plants and your business

Pricing

Request a demo for pricing information

Is there a difference between the recreational and medical marijuana industries?

Whether you’re a bookkeeper looking to find your niche or a cannabis enthusiast starting a business, it’s important to understand the differences between the recreational and medical marijuana industries.

There are differences between recreational and medical marijuana that will have a major impact on how you conduct business and do your dispensary bookkeeping.

The main difference between the two industries is that medical marijuana is only legal for medical purposes, such as to ease the pain of cancer patients, and must be approved by the state and the patient’s doctor.

Recreational marijuana, on the other hand, can be used by any consumer for any legal purpose.

Medical marijuana accounting is similar to recreational accounting, as both have very strict guidelines in place by the government.

However, medical marijuana accounting can have additional complexities due to its involvement with the medical industry and insurance of qualifying patients.

I was offered a bookkeeping position in the cannabis industry. Will it look bad on my resume?

If you’re a professional accountant just getting into the world of bookkeeping services, you may be hesitant to get into cannabis bookkeeping.

While it might seem like cannabis bookkeeping would negatively impact your chances of better future opportunities, the cannabis industry is a legitimate one in many states.

By taking the position, you’ll build experience, cultivate your skills, and even learn more complex accounting and bookkeeping tasks that general accountants may not know how to perform.

This opens you up to specialized business opportunities in industries that require detailed financial reporting on business expenses due to intense governmental regulations.

With this new opportunity in cannabis accounting and bookkeeping, you may even gain enough experience to open your own cannabis accounting firm!

Frequently asked questions

What are the differences between CBD and THC accounting?

Understanding the difference between cannabidiol (CBD) and tetrahydrocannabinol (THC) and the tax credit differences applicable to cannabis accounting is important. It is possible to extract CBD from hemp or marijuana.

Cannabis plants classified as hemp have a THC content of less than 0.3 percent, whereas marijuana plants have greater THC levels.

THC, the central ingredient in marijuana, produces a high sensation.

You can take it by smoking marijuana, extracting the THC, and putting it in an edible or topical delivery system.

The only true difference between the plants is in their chemistry, which makes it difficult to distinguish between them because they appear identical to the untrained eye.

Another notable distinction between hemp and THC is the availability of greater tax incentives under hemp, notably the R&D tax credit.

For instance, you might create a cannabis strain with less than 0.3 THC that is extremely resistant to pests, drought, or other environmental factors comparable to conventional farming methods.

Growing hemp has numerous potential for advancements, but under Code 280E, you are not permitted to claim such credits.

What is a dispensary chart of accounts, and why is it vital for cannabis businesses?

A chart of accounts (COA) overviews an organization’s financial accounts.

This index presents all financial transactions completed during a given accounting period in five main categories: assets, liabilities, equity, income/income, and expenses.

Under each main category, transactions are further itemized into smaller categories. The Chart of Accounts (COA) helps organize your finances, increases internal accountability, and gives investors, auditors, and shareholders a clear view of your business finances.

A COA can help marijuana businesses meet the tough reporting standards of the cannabis industry.

Creating and submitting quarterly financial reports and your tax returns becomes much easier.

As a cannabis operator, the COA is especially important because 280E limits the number of business deductions you can take on your tax return.

Hence, it would help to categorize expenses correctly to make the most of your limited deductions.

A COA for your cannabis operation will help you document your business and keep track of your expenses.

The more details you provide for each transaction, the easier it will be for your accountant to have the time to achieve the more thoughtful assignment of CoGS concerning your taxes.e more thoughtful assignment of CoGS concerning your taxes.

What are common accounting problems that cannabis businesses face?

1. It’s not easy to open a business bank account or get a loan for your cannabis business, depending on your state.

2. Cannabis tax laws are complicated, and the IRS monitors cannabis businesses since marijuana is classified as a Schedule I substance. It’s recommended for business owners to work with cannabis professionals like accounts and lawyers to ensure they do not violate tax regulations.

3. Cannabis businesses are more likely to be inspected by the government.

4. Third-party bookkeepers and payroll professionals specializing in cannabis are limited.

5. Cannabis businesses risk losing inventory when not many banks let them open a business account.

6. IRS limits how cannabis businesses can apply for tax deductions for their products.

7. The cannabis industry has higher startup costs than normal.

Where can I find more information on cannabis bookkeeping courses?

• Cannabis Accounting Education and Training—Provides seminars, workshops, whitepapers, and templates guiding bookkeeping professionals and business owners in operating their cannabis businesses compliantly.

• CPA Academy—A leading organization that has a specific course for bookkeeping beginners who are working in the cannabis industry.

• CBM Network—Teaches accountants about cannabis accounting, cannabis taxes, and what to do as a cannabis bookkeeper, cannabis accountant, or cannabis business owner.

• My CPE—Provides a deep-dived webinar into everything a small business owner needs to know related to Cannabis, CBD, and Hemp Bookkeeping.

• National Association of Cannabis—Offers a complete guide on the day-to-day accounting requirements of working with cannabis companies for bookkeepers and accountants.

What type of bookkeeping systems are used in a cannabis business?

The bookkeeping systems used in the cannabis business includes the following:

QuickBooks

Xero

Excel

365 Cannabis

Final thoughts on bookkeeping for the cannabis industry

We have yet to know when the federal legalization of cannabis is coming and how it will change the bookkeeping practices in cannabis companies.

Whatever may happen, keeping accurate and organized books will enable you to enjoy smooth business operations.

Bonus resources on bookkeeping for dispensaries

Bonus infographic: The US cannabis market segmentation

US Cannabis Market Segmentation

You might be interested in:

What Is Receipt Paper Made Of? 3 Common Types of Receipt Paper

Financial Record Keeping: 6 Best Practices for Small Businesses

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed for free today!