According to a survey from Upwork, a popular marketplace for freelancers, there are about 59 million freelancers in just the US alone.

Freelancing is a great alternative to the hustle and bustle of a 9-5. However, it also comes with the necessity of bookkeeping for freelancers.

As a freelancer, you’re your own business. According to the IRS, freelancers are classified as self-employed. Which means you must manage your finances and be prepared to file your taxes. This can often seem daunting, but fortunately, a few straightforward strategies can help freelancers with self-accounting.

This article examines best practices, top accounting software for freelancers, and things to keep in mind for accurate expense tracking.

Why is bookkeeping important for freelancers?

Keeping detailed and accurate books gives you the groundwork for building your financial plans as a solopreneur. It helps you measure your success, plan and budget for your business goals, and prepare for tax returns and tax season.

5 bookkeeping best practices for your freelance business

A bookkeeping system for an independent contractor is crucial to your success. Fortunately, there are several solutions available on the market. Whether it is software or hiring a bookkeeper, a good bookkeeping system for freelancers will assist you in reaching your business goals.

1. Open a dedicated bank account for your business.

Separate your personal and business expenses by opening a dedicated bank account for your freelancing business.

It might initially be difficult to keep your personal and company finances separate as a freelancer. And many freelancers likely pay their business expenses from their personal accounts. However, doing so can lead to a huge hassle as you sort through and separate personal and business expenses.

You should open a business-only bank account as soon as you start your freelance business. It doesn’t necessarily need to be a business account. A second bank account is sufficient when you’re just getting started.

Having a separate bank account will simplify bank reconciliation and help you better visualize where your money is going and coming from, making your tax preparation and cash flow analysis more precise. This simple practice also helps you avoid financial problems in the future and determine which expenses are necessary for your work.

2. Keep track of your records

Staying on top of your bookkeeping is critical to filing your taxes. Besides staying organized, you also need to keep track of some essential information, documents, and expenses for tax season, including:

Total hours you worked on a project

Cost per hour for each client

Records of products or services you’ve provided to your clients

Internet and phone bills

Power and utility bills

Office supplies

Educational expenses

Software subscription fees

Office rent (if you work from home, you can claim mortgage and property taxes)

See also: Accounting for Property Managers: A 6-Step Guide

In most states, freelancers must keep business-related financial documentation for up to six years for tax purposes. It’s a good practice to keep your documentation and data well organized and safely preserved, regardless of where you work or how much money you make.

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic approach to receipt tracking for tax season. Try free for 30 days!

Get Started TodayAlso, brush up on the various deductibles you could be taking.

Try to incorporate a coherent digital filing system that allows you to quickly and efficiently access your financial data, like bills, receipts, and notes. You never know when you’ll need to find some random document from the past!

You can also check out our step-by-step guide on filing taxes as an independent contractor to get yourself ready for tax season.

7 record-keeping tips for small business owners by Work Life Glue3. Manage your cash flow

Getting clients and contract negotiations can often be challenging for freelancers. Having a system to manage your cash inflow helps you keep track of your business expenses and bookkeeping.

a. Project management: Quotes and estimates

Prompt sending of quotes and price estimates to clients for projects will help you land contracts more easily. It will also help you estimate how long it takes to finish the project when handling multiple clients.

Once the project is done, your price quote can also be turned into an invoice. This will make it simpler for your customers to pay you since they already have an idea of how much the project costs.

b. Invoices

A freelancer likely works with many projects and clients, meaning that your payment depends on your clients’ schedules.

Staying on top of your income may be difficult when you’re waiting to be paid. Since your clients are focused on their business, they might forget upcoming bill dates, and you may receive your payments later than expected. These overdue payments can affect your cash flow and planned income.

A solution is to send out invoices with clear due dates and set up automatic reminders for overdue payments. A little effort can go a long way in helping you monitor outstanding invoices and receive your payments on time.

4. File your taxes

Filing taxes can be a challenge for a freelancer, especially given all the aspects of your business that you must handle.

Before you file your tax returns, think about your business structure. As a freelancer, your business is most likely a sole proprietorship. In this case, you pay your business taxes on your tax return by filing a Schedule C form with your Form 1040 Individual tax return.

On the other hand, if you’re in a partnership or have formed an LLC (limited liability company), you can consider hiring a tax professional or using accounting software.

See also: Bookkeeping for LLC: Best Practices and FAQs

This is where freelance accounting software can help you keep accurate financial records of your business transactions, online payments, expense reports, mileage tracking for tax purposes, as well as help you track income too.

5. Review your financial statements regularly

As a solopreneur, you’re the one making business decisions. Consistently review your financial statements to gain a clear understanding of your business’s financial health.

Regular checkups on your business’s finances, including cash flow reports and looking over all your transactions from time to time will help you forecast budgets and account for issues in the long run. It also helps you keep track of accurate reporting on your books.

Managing Freelance Finance by Flux Academy5 bookkeeping tools for freelancers

Accounting software for freelancers will help you more easily manage your finances and stay on top of your record-keeping as an independent contractor. Here are some of the best options available in 2023.

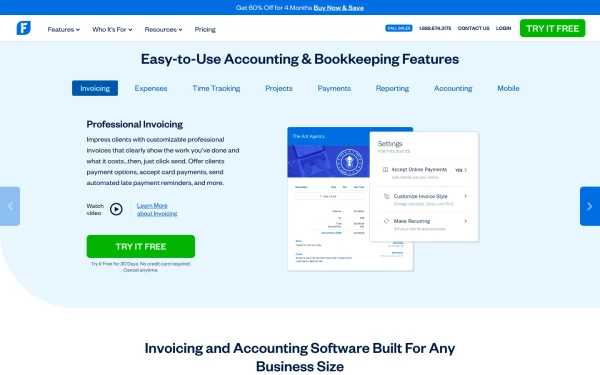

1. Freshbooks for freelancers

Freshbooks’ customizable accounting software can help freelancers with managing their finances—allowing you to invoice your customers and get paid faster, manage your clients, stay on top of cash flow, and automatically track your finances. They offer a 30-day free trial and multiple subscription plans depending on your needs.

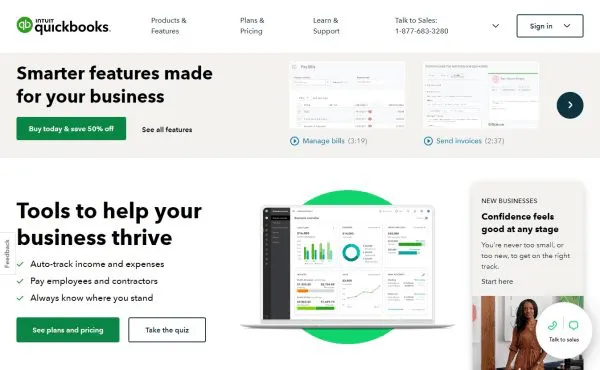

Freshbooks Review – Best Billing Software for Freelancers + Solopreneurs? by Torie Mathis2. Quickbooks for self-employed contractors

Quickbooks Online is a good online accounting software for self-employed individuals that helps you manage and track your expenses, organize your receipts, run reports, and estimate and file your taxes. They offer flexible pricing and bundles on bookkeeping for independent contractors and freelancers.

3. Wave for freelancers

Wave was built for freelancers to help make invoicing and bookkeeping less taxing. The best part of Wave is that they provide free accounting software, and you can access unlimited accounting options.

4. Shoeboxed for small business owners and entrepreneurs

Outsource receipt scanning to Shoeboxed’s scanning service and free up your time for good.

Shoeboxed demo—how to turn receipts into data and deductibles!

Never lose a receipt again 📁

Join over 1 million businesses scanning receipts, creating expense reports, and reclaiming multiple hours every week—with Shoeboxed.✨

Get Started Today5. Google Sheets for DIY bookkeepers

If you’re not too fond of other DIY bookkeeping and accounting software and apps, Google sheets is a good way to do your online work as freelance work. Thankfully there are a lot of templates available online. Since Google Sheets is cloud-based, you can easily access it across all your devices. You can customize it to your needs and make it as simple or robust as you want. The best part is, it is completely free!

FREE TEMPLATE for a simple, easy, FREE way to do BOOKKEEPING by Realistic Bookkeeping4 tax tips for freelancers

1. Level up your skills before the year runs out

Are your business skills feeling more outdated than a flip phone in 2023? Can’t afford a programmer because your wallet is on a diet? Don’t sweat it! It’s time to dive headfirst into that web developer boot camp or hit up the small business conference in Vegas like a high-rolling entrepreneur. And hey, guess what? These courses are as tax-deductible as claiming a pet elephant as a dependent. You’ll be a certified business ninja and have some spare cash to show off your newfound skills.

2. Give your business a makeover

Now that you’ve decided to invest in yourself, it’s time to show some love to your business too. Think of it as a makeover montage, but instead of a rom-com heroine, it’s your business stealing the spotlight. Ramp up your marketing presence and expand your ad space like a boss. Not only will it boost your deductions faster than a rocket-powered shopping cart, but it’ll also make your business grow like a beanstalk on steroids. Jack who?

3. Invest in business assets

Invest in some shiny assets that will take your productivity to the next level. Picture this: new computers that make your old ones look like museum relics, office furniture that screams “I’m the CEO of comfort,” and equipment so fancy it could moonlight as a spy gadget. The best part? You can write off 100% of these babies like a magician making expenses disappear. Abracadabra, tax savings!

4. Pay your quarterly estimated taxes

Paying quarterly estimated taxes may sound as thrilling as watching paint dry, but trust me, it’s essential. You don’t want to face the wrath of the tax gods with penalties raining down on you like a hailstorm of bad luck. The final countdown to pay your estimated taxes is January 1st, so mark it on your calendar like it’s the release date of your favorite superhero movie. If you’re a freelancer with cash basis taxes, make it rain in January by convincing your clients to pay you then. Boom! You’ll delay declaring that income on your taxes for another year and give yourself an extra dose of financial superhero powers.

Frequently asked questions on bookkeeping for freelancers

What should freelancers know about bookkeeping?

Freelancers should know that bookkeeping is necessary for their career—it should not be considered an afterthought when it comes to maintaining healthy freelance finances. Bookkeeping is important because it helps you set your goals as a business, lets you see your growth, and helps you plan for tax season.

How do I do my own bookkeeping as a freelancer?

Whether you’re a freelancer or a small business owner, you can do your own bookkeeping with the help of bookkeeping tools like Quickbooks, apps like Shoeboxed, and spreadsheets like Google Sheets.

How do freelancers keep books?

Freelancers keep books as self-employed individuals. They must keep track and manage their business expenses so they can file them as write-offs during tax season.

Are freelancers self-employed?

Freelancers are categorized as self-employed by the IRS. Bookkeeping for solopreneurs means that you will have tax deductions that are business expenses as long as they are considered ordinary and necessary to run your business.

In closing

Bookkeeping for freelancers is crucial to your business’s success. Taking charge of your finances and mastering accounting while juggling freelance work is difficult. Yes, it can seem overwhelming, and keeping books can get confusing, especially when it is not your strong suit.

Thankfully, there are a lot of tips and tools for freelancers. By incorporating some of the helpful best practices for bookkeeping for self-employed individuals outlined in this article, you can streamline your financial record-keeping, spend more time on your business’s core tasks and bring the best services to your clients. If you’d like to discover more helpful tips on bookkeeping for freelancers, accounting tax tips, and engaging entrepreneur stories, don’t forget to subscribe to the Shoeboxed blog!

You might also like:

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!