Bookkeeping is a critical function in law firms. It ensures that financial records are accurate, up-to-date, and compliant with legal and regulatory standards, which is crucial for managing the firm's finances. Effective bookkeeping not only supports a law firm’s financial health but also enhances its operational efficiency and client trust.

Here’s a comprehensive look at the importance and components of bookkeeping for law firms.

What’s the difference between bookkeeping and law firm accounting?

The terms “bookkeeping” and “accounting” for law firms are often used interchangeably, but they use the same financial data for different purposes.

Bookkeeping

Bookkeeping is the administrative task of recording financial transactions and balancing financial accounts. Bookkeepers track the money coming in and out of the firm. Bookkeepers provide the financial data that accountants need to do their job. Bookkeeping is the foundation for law firm accounting.

Bookkeepers typically do the following:

Record financial transactions

Balance accounts

Reconcile financial accounts

Invoicing

Payroll

Accounting

Accountants take the data from the bookkeeper and work their magic. They summarize, analyze, and interpret this financial data. With this data, they can advise law firm business owners on financial decisions and forecasting, help a firm stay compliant, and grow.

Accountants do the following:

Manage financial data using financial statements

Analyze expenses

File tax returns

Trust accounting for clients

Case cost accounting

Analyze revenue and income

Why is bookkeeping and law firm accounting important?

Good bookkeeping and accounting practices are key to a law firm’s growth and success.

1. Law firm bookkeeping and accounting keeps you compliant

Every law firm must comply with certain regulations and follow certain rules regarding recordkeeping, holding funds in trust, and notifying clients of receipt of property or funds. Breaking legal accounting and compliance rules can result in fines, suspension of license, and even disbarment.

2. Law firm bookkeeping and accounting is a business growth process

Bookkeeping and accounting for law firms allows you to collect, record, and analyze financial data. Analyzing that data will show you what parts of the firm are working and what needs work.

Then, you can focus on the areas that need work to make the firm as efficient as possible. The most efficient firm will have the lowest expenses and highest profit, which is the only way to business growth.

If you don’t have a system to track what’s coming in and out of your firm, you’d never know where your law firm stands financially. Without that information, your business would never get off the ground, grow, or succeed.

3. Law firm bookkeeping and accounting won’t let you ruin your business’s reputation

If you don’t have a good bookkeeping and accounting system, you risk missed payments, late payments, late filings, or mismanagement of funds. Accounting errors make law firms look unprofessional. Unprofessionalism can ruin a business’s reputation. A bad reputation can lose you business and even run your law firm into the ground. So, you must run your business on a foolproof financial system.

What are the best practices for law firm accounting?

While legal accounting is a bit more complicated, you can do a few things to make the accounting process for law firms as painless as possible.

1. Open separate bank accounts

Opening separate bank accounts in a legal accounting system is crucial. It is essential to keep client funds separate from law firm operating funds to maintain financial integrity and compliance. Never mix personal and business expenses.

You should open at least three bank accounts for your law firm. Before you open a business bank account, your business must be registered with the state, have a registered business name, and have an employer identification number (EIN).

Checking

The checking account is where you manage business income.

Savings

A business savings account stores money for unexpected expenses, taxes, or money you’ll need later.

Interest on Lawyers’ Trust Accounts (IOLTA accounts)

Law firms hold client funds in a separate trust account called an IOLTA account. IOLTA accounts are lawyers’ trust accounts with particular rules on what you can and can’t do and stiff penalties for breaking those rules.

Here are some things to consider when managing trust accounts:

Never withdraw any fee from an IOLTA account before it’s earned. Never borrow from an IOLTA account.

All trust and business accounts must always be separate. An IOLTA can never be used as an operating or savings account.

Trust deposits are never recorded as income. These are not your funds but funds you owe your clients.

Three-way trust reconciliation

If you have trust accounts in your firm, you must do a three-way reconciliation every 30-90 days. A three-way reconciliation is where you match three balances. The one on the trust account ledger is the total of the individual client’s ledgers and the bank statement for the trust.

2. Choose your accounting method

Law firms have two options for their books: cash accounting or accrual accounting. You must choose this wisely, as it will affect your tax filing, cash flow, and bookkeeping.

Cash basis accounting

With cash basis accounting for law firms, revenue is recognized when cash is received, and expenses are recognized when paid. Accounts payable and accounts receivable are not recognized.

Accrual basis accounting

With accrual accounting, revenue and expenses are recognized when earned and incurred. Accounts payable and accounts receivable are recognized.

Most law firms use cash accounting, but the best method for your firm will depend on your accounting needs. It’s best to consult with an accounting professional to help you decide.

3. Create a budget

If you don’t plan, you can’t achieve. To succeed, your law firm must have a budget. A budget will be your roadmap to keep your firm on track to those goals.

Creating your budget will include setting revenue targets, setting an amount for expected expenses, setting aside an amount for unexpected expenses, and getting a feel for the kind of cash flow that will be required.

4. Watch trust accounting

Trust accounting is a unique part of legal accounting, and law firms must follow specific industry regulations based on their jurisdiction. More errors occur with trust accounting than in any other area of law firm accounting.

One must keep detailed and comprehensive records of their client’s trust accounts. Lawyers must have multiple bank accounts. One should be an operating bank account and a separate account for Interest on Lawyer Trust Accounts (IOLTA), which holds client funds.

5. Review financials monthly to find opportunities

By reviewing your firm’s financials monthly, you’ll get a good feel for its financial position and be better equipped to find ways to reduce expenses and overhead and achieve financial growth.

The following are some financial statements and reports that law firms should review every month:

Profit and loss statement

Unbilled time report

Accounts receivable

Balance sheet

Accounts payable

6. Keep supporting documents

It’s essential to keep all supporting documents that back up the financial data you submit on your tax returns, such as income, deductions, and credits. You’ll need these documents if you’re ever audited.

These include:

Bank statements

Credit card statements

Receipts

Bills

Canceled checks

Proof of payments

Previous tax returns

W-2’s

1099’s

Invoices

Accounts receivable journal

You should keep these supporting documents for the time required by the IRS. You can even keep digital copies of receipts from apps and online services like Shoeboxed, which scans and saves receipts in digital files.

7. Track tax deductions

Many business expenses can be deducted from your tax return. These are expenses incurred while working.

Here are some deductions law firms take:

Business travel

Meals

Home office expenses

Professional publications subscriptions

Training, seminars, conferences

Business-related car expenses

Business transportation costs

You must keep all receipts for any deductions you take as supporting evidence that the transaction occurred.

8. Use legal accounting software

Accounting software makes financial management for law firms easy and is an excellent tool for tracking your firm’s financial transactions. Industry-specific accounting software is always the way to go, and attorney-specific software does exist.

Legal accounting software lets you manage your accounting from anywhere, create digital invoices, see your firm’s cash flow in real time, and reconcile accounts instantly. It will save you time, money, and stress.

How to simplify bookkeeping and document management for law firms

According to the U.S. Bureau of Labor Statistics, lawyers primarily work in offices, often with a lot of paperwork and document management. The legal services industry employs many lawyers, with other significant employment in local, state, and federal government positions. Paralegals and legal assistants who support lawyers by maintaining and organizing files, conducting AI contract analysis, and drafting documents also play a significant role in managing paperwork in legal settings.

Law firms can simplify their bookkeeping and accounting tasks by automating expense management.

Shoeboxed

Lawyers and administrators can automate their operations using an app or outsource their receipt and document management to Shoeboxed.

Shoeboxed is a two-in-one receipt scanner used by over a million businesses.

Digitizes receipts and documents

Lawyers handle many receipts and documents to ensure accurate financial records, comply with legal regulations, and manage operations efficiently.

Here are some of their paperwork:

Client expense receipts

Operational expense receipts

Payroll

HR documentation

Client correspondence

Case related documents

Compliance and regulatory documents

Tax filings

Financial statements

Meeting minutes

Insurance policies

That’s a lot of paper!

Digitizing these reduces clutter and manual entry and makes the documents more accessible.

All receipts and documents are stored in the cloud, so they’re available anywhere, which reduces the risk of lost paperwork.

Never lose a receipt again 📁

Join over 1 million businesses organizing & scanning receipts, creating expense reports, and reclaiming multiple hours every week—with Shoeboxed.✨

Get Started TodayMobile app

With Shoeboxed, lawyers can use the camera on their mobile device to scan, digitize, and upload receipts and documents into their Shoeboxed account.

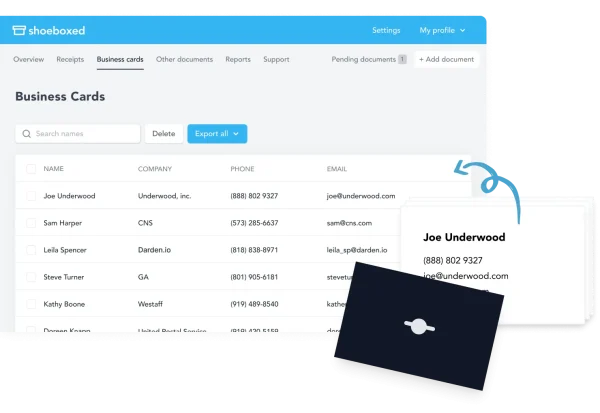

Business card management

Lawyers collect many business cards from colleagues, financial institutions, and potential clients.

The Shoeboxed mobile app takes photos of business cards. It then extracts and digitizes the contact information.

All digitized business cards are stored in a central cloud-based database, making contact information accessible anywhere.

The contact information that was extracted becomes searchable, so you can quickly find specific contacts when needed.

Shoeboxed allows you to export contact information to various CRM systems so all your business contacts are organized and accessible within your preferred customer relationship management tools.

Contacts can also be exported as CSV files and imported into other contact management systems or email clients.

Do business cards like a boss ✨

Use Shoeboxed’s app to organize business cards, receipts, and more. Try free for 30 days!

Get Started TodayMagic Envelope service

If lawyers don't have time to scan their receipts, business cards, or documents, they can outsource the task to Shoeboxed. Shoeboxed provides a free postage-paid Magic Envelope that can be filled with batches of receipts and mailed to Shoeboxed's processing center for them to scan, human-verify, and upload into your designated account.

Shoeboxed is the only receipt scanner app that will handle both your paper receipts and your digital receipts—saving customers up to 9.2 hours per week from manual data entry!

Break free from paper clutter ✨

Use Shoeboxed’s Magic Envelope to ship off your receipts and get them back as scanned data in a private, secure cloud-based account. 📁 Try free for 30 days!

Get Started TodayGmail plug-in

The Shoeboxed Gmail plugin automatically detects and extracts receipts from your inbox and turns them into organized expense records.

The plugin categorizes expenses from email receipts to track and organize all business expenses.

Lawyers who don’t have a Gmail account can forward email receipts to their Shoeboxed account for automatic processing and categorization.

Organizes and categorizes

For receipt management, once uploaded, Shoeboxed organizes and categorizes receipts into tax or custom categories such as office supplies, utilities, travel expenses, etc.

Lawyers can create custom tags and categories to suit their bookkeeping needs, so they have tailored financial oversight.

Receipts and documents become part of a searchable database so you can quickly find what you need when you need it.

This auto-categorization saves lawyers time, reduces errors, and helps track spending and manage budgets.

Expense reports

Shoeboxed generates expense reports that give lawyers insight into their spending so they can plan budgets and perform financial analysis.

Tracks mileage

Shoeboxed has a mileage tracking feature that logs business trips so you can claim mileage deductions.

Detailed mileage reports can be generated to track and claim mileage deductions.

Integrates with accounting software

Shoeboxed integrates with accounting software like QuickBooks, Xero, and Wave to transfer and sync data seamlessly.

Shoeboxed syncs digitized receipts and expense reports with your accounting software, making bookkeeping and tax time a breeze.

Tax preparation and compliance

Receipts are stored in a format accepted by the IRS, making tax preparation smoother and audit-proof. Shoeboxed helps track deductible expenses, ensuring that all eligible deductions are claimed. It generates tax-friendly reports summarizing deductible expenses, aiding in accurate and efficient tax filing.

Accurate and organized records make responding to audits and inquiries from tax authorities or regulatory bodies easier.

Enhanced collaboration with free sub-users

With a Shoeboxed account, law firms can add unlimited free sub-users so colleagues and accountants can access Shoeboxed and work on bookkeeping, documents, and accounting tasks.

Different levels of access and permissions can be set for each user so sensitive financial data is protected.

Implementing Shoeboxed in a law firm

Account setup:

Create a Shoeboxed account and download the mobile app for easy receipt and document capture.

Adding sub-users:

Add team members as sub-users to collaborate on bookkeeping tasks.

Assign roles and permissions based on responsibilities.

Capturing receipts and documents:

Use the mobile app to capture and upload receipts to your Shoeboxed account.

Organize and categorize the digitized documents within Shoeboxed.

Integrating with accounting software:

You can integrate Shoeboxed with your preferred accounting software for seamless data transfer and financial management.

Regular review and maintenance:

Regularly review financial reports and dashboards for insights.

Ensure all receipts and documents are uploaded and categorized promptly.

By leveraging Shoeboxed, law firms can streamline their accounting processes, save time, ensure accurate financial tracking, and ultimately focus more on their core legal work.

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic award-winning approach to receipt tracking for tax season. Try free for 30 days!

Get Started TodayFrequently asked questions

What does a bookkeeper do in a law firm?

Bookkeeping is an administrative task that involves recording the law firm’s business transactions and reconciling and balancing the firm’s financial accounts.

What are the two types of records in a law firm accounting?

Law firms can choose one of two accounting methods. They can choose either cash accounting for law firms or accrual accounting for law firms.

In conclusion

Modern law firms can greatly benefit from using bookkeeping software and tools like Shoeboxed. These tools automate many bookkeeping tasks, such as receipt capture, expense categorization, and financial reporting. These tools integrate with popular accounting software, making it easier to manage financial records and comply with regulations.

Caryl Ramsey has years of experience assisting in different aspects of bookkeeping, taxes, and customer service. She uses a variety of accounting software for setting up client information, reconciling accounts, coding expenses, running financial reports, and preparing tax returns. She is also experienced in setting up corporations with the State Corporation Commission and the IRS.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!