A business expenses worksheet is a tool for small business owners to organize and categorize tax-deductible expenses incurred for tax season reporting.

These worksheets come in various formats, from simple printable templates to sophisticated software systems, adaptable to the unique demands of different businesses.

For small enterprises, these spreadsheets make it easier to monitor cash flow and provide critical data for making informed financial decisions.

We've gathered 4 free templates + 1 amazing service to help you get prepared for tax time.

Top free business expenses worksheets

The following templates can significantly simplify tax time expense reports, allowing businesses to easily prepare for tax time.

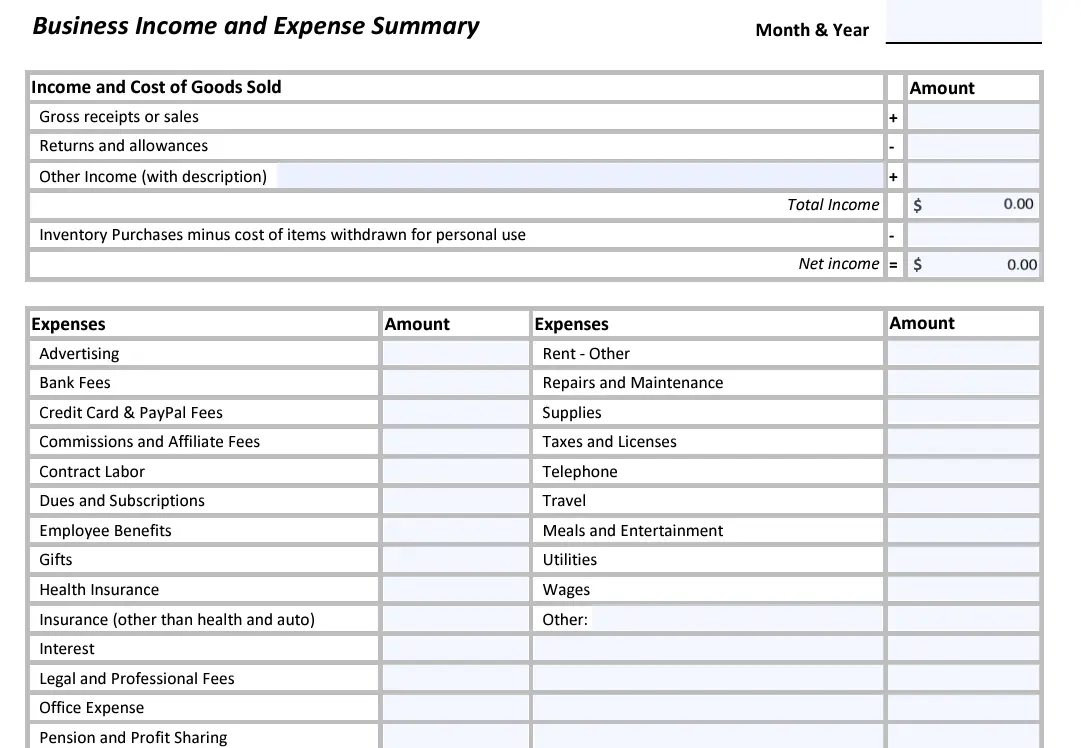

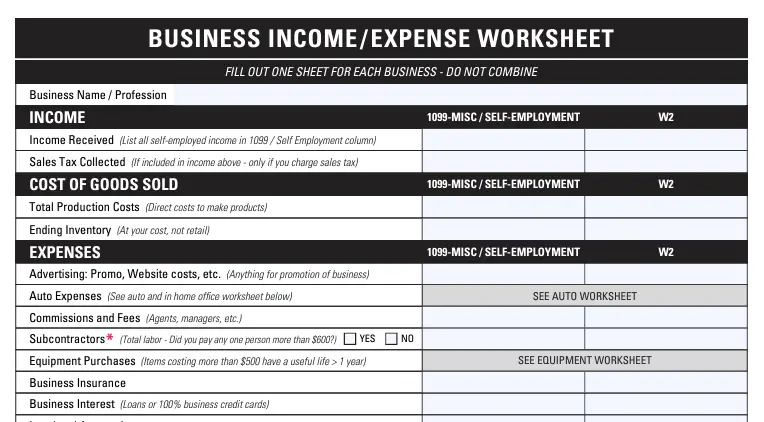

1. Business income and expense worksheet

This template has been crafted by financial experts at 1st Step Accounting. It features separate sections for documenting business income and expenses and facilitates a comprehensive view of the business's financial activities.

You can easily track income and cash flow, and the simplified financial analysis for decision-making purposes are just a few benefits of this expense spreadsheet.

See also: Income and Expense Worksheet: 4 Free Templates

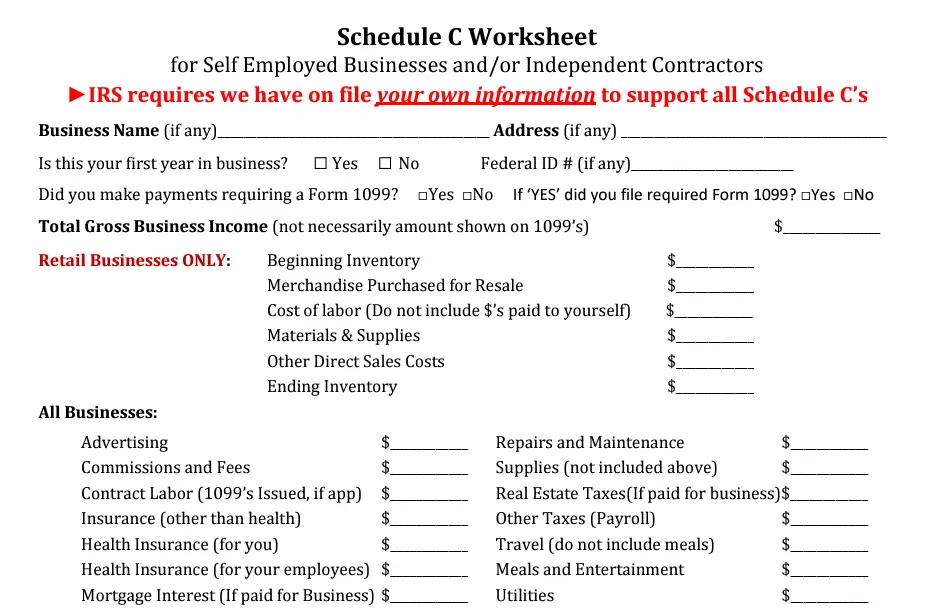

2. Schedule C Worksheet by Kristel's Tax & Accounting

Designed specifically for self-employed individuals and single-member LLCs, Kristel's Tax & Accounting worksheet focuses on relevant expenses for Schedule C tax filings.

It includes categories that the IRS recognizes, helping ensure that tax reporting is thorough and compliant with federal requirements.

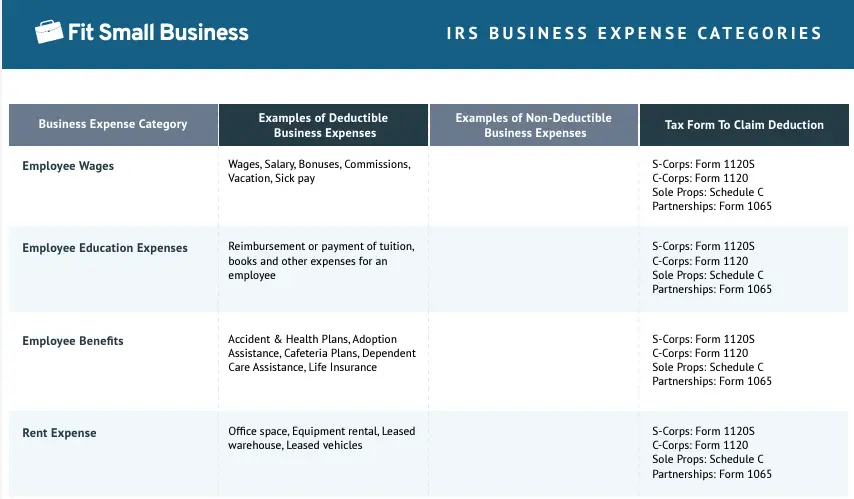

3. IRS business expense categories

Fit Small Business provides a robust worksheet template categorized according to IRS standards.

It ensures business owners can quickly identify and record deductible expenses in the correct categories and forms for tax purposes.

Its main advantage is that it directs business owners to the correct forms to use when claiming deductions.

4. FoxTax's business worksheet

The FoxTax Business Worksheet was developed to offer business owners and freelancers a straightforward method for calculating their expenses ahead of tax time.

It includes detailed sections for different types of business expenses, thus giving users the ability to grasp their financial landscape fully and prepare for tax submissions accurately.

5. Smartsheet's small business expense report

While worksheets are great at helping you summarize and claim all the available tax deductions, a business expenses spreadsheet will ensure that you're tracking all the daily, weekly, or monthly expenses regularly.

This expense report template by Smartsheet is a great expense tracker template to start with. Users can benefit from its premade structures while also having the flexibility to adapt the template to their business needs.

This template simplifies the monitoring of expenditures and provides automatic calculations – an essential feature for time-pressed business owners.

6. Bonus: Shoeboxed, a receipt scanning service for small business owners

Want to get a head start on next year's tax season? While some people thrive on using business expense tracking spreadsheets, others prefer a more automated method.

If you'd like to forgo manual entry entirely, consider Shoeboxed!

Join over 1 million users and start digitizing your receipts today!

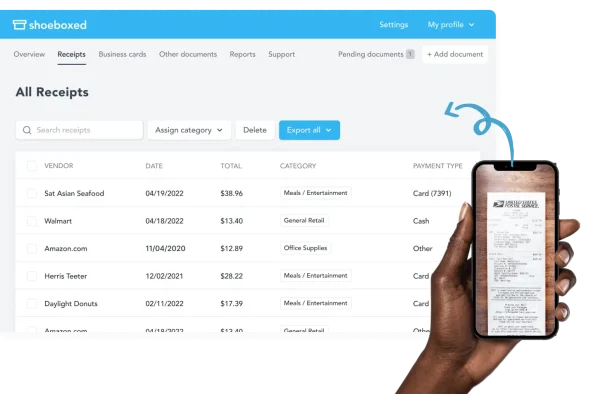

With Shoeboxed's receipt scanner app, simply snap a picture and upload it to your Shoeboxed account, and Shoeboxed's team will extract and verify the expense data from your receipts, assigning the expense one of 15 common tax categories.

For those who want an even easier method for getting receipts in their accounts, Shoeboxed's Magic Envelope service does just that.

Simply stuff your receipts into Shoeboxed's postage-prepaid envelopes and outsource receipt scanning to the pros.

Shoeboxed is the only receipt scanner app that will handle both your paper receipts and your digital receipts—saving customers up to 9.2 hours per week from manual data entry!

Stop doing manual data entry 🛑

Outsource receipt scanning to Shoeboxed’s scanning service and free up your time for good. Try free for 30 days! ✨

Get Started TodayWhat else can Shoeboxed do?

Shoeboxed has been voted as the best receipt scanner app for tax season by Hubspot and given the Trusted Vendor and Quality Choice awards by Crozdesk.

A quick overview of Shoeboxed's award-winning features:

a. Mobile app and web dashboard

Shoeboxed’s mobile app lets you snap photos of paper receipts and upload them to your account right from your phone.

Shoeboxed also has a user-friendly web dashboard to upload receipts or documents from your desktop.

b. Gmail receipt sync feature for capturing e-receipts

Importing e-receipts to your Shoeboxed account is as easy as syncing your Gmail with Shoeboxed, using Shoeboxed's special Gmail Receipt Sync feature.

Shoeboxed’s Gmail Receipt Sync grabs all receipt emails and sends them to your account for automatic processing! These receipts are then labeled as Sent to Shoeboxed in your Gmail inbox.

In short, Shoeboxed pulls the receipt data from your email, including the vendor, purchase date, currency, total, and payment type, and organizes it in your account.

Your purchases will even come with images of the receipts attached!

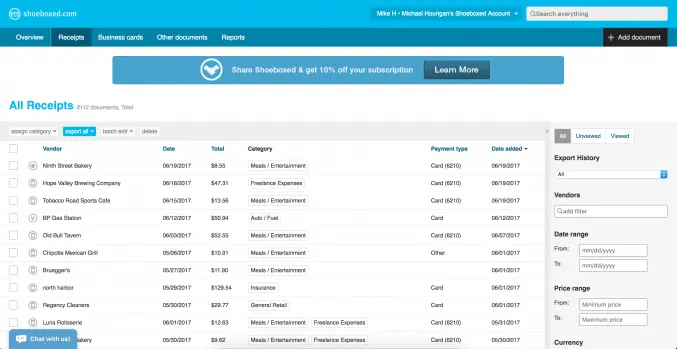

c. Expense reports

Expense reports let you view all of your expenses in one cohesive document. They also make it simple to share your purchases with your accountant.

Shoeboxed makes it easy to export your yearly expenses into a detailed report. All expenses come with receipts attached.

You can also choose certain types of receipts to include in your expense report. Just select the receipts you want to export and click “export selected.”

d. Search and filter

Call up any receipt or warranty in seconds with advanced search features.

Filter receipts based on vendors, date, price, currency, categories, payment type, and more.

e. Accounting software integrations

Export expenses to your accounting software in just a click.

Shoeboxed integrates with 12+ apps to automate the tedious tasks of life, including QuickBooks, Xero, and Wave Accounting.

f. Unlimited number of free sub-users

Add an unlimited number of free sub-users to your account, such as family members, employees, accountants, and tax professionals.

g. Mileage tracker for logging business miles

After you sign up for Shoeboxed, you can start tracking miles in seconds:

Open the Shoeboxed app.

Tap the “Mileage” icon.

Click the “Start Mileage Tracking” button.

And drive!

Whenever you start a trip, Shoeboxed tracks your location and miles and saves your route as you drive.

As you make stops at stores and customer locations, you can drop pins to make tracking more precise.

At the end of a drive, you’ll click the “End Mileage Tracking” button to create a summary of your trip. Each summary will include the date, editable mileage and trip name, and your tax deductible and rate info.

Click “Done” to generate a receipt for your drive and get a photo of your route on the map. Shoeboxed will automatically categorize your trip under the mileage category in your account.

h. The Magic Envelope

The Magic Envelope service Shoeboxed's most popular feature, particularly for businesses, as it lets users outsource their receipt management.

When you sign up for a plan that includes the Magic Envelope, Shoeboxed will mail you a pre-paid envelope for you to send your receipts in.

Once your receipts reach the Shoeboxed facility, they’ll be digitized, human-verified, and tax-categorized in your account.

Have your own filing system?

Shoeboxed will even put your receipts under custom categories. Just separate your receipts with a paper clip and a note explaining how you want them organized!

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic award-winning approach to receipt tracking for tax season. Try free for 30 days!

Get Started TodayBusiness expense tracking fundamentals

In managing a company's finances, it is vital to understand that business expenses are the costs incurred during the operation of a business.

These are necessary and ordinary charges that are integral to conducting business operations. They must be both ordinary and necessary to be considered legitimate by tax authorities.

Know what types of business expenses to track

A company may encounter a wide array of business expenses during their routine operations. These can be broadly categorized into direct costs, such as raw materials and labor, and indirect expenses, including marketing, utilities, and rent.

Some common expense categories include:

Employees wages and benefits

Rent or mortgage payments for business space

Utilities like electricity, water, and internet service

Marketing and advertising costs

Supplies and equipment

For specialized expenses such as self-employed health insurance, there are specific forms like Form 7206 introduced in 2023.

Regularly using a structured business expenses worksheet ensures that these different expenses are accurately tracked and recorded.

Using a worksheet from a professional accounting service will ensure that you track expenses that can be claimed during tax time.

Alternatively, you could create your own expense sheet that follows IRS expense categories.

The layout of the business expenses worksheet should facilitate quick entry and clear visualization of data.

Typically, it includes columns for date, description, category, amount, and notes. A top row should have clear headers; alternating row colors can improve readability.

See also: Project Cost Tracker: Free Templates to Stay Within Budget

Be diligent in recording business expenses

Effective expense management starts with consistent recording practices. This section breaks down the process into daily and monthly tasks to ensure financial accuracy and insight.

Businesses should record expenses as they occur to maintain an up-to-date picture of their financial health.

A Google Sheets business expense template can be invaluable for tracking these transactions.

The expense template typically includes columns for date, expense category, vendor, payment method, and amount.

Recording daily expenses minimizes errors and provides a real-time view of the business’s spending patterns.

On a monthly basis, businesses should review their expense records comprehensively.

A small business expense report template enhances the process by automatically calculating the totals and allowing for easy comparison with the budget.

Frequently asked questions

What are business expense categories?

Business expense categories are specific costs that companies incur during their operation. They can typically include employee wages, rent, and supplies.

Are there templates available for expense tracking?

There are free templates available for different types of expense tracking. Depending on a business's needs, these can range from simple spreadsheets to more comprehensive systems. Some popular options include annual business expense templates and small business expense spreadsheets.

In closing

Worksheets and expense management services like Shoeboxed can lead to more efficient operations and, ultimately, contribute to the business’s success and growth.

If you enjoy data entry, then worksheets and spreadsheets might be a great way to stay on top of your business expenses.

On the other hand, if you prefer a more automated approach, consider outsourcing expense management and data entry to Shoeboxed!

Tomoko Matsuoka is managing editor for Shoeboxed, MailMate, and other online resource libraries. She covers small business tips, organization hacks, and productivity tools and software.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!