Are you missing out on the business mileage deduction, which, by the way, can save you money on your taxes? Business mileage is a big part of expense management for many professionals, mainly self-employed, independent contractors, and businesses with employees who travel for work.

Knowing how to calculate business mileage, follow Internal Revenue Service (IRS) rules, and create transparent mileage reimbursement policies will save you time, money, and headaches.

The Internal Revenue Service has introduced changes to the standard mileage rate in 2024. Understanding these changes and the new rate is crucial for accurate mileage reimbursement and tax deductions.

What is business mileage?

Business mileage is the total distance traveled for business use. Business use includes any travel for work, such as driving to meet clients, attending meetings, or traveling to work sites, and is considered a business expense.

However, it does not include personal travel or commuting from home to the office, regarded as personal mileage.

Business mileage is essential for self-employed and independent contractors, who can deduct these expenses from their taxes. Proper record-keeping and knowing the rules are key to maximizing deductions and complying with tax laws.

What are the mileage reimbursement rules?

The IRS rules for mileage reimbursement apply to both employees and self-employed.

Here are the critical mileage reimbursement rules:

1. Employers must reimburse employees at a rate of or greater than the IRS standard mileage rate.

2. Employees must keep detailed records to be eligible for reimbursement, which includes the trip’s date, destination, purpose, and total miles traveled. Keeping detailed records of actual costs such as fuel, maintenance, and repairs is key to accurate reimbursement and tax deductions.

These records are essential for deducting business mileage from taxes. Not keeping accurate records could result in lost deductions or compliance issues during tax time.

What is the 2024 IRS mileage rate?

In 2024, the IRS increased the standard mileage rate for business use to 67 cents per mile, up 1.5 cents per mile from 2023.

The IRS determines this rate based on an annual study of fixed and variable costs associated with automobile operations. This rate applies to electric and hybrid vehicles as well as gasoline and diesel-powered vehicles.

In addition to business mileage, the IRS has rates for other purposes:

Medical or moving purposes: 21 cents per mile.

Charitable purposes: 14 cents per mile.

These rates make it easy to calculate deductions or reimbursements for different types of mileage, helping businesses and self-employed individuals comply with tax laws.

How do you calculate reimbursements for mileage?

There are two ways to calculate mileage reimbursement:

1. Standard IRS mileage rate

The easy way is to multiply the number of business miles by the IRS rate (67 cents per mile in 2024).

2. Actual expense method

This method tracks all actual expenses for vehicle maintenance, fuel, repairs, and insurance and calculates the percentage used for business purposes.

While it may require more record-keeping effort, it can be more beneficial for those with high vehicle expenses, as it can potentially result in a higher reimbursement than the standard IRS mileage rate.

Both self-employed individuals and employees can choose their preferred method of mileage reimbursement. While the actual expense method offers a detailed breakdown, the standard mileage rate method provides a simpler calculation. This flexibility puts you in control of your reimbursement process.

How do you create a clear mileage reimbursement policy?

Employers should create a mileage reimbursement policy that includes everything from mileage rates and what expenses can be reimbursed to what records are required from employees. Employers should also have a system for tracking and managing employee mileage reimbursements.

Employers should check with the IRS to see what records are required and what expenses can be reimbursed. They should also check with their employees to see what records are needed and what expenses can be refunded.

What is the best way to track miles?

In my experience, a mileage-tracking app is the most efficient way to track miles driven for business purposes.

Shoeboxed - ideal for business owners looking for a mileage tracking app

Shoeboxed is the best mileage tracker because it offers accuracy and ease of use in one platform. It simplifies the process of tracking business mileage and has many other features that make expense management and tax preparation a breeze.

Here’s why Shoeboxed is the best for tracking business miles:

1. Shoeboxed's mileage feature makes it easy to claim deductions during tax season with the miles you log.

Shoeboxed offers mileage tracking by using your phone's GPS. You can rely on the app to track your route and mileage. This way, no business miles are missed, which is key to maximizing tax deductions or accurate employee mileage reimbursements.

After you sign up for Shoeboxed, you can start tracking miles in seconds:

Open the Shoeboxed app.

Tap the “Mileage” icon.

Click the “Start Mileage Tracking” button.

And drive!

Shoeboxed tracks your location and miles whenever you start driving and saves your route as you drive.

You can drop pins to make tracking more precise as you make stops along the way.

At the end of a drive, click the “End Mileage Tracking” button to create a trip summary. Each summary will include the date, editable mileage, trip name, and tax-deductible miles and rate information.

Click “Done” to generate a receipt for your drive and get a photo of your route on the map.

Shoeboxed's mileage tracker app will automatically categorize your trip under the mileage category in your account.

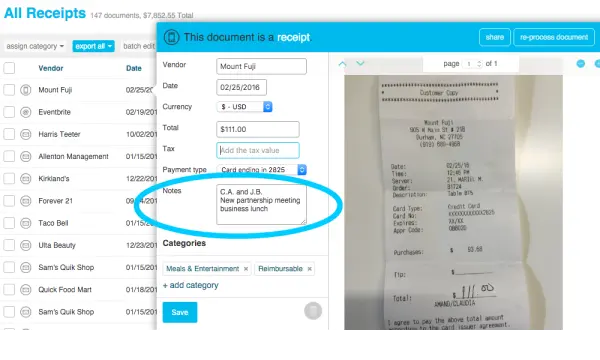

2. Trip details can be added in 'notes' for further clarification

Another great feature is that you can go into Shoeboxed's app and add trip details under the notes section with each mileage receipt, which can be edited whenever needed.

For example, it's a great idea to go in and add the purpose of the receipt in the 'notes' section.

3. Provides accurate and IRS-compliant records

One of the essential requirements for business mileage deductions or reimbursements is record keeping.

Shoeboxed provides detailed IRS-compliant logs of each trip, including:

Date of the trip

Starting and ending locations

Total miles traveled

The purpose of the trip can be added in 'Notes'.

The app stores these records so you can easily generate reports for tax filings or reimbursement requests.

4. Shoeboxed does more than just track miles

Shoeboxed isn’t just for mileage tracking; it's also an expense management tool that creates a complete financial tracking system.

You can combine mileage logs with other business expenses like fuel, repairs, and maintenance to manage all business travel expenses in one place. This helps you track variable costs associated with business travel, such as fuel and maintenance.

5. Offers time-saving features

There is no manual entry or risk of losing paper mileage logs. Everything is stored in the cloud. With just a few clicks, you can generate mileage reports in seconds, perfect for busy professionals who need a quick way to manage their business miles.

Track mileage with Shoeboxed 🚗

Track mileage using your phone’s built-in GPS for unmatched ease and accuracy. 💪🏼 Try free for 30 days!

Get Started TodayMore features of Shoeboxed

With Shoeboxed, you get even more features.

1. Mobile app for receipt scanning

Shoeboxed is excellent at scanning receipts for other business expenses. With the app, you can take a photo of your receipt with your smartphone's camera, and the app will automatically upload it to your designated account.

This is perfect for tracking expenses beyond mileage, like fuel, meals, and other business expenses.

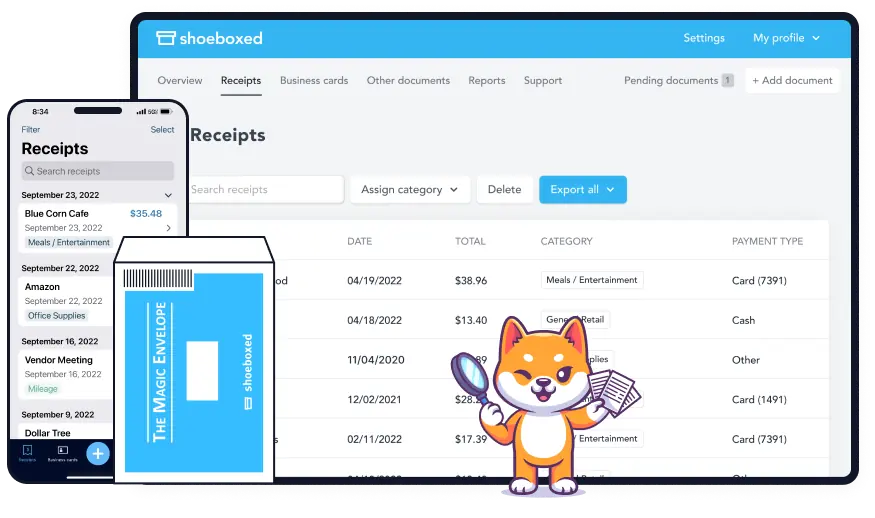

2. Magic Envelope outsourcing service

Shoeboxed offers a physical document scanning service for users with many paper receipts or documents or for those who don't have time to scan their own receipts.

You can mail your receipts and documents in their prepaid postage-free Magic Envelope, and Shoeboxed's team will scan and upload them to your account.

3. Organizes and categorizes receipts

Once receipts are uploaded, Shoeboxed automatically organizes them under 15 custom or tax categories.

The tax categories are editable; add tags and descriptions for each expense to further categorize your purchases.

Shoeboxed also offers advanced search and filters to sort and find receipts by date, vendor, payment type, and more.

This ensures all business expenses, including travel, are organized to make tax time easier and IRS compliant.

4. Automatically generates expense reports

Shoeboxed creates detailed, customizable expense reports with just the click of a button. Reports can include business miles, receipts, and other business expenses.

5. Integrates with accounting software

You can export reports to accounting software like QuickBooks or Xero to integrate Shoeboxed with your overall financial system, making everything consistent and up-to-date across platforms.

6. Offers mobile and desktop access

Shoeboxed has mobile and desktop access, so you can manage your expenses and track your miles on the go. Since the app syncs across devices, all your information is up-to-date and accessible anywhere.

7. Makes tax time more straightforward

Shoeboxed helps you prepare for tax time by tracking your miles and categorizing your expenses. The app gives you clear and detailed records of all your business travel and expenses, giving you everything you need to claim deductions or report reimbursements.

With receipt scanning, document organization, automatic categorization, easily generated expense reports, and tax time assistance, Shoeboxed is a one-stop shop for all your business expenses.

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic award-winning approach to receipt tracking for tax season. Try free for 30 days!

Get Started TodayWhat are the tax implications of mileage reimbursement?

The tax implications of mileage reimbursement vary depending on the relationship between the employer and the employee or the individual taxpayer.

For employees, if an employer reimburses them for business mileage at or below the IRS standard rate (67 cents per mile for 2024), the reimbursement is typically tax-free and does not need to be reported as income. However, the excess amount may be taxable if the reimbursement exceeds the IRS rate.

Mileage reimbursement is tax deductible for employers and independent contractors.

The IRS standard mileage rate makes tax reporting more straightforward for employers and employees.

Using a business mileage rate different from the federally approved reimbursement rate makes tax reporting more complicated.

Qualified active duty members can deduct mileage related to moving for tax purposes if the move was due to a military order.

Frequently asked questions

1. Can I use the standard mileage rate and the actual expense method together?

You must choose between the standard mileage rate and the actual expense method for your mileage deduction or reimbursement. The standard mileage rate is easier, but the actual expense method requires tracking all actual costs related to vehicle maintenance, fuel, repairs, etc.

2. How do I track business miles for tax purposes?

The IRS requires detailed records of business miles, date of trip, destination, miles traveled, and purpose. A mileage tracking app like Shoeboxed can automate this process and digitally store all the information so you are compliant and tax time is easier.

In conclusion

Maximizing your tax deductions while staying compliant with the IRS can be tricky, but understanding the new 2024 business mileage rate will save time and money.

For self-employed individuals and independent contractors, mileage can be deducted as a business expense on their tax return using the standard mileage rate or actual expense method.

Accurate record-keeping is essential to ensure compliance and maximize deductions. Shoeboxed, an expense management tool, makes reimbursements and tax time a breeze.

Caryl Ramsey has years of experience assisting in different aspects of bookkeeping, taxes, and customer service. She uses a variety of accounting software for setting up client information, reconciling accounts, coding expenses, running financial reports, and preparing tax returns. She is also experienced in setting up corporations with the State Corporation Commission and the IRS.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!