During tax season, many individuals and business owners wonder if they can use their gas receipts to claim deductions on their tax returns. Understanding all the ins and outs of these receipts can lead to significant tax savings.

Here's a detailed look at when, how, and where you can use gas receipts for tax purposes.

Who can use gas receipts for tax purposes?

There are certain instances where you can use your gas receipts for taxes. These instances are if you are a business owner or self-employed and use your vehicle for business.

These individuals can deduct car expenses from their tax returns. If the vehicle is used for both business and personal use, the deduction is based on the percentage of mileage used for business.

What are the two methods for figuring car expenses?

There are two main methods for claiming this tax deduction. You can choose to use one of the two methods.

1. Standard mileage method

Here's what you need to know about the standard mileage deduction.

Business owners and the self-employed who want to use the standard mileage method for a vehicle they own must choose to take the standard mileage deduction in the first year the car is used in their business.

Business owners and self-employed people who want to use the standard mileage deduction for a car they lease must use it for the entire lease period.

The IRS sets a standard mileage rate every year. The standard mileage rate for 2024 is 67 cents per mile.

2. Actual expenses method

With the actual expenses method, qualified taxpayers can deduct the actual vehicle expenses for the tax period.

These include the following expenses:

Registration fees

Parking fees

Insurance

Repairs

Tune-ups

Tires

Gas

Oil

Lease payments

Depreciation

Using the actual expense method, how do you write off gas expenses as a tax deduction?

Here's a closer look at how you can write off gas and other vehicle-related expenses as a tax deduction using the actual expenses method.

Keep detailed records: To deduct gas expenses, you must keep meticulous records of your purchases. This includes saving all gas receipts and documenting each purchase's date, amount, and business purpose.

Calculate business use percentage: You need to determine the percentage of your vehicle's use for business. This is done by dividing the number of miles driven for business purposes by the total number of miles driven in the year.

Apply business use percentage: Apply the business use percentage to your total gas expenses to determine how much can be deducted. For example, if 50% of your vehicle use is for business, you can deduct 50% of your total gas expenses.

Include other expenses: Along with gas, all other relevant vehicle expenses (maintenance, insurance, business-related parking fees, etc.) are calculated using the same business use percentage to calculate your total vehicle expense deduction.

Report on tax return: Report your deductions on Schedule C (Form 1040) if you are self-employed. Employees who use their car for work-related driving can't take the employee business expense deduction from their miscellaneous itemized deductions on Schedule A, even if the employer doesn't reimburse the expenses for using their car.

Exception for unreimbursed expenses: Armed Forces reservists, local government officials, and qualified performing artists can still deduct unreimbursed employee travel expenses.

Special considerations

Record-keeping: This method requires thorough documentation, including receipts and a detailed business log versus personal use.

More complex calculations: You'll need to calculate the percentage of business use and apply it to various expenses, which can be more complicated than simply tracking miles as in the standard mileage rate method.

What is an example using the actual expenses method?

Let's explore an example of how you might use the actual expenses method to calculate and write off vehicle expenses for a business on your tax return.

Scenario: Business use of a personal vehicle

Facts:

You're self-employed and use your personal car exclusively for business.

Total miles driven for the year: 20,000 miles.

Total gasoline expenses for the year: $3,000.

Other vehicle expenses (maintenance, repairs, insurance, etc.): $4,000.

Total expenses: $7,000.

Step-by-step calculation:

-

Determine total vehicle expenses:

Gasoline: $3,000

Maintenance and repairs: $2,000

Insurance: $1,000

Depreciation: $1,000

Total expenses: $7,000

-

Calculate business use percentage:

If every mile driven was for business purposes, your business use percentage is 100%.

-

Apply business use percentage:

Since all use is for business, 100% of your vehicle expenses are deductible.

Total Deductible Expenses: $7,000

-

Documenting your expenses:

Keep all receipts for gasoline purchases, maintenance, insurance payments, and other costs.

Maintain a detailed log or diary of your vehicle use to substantiate the business use percentage.

-

Reporting on your tax return:

Report these expenses on Schedule C (Form 1040) as part of your business expenses.

Include detailed information and supplementary documents with your tax return if required.

Where do you claim car expenses like gas?

To claim car expenses like gas on your tax return, if you are self-employed and use your car for business purposes, you can claim gas and other car expenses on Schedule C (Form 1040).

How can you keep track of gas receipts?

You can keep track of gas receipts and other expenses manually or digitally.

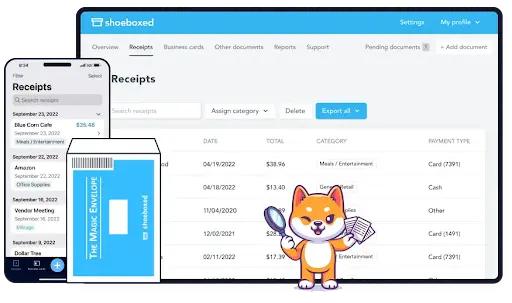

An expense management tool like Shoeboxed is a very efficient method for keeping track of gas and other receipts for tax deductions.

Shoeboxed—a great service for keeping track of car-related expenses

Shoeboxed is used by over a million businesses.

The one thing beneficial about Shoeboxed, in particular, is its Magic Envelope service.

Magic Envelope

The Magic Envelope makes saving and processing gas receipts for taxes even more manageable.

The Magic Envelope service, which is only offered by Shoeboxed, simplifies expense tracking by allowing users to send all their receipts in a prepaid envelope to Shoeboxed to have them processed.

You mail the receipts to Shoeboxed, and they will do the rest! The receipts are scanned, digitized, organized, and auto-categorized there for easy online access.

Drivers can keep this envelope on their car dashboard and fill it with gas receipts before they leave the gas station, which means there will be no more lost or damaged receipts!

Never lose a receipt again 📁

Join over 1 million businesses organizing & scanning receipts, creating expense reports, and reclaiming multiple hours every week—with Shoeboxed.✨

Get Started TodayMobile app

Shoeboxed's mobile app makes tracking expenses on the road or on a business trip convenient.

With its mobile app and smartphone camera, Shoeboxed allows users to snap pictures of receipts while on the go. From there, the data is OCR extracted, organized, auto-categorized, and uploaded into your Shoeboxed account. This makes it even easier to track gas receipts immediately after they occur and makes them accessible from anywhere.

Mileage tracking

Shoeboxed even has a feature to track mileage.

Shoeboxed also offers a mileage tracking feature, which is crucial for business owners or self-employed people using the standard mileage method. This feature keeps a mileage log of business miles driven for accurate expense reporting and tax deductions.

Additional features

Shoeboxed offers several other features contributing to its recognition as an award-winning service.

Digital Document Management

Shoeboxed is the best tool for digitally managing gas receipts and other auto expenses.

Shoeboxed converts physical receipts into digitized and organized data and prepares the data for reimbursements or tax purposes.

Shoeboxed doesn't just manage receipts. They can digitize and organize any other type of document.

Organization and categorization

Shoeboxed organizes and categorizes your gas receipts and other auto expenses.

Once the receipt is scanned, the data is auto-categorized into 15 tax or custom categories and stored securely online in your Shoeboxed account.

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic award-winning approach to receipt tracking for tax season. Try free for 30 days!

Get Started TodayExpense Reporting

Shoeboxed creates expense reports with the click of a button.

After the data is auto-categorized, users can quickly generate expense reports with images of the receipts attached.

These reports can be customized and are suitable for reimbursement processes or tax preparation.

Integration with Accounting Software

Shoeboxed integrates with accounting software.

Shoeboxed integrates with popular accounting solutions like QuickBooks, Xero, and more.

This integration ensures that expense tracking aligns with broader financial management systems.

IRS Compliant

Shoeboxed makes it easy to comply with IRS requirements.

The digitization process creates IRS-accepted images of receipts, which is essential for tax deductions and audits.

These features make Shoeboxed a comprehensive tool for expense management, appealing to the self-employed, small business owners, and anyone needing to streamline their financial tracking.

Its efficiency in processing and organizing receipts and expenses saves time and enhances financial accuracy, underpinning its reputation as an award-winning service.

Shoeboxed demo

Frequently asked questions

Can I still claim the expense if I lose a gas receipt?

If you lose a gas receipt, you might still be able to claim the expense on your tax return, but substantiating the deduction will be more challenging if the IRS audits you.

Other documentation can support your claim if the receipt is lost.

This might include:

Bank or credit card statements showing the purchase.

A logbook that records the expense's date, purpose, and amount alongside vehicle-related other expenditures.

Maintaining a consistent and detailed mileage log of all your business-related driving and expenses can help justify your claims without specific receipts. This should include dates, destinations, business purposes, and total mileage made for each trip.

If I rent instead of owning the car, can I deduct car expenses?

You can deduct vehicle expenses for a rented car if you use it for business purposes. Typically, you would deduct the rental fee and gas.

In conclusion

Using gas receipts for taxes is permissible and can benefit the self-employed and business owners. However, choosing between the standard mileage rate and the actual expense method depends on which provides the more significant tax benefit. Expense management digital tools like Shoeboxed can help you keep track of your receipts and prepare the data for tax deductions.

Caryl Ramsey has years of experience assisting in different aspects of bookkeeping, taxes, and customer service. She uses a variety of accounting software for setting up client information, reconciling accounts, coding expenses, running financial reports, and preparing tax returns. She is also experienced in setting up corporations with the State Corporation Commission and the IRS.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports, including IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports, and more—with Shoeboxed.

Try Shoeboxed today!