Bookkeeping is the foundation of financial management for any business, making sure income, expenses, and transactions are recorded and organized.

If you’re a small business owner, freelancer, or entrepreneur, you may wonder if you can do your own bookkeeping instead of hiring someone. The answer is a big yes – with the right tools, knowledge, and commitment, many people do their own books.

What is bookkeeping?

Bookkeeping tracks and records financial and business transactions, including income and expenses, to assess a business’s financial health.

Bookkeeping tasks include:

Recording income and expenses.

Managing accounts payable and receivable.

Reconciling bank statements.

Preparing financial reports like profit and loss statements.

Bookkeeping helps small business owners make informed decisions, identify areas for cost-cutting, and ensure compliance with tax laws and regulations.

Accurate bookkeeping is also crucial for small businesses, as it allows them to avoid cash flow issues and ensure they can pay themselves and their employees.

Can you do your own bookkeeping?

Yes, many business owners do their own bookkeeping, especially in the early stages of their business or when on a tight budget. But can you?

It depends on:

The complexity of your transactions.

Your comfort with numbers and accounting.

The time you have to keep records accurate.

What are the benefits of doing your own bookkeeping?

There are some key benefits to doing your own bookkeeping.

1. Cost savings

A professional bookkeeper can cost you hundreds or thousands of dollars to hire a bookkeeper every year. Do it yourself and save that money.

2. Financial awareness

Doing your own bookkeeping keeps you close to your business’s financial performance so you can make better decisions. Bookkeeping software can automate many tasks, making it easier for most small business owners to manage their finances.

3. Skill building

Learning bookkeeping skills will help you better understand your business and be ready to manage its finances if you decide to outsource in the future.

How to get started with DIY bookkeeping

Here's how to get started.

1. Tools

Get bookkeeping software that makes financial management easy.

2. System

Create a process to track transactions:

Keep personal and business finances separate with a business bank account.

Record income and expenses as you go so you don’t fall behind.

Learn:

Chart of accounts.

Cash vs. accrual.

Reconciling accounts.

3. Online resources

Use free tutorials, webinars, and articles to learn bookkeeping.

4. Organize

Keep all receipts, invoices, and financial documents in a system—digital or physical.

Bookkeeping basics for small businesses

Small business owners need to set up a business bank account to separate their personal finances and business finances.

They should choose an accounting method that suits their business needs, such as cash or an accrual accounting method only.

Bookkeeping software can help small business owners manage their financial transactions, including their business income, and expenses.

Small business owners should regularly review and reconcile their financial statements to ensure accuracy.

How to choose the right accounting software for your business

Small business owners should choose accounting software that matches their business stage and budget.

When selecting accounting software, small business owners should consider features such as bank reconciliation, expense management, and core accounting.

They should also read reviews and ask for recommendations from other small business owners.

How can Shoeboxed help with your own bookkeeping?

Doing your own bookkeeping can be a great way to save money and stay connected to your business’s finances, but it requires organization and consistency.

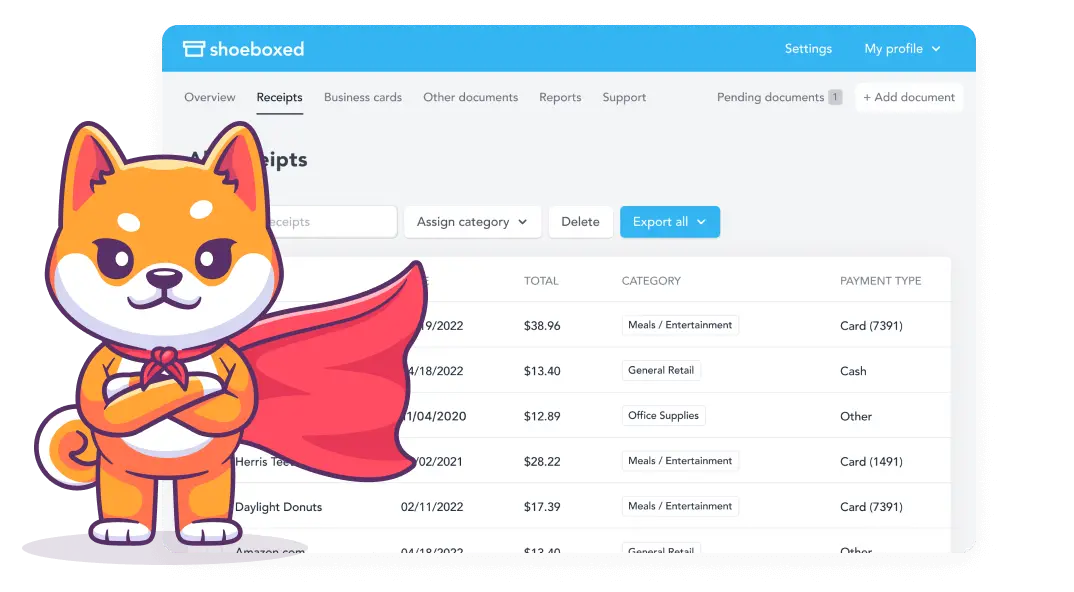

Shoeboxed is a tool that makes DIY bookkeeping easy by helping you keep track of receipts, expenses, and documentation efficiently.

Here’s how Shoeboxed can help you do your books like a pro:

1. Easy receipt management

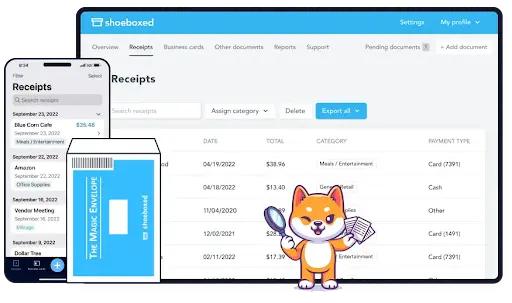

Shoeboxed digitizes your receipts. Their platform lets you scan and upload physical receipts using your smartphone. Just snap a picture of the receipt with your phone's camera, and Shoeboxed's app will upload the digital version and store it in the cloud in your designated Shoeboxed account.

Or, if you don't want to deal with the scanning, you can mail them via the free postage-paid Magic Envelope service, and they will scan, human-verify, and upload them to your account for you.

Once uploaded, receipts are stored in the cloud. No more manual data entry, errors, or clutter.

Shoeboxed is the only receipt scanner app that will handle both your paper receipts and your digital receipts—saving customers up to 9.2 hours per week from manual data entry!

Stop doing manual data entry 🛑

Outsource receipt scanning to Shoeboxed’s scanning service and free up your time for good. Try free for 30 days!✨

Get Started Today2. Auto-expense categorization

The platform extracts date, vendor, and amount using OCR (Optical Character Recognition), so you don’t have to enter data manually.

Shoeboxed automatically categorizes your expenses into tax-friendly categories like travel, meals, and office supplies.

Create custom categories to fit your own business needs so you can keep accurate records for tax prep or financial analysis.

3. Detailed expense reports

You can create professional, IRS-compliant expense reports with receipts attached in seconds. Shoeboxed compiles your expenses into a neat expense report with just the click of a button.

Shoeboxed automates most of the bookkeeping process so small businesses can focus elsewhere.

4. Tax compliance and audit readiness

Shoeboxed provides IRS-compliant digital copies of your receipts so you can validate deductions and be audit-ready.

Generate reports summarizing your financial activity so you can prep tax filings like Schedule C for self-employed individuals.

5. Time saver

You can upload multiple receipts simultaneously using the drag-and-drop method on your laptop or desktop.

6. Easy and convenient access

Since your information is in the cloud, you have access and can update your records anytime, anywhere.

7. Financial visibility

Use Shoeboxed’s reporting to track spending, find cost savings, and stay on top of your business’s financials. This will help you make informed decisions and manage cash flow.

Example

You’re a freelance graphic designer doing your own books.

With Shoeboxed you can:

Take a photo of every receipt after you buy design software, meet with clients for meals, etc.

Let Shoeboxed automatically categorize the expenses for you.

At the end of the month, finalize your profit and loss statement without any manual input errors.

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic award-winning approach to receipt tracking for tax season. Try free for 30 days!

Get Started TodayWhat are the challenges of doing your own bookkeeping?

Bookkeeping, just like anything else, can be challenging at times.

1. Time-consuming

Bookkeeping requires regular attention and can take time away from running your business.

2. Learning curve

Understanding accounting principles, tax laws, and financial and accounting software may be challenging for those without a financial background.

3. Risk of errors

Mistakes in recording transactions or categorizing business expenses can lead to inaccuracies, potential audits, or penalties. However, Shoeboxed can help avoid or minimize errors.

4. Limited scalability

As your business grows and transactions become more complex, DIY and bookkeeping processes may no longer be practical.

How to avoid the challenges of DIY bookkeeping

Here are some tips I've found helpful in avoiding the most common challenges of doing your own books.

Small business owners should avoid mixing their personal and business finances.

They should regularly review and reconcile their financial statements to avoid errors.

Small business owners should also avoid using the wrong accounting method, such as cash accounting instead of accrual accounting.

They should keep accurate records of financial transactions and avoid missing deadlines for tax filings.

Frequently asked questions

Do I need bookkeeping software?

No, it's not required, but bookkeeping software such as Shoeboxed makes tracking and organizing financial records easier, reduces errors, and saves time.

How long does DIY bookkeeping take?

The time spent on your own bookkeeping system will depend on the volume of transactions. For small businesses, it typically takes 1-5 hours a week.

In conclusion

Doing your own bookkeeping can be a cost-effective and efficient way for small business owners to manage their finances.

However, having the right tools such as Shoeboxed and knowledge to avoid errors and ensure compliance with tax laws and regulations is essential.

Small business owners should consider outsourcing their online bookkeeping service if they struggle to manage their finances or need guidance on bookkeeping tasks.

By following these tips and best practices, small business owners can ensure accurate financial reporting and make informed decisions to boost business growth.

Caryl Ramsey has years of experience assisting in bookkeeping, taxes, and customer service. She uses a variety of accounting software to set up client information, reconcile accounts, code expenses, run financial reports, and prepare tax returns. She is also experienced in setting up corporations with the State Corporation Commission and the IRS and is a contributing writer to SUCCESS magazine.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!