Cannabis accounting software is designed to address the unique financial needs and challenges faced by cultivators, manufacturers, and distributors of marijuana products.

Accounting software can help streamline operations, reduce labor costs, and ensure compliance with industry regulations.

Though navigating the world of cannabis finance can be challenging, with the right accounting software, you can manage your books with ease and focus on scaling your business.

In this guide, we review the top accounting software for cannabis companies, discuss what to look for to meet your needs, and answer common questions.

What should you look for in cannabis software?

The cannabis industry is a complex and heavily regulated one, so when you’re considering cannabis cultivation software, there are several important factors to look for to ensure it meets the needs of your cannabis business.

1. Inventory management

One of the most important aspects to consider in accounting software is if it has inventory management capabilities.

Your cannabis company needs accurate tracking of inventory from seed to sale. This is essential for both regulatory compliance and optimizing your operations.

Read More: Best Cannabis Inventory Software

2. ERP

Enterprise resource planning (ERP) is another critical element for cannabis companies.

Your accounting software should integrate well with other business management solutions, such as customer relationship management (CRM) and project management tools.

An all-in-one solution can streamline your operations by centralizing your data, ensuring seamless collaboration between departments, and providing real-time insights.

3. Cloud-based software

Cannabis businesses face unique legal requirements, making it important to choose a cloud-based accounting software that stays up-to-date with the ever-changing regulatory landscape.

These software programs should also include features like tax time support and reporting functions to help you meet mandatory compliance standards.

4. Reasonable cost

Look for an affordable solution with tiered packages that cater to businesses of varying sizes. As your business grows, you want software that is flexible enough to grow with you.

5. Unlimited users

If you have a large team or plan on adding multiple users to your accounting software, choosing software that allows for unlimited users offers sustainable growth potential without incurring additional costs.

6. Ease of use and customer support

Finally, evaluate the ease of use and customer support offered by the software.

Choose a solution that simplifies your daily accounting tasks and allows easy access to important functions like:

Bank account management.

Payroll reports.

Cash flow analysis.

Sending invoices.

You’ll also want to consider the quality of customer support provided and ensure that you have access to assistance to tackle any challenges you may encounter.

By considering these factors, you can confidently choose a cannabis accounting software that aligns with your business needs and supports your growth.

Inventory management for cannabis business | GreenGrowth CPAsBest cannabis accounting software in 2024

1. FreshBooks – Best for accounting novices

FreshBooks homepage

Get paid on a single platform.

Generate reports on your business’s health.

Cons:

Doesn’t offer an unlimited number of free users. The cost can quickly add up depending on how large your team is.

The number of clients is limited in the Lite (up to 5 clients) and Plus (up to 50 clients) plans.

Pricing:

Lite – $17/month

Plus – $30/month

Premium – $55/month

Select – Get a free consultation for your business’s accounting needs.

2. Xero – Best for small businesses

Xero accounting software for small businesses.

Xero is our top pick for small cannabis businesses mainly because of its end-to-end accounting features (but in part due to its fantastic modern web and app interfaces).

This software can benefit marijuana businesses by allowing them to pay bills, manage spending, invoice and accept payments from clients, track profitability, manage inventory, and create accounting reports all in a single platform.

You can even add your accountant to your Xero profile to view your expense data in real time and integrate Gusto with your account to manage payroll for your employees.

We also really liked that you can store and manage your important files such as receipts, tax documents, contracts, and records of paid bills on Xero.

Pros:

24/7 customer support.

Modern, easy-to-navigate mobile and web interfaces.

Pay bills, reimburse employees for business expenses, and do payroll.

Send invoices and get paid through Xero.

Easily enable bank transactions.

Track projects, business costs, and profitability. Manage business contacts and store important business data and files.

Expense reports for tax time.

Manage inventory.

Cons:

Does not provide a cannabis industry chart of accounts.

Pricing:

Early – $13/month

Growing – $37/month

Established – $70/month

3. QuickBooks – Best for growing operations

QuickBooks Online

QuickBooks is used by companies across virtually every industry to manage money and streamline business operations, among other benefits.

QuickBooks has 3 primary software programs to meet the needs of cannabis businesses:

QuickBooks Online.

QuickBooks Desktop Premier Plus.

QuickBooks Enterprise.

These programs offer the perfect solution for scalability and enable businesses to comfortably grow.

QuickBooks Online

QuickBooks Online is best for marijuana businesses that are just getting off the ground.

This software provides the basics of accounting for new businesses such as income and expense tracking, tax deduction recommendations, mileage tracking, cash flow management, client invoicing and payments, profitability and business reports, and integration with e-commerce platforms.

You can also pay bills and manage your company’s inventory with QuickBooks Online.

QuickBooks Desktop Premier Plus

A step up from QuickBooks Online, QuickBooks Desktop Premier Plus has all of the features offered by QuickBooks Online with the addition of better inventory management features.

Premier Plus makes it easy to calculate deductions and cannabis-related taxes, get live feedback from your accountant, and project your store’s profit margins.

Users can access their data, perform tasks, and view their expenses wherever they go with the mobile app.

QuickBooks Enterprise

QuickBooks Enterprise is designed for large-scale marijuana dispensaries and businesses with complex accounting needs. It has everything offered by the other packages but on a broader scale.

QuickBooks Enterprise has built-in payroll, customizable reporting features, multi-level inventory and order management, and more.

Pros:

Various levels of accounting solutions based on your company size.

Expense and income tracking.

Inventory management.

Scalable software.

Insights into sales and future performance.

Tax prep.

Accept payments online.

Business integrations with e-commerce platforms and other apps.

Cons:

No cannabis industry chart of accounts.

Pricing:

QuickBooks Online – As low as $30/month (up to $200/month).

QuickBooks Desktop Premier Plus – As low as $799/year (up to $1,410/year).

QuickBooks Enterprise – As low as $1,830/year (up to $4,400/year).

4. Wave – Best free software

Wave is free accounting software for businesses

If money is your biggest concern, Wave can help you manage your marijuana business’s finances without spending a dime.

Wave is one of the best free accounting software options on the market today and has features that help businesses track income and expenses and identify cash flow trends.

Wave’s accounting software is unlimited and always free to use unless you want to add features such as receipt capture, payroll, and payments from customers.

Pros:

100% free to use.

Identify cash flow trends with reports.

Track income and expenses.

Option to capture and manage receipts, invoice and receive payments from customers, and pay employees.

Cons:

Not the most scalable option. Best for small businesses.

Pricing:

Free to use. Only pay for additional features.

5. 365 Cannabis – Best industry-specific software

365 Cannabis is an ERP software solution for dispensaries

365 Cannabis is an ERP software solution designed to help you “Grow beyond the limits of basic seed to sale software.”

With 365 Cannabis, you can manage your finances, track your cultivation process, use CRM to gain insights into your customers, manage your inventory and distribution, and use the built-in POS system at your retail locations.

This software also integrates with various platforms to make your marijuana accounting and business management as smooth as possible including Shopify, weedmaps, Leafly, and CannabisOneFive.

Pros:

Industry-specific software.

End-to-end accounting.

Built-in CRM and POS systems.

Manage your finances.

Integrates with multiple e-commerce and marijuana platforms.

Cons:

Pricing isn’t transparent.

Pricing:

Request a demo for a free consultation.

6. Zoho Books – Best for tax compliance

ZohoBooks accounting software.

Last but not least, Zoho Books is our pick for an array of accounting features and an emphasis on tax compliance.

One of our favorite aspects of Zoho is its sales tax features that let businesses set a default tax rate, define multiple taxes, automatically calculate their tax liability, and prepare 1099s for contractors.

With Zoho, you can also track payments to vendors, invoice clients, create quotes, manage your expenses with receipt capture, track your inventory, receive payments from customers, and automate business reports to get insights into various aspects of your business.

Additionally, Zoho lets businesses store digital copies of documents and attach them to transactions, manage purchase and sales orders, use timesheets for accurate billing, reconcile bank accounts, and more.

Pros:

Features that help marijuana businesses stay tax compliant.

Invoice and get paid by customers.

Manage expenses and income.

Pay bills.

Generate business reports for valuable insights.

Track business documents and tax receipts.

Timesheets for billing.

Reconcile accounts.

Cons:

Limits on the number of invoices you can issue annually (regardless of your plan).

No payroll services.

Not the best option to grow with your company.

Pricing:

Free

Standard – $15/month (up to three users, billed annually).

Professional plan – $40/month (up to five users, billed annually).

Premium plan – $60/month (up to ten users, billed annually).

Elite – $120/month (up to ten users, billed annually).

Ultimate – $240/month (up to fifteen users, billed annually).

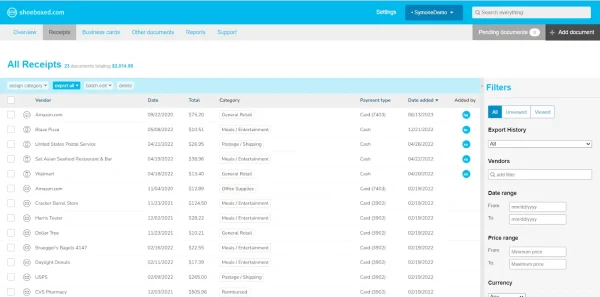

BONUS: Shoeboxed – Best for receipt management

Shoeboxed is trusted by over 1 million users to manage business receipts

With all of the government regulations put in place, bookkeeping for dispensaries is a cumbersome process.

Cannabis retailers and businesses must keep a record of every transaction they make with suppliers, customers, and distributors.

Shoeboxed is the best software for receipt scanning and is designed to simplify receipt management and prepare expenses for tax season.

Let’s go over Shoeboxed’s features and how they can benefit those in the cannabis industry.

1. Shoeboxed’s mobile app and web dashboard

The web dashboard of a Shoeboxed demo account.

With Shoeboxed’s user-friendly mobile app and web dashboard, you and your employees can scan receipts on the go or manage expenses via desktop.

When you snap photos of receipts with the app, the information is pulled using smart OCR technology, is human-verified for accuracy, and is uploaded to your account under 15 tax categories.

The tax categories are editable so you can add tags to further categorize your expenses by supplier, customers, card, purpose, etc.

Shoeboxed’s web dashboard lets you upload documents and receipts from your computer or automatically import e-receipts from your Gmail to your account.

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic award-winning approach to receipt tracking for tax season. Try free for 30 days!

Get Started Today2. Advanced search, filters, and expense reports

Example of a CSV expense report from Shoeboxed

Shoeboxed offers users advanced search so they can find a receipt from a certain date, vendor, currency, category, user, and more in seconds.

You can also filter receipts to see purchases:

Made to a certain vendor or supplier.

Made with a particular payment method.

That falls within a specific price range.

Shoeboxed’s expense reporting feature is a huge help during tax season and gives businesses an overview of their expenses.

Business expenses for the year can easily be shared with an accounting professional or the IRS through CSV files or PDFs, and each expense is automatically categorized with receipts attached.

3. Unlimited number of free sub-users

Shoeboxed lets you add an unlimited number of users to your account for free.

If employees make purchases for the company, you can add them as users to your Shoeboxed account to upload images of the receipts they receive for business expenses.

Adding employees as sub-users to Shoeboxed also makes it easy to track and approve reimbursements.

NOTE: The users added to your account will have access to the details of every expense. If you don’t want employees to see certain expenses, you must create a separate account.

4. The Magic Envelope

Outsource your receipt scanning with the Magic Envelope!

Businesses in general have to keep track of mounds of receipts, but it’s especially important for cannabis companies to ensure they have a record of every penny.

With the Magic Envelope, cannabis companies can outsource their receipt scanning to Shoeboxed.

When you sign up for a plan that includes that Magic Envelope, you’ll receive a postage-pre-paid envelope in the mail to send your receipts in.

Once the Magic Envelope reaches the scanning facility, the team at Shoeboxed will scan, data-verify, and upload the receipts to your Shoeboxed account under the 15 tax categories.

If you want your receipts to be categorized under specific categories, just separate the receipts and leave a note detailing how you want them organized.

Let Shoeboxed scan your receipts and other important documents for you!Pros:

Receipts are auto-categorized under 15 tax categories. Categories are editable and you can add categories specific to your cannabis business.

Outsource receipt scanning with the Magic Envelope service.

Unlimited number of free sub-users.

Mobile app to scan receipts on the go.

Create expense reports with receipts attached for tax season.

Integrate with the best accounting software, including QuickBooks, Xero, and Wave.

Free built-in mileage tracker. Track the mileage you and your employees spend traveling for work to invoice accurately and maximize tax deductions for your business.

Automatically forward receipts from Gmail.

Store business contacts and digital copies of business documents.

Cons:

The Magic Envelope is included on desktop plans only.

Pricing:

The Digital Download Only Starter Plan is $4.99/month, up to $19.99/month for the Pro digital plan. (Magic Envelope service is not available with the mobile app plans.)

Plans that include the Magic Envelope start at $18/month, up to $54/month. (Available on desktop only.)

Break free from paper clutter ✨

Use Shoeboxed’s Magic Envelope to ship off your receipts and get them back as scanned data in a private, secure cloud-based account. 📁 Try free for 30 days!

Get Started TodayWhat are the benefits of using accounting software for cannabis?

When managing a cannabis business, it’s essential to use efficient and precise bookkeeping software to ensure your operations run smoothly.

Bookkeeping software will help you…

1. Stay compliant

Software programs will help you stay compliant with legal requirements, as cannabis companies are subject to strict regulations and audits.

By using software programs, you can easily generate accurate and timely financial statements, trace inventory, and calculate adequate tax payments.

This ensures your books are always audit-ready and prevents any potential legal issues.

2. Streamline inventory management

Another significant advantage is the ability to manage your inventory effectively. Cannabis businesses often deal with large inventories and numerous products.

Cannabis software offers comprehensive inventory management features, allowing cannabis companies to monitor stock levels, track costs, and predict future needs.

This leads to improved efficiency and customer satisfaction.

3. Improve operational management

Cannabis accounting software also provides better financial management by integrating multiple business functions such as project management, customer relationship management (CRM), and an ERP system.

This integration lets you manage your finances, sales, and operations in one platform.

As a result, you can operate more efficiently, streamline processes, and make better decisions.

4. Store and protect your data

An added benefit of choosing cloud-based accounting software is easy access to your financial data from anywhere and at any time.

Cloud-based solutions offer better security and automatic backup features, ensuring your critical data remains safe and accessible.

5. Promote collaboration

Software for cannabis companies promotes collaboration among your team members, as multiple users can access the platform simultaneously.

6. Maintain a healthy cash flow

Finally, adopting software can benefit cannabis companies by improving cash flow management.

Accurate tracking of income, expenses, and accounts receivable can help you maintain healthy cash flow levels.

Regular cash flow reports enable you to predict any potential financial issues before they become critical.

By implementing cannabis accounting software, your cannabis business can improve its operations, ensure compliance with regulations, and better track its finances.

What are some challenges with cannabis accounting?

1. Compliance aspects

Because the sale and distribution of cannabis are still illegal in some states, compliance is one of the most challenging aspects of accounting for cannabis businesses.

It’s essential to incorporate a software system that keeps up with the ever-changing landscape of regulations.

Inventory management, enterprise resource planning, and customer relationship management (CRM software) are all essential components for cannabis companies.

From seed-to-sale tracking to managing cash flow, proper compliance measures must be maintained through the right accounting software.

2. Taxation challenges

Taxation is another challenge in the cannabis industry, and it’s crucial for businesses to use the best accounting software to manage tax obligations effectively.

Tax rates and rules can vary significantly across jurisdictions, making it a complex process that requires careful attention.

With the right accounting software, companies can add accounting professionals to their accounts to review finances and handle reports, including payroll reports, accounts payable, and cash flow.

By using an accounting system, cannabis businesses can maintain accurate records and stay on top of tax requirements.

3. Multi-entity accounting

One of the biggest challenges with cannabis accounting is when a company needs to manage finances and sales across multiple stores.

From seed to sale, every monetary aspect of a cannabis business needs to be recorded and managed in an organized program, and this can be especially difficult for multi-entity operations.

Cannabis software options, like ERP systems and point of sale (POS) integrations, can play a vital role in streamlining these operational complexities.

Frequently asked questions

Can I use QuickBooks for cannabis?

QuickBooks Online can be a good choice for small dispensaries and cannabis companies thanks to its accounting, inventory management, and sales features. For multi-store operations, QuickBooks Enterprise is the better option.

Is Xero cannabis friendly?

Xero is cannabis friendly and offers various features to help cannabis businesses thrive, including unlimited users, bank reconciliation, payments for bills and from customers, and more.

Conclusion

Cannabis accounting software plays a significant role in ensuring your business’s sustainability and growth.

Choosing the right accounting software for your cannabis business is essential for effective financial management and regulatory compliance.

By evaluating the various options available, you can find the best solution to support your business needs, optimize your processes, and lay the foundation for long-term success in this billion-dollar industry.

Hannah DeMoss is a staff writer for Shoeboxed covering organization and digitization tips for small business owners. Her favorite organization hack is labeling everything in her kitchen cabinets, and she can’t live without her mini label maker machine.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!