Cash flow is key for individuals and businesses to be financially stable. A cash flow projection template in Google Sheets is a powerful and affordable tool to forecast your incoming and outgoing cash over a set period.

Whether you’re a small business owner, freelancer, or managing personal finances, cash flow forecasting gives you financial clarity.

What is cash flow management?

Cash flow management is tracking and managing money flow into and out of a business. It involves monitoring cash inflows and outflows to ensure a positive cash balance.

Effective cash flow management is crucial for businesses to maintain financial health and make informed decisions.

Understanding business cash flow forecasting

Business cash flow forecasting involves estimating future cash inflows and outflows based on historical financial data.

It helps businesses make informed decisions about investments, funding, and other financial matters.

Cash flow forecasting is essential for ensuring that businesses and investors manage finances effectively to maintain financial stability.

What are the benefits of using a cash flow template?

A cash flow template helps you control the money in and out of your business.

Here are some of the key benefits:

1. Helps plan for the future

A cash flow template helps businesses anticipate and plan for future cash inflows and outflows.

2. Identifies cash shortfalls

It enables better financial planning and management by identifying potential cash shortfalls.

3. Optimizes cash flow management

Using a cash flow template helps businesses reduce unnecessary expenses and optimize cash flow.

4. Accessibility

With Google Sheets templates, you can work on your cash flow projections anywhere with an internet connection.

5. Collaboration

In real time, you can share and edit the Google Sheet templates with team members or advisors.

6. Customization

You can tailor the template to meet your specific needs with categories, formulas, and formatting.

7. Automation

Use built-in formulas and functions to automatically calculate totals, averages, and trends.

How do you create a cash flow forecast?

To create a cash flow forecast, businesses must gather historical financial data, including sales revenue, accounts receivable, and accounts payable.

They should also estimate future cash inflows and outflows based on market trends, seasonal fluctuations, and other factors.

A cash flow forecast template can help businesses organize and evaluate their data to make informed financial decisions.

What are the components of a cash flow template?

A cash flow template will have the following sections:

1. Income: (cash inflow)

Sales.

Rent.

Interest or investment income.

Other.

2. Expenses: (cash outflows)

Fixed costs (e.g., rent, salaries, utilities).

Variable costs (e.g., marketing, travel, supplies).

Loan repayments or interest payments.

3. Net cash flow:

Automatically calculate the difference between income and expenses for each period.

Show whether cash flow is positive (surplus) or negative (deficit).

4. Periods:

Break down data into weeks, months, or quarters to see trends and plans.

5. Opening and closing balances:

Show your starting balance and calculate your closing balance.

How can you automate cash flow forecast creation with Google Sheets?

Google Sheets is an accessible, cloud-based platform for building and managing cash flow projections. Its flexibility, ease of use, and real-time collaboration features make it ideal for tracking transactions and forecasting cash flow.

Using formulas and templates, Google Sheets can automate cash flow forecast creation.

The FORECAST function in Google Sheets can calculate expected cash inflows and outflows based on historical data.

Automating cash flow forecast creation can save businesses time and reduce errors.

How to choose the right cash flow template

Various cash flow analysis and forecast templates are available for Google Sheets, each with different features and functionalities.

Businesses should choose a template that meets their needs and is easy to use.

A simple cash flow template or spreadsheet can be a good starting point for small businesses or startups.

Free cash flow projection template for Google Sheets

Here is an example of a free downloadable cash flow projection Google Sheet template:

12-Month Cash Flow Template by Coefficient

Chart your business's financial future with this 12-month simple cash flow template. Enter your email, and you can download this free cash flow template.

How can Shoeboxed help with cash flow management?

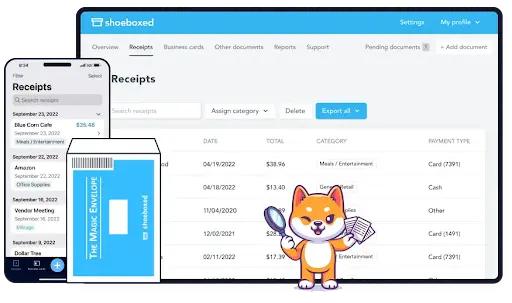

By integrating Shoeboxed into your expense management, you can enhance the accuracy and efficiency of your cash flow projections.

Here's how Shoeboxed can help:

1. Streamlines expense tracking

Shoeboxed allows you to digitize all your receipts and expenses so they're all in one place and easily accessible.

Use your smartphone to snap a picture of your receipt or document, and Shoeboxed's app will automatically upload a copy to your designated Shoeboxed account.

This provides users with a comprehensive record of expenses all in one place.

If you don't want to deal with the hassle of scanning, you can outsource your scanning by mailing your receipts or documents to Shoeboxed using their free pre-paid Magic Envelope. Their team will scan, human-verify, and upload them into your account for you.

Shoeboxed is the only receipt scanner app that will handle both your paper receipts and your digital receipts—saving customers up to 9.2 hours per week from manual data entry!

Stop doing manual data entry 🛑

Outsource receipt scanning to Shoeboxed’s scanning service and free up your time for good. Try free for 30 days!✨

Get Started Today2. Automatically organizes and categorizes expenses

With OCR technology, Shoeboxed extracts date, vendor, amount, and payment method from receipts. Receipts are then categorized into 15 tax or custom categories.

Add custom tags to receipts for easy searchability.

The organized data ensures accurate tracking of cash outflow, which is essential to accurate projections of cash flow.

3. Enhances data accuracy

This automation of the extraction and categorization of your expense data minimizes manual entry errors.

Accurate expense records lead to more reliable cash flow forecasts, resulting in better financial planning.

4. Increases time savings

Shoeboxed saves time by automating receipt management. This extra time can be better spent analyzing data rather than organizing it.

This efficiency of data management results in timely and informed financial decisions and projections.

Turn receipts into data with Shoeboxed ✨

Try a systematic approach to receipt categories for tax time. Try free for 30 days!

Get Started TodayWhat are some common mistakes to avoid in cash flow forecasting?

Errors in cash flow management can lead to inaccurate projections.

One common mistake is failing to account for seasonal fluctuations in cash flow.

Another mistake is not regularly updating the cash flow forecast to reflect changes in the business.

Businesses should also avoid using inaccurate or incomplete data when creating a cash flow forecast.

Frequently asked questions

Why is a cash flow projection important?

A cash flow projection helps you plan enough money ahead of time, plan for expenses, and ensure you have enough cash to pay the bills. For businesses, it’s for identifying surplus or deficit periods and making informed decisions on investments or cost cuts.

Can I use a pre-made template in Google Sheets?

Many pre-made simple cash flow template templates are available online for Google Sheets. They’re often customizable and have built-in formulas, so you don’t have to make one from scratch.

In conclusion

A cash flow forecast template is valuable for businesses because it allows them to manage cash flow effectively and make informed financial decisions. By understanding the benefits and process of cash flow forecasting, companies can choose and implement the right template in advance.

By incorporating Shoeboxed into your financial workflow, you can enhance the process of maintaining organized and accurate expense records, which are crucial for efficient cash flow management.

Regularly reviewing and updating the cash flow forecast can help businesses maintain financial health and achieve long-term success and growth.

Caryl Ramsey has years of experience assisting in bookkeeping, taxes, and customer service. She uses a variety of accounting software to set up client information, reconcile accounts, code expenses, run financial reports, and prepare tax returns. She is also experienced in setting up corporations with the State Corporation Commission and the IRS and is a contributing writer to SUCCESS magazine.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad, and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports, including IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports, and more—with Shoeboxed.

Try Shoeboxed today!