Running a business means lots of transactions. A cash receipt is a record of a cash transaction between a business and its customer, proof of payment, and helps businesses track their income.

Knowing how to make and manage cash receipts is key to keeping records accurate, cash flow in check, and making informed decisions.

What is a cash receipt?

A cash receipt is a formal document that records a customer paying cash for goods or services from a business. It includes the amount of cash received, the date of the transaction, and the description of goods or services.

Recording cash receipts is important for businesses to track cash inflows, manage cash reserves, and account for all income. Whether customers pay with cash or use another form of payment, you need to record all transactions to show all payment methods.

What are the benefits of logging cash receipts?

Logging cash receipts is essential if you want to know where your business stands financially.

Some of these benefits include the following:

1. Accurate income tracking

By logging each cash transaction you can track your income, so all sales and payments are recorded. This is crucial for financials and taxes.

2. Better accounting management

Logging cash receipts increases the cash balance on the balance sheet by recording the money coming in from customers, affecting accounting and asset management.

3. Better cash flow management

Logging cash receipts regularly lets you see your cash flow in real-time, making it easier to pay suppliers, employees, and other expenses.

4. Informed decisions

Detailed records of income and expenses let you make informed decisions, like when to re-invest in the business, manage inventory, or expand.

5. Time-saving

Logging cash receipts consistently saves you time reconciling accounts and calculating total income from customers, so financials run smoother.

How to create a cash receipt template

Using a cash receipt template makes recording a cash transaction easy and ensures all the information is captured.

Here’s how to create and use a cash receipt template:

1. What to include

A good cash receipt template gives a clear professional record of each transaction, date, amount received, and description. This standardization helps prevent mistakes and omissions.

Having your business name on cash receipts is not only professional but profitable, so customers can buy from you again and again.

2. Customization

A cash receipt template should be customizable to fit your business needs; you can add extra fields or branding that reflects your business.

3. Downloadable template

Download a premade cash receipt template online to save time and effort so you can focus on other areas of your business.

How are cash payments and receipts recorded in accounting?

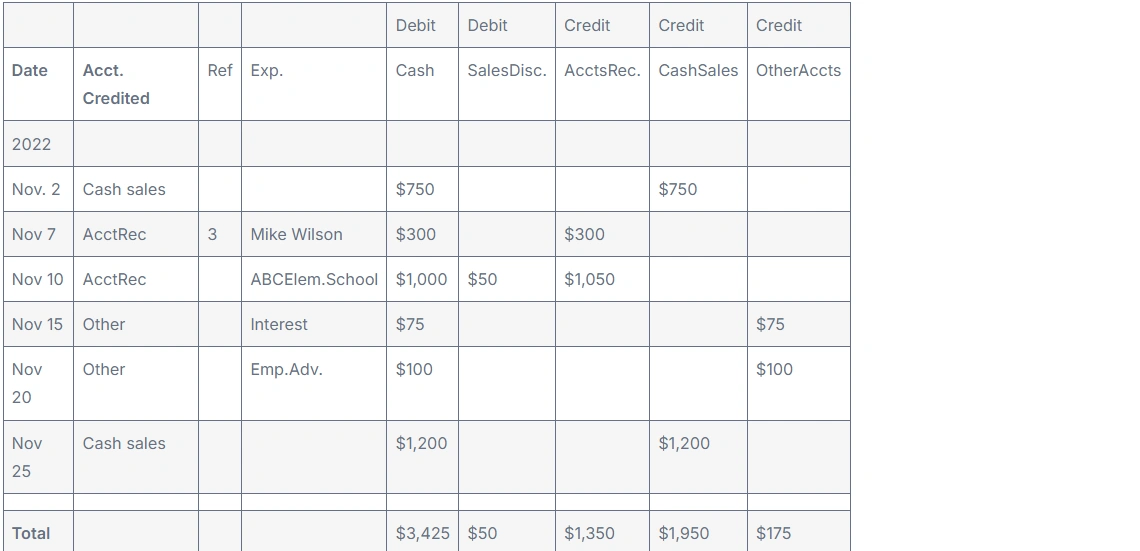

Example:

Recording cash receipts and cash payments is very important for keeping the balance sheet balanced and your business financially healthy.

Here’s how cash receipts and payments are recorded:

Recording a cash receipt: When cash is received, it’s recorded as a debit to a cash account and credit to a sales or accounts receivable account. This reflects the increase in cash and the revenue earned. Use a deposit slip to ensure the amount matches the recorded transaction.

Recording a cash payment: When cash is paid out, it’s recorded as a credit to the cash account and a debit to the accounts payable or expenses account. This reflects the decrease in cash and the payment of expenses or debts.

Journal entries: Cash receipts and payments can be recorded in a cash receipts journal or general ledger. These accounting tools ensure all transactions are recorded and the business financial statements reflect true financial performance.

What's the best method for managing cash receipts?

Shoeboxed has a simple solution for managing cash receipts so you can stop dealing with paper clutter and manual entry.

Here’s how Shoeboxed helps you manage cash receipts:

1. Receipt scanning and digitization

Shoeboxed lets you digitize your physical cash receipts. No more manual entry and no more paper clutter.

Use the Shoeboxed app to scan cash receipts as soon as you get them. Use your smartphone’s camera to snap a picture of your receipt and the app will automatically upload the data to your account.

2. Magic Envelope service

Or, you can use Shoeboxed as a service and outsource your receipt scanning with their Magic Envelope.

When you buy a plan that includes the Magic Envelope, Shoeboxed will send you a monthly postage-prepaid envelope to mail your receipts.

Once your receipts reach Shoeboxed’s scanning facility, they’ll be scanned, human-verified, and uploaded to your account under the associated tax categories (or specific categories of your choosing).

Shoeboxed is the only receipt scanner app that will handle both your paper receipts and your digital receipts—saving customers up to 9.2 hours per week from manual data entry!

Break free from manual data entry ✨

Use Shoeboxed’s Magic Envelope to ship off your receipts and get them back as scanned data in a private, secure cloud-based account. 📁 Try free for 30 days!

Get Started Today3. Automatic data extraction

The app will process the scanned receipt with Optical Character Recognition technology to extract the date, amount, and description. The digital receipt is stored in the cloud so that you can access it anytime.

By automating data extraction, Shoeboxed reduces the risk of human error and ensures all information is accurate.

4. Categorization and organization

Once your cash receipts are digitized and processed, Shoeboxed categorizes them based on tax categories or your pre-defined criteria. You can customize categories to suit your specific business needs. This automated categorization makes tracking specific transactions and reviewing your financial records easy.

5. Expense reports and auditing

Shoeboxed lets you generate detailed expense reports from your cash receipts. You can customize the reports to show specific categories, date ranges, or transaction types.

6. IRS-accepted and audit-ready

And Shoeboxed makes your cash receipts audit ready by storing them in a format accepted by the IRS. In the event of an audit, you can access and present the required documentation in seconds to verify your financial records.

7. Accounting software integration

Shoeboxed integrates with popular accounting software like QuickBooks, Xero, and many others. This integration lets you sync your digitized cash receipts with your accounting system so your financial records are always up-to-date and consistent.

No more manual data entry into your accounting software, saving time and reducing errors.

8. Cloud storage and accessibility

All digitized cash receipts are stored in the cloud and encrypted by industry standards. Your financial data is safe from loss or damage and available whenever you need it.

Shoeboxed keeps your cash receipts at your fingertips so you can manage your finances from anywhere: at the office, home, or on the go.

Turn receipts into data with Shoeboxed ✨

Try a systematic approach to receipt categories for tax time. Try free for 30 days!

Get Started TodayWhat tools and resources do you need to manage cash receipts?

To manage cash receipts, you need the right tools and resources:

Cash receipt templates: Downloadable online, these templates give you a standard format to record cash transactions.

Deposit slips: Deposit slips are important to document cash deposits and record all cash received in your bank account.

Cash receipts journal or general ledger: These accounting tools are necessary to record and organize cash receipts and payments.

Accounting software: Shoeboxed automates cash receipts and payments, making life easier.

Frequently asked questions

What if I have sales tax or store credit in my cash transactions?

When conducting cash transactions with sales tax, ensure the tax is itemized on the receipt. When using store credit, record the credit used for the purchase and the balance remaining.

How do I record cash receipts and payments in my accounting system?

Cash receipts go to the cash account and sales or accounts receivable account. Cash payments go to the cash account and accounts payable or expenses account. Transactions can be in a cash receipts journal or general ledger.

In conclusion

Cash receipts are crucial to your business’s financials. Use a cash receipt template, have a full receipt due process, and use Shoeboxed in your workflow to track, reduce errors, and keep your finances in order.

Caryl Ramsey has years of experience assisting in different aspects of bookkeeping, taxes, and customer service. She uses a variety of accounting software for setting up client information, reconciling accounts, coding expenses, running financial reports, and preparing tax returns. She is also experienced in setting up corporations with the State Corporation Commission and the IRS.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!