Are you a small business owner looking to lower your tax liability?

The best way for a business to reduce its tax burden is by taking advantage of business deductions.

To do this, you must establish categories of business expenses for taxes to determine what is and isn’t tax deductible.

Knowing which deductions are available and their eligibility requirements is the key to keeping more of your hard-earned money within the business and in your pocket.

What are tax-deductible business expenses?

The IRS defines a business expense as ‘ordinary and necessary’ for business operations.

These business expenses can be used as deductions at tax time to reduce the business’s taxable income.

To maximize tax deductions, keeping accurate records, including receipts, of all business expenses is essential.

Utilizing tools such as expense management software, business credit cards, and an accredited tax advisor can help correctly categorize these business expenditures.

This will ensure your company gets all the significant opportunities when filing taxes.

How can you maximize tax deductions through proper expense categorization?

To take advantage of these tax breaks, you must account for all business expenses incurred by your company and place them in expense categories.

Placing these expenses in categories helps determine which expenses are tax deductible and which ones are not.

Once the tax-deductible expenses are determined, they can be deducted from your business income to lower your tax liability.

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic award-winning approach to receipt tracking for tax season. Try free for 30 days!

Get Started TodayWhy are business expense categories crucial for your business?

Not only are categories of business expenses crucial for expense reports and taxes, but they’re also beneficial in other aspects of the business.

These essential business expense categories provide a birds-eye view of where all the money in your business is going. For those in the coaching business, it’s crucial to scrutinize these categories, ensuring strategic allocation of funds to areas that will amplify the growth and success of your coaching enterprise.

This insight highlights spending trends and makes generating and adjusting your budget easier throughout the year.

What are the key categories of business expenses for taxes?

The following is a list of common business expense categories.

1. Advertising and marketing costs

Advertising and marketing costs involve promoting a brand through pay-per-click ads, billboard ads, giveaways, and business cards.

It’s essential to keep track of all advertising expenditures for business since these expenses can be pretty significant and are eligible as deductions.

You can promote your business and save money at the same time by reducing your taxable income.

2. Office supplies

Office expenses are essential investments for business operations and are among the most common of the business expense categories.

These items include stationery, printer ink, coffee or snacks, pens, folders, disinfectant wipes, trash bags, and cleaning products.

Just remember to save all receipts for these products.

3. Employee salaries and benefits

Business expenses such as salaries, wages, bonuses, and employee benefit programs can significantly impact your tax liability.

Health insurance premiums and contributions to retirement plans are also deductible expenses. Therefore, businesses may receive tax advantages from them to reduce taxable income.

4. Mortgage interest

Businesses are subject to business expenses such as mortgage interest paid to banks.

The interest on your mortgage is deductible.

5. Rent or lease

Rent or lease payments are ordinary small business expenses.

Renting or leasing vehicles, machinery, equipment, or other business property is tax-deductible.

6. Travel and meal expenses

Business-related travel expenses such as transportation, lodging, and meals can be categorized as a tax deduction.

Business travel

Business trips involving expenses such as airfare, lodging, and car rentals are considered business travel.

The IRS regulations state that business travel must involve an overnight stay more than 100 miles from home to be eligible.

Business meals

Business meal expenses include the cost of customer dinners and food consumed during business trips.

The IRS permits deductions up to 50% for applicable dining out or beverages related to professional activities for work-related excursions.

7. Professional fees

When it comes to your taxes, there are various professional services and fees that affect your tax deductions.

These include legal or accounting services, consulting costs, and membership fees for certain associations or trades.

Legal and accounting services

Tax deductions can be taken advantage of when engaging professional services to guide and consult you on business matters.

These professional fees include certified public accountants (CPAs), financial advisors, lawyers, or other qualified experts who provide expertise in this area.

Such fees are deemed ordinary and necessary for conducting operations within a company environment.

They are fully tax deductible.

Licenses, permits, and memberships

Having accurate records of expenditures for licenses, permits, and memberships will allow small businesses to take advantage of an additional tax deduction.

Business licenses and permits include building permits or occupational licenses.

8. Bank fees

If bank fees are business-related, then they’re a tax-deductible business expense. These fees include ATM fees, overdraft charges, and credit card fees.

9. Insurance

Adequate business insurance is necessary to protect your enterprise from unexpected events and liabilities.

This typically involves property, liability, and workers’ compensation insurance coverage.

Business-related insurance protects your business and saves you money on taxes.

10. Utilities

Examples of deduction-eligible utility expenses include electricity, gas, water bills, phone, and internet charges.

Remember, if you have a home office, these expenses will be based on the percentage used exclusively for business.

What are some methods for establishing categories of business expenses?

Tracking costs meticulously with documentation such as receipts is a necessity when claiming these other business-related expenses as deductions.

Expense management tools, business cards, and tax professionals are essential to efficiently track business expenses and simplify the categorization process.

Utilizing expense management tools

Expense management tools such as Shoeboxed help businesses more efficiently track and categorize business expenses.

Shoeboxed has helped over a million businesses track, organize, and categorize business expenses.

Shoeboxed is a receipt-scanning app that tracks, organizes, and categorizes business and personal expenses.

Shoeboxed turns receipts into data and categories of business expenses for taxes.

The app turns receipts into data and, ultimately, tax deductions.

Shoeboxd features OCR technology that transforms printed text into searchable data.

You can use Shoeboxed in one of two ways.

One way is to scan the receipts with your phone and let Shoeboxed do the rest.

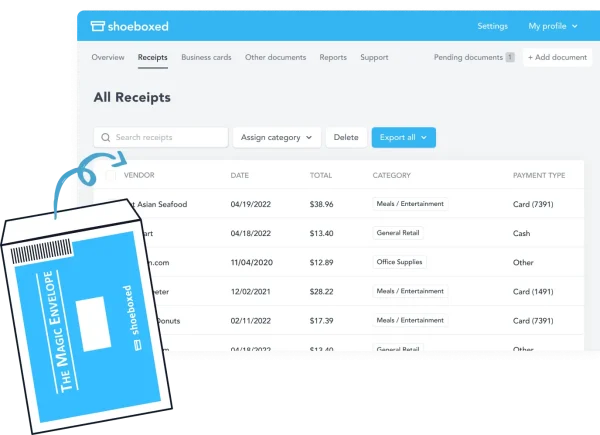

Not only is Shoeboxed an app, but it also offers receipt-scanning services.

The second method involves mailing all your business receipts to Shoeboxed’s process center in one of their prepaid postage envelopes known as the Magic Envelope and let Shoeboxed do the rest.

Once the receipts arrive at the processing center, an associate will scan, human-verify, and upload all receipts into an account where the expenses are organized and categorized.

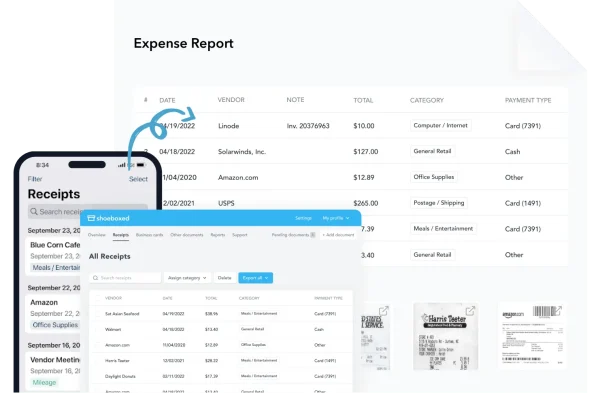

Shoeboxed can also use your Android or iPhone’s GPS to track business mileage.

The trip information is then submitted to Shoeboxed as a receipt labeled with the tax category for business miles.

Shoeboxed categorizes expenses and generates expense reports from the web or mobile app.

These programs offer advantages, including streamlining expense tracking, integrating with accounting software to give an accurate overview of finances, making it more straightforward to manage company funds, and providing detailed records of expenditures.

By using Shoeboxed, you can automate the process of organizing expenditures, reducing the risks caused by human errors.

Shoeboxed is also beneficial when creating budgets or keeping track of cash flow performance, which are two components that provide invaluable financial insights into your business operations.

Shoeboxed Demo by Shoeboxed YouTube

Break free from paper clutter ✨

Use Shoeboxed’s Magic Envelope to ship off your receipts and get them back as scanned data in a private, secure cloud-based account. 📁 Try free for 30 days!

Get Started TodayUsing business cards

Business cards provide a documented source for keeping all the business expenses in one place. Pulling expenses from a monthly statement with detailed information such as vendor, date, and amount is convenient and easy.

Working with a tax advisor

Engaging the services of a tax professional can provide many advantages to your business.

These benefits include offering advice on accurately labeling expenditures, discovering potential deductions, devising tax planning strategies, and assisting with maintaining up-to-date records.

Working together with a professional in this field helps minimize any compliance issues that could cause hefty fines if not addressed accordingly.

Taking advantage of some or all available opportunities is essential when minimizing taxable income and tax liability.

Frequently asked questions

What are the main categories of business expenses that impact tax deductions?

Business expenses such as advertising, office supplies, wages, employee benefits, mortgage interest, rent, travel expenses, professional fees, bank fees, insurance, and utilities can all influence the tax deductions taken.

How can I track my business expenses and receipts accurately?

Having an accurate and detailed record of your business expenses is essential. Using expense management tools such as Shoeboxed, business cards, and a tax advisor, all necessary details are kept up-to-date with all crucial information.

How can I maximize my tax deductions through proper expense categorization?

When aiming to get the most out of tax deductions, expenses should be accurately categorized into tax deductible and non-deductible expenses in order for all allowable write-offs to be taken advantage of while also providing assurance against audits.

In conclusion

Knowing the various categories of business expenses for taxes and their implications is essential for capitalizing on tax breaks and abiding by government taxation regulations.

Use expense management tools for automated tracking, documenting, categorization, expense reports, and insight into the financial health of your business.

Reach out to a tax professional to optimize deductions and ensure compliance.

Caryl Ramsey has years of experience assisting in different aspects of bookkeeping, taxes, and customer service. She uses a variety of accounting software for setting up client information, reconciling accounts, coding expenses, running financial reports, and preparing tax returns. She is also experienced in setting up corporations with the State Corporation Commission and the IRS.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!