Running a successful cleaning business requires diligent financial management. One essential tool to help you achieve this is a cleaning business expenses spreadsheet.

Customizable spreadsheets can streamline your accounting process, ensuring that you properly allocate and track business expenses.

By leveraging the benefits of a spreadsheet, you’ll maintain an organized approach to your company’s finances and make informed decisions based on accurate and up-to-date information.

A cleaning business expenses spreadsheet provides a systematic method for recording your company’s expenditures, from cleaning supplies and equipment to staff salaries and advertising costs.

By carefully documenting these expenses, you can gain a better understanding of your financial health, identify areas where you can cut costs, and ensure the long-term growth of your cleaning business.

When you have a template specific to the cleaning service industry, you can tailor the spreadsheet to your unique needs and preferences.

You can also incorporate tools, like online accounting software, to further streamline your financial management process, saving you time and reducing the potential for costly errors.

The combination of these resources empowers you to focus on delivering excellent cleaning services to your clients and growing your business.

Why should you use a cleaning business expenses spreadsheet?

1. Efficient record keeping

A cleaning business expenses spreadsheet helps you efficiently manage your financial records.

By using a spreadsheet, you can easily input, update, and track business documents on a daily or weekly basis.

This ensures accuracy in your records and prevents any missing or misreported expenses.

Staying organized with a spreadsheet makes it a breeze to maintain your financial information and helps you stay on top of your budget.

2. Financial overview

One of the key benefits of using a small business expense spreadsheet for your cleaning business expenses is that it provides a clear financial overview.

With all your expenses neatly categorized, you can quickly analyze your spending patterns and identify areas where you could potentially cut costs.

A well-organized budget spreadsheet allows you to easily compare your expenses against your (annual) revenue, which can help you make better financial decisions for your business and its growth.

3. Tax preparation

When tax season rolls around, having a comprehensive spreadsheet of your cleaning business expenses will prove invaluable.

You can claim a tax deduction for business-related vehicle expenses, and a thorough spreadsheet helps you accurately calculate these deductions.

By keeping a well-organized tax expense spreadsheet throughout the year, you simplify the tax preparation process, save time, and minimize the risk of errors on your tax return.

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic award-winning approach to receipt tracking for tax season. Try free for 30 days!

Get Started TodayWhat are the key components of a cleaning business expenses spreadsheet?

1. Fixed expenses

Your cleaning business expenses spreadsheet should include a fixed expenses section.

These are the expenses that remain constant, regardless of the number of jobs you complete or clients you serve.

Some examples of fixed expenses include:

Rent or mortgage payments for your office space

Office cleaning expenses for your business

Salaries of full-time employees

Insurance premiums

Depreciation of equipment and vehicles

Expense-tracking software subscriptions

Make sure you list all your fixed expenses and their corresponding amounts in a clear and organized manner.

2. Variable expenses

The next section to include in your spreadsheet is variable expenses. These are the costs that fluctuate depending on your business activities.

This can include:

Wages for part-time or temporary staff

Cleaning supplies costs (e.g., detergents, sponges, mops)

Tracking car expenses, such as fuel expenses for transportation

Advertising and marketing costs

Equipment maintenance and repairs

Create a table or edit a list with the names of the variable expenses, your estimated monthly cost, and space for updating costs as they change.

3. Income tracking

Finally, it’s important to track your income to understand the overall performance of your cleaning business.

In the income tracking section of your expenses spreadsheet, you should record:

Revenue from cleaning services

Money earned from add-on services, like carpet cleaning or window washing

Any other income streams, like affiliate marketing partnerships or consulting

Use a table or a chart to track your income on a monthly or quarterly basis. This will help you monitor your cash flow and identify trends in your business.

By organizing your cleaning business expenses spreadsheet into these three clear sections, you will have a comprehensive overview of your company’s financial health, allowing you to make informed accounting decisions and plan for the future.

What are the top free cleaning business expenses spreadsheets?

Managing and organizing your cleaning business expenses is less stressful when you have the right tools at your disposal.

In this section, you’ll find some of the top free cleaning business expenses spreadsheet templates available online.

These templates will help you easily track and add itemized receipt expenses, manage budgets, and make informed financial decisions to improve your cleaning business’s overall efficiency.

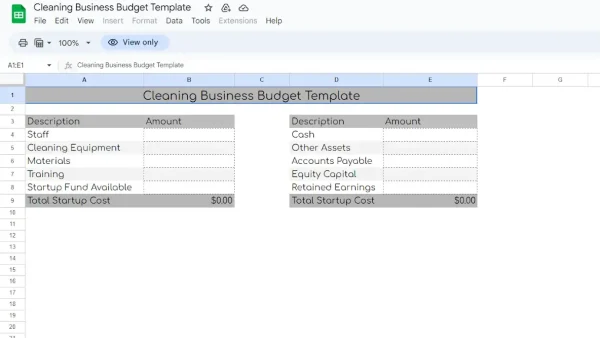

1. Spreadsheetdaddy Cleaning Business Budget Template

Spreadsheetdaddy Cleaning Business Budget Template

The Spreadsheetdaddy Cleaning Business Budget Template is a user-friendly expenditure spreadsheet solution designed specifically for cleaning businesses.

This template covers essential expense categories, like:

Employee wages

Supplies and equipment

Vehicle expenses

Simply input your income and expense sheet data and use the built-in formulas to quickly analyze your budget.

The spreadsheet also offers graphical representations of your financial data, which can help you spot trends and make informed decisions.

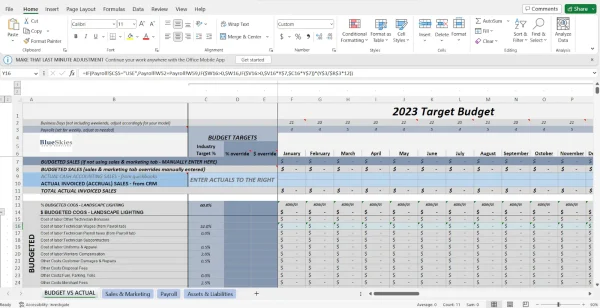

2. BlueSkies home cleaning budget template

BlueSkies home cleaning budget spreadsheet template for cleaning businesses.

BlueSkies home cleaning budget spreadsheet template is a versatile option for small to medium-sized cleaning businesses.

It offers customizable expense categories, so you can tailor them to your specific needs.

This template helps you track:

Monthly expenses

Year-to-date totals

Expense ratios

The template’s clean design and straightforward format make it easy to visualize your business’s financial health.

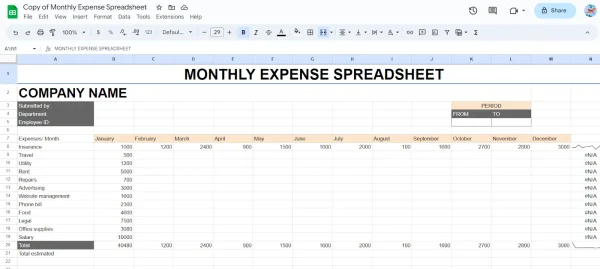

3. Spreadsheet Point monthly expenses template

Spreadsheet Point monthly expenses spreadsheet template.

The Spreadsheet Point monthly expenses template is a practical choice for businesses looking to track their daily, weekly, and monthly expenses.

This template allows you to:

Organize expenses by date, category, and description

Easily update your daily input with a built-in calculator

Summarize your expenses by category

With its simple layout and intuitive functions, this template will help you streamline your expense tracking.

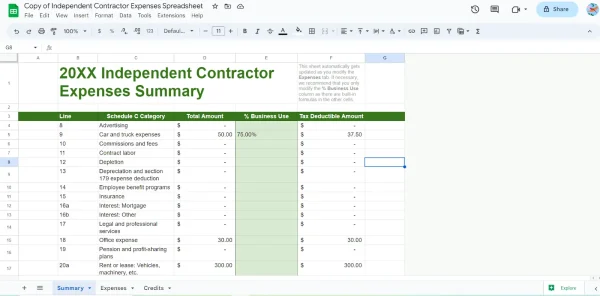

4. Spreadsheet Point independent contractor expenses template

Independent contractor expenses spreadsheet from Spreadsheet Point.

Tailored for independent cleaning contractors, the Spreadsheet Point independent contractor expenses template provides a comprehensive solution to manage various expense categories and track important documents.

In addition to the typical cleaning expense categories, this template covers categories such as:

Marketing and advertising

Insurance, licenses, and bonding

Professional fees and services

Its detailed nature ensures that you won’t overlook any important expenses related to your entrepreneurial venture.

Additionally, if you have employees, you might want to consider a Google Sheets expense report template.

Make sure to download and leverage these free cleaning business expenses spreadsheet templates to gain more control over your finances and bolster your financial decision-making skills!

5. Shoeboxed, a business expense spreadsheet alternative

Don't want to track expenses manually? We hear you. While some people thrive on using business expense tracking spreadsheets, others might prefer a more automated method.

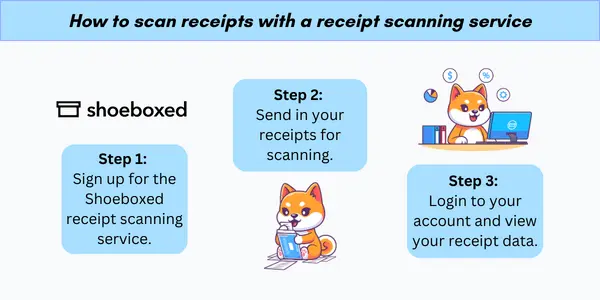

If you'd like to forgo manual entry entirely, consider Shoeboxed!

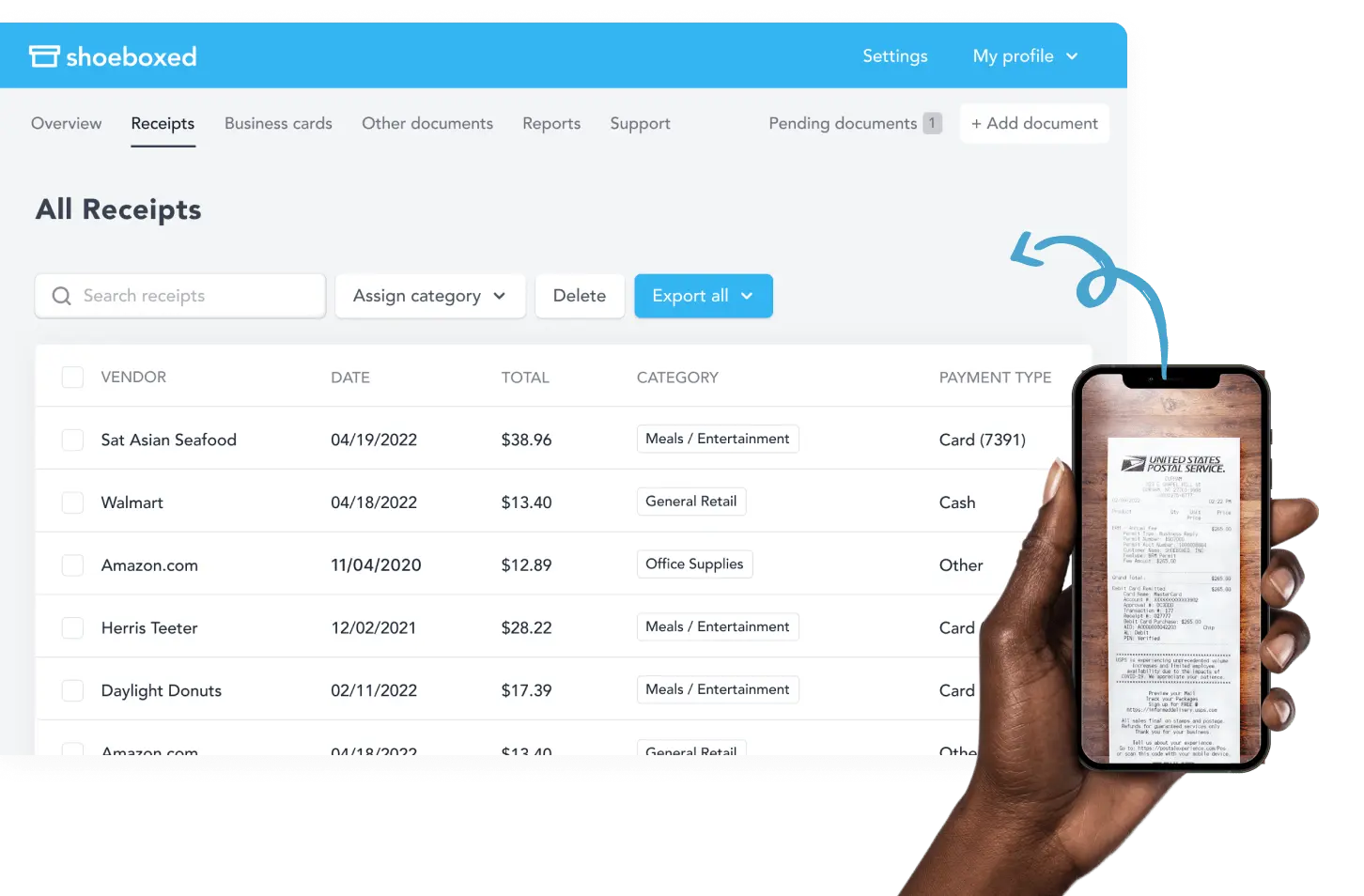

With Shoeboxed's receipt scanner app, simply snap a picture and upload it to your Shoeboxed account, and Shoeboxed's team will extract and verify the expense data from your receipts, assigning the expense one of 15 common tax categories.

For those who want an even easier method for getting receipts in their accounts, Shoeboxed's Magic Envelope service does just that.

Simply stuff your receipts into Shoeboxed's postage-prepaid envelopes and outsource receipt scanning to the pros.

Shoeboxed is the only receipt scanner app that will handle both your paper receipts and your digital receipts—saving customers up to 9.2 hours per week from manual data entry!

Stop doing manual data entry 🛑

Outsource receipt scanning to Shoeboxed’s scanning service and free up your time for good. Try free for 30 days! ✨

Get Started TodayWhat else can Shoeboxed do?

Shoeboxed has been voted as the best receipt scanner app for tax season by Hubspot and given the Trusted Vendor and Quality Choice awards by Crozdesk.

A quick overview of Shoeboxed's award-winning features:

a. Mobile app and web dashboard

Shoeboxed’s mobile app lets you snap photos of paper receipts and upload them to your account right from your phone.

Shoeboxed also has a user-friendly web dashboard to upload receipts, warranties, contracts, invoices, and other documents from your desktop.

b. Gmail receipt sync feature for capturing e-receipts

Importing e-receipts to your Shoeboxed account is as easy as syncing your Gmail with Shoeboxed, using Shoeboxed's special Gmail Receipt Sync feature.

Shoeboxed’s Gmail Receipt Sync grabs all receipt emails and sends them to your account for automatic processing! These receipts are then labeled as Sent to Shoeboxed in your Gmail inbox.

In short, Shoeboxed pulls the receipt data from your email, including the vendor, purchase date, currency, total, and payment type, and organizes it in your account.

Your purchases will even come with images of the receipts attached!

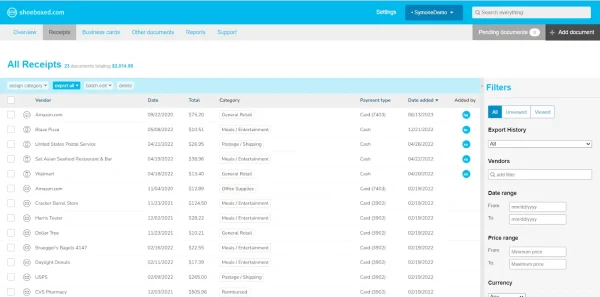

c. Expense reports

Expense reports let you view all of your expenses in one cohesive document. They also make it simple to share your purchases with your accountant.

You can also choose certain types of receipts to include in your expense report. Just select the receipts you want to export and click “export selected.”

d. Search and filter

Call up any receipt or warranty in seconds with advanced search features.

Filter receipts based on vendors, date, price, currency, categories, payment type, and more.

e. Accounting software integrations

Export expenses to your accounting software in just a click.

Shoeboxed integrates with 12+ apps to automate the tedious tasks of life, including QuickBooks, Xero, and Wave Accounting.

f. Unlimited number of free sub-users

Add an unlimited number of free sub-users to your account, such as family members, employees, accountants, and tax professionals.

g. Mileage tracker for logging business miles

After you sign up for Shoeboxed, you can start tracking miles in seconds:

Open the Shoeboxed app.

Tap the “Mileage” icon.

Click the “Start Mileage Tracking” button.

And drive!

Whenever you start a trip, Shoeboxed tracks your location and miles and saves your route as you drive.

As you make stops at stores and customer locations, you can drop pins to make tracking more precise.

At the end of a drive, you’ll click the “End Mileage Tracking” button to create a summary of your trip. Each summary will include the date, editable mileage and trip name, and your tax deductible and rate info.

Click “Done” to generate a receipt for your drive and get a photo of your route on the map. Shoeboxed will automatically categorize your trip under the mileage category in your account.

h. The Magic Envelope

Outsource your receipt scanning with the Magic Envelope!

The Magic Envelope service is the most popular Shoeboxed feature, particularly for businesses, and lets users outsource their receipt management.

When you sign up for a plan that includes the Magic Envelope, Shoeboxed will mail you a pre-paid envelope for you to send your receipts in.

Once your receipts reach the Shoeboxed facility, they’ll be digitized, human-verified, and tax-categorized in your account.

Have your own filing system?

Shoeboxed will even put your receipts under custom categories. Just separate your receipts with a paper clip and a note explaining how you want them organized!

Break free from paper clutter ✨

Use Shoeboxed’s Magic Envelope to ship off your receipts and get them back as scanned data in a private, secure cloud-based account. 📁 Try free for 30 days!

Get Started TodayBonus expense-tracking tools and templates to help grow your business

In addition to using spreadsheets for tracking your cleaning business expenses, there are other tools and templates available to help you better manage your company’s financials.

This section will cover expense report templates, expense tracking software, tracker templates, and alternatives to spreadsheets.

1. Expense report templates

An important tool for managing your cleaning business expenses is the expense report form template.

These templates can help you and your employees keep track of expenses and receipts in an organized way so that every authorized expense is reimbursed promptly.

With standardized templates, you can be sure that all necessary information is captured consistently, making expense management more efficient and accurate.

2. Expense tracker template

Another useful template to consider for your cleaning business is an expense tracker template.

These templates enable you to track a variety of expenses, such as cost and price, administrative expenses, vendor payments, and reimbursable employee costs.

Using an expense tracker template can help you monitor all expenditures, ensuring that your business remains financially stable and organized.

3. Alternatives to spreadsheets

While spreadsheets are a popular choice for tracking expenses, there are alternative tools that you can consider for your cleaning business.

Many online platforms offer cloud-based solutions to manage expenses efficiently and securely.

a. Monday.com

For example, monday.com provides a free Excel spreadsheet for business expenses. This Excel template includes features like expense approvals, print receipt attachments, and real-time syncing.

b. Accounting software

Additionally, a small business bookkeeping system, such as QuickBooks or Xero, can help you manage not only your total expenses but also your invoicing and tax compliance.

These programs often have built-in tools designed specifically for small businesses, making them more comprehensive options compared to spreadsheets.

By exploring these additional expense-tracking tools and templates, you can choose the best business income and expense sheet for your cleaning business, ensuring accurate and efficient expense management.

How do you set up a spreadsheet for business expenses from scratch?

1. Choose a software

Google Sheets is a popular spreadsheet application

When starting your cleaning business, it’s essential to select the right software for tracking your expenses.

There are numerous options available, such as Google Sheets and Excel.

Consider the software’s features, ease of use, and compatibility with your devices before choosing the one that best suits your needs.

Watch the tutorial below to see how to track expenses in Google Sheets:

Caption: How To Track Your Expenses in 2023 | Mind Blowing Google Sheets Tutorial, Brian Turgeon2. Organize expense categories

Proper organization is crucial when setting up your spreadsheet.

Create columns for key information, such as:

Date

Vendor/supplier

Description

Category

Amount spent

Payment method

Notes

Categorizing your expenses makes it easier to analyze your financial data and helps with budgeting and tax preparation.

Include categories like cleaning supplies, equipment, insurance, advertising, and payroll. Customize these categories to suit your business needs and financial structure.

3. Track monthly expenses

Regularly updating your expense spreadsheet is necessary for accurate financial tracking and decision-making.

Input expenses on a monthly basis, or even more frequently if needed. Be sure to save all corresponding receipts and transaction records. Shoeboxed is a great way to digitally manage your receipts so you don’t have to juggle piles of paper receipts.

Use Shoeboxed to keep track of your receipts and organize them for tax time.

You may also find it helpful to use online accounting software to automate some of the processes and ensure accuracy.

When updating your spreadsheet, pay special attention to:

Entering data accurately to avoid discrepancies.

Using consistent formatting for dates, currencies, and other values.

Reconciling your transactions with your business bank account to ensure accuracy.

Adjusting your expense categories as needed to reflect changes in your business operations.

By diligently tracking your cleaning business expenses in a well-organized spreadsheet, you will be well-prepared for tax season, budgeting, and making informed business decisions.

Stop doing manual data entry 🛑

Outsource receipt scanning to Shoeboxed’s scanning service and free up your time for good. Try free for 30 days! ✨

Get Started TodayHow to maintain and analyze your expense sheet

Managing a cleaning business requires efficient tracking of expenses and revenues.

Regular maintenance and analysis of your cleaning business expenses spreadsheet will help you stay organized and track business expenses accurately.

In this section, we’ll discuss the importance of updating monthly records, identifying financial trends, and making data-driven decisions.

1. Update monthly records

To maintain an accurate record of your cleaning business’s financial health, it’s essential to consistently update your expense spreadsheet.

Here are some steps to follow:

Step 1. Record expenses

Enter all business-related expenses in the designated columns, such as cleaning supplies, equipment, and labor costs.

Step 2. Track revenues

Input all payments received from clients.

Step 3. Categorize

Organize expenses and revenues into appropriate categories for easy analysis.

Step 4. Reconcile

Compare your spreadsheet data with your bank statements to ensure accuracy.

By keeping your records up-to-date, you’ll be able to monitor the financial success of your cleaning business.

2. Identify financial trends

Monitoring trends in your cleaning business expense spreadsheet can help you identify areas of potential growth or areas where improvements could be made.

Keep an eye on the following:

Expenses: Analyze expenses for patterns, such as an increase in cleaning supplies costs or a decrease in repairs and maintenance.

Revenues: Examine revenue streams to track fluctuations and identify which services are driving growth.

These insights enable you to make strategic decisions on your business operations.

3. Make data-driven decisions

Using your cleaning business expense spreadsheet as a tool for decision-making ensures that your choices are backed by accurate data.

Here are a few tips to harness the power of data-driven decisions:

Budgeting: Use historical expense data to create realistic budgets for future periods.

Resource allocation: Identify underperforming areas and allocate resources to strengthen them.

Pricing: Analyze your expenses and revenue trends to determine if pricing adjustments are necessary.

Growth strategy: Use financial trends to inform your expansion or investment decisions.

By incorporating regular maintenance and analysis of your cleaning business expense spreadsheet, you’ll be able to make informed decisions that ultimately lead to long-term success.

Final thoughts

Managing your cleaning business expenses efficiently is crucial for the success of your company.

With the right expenses spreadsheet in place, you can easily track your finances and make informed decisions.

Remember to utilize small business expense report templates to track income and expenses on a month-to-month basis.

Customizing these templates to your specific business needs will help streamline your financial management and lead to better insights into your company’s performance.

You can also benefit from using online accounting software for your cleaning service or business.

Investing in a solution such as AI bookeeping, can automates processes like calculating the cost of goods sold, reconciling transactions, and organizing receipts will save you time and effort that can be better spent on growing your business.

By implementing these tips and strategies, you’ll be well on your way to maintaining a clear and accurate picture of your cleaning business expenses, leading to better financial decisions and overall success.

Hannah DeMoss is a staff writer for Shoeboxed covering organization and digitization tips for small business owners. Her favorite organization hack is labeling everything in her kitchen cabinets, and she can’t live without her mini label maker machine.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!