Are you having trouble keeping up with your company expenses? Consider taking a systematic approach.

Managing company expenses is key to financial health and record keeping. A business expenses template provides a framework for tracking, reporting, and analyzing expenses.

Why are company expense templates beneficial?

The success of your business will depend on your approach to managing expenses.

Using expense templates will benefit your company in many ways:

1. Accuracy

Expense templates make sure all expense information is captured consistently. This accuracy is critical for financial reporting, budgeting, and auditing. Templates also automatically calculate total expenses for accuracy.

2. Time

Using standard templates saves a significant amount of time for employees and accounting teams by simplifying the data entry process. Templates eliminate the need to start from scratch each time to create new formats for each report.

3. Transparency

Templates provide a clear and organized way to present expense data. This transparency shows key expense information so managers can see spending patterns, identify areas to save, and make informed financial decisions.

4. Compliance

Structured expense reporting, with its compliance features, brings peace of mind. Templates can include fields for approvals and signatures, so that your records remain in line with internal and external compliance standards.

What are the best free company expense templates?

Expense templates provide an organized and systematic approach to tracking and reporting expenses.

Here are the best free company expense templates for tracking business expenses.

1. Microsoft Excel Expense Report Template

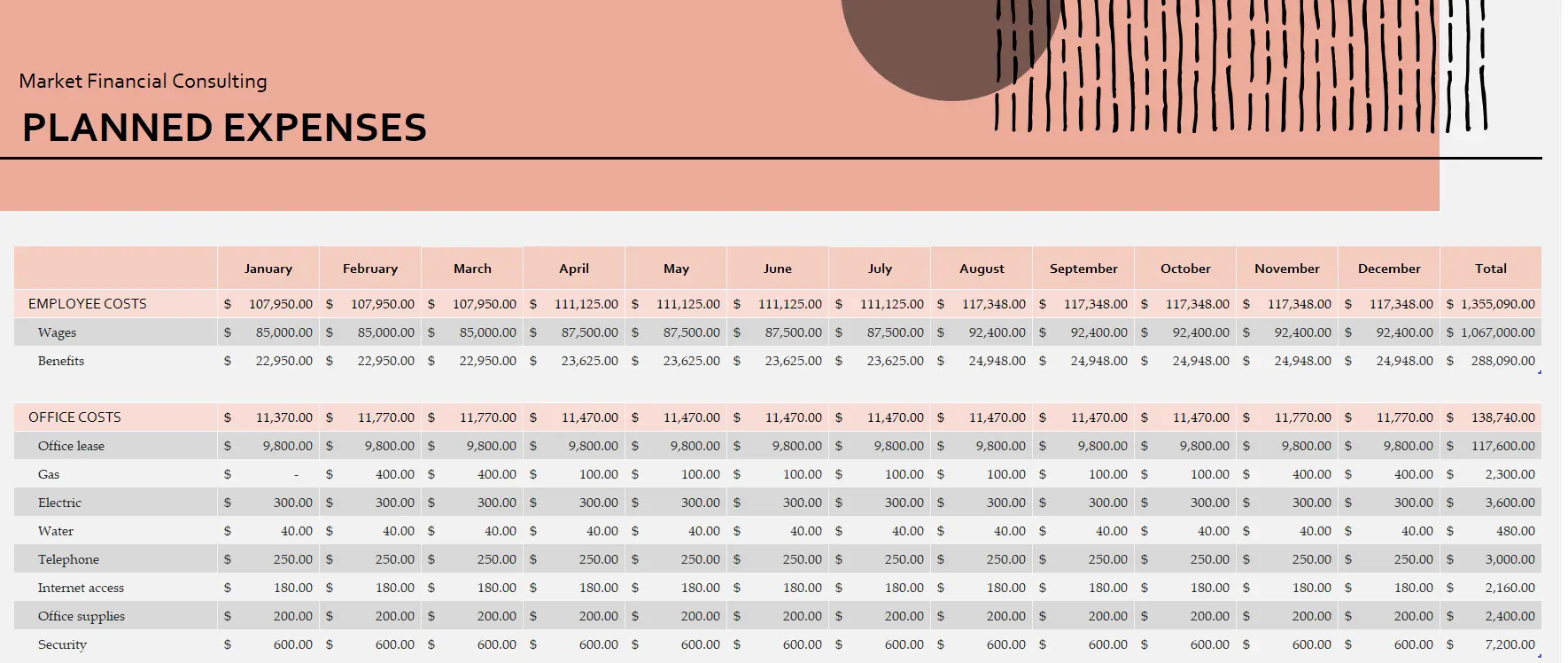

The Microsoft Excel business expense template with a “Pink Organic Boho” theme is designed to bring style and creativity to your business expense tracking. This template combines functionality with a visually appealing design and offers comprehensive features for tracking expenses.

👉 Download Link: Microsoft Templates

2. Coefficient Google Sheets Expense Template

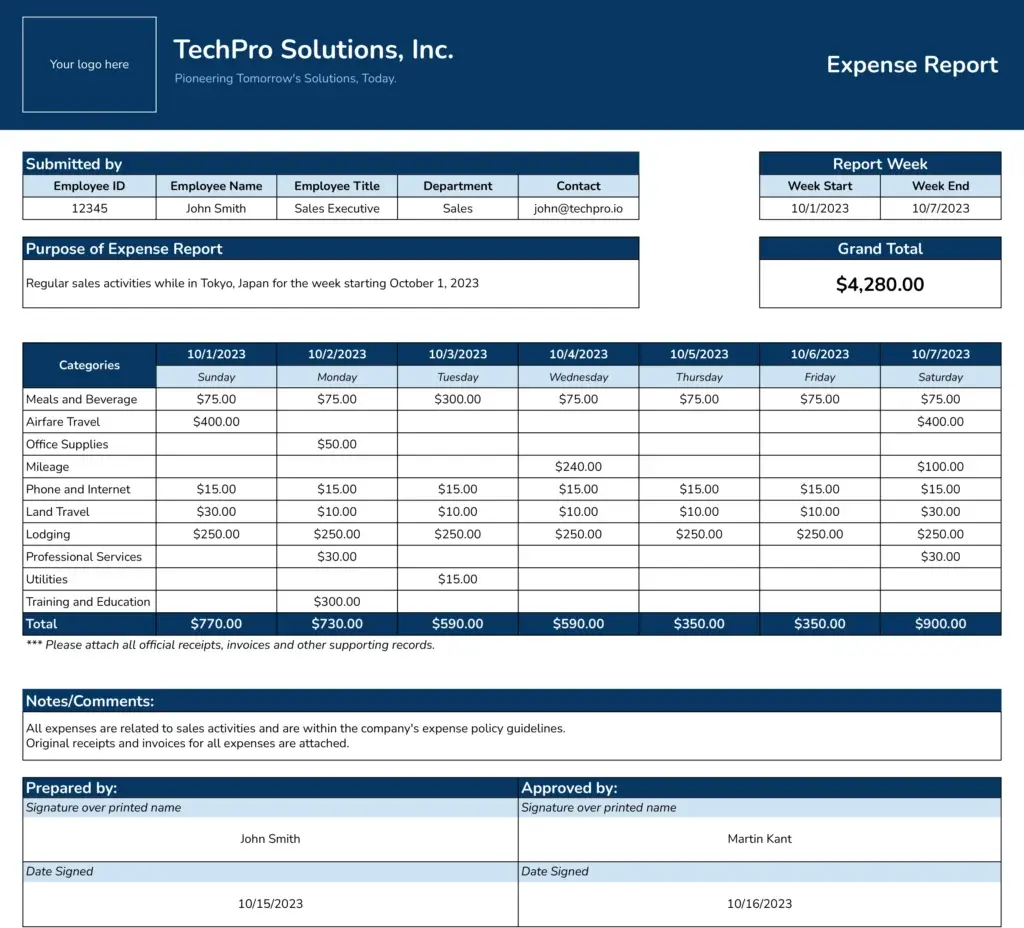

The Coefficient Google Sheets Expense Template is designed to streamline weekly expense tracking, making it easier for businesses and individuals to monitor their spending and stay within budget. Its user-friendly design, automated calculations, and collaborative features simplify the process of tracking and analyzing weekly expenses.

👉 Download Link: Google Sheets Templates

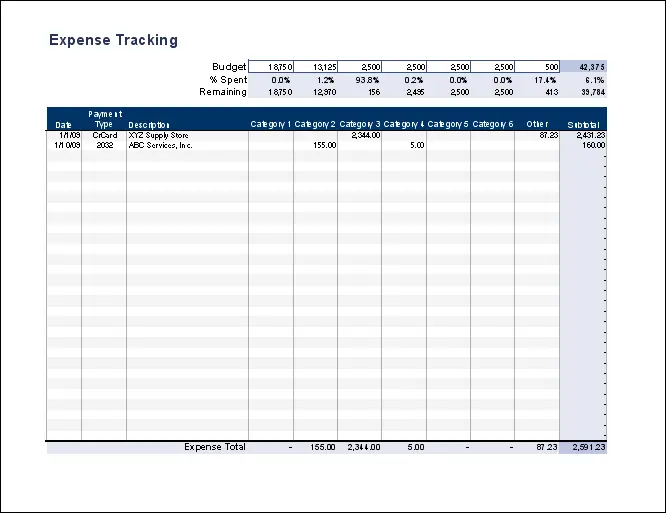

3. Vertex42 Expense Report Template

This spreadsheet is a simple expense or budget tracker. It lets you record your monthly expenses like a checkbook register, but it has separate columns for recording and totaling them.

The budget tracking chart compares the totals to your budget to see the percentage spent versus your remaining budget.

👉 Download Link: Vertex42 Templates

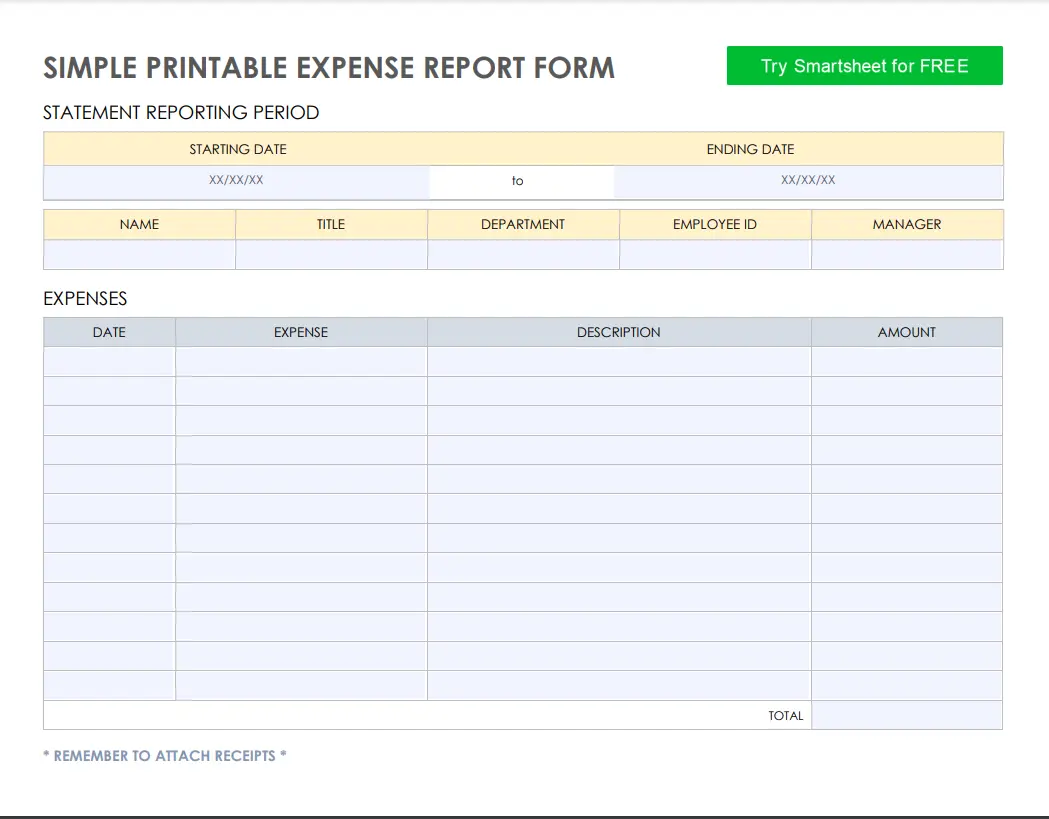

4. Smartsheet Expense Report Template

The Smartsheet Expense Report Template offers a streamlined and efficient solution for tracking and managing business expenses. Designed with simplicity and practicality, this template is perfect for organizations looking to maintain transparency and organized expense records.

👉 Download Link: Smartsheet Templates

BONUS: Shoeboxed—ideal for small business owners looking for the best alternative to company expense templates

As a bonus, we'll introduce Shoeboxed, an ideal alternative to company expense templates for small business owners.

Using free company expense templates is one way to take control of your business or personal finances. While these templates are helpful, they require manual input and maintenance, which can be time-consuming and lead to errors.

Fortunately, there is an automated alternative.

For those looking for a more efficient and effective way to track and manage expenses, Shoeboxed is an excellent alternative to company expense templates.

Here’s why:

Digital receipt management

Shoeboxed transforms the way you manage receipts and expenses by turning receipts into digital data.

Accessibility and security

Instead of manually tracking expenses while on the go, Shoeboxed has a mobile app that scans receipts, automatically extracts data, and categorizes expenses for you.

You can also access your expense data from anywhere, at any time. Shoeboxed uses secure cloud storage, so your financial data is safe and always accessible.

Stop doing manual data entry 🛑

Outsource receipt scanning to Shoeboxed’s scanning service and free up your time for good. Try free for 30 days!✨

Get Started Today

For those who want an even easier method for getting receipts in their accounts, Shoeboxed's Magic Envelope service does just that.

Simply stuff your receipts into Shoeboxed's postage-prepaid envelopes and outsource receipt scanning to the pros.

Shoeboxed is the only receipt scanner app that will handle both your paper receipts and your digital receipts—saving customers up to 9.2 hours per week from manual data entry!

Integration

Shoeboxed integrates with accounting software like QuickBooks, Xero, and many more, making it easy to synchronize your expense data for accounting and tax purposes.

IRS compliance

Shoeboxed makes sure that all digital copies of receipts are legible and categorized following IRS guidelines.

An overview of Shoeboxed

While free company expense templates can be a good option for those who prefer paper-based and manual methods to organize expenses, the time and effort required to maintain one can be overwhelming.

Shoeboxed offers a powerful and efficient alternative. It automates the expense tracking process and provides added benefits such as secure storage, easy integration, and compliance with tax regulations.

Shoeboxed is the best choice for modern professionals and businesses looking for a streamlined approach to finance management.

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic award-winning approach to receipt tracking for tax season. Try free for 30 days!

Get Started TodayWhat are the different types of templates?

Templates come in many forms, each for different expense types and reporting periods.

Here are the types of company expense templates:

1. Monthly business expense spreadsheet: A spreadsheet summarizing monthly expenses in one report.

2. Basic business expenses spreadsheet: A simple list of expenses with columns for date, payment method, and expense amount.

3. Travel expense report template: A template to document expenses for business travel. Includes transportation, lodging, meals, and incidentals. It may also include mileage reimbursement.

4. Employee reimbursement form: A business expense form for employees to request reimbursement for out-of-pocket business expenses. This includes employee details, expense descriptions, and approval signatures.

5. Mileage reimbursement template: A business expense template to track miles driven for business purposes and calculate reimbursement. Fields include date, starting and ending locations, total miles, and reimbursement rate.

6. Project expense report template: A business expense template to track expenses for a specific project. This includes the project name, expense categories, amounts, and budget.

7. Annual expense report template: An annual business expense, spreadsheet to summarize and analyze annual expenses for budgeting and financial planning. An annual expense spreadsheet includes yearly totals, expense categories and summary.

How to use a template to track business expenses

Here’s a step-by-step guide on how to use a template to track your business expenses:

Step 1: Choose a template

Choose a template that suits your business needs. Templates are available in Microsoft Office, Google Sheets, Smartsheet, and Vertex42. Make sure the template has the fields you need for your expense tracking.

Step 2: Customize the template

Add company details: Add your company name, logo, and contact details.

Set up expense categories: Customize the categories to match your business expenses, e.g. travel, meals, and office supplies.

Add expense description fields: Make sure fields for date, description, amount, payment method, and receipt attachment are included.

Approval section: If required, add sections for manager approval and signatures.

Step 3: Enter expense data

Enter expenses immediately: Enter expense details as soon as they occur to keep records up to date.

Categorize each expense: Select the category for each expense to track spending patterns.

Add receipts: If using a digital template, scan and add receipts to each entry. If using a paper template, keep physical receipts in a file.

Step 4: Use automated features

Automated calculations: Use templates with formulas to calculate total expenses and subtotals for each expense category and overall expenses.

Budget comparison: Some templates allow you to compare actual expenses to budgeted amounts. Use this to track spending and make sure it's in line with your budget.

Step 5: Review and approve expenses

Regular review: Set a schedule to review business expense entries weekly or monthly. Make sure all expenses are categorized correctly and receipts are attached.

Approval process: If your template has an approval section, make sure expenses are reviewed and approved by the designated manager or financial officer.

Step 6: Generate reports

Monthly/quarterly expense reports: Use the data in your template to generate business expense reports. These reports will help you track spending and make informed financial decisions.

Year-end summary: Create an annual expenses spreadsheet summary to review total expenses and help with budgeting for the next year.

What are common expense categories?

Here are some common expense categories:

1. Travel and transportation

Airfare: Flights for business travel.

Lodging: Hotel or accommodation.

Car rental: Vehicles for business use.

Mileage: Personal vehicle use reimbursement.

Public transport: Taxis, trains, buses, ride-sharing.

2. Meals

Client meals: Meals with clients.

Employee meals: Meals provided to employees during work hours.

3. Office supplies

Stationery: Pens, paper, notebooks and other office supplies.

Computers and software: Computers, software licenses and subscriptions.

Furnishings: Desks and chairs.

4. Utilities

Electricity: Office premises electricity bills.

Water: Water service.

Internet and phone: Internet and phone costs.

5. Rent and lease

Office rent: Office space payments.

Equipment lease: Equipment lease costs.

6. Professional services

Legal fees: Lawyers and legal consultants.

Accounting fees: Accounting services and bookkeeping.

Consulting fees: Business consultants.

7. Employee benefits

Salaries and wages: Regular pay.

Bonuses: Performance bonuses.

Health insurance: Employee health insurance.

Superannuation: Contributions to employee superannuation.

8. Marketing and advertising

Online advertising: Online ads like Google AdWords.

Print advertising: Newspaper and magazine ads.

Promotional materials: Business cards, brochures and other marketing collateral.

9. Training and development

Course fees: Training course and seminar costs.

Books and materials: Educational materials for employee development.

10. Insurance

Public liability: Business operations insurance.

Workers comp: Employee injury at work insurance.

Property insurance: Office and equipment insurance.

11. Taxes and licenses

Business taxes: Income tax, property tax, and other business taxes.

Licenses and permits: Business license and permit fees.

12. Miscellaneous expenses

Petty cash: Small miscellaneous purchases.

Bank fees: Bank fees and charges.

Subscriptions: Professional memberships and journal or online service subscriptions.

Frequently asked questions

What are the benefits of expense templates?

Here are the benefits:

Accuracy

Time-saving

Financial control

Compliance

Accountability

Consistency

What’s the alternative to expense templates?

Looking for a better way to track and manage expenses? Shoeboxed is the alternative to company expense sheet templates. Shoeboxed digitizes the data and automates expense recording, tracking, and reporting. Automation reduces human error and saves time.

In conclusion

Expense templates give you a structured way to track, report, and analyze business expenses. Shoeboxed automates scanning and digitizing receipts, categorizing expenses, and generating reports. The platform integrates with various accounting software for real-time sync and accuracy.

Caryl Ramsey has years of experience assisting in bookkeeping, taxes, and customer service. She uses various accounting software to set up client information, reconcile accounts, code expenses, run financial reports, and prepare tax returns. She also has experience setting up corporations with the State Corporation Commission and the IRS.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple receipt capture methods: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad, and Android) to snap a picture while on the go—auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports, including IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports, and more—with Shoeboxed.

Try Shoeboxed today!