Concur is a great expense management tool with many features and integrations. However, businesses often look for alternatives that fit their needs, budgets, or preferences. Here, we will show you our best alternatives to Concur.

What is expense management?

Expense management is the process of tracking, auditing and controlling company spending to ensure expenses align with budgets and financial policies. This involves recording, tracking, approving and reimbursing employee expenses during business travel or daily operations.

Expense management systems often include software tools to make the process more efficient so you can easily manage expense reports, receipt tracking and policy compliance.

Why is expense management important?

1. Financial control

Expense management helps businesses control their financial outflows so all expenses are accounted for and within the budget. This control is key to preventing overspending and finding areas to save.

2. Compliance and accountability

Proper expense management ensures all expenses comply with internal policies and regulations, such as tax laws. This compliance is critical to avoid legal issues and penalties. It also holds employees accountable for their expenses.

3. Cost savings

By tracking and analyzing spending, businesses can find unnecessary expenses and implement cost savings. Effective expense management often reveals inefficiencies and areas to negotiate better rates with suppliers or eliminate redundant expenses.

4. Better cash flow

Managing expenses well means better cash flow management. Timely and accurate recording of expenses ensures financial statements reflect the true financial position of the business, helping with cash flow forecasting and planning.

5. Increased employee productivity

Automated expense management systems reduce the administrative burden on employees and finance teams so they can focus on more strategic work. This automation also speeds up the reimbursement process and enhances employee satisfaction.

6. Data-driven decision-making

Expense management provides data that can be used to make strategic decisions. Businesses can use expense reports for budget allocations, spending cuts, and investment opportunities.

What are the key features to look for in SAP Concur alternatives

Here’s what to look for in SAP Concur alternatives:

1. Automation

Auto expense management to reduce manual errors and increase efficiency.

2. Integrations

Integrates with accounting software and other systems for seamless expense tracking and reporting.

3. User experience

Expense report creation should be easy to create and customizable for each business.

4. Customization

Features like auto employee expense reporting and real-time approval can increase employee satisfaction and reduce reimbursement time.

Comparison of SAP Concur Alternatives

Features |

SAP Concur vs |

Shoeboxed vs |

Emburse vs |

Zoho Expense vs |

Airbase vs |

|---|---|---|---|---|---|

Expense reporting |

Advanced, automated reporting |

Automated reports |

Automated customizable reports |

Automated reports |

Comprehensive reporting |

Receipt scanning |

Yes, with OCR |

Yes, with OCR |

Yes, with OCR |

Yes, with OCR |

Yes, with OCR |

Mobile app |

Yes |

Yes |

Yes |

Yes |

Yes |

Integration |

Extensive integration |

QuickBooks, Xero, and many more |

QuickBooks, Xero, NetSuite |

Zoho Books, Zoho CRM |

QuickBooks, Xero, NetSuite |

Ease of use |

Moderate |

Easy |

Moderate |

Easy |

Moderate |

Pricing |

Contact for pricing |

Starts at $18/month |

Contact for pricing |

Starts at $3/user/month |

Contact for pricing |

Pros |

Extensive features, integrations |

User- friendly, cost- effective |

Comprehensive, customizable |

Cost-effective, integrates well |

Unified spend management |

Cons |

Expensive, complex setup |

Limited advanced features |

Expensive, learning curve |

Limited third-party integration |

Expensive, learning curve |

Best for |

Large enterprises |

Small to medium businesses |

Mid-sized to large enterprise |

Small to medium businesses |

Mid-sized to large enterprise |

What are the top SAP Concur alternatives for expense management software?

Choosing the right expense management tool depends on your specific business needs, budget, and desired features. While SAP Concur is a great option, there are other SAP Concur expense alternatives that have unique benefits that may better suit your needs.

1. Shoeboxed - ideal for small businesses looking to manage receipts and expenses

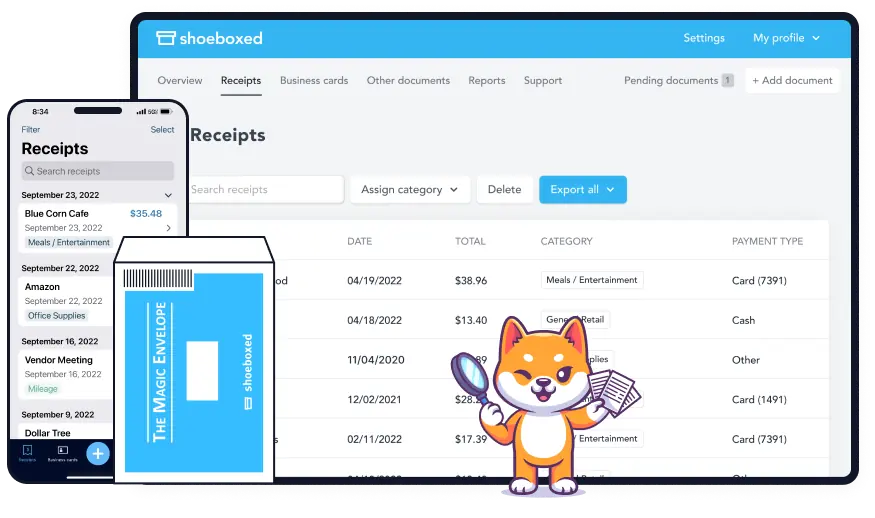

Shoeboxed was voted the #1 best receipt tracking app by Forbes and is used by over a million businesses.

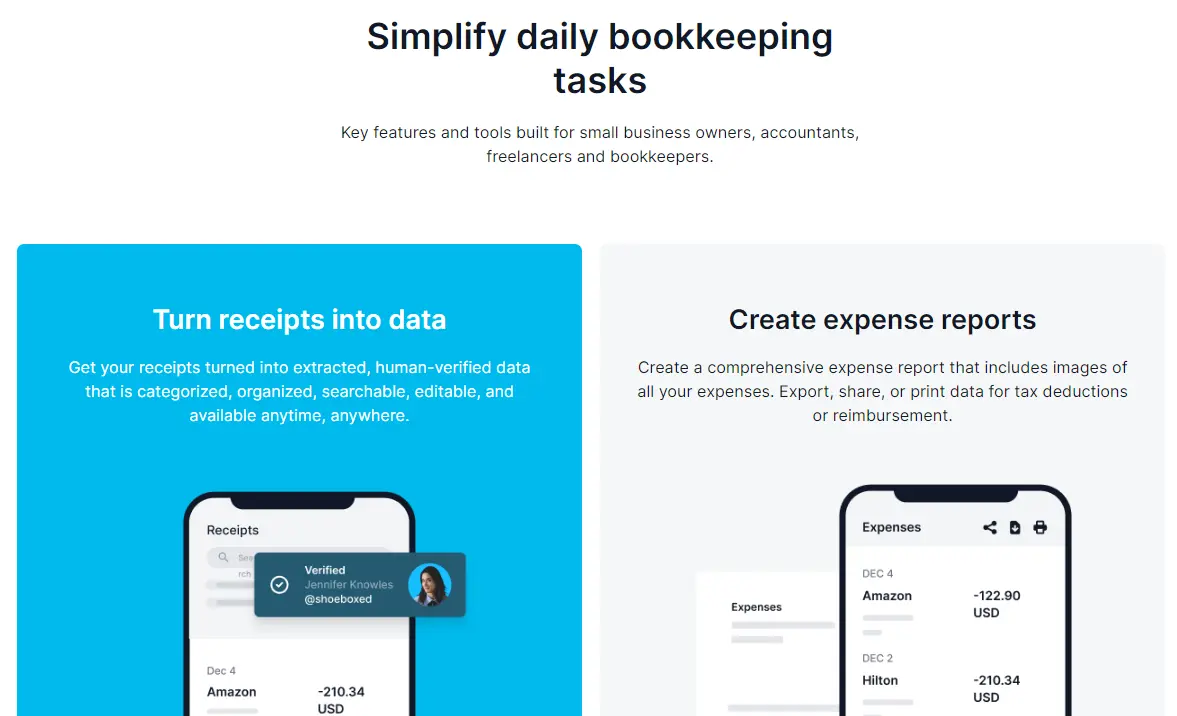

Shoeboxed turns your receipts into data for expense reporting, tax prep, and so much more.

Receipt scanning and digitization

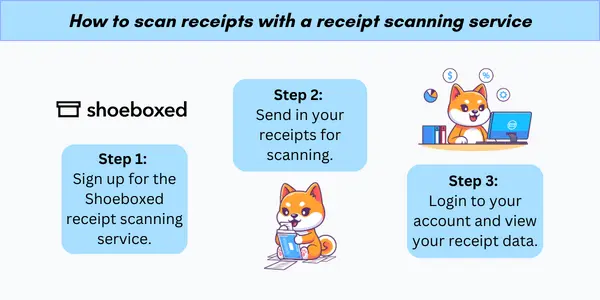

Shoeboxed is a receipt scanner app that allows users to convert paper receipts into digital format using OCR (Optical Character Recognition) technology so all key data is captured accurately.

To scan receipts, just take a photo of the receipt with your mobile device's camera and automatically upload data into your designated Shoeboxed account via the app.

Mail-in service

If you want to outsource the scanning or have a large volume of receipts, Shoeboxed offers a mail-in service. Users can send their receipts in a prepaid Magic Envelope, and Shoeboxed will scan and upload them into your account.

Shoeboxed is the only receipt scanner app that will handle both your paper receipts and your digital receipts—saving customers up to 9.2 hours per week from manual data entry!

Stop doing manual data entry 🛑

Outsource receipt scanning to Shoeboxed’s scanning service and free up your time for good. Try free for 30 days!✨

Get Started Today

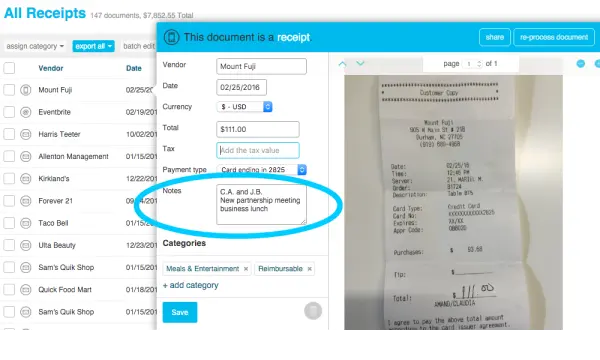

Add further details to receipts

With Shoeboxed, you can add more details on your receipts in the 'notes' section for a more detailed description of the expense.

Shoeboxed’s OCR (Optical Character Recognition) automatically categorizes your receipts based on the extracted data.

You can create custom categories to organize receipts according to your needs, such as business travel, office supplies, etc.

Integration with accounting software

Shoeboxed integrates with popular accounting software such as QuickBooks, Xero, and many more for easy syncing and consistency across platforms.

Expense report creation

Shoeboxed automatically generates detailed expense reports with just the click of a button, which are essential for financial analysis and tax prep.

Tax prep

Shoeboxed provides IRS-accepted digital receipts so businesses can prepare for tax season and comply with regulations.

Shoeboxed has been voted as the best receipt scanner app for tax season by Hubspot and given the Trusted Vendor and Quality Choice awards by Crozdesk.

Pros:

User-friendly interface: Shoeboxed is designed to be simple so users can navigate and manage their receipts without a learning curve.

Reliable receipt scanning: OCR technology ensures receipt data is captured and categorized accurately so there are no manual data entry errors.

Integration options: Its integration with major accounting software makes updating financial records and generating reports easy.

Flexible plans: Shoeboxed has different pricing plans to accommodate different volumes of receipts, so small businesses and freelancers can also use it.

Cons:

Limited advanced features: Compared to Concur, Shoeboxed may lack some advanced features and customization options that larger enterprises might require, but this makes Shoeboxed easy to use and an efficient expense management software.

Pricing:

Startup: Starts at $18 per month, suitable for freelancers and small businesses with a low volume of receipts.

Professional: $36 per month, offers more features and higher receipt limits.

Business: $54 per month, ideal for growing businesses needing advanced features and higher volume handling.

Why it stands out

Shoeboxed is a top alternative to SAP Concur for businesses looking for a simple, affordable way to manage their receipts and expenses.

With features like receipt scanning, expense reporting, and integration with major accounting software, Shoeboxed makes expense management easy for small- to medium-sized businesses. Its flexible plans make it a versatile tool in financial management.

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic award-winning approach to receipt tracking for tax season. Try free for 30 days!

Get Started Today2. Emburse - is ideal for businesses of all sizes looking for advanced analytics

Emburse is a worthwhile alternative to SAP Concur due to its comprehensive features designed for expense management, ease of use, and flexibility, making it suitable for various business sizes and industries.

Features

Expense reporting

Emburse automates expense reporting, captures receipt data through OCR, and integrates it into reports.

Corporate card management

The platform has robust tools for corporate card management, so transactions are tracked and reconciled automatically.

Real-time analytics

Emburse has real-time expense analytics so you can easily recognize spending patterns, compliance issues, and cost savings opportunities.

Mobile

User-friendly mobile app so employees can capture receipts, submit expense reports, and track approvals on the go.

Travel management integration

Emburse integrates with travel management systems to book travel and generate expense reports.

Policy compliance

Automated compliance features so all expenses comply with company policies and non-compliance is reduced.

Pros:

User-friendly: Emburse has an intuitive interface, so expense reporting is easy for employees and administrators.

Advanced analytics: The platform has robust analytics for deep insights into expense data so businesses can make informed financial decisions.

Customization: High degree of customization to fit specific business needs, approval workflows, and policy enforcement.

Integration: Integrates with various accounting, ERP, and travel management systems so data flows smoothly across platforms.

Cons:

Steep learning curve: With so many features and customization options, there is a significant learning curve for new users.

Pricing: Emburse can be pricey, especially for smaller businesses or those with limited budgets.

Pricing:

Emburse has flexible pricing plans for different business sizes and needs. Pricing is often customized based on the business’s needs.

Why it stands out

Emburse stands out with real-time expense management and advanced analytics. It has advanced customization and integration capabilities, so it’s a great tool for companies that need detailed control over expenses.

3. Zoho Expense - is an ideal expense management solution for global businesses

Zoho Expense is a good alternative to SAP Concur because it has robust features, a user-friendly interface, and competitive pricing.

Features

Auto expense recording

Zoho Expense captures expenses from emails and receipts so manual data entry and errors are minimized.

Policy compliance

The platform enforces policy and compliance and flags non-compliant expenses for review.

Multi-level approval

Zoho Expense has customizable approval workflows, so expenses are reviewed and approved by the right people.

Mobile app

Users can manage expenses on the go, capture receipts, submit reports, and approve expenses from their mobile phones.

Integrates with other Zoho products

Integrates with other Zoho apps like Zoho Books and Zoho CRM so there’s a unified experience across the Zoho ecosystem.

Multi-currency and multi-language support

Zoho Expense supports multiple currencies and languages, so it’s perfect for global businesses.

Pros:

User-friendly: It is easy to use and navigate for users to manage their expenses.

Comprehensive integrations: Integrates with other Zoho products and third-party accounting software so data flows smoothly.

Customizable approval workflows: Businesses can set up multi-level approval workflows so expenses are reviewed and approved properly.

Affordable: Competitive pricing is great for small to medium-sized businesses.

Cons:

Limited third-party integrations: While it integrates well within the Zoho ecosystem, its third-party integration options are limited compared to SAP Concur.

Complex setup for advanced features: Setting up advanced features and customizations can be complex and may require support.

Pricing:

Free: Up to 3 users, basic expense tracking and reporting features.

Standard: $4 per monthly user, multi-level approvals, and basic integrations.

Premium: $7 per monthly user, policy compliance, and advanced integrations.

Enterprise: Custom pricing for large businesses with specific needs and high volume of expenses.

Why it stands out

Zoho Expense stands out with its strong integration within the Zoho suite, so it’s a great choice for businesses that are already using Zoho products. It’s user-friendly and has robust automation features, so it’s perfect for businesses of all sizes.

4. Airbase - ideal for businesses looking for an all-in-one expense management platform

Airbase is a modern expense and spend management platform with a full suite of tools to streamline and simplify financial operations.

Features

Unified spend management

Airbase has all aspects of spend management – expense management, accounts payable and corporate card spending – in one platform.

Auto expense reporting

The platform automates expense capture, categorization, and reporting so that manual data entry and errors are reduced.

Virtual and physical cards

Airbase has virtual and physical corporate cards to control and track spending in real-time.

Real-time budgeting

The system has real-time budgeting and alerts so managers can track expenses against the budget and prevent overspending.

Approval workflows

Customizable approval workflows so all expenses are reviewed and approved according to company policies.

Integrations

Airbase integrates with accounting software like QuickBooks, Xero, NetSuite and more.

Pros:

Full solution: Airbase has a unified platform that handles all types of business spending – expense reports to vendor payments.

Real-time spend visibility: Gives real-time visibility into spending so better budgeting and financial planning.

Automation: Automates many tedious tasks in expense management, like data entry and approval workflows, so it’s more efficient and error-free.

Flexible cards: Virtual and physical cards so businesses can manage expenses more flexibly and securely.

Cons:

Steep learning curve: The platform has many features and capabilities so new users may experience a steep learning curve.

Cost: Airbase can be more expensive than other simple expense management tools, so it's not suitable for very small businesses with a limited budget.

Pricing:

All plans: Request a quote

Why it stands out

Airbase handles the complexity of modern business spend management by having multiple financial processes in one platform. This integration simplifies operations and gives you visibility and control over all business expenses.

How to implement expense management software

To implement the best expense management process for your business, you need to select the expense management solution that best meets your needs, consider the best practices for implementing and using the software, and weigh the benefits for your business against the cost.

Selecting the right expense management software for your business

When selecting an expense management software consider ease of use, customization and integrations with existing systems.

Look at the features and pricing of SAP Concur alternatives to find the best for your business.

Best practices for implementation

Have a clear expense management policy and communicate it to all employees.

Provide training and support for a smooth transition to the new expense management software.

Monitor and track expense data to find areas to cut costs and improve.

Benefits for your business

Expense management can help businesses minimize business expenses, increase productivity and employee satisfaction.

It also gives real-time expense tracking, faster reimbursement and financial visibility.

What are the benefits of automating expense management?

Automating expense management has many benefits that can boost a business’s operational efficiency, accuracy, and financial health.

Here are some of the advantages:

1. Time savings

Automated systems make the entire expense reporting process seamless, reducing time spent on manual entry and approval. Employees and finance teams can focus on more strategic work rather than administrative work.

2. Accuracy

Automated expense management systems eliminate human error by capturing and categorizing expenses accurately. Financial records are precise, which is important for budgeting, forecasting, and tax compliance.

3. Compliance

Automation ensures all expense reports comply with company policies and regulations. Systems can automatically flag non-compliant expenses so businesses can avoid legal issues and penalties.

4. Real-time tracking

Automated systems provide real-time tracking of expenses, so businesses have immediate visibility into spending. Real-time data helps with better financial planning and decision-making.

5. Cost savings

By finding and eliminating inefficiencies, automation can lead to big cost savings. Businesses can avoid duplicate payments, detect fraud, and negotiate better rates with suppliers by analyzing spending trends.

6. Faster reimbursements

Automation speeds up the reimbursement process so employees are reimbursed quickly. This means improved employee satisfaction and morale.

7. Data-driven insights

Automated systems generate reports and analytics so businesses can see spending patterns and trends. This helps businesses make informed decisions on budget and cost management.

8. Scalability

Automated expense management systems can scale with the business. They can handle more expense reports without additional manual processing.

9. Security

These systems have robust security features to protect financial data. Automated systems can enforce data access controls so only authorized personnel can view or edit expense records.

10. Integration with other systems

Automated expense management solutions often integrate with other financial and accounting software. This integration ensures expense data is automatically synced across systems so data is consistent and accurate.

Frequently asked questions

Are these SAP Concur alternatives for small business?

Yes, many of these alternatives, like Shoeboxed and Zoho Expense, have features and pricing plans for small businesses, so it’s affordable and scalable.

Do these tools integrate with existing accounting software?

Most of these tools integrate with popular accounting software like QuickBooks, Xero and other financial systems for seamless data transfer and financial management.

In conclusion

Choosing the right expense management tool depends on your business needs, budget, and desired features. While SAP Concur is a robust option, alternatives like Shoeboxed have unique benefits that may be more suitable for you.

By examining the features, pros, cons, and pricing of each, you can make an informed decision that improves your expense management and business growth.

Caryl Ramsey has years of experience assisting in bookkeeping, taxes, and customer service. She uses various accounting software to set up client information, reconcile accounts, code expenses, run financial reports, and prepare tax returns. She also has experience setting up corporations with the State Corporation Commission and the IRS.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple receipt capture methods: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad, and Android) to snap a picture while on the go—auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports, including IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports, and more—with Shoeboxed.

Try Shoeboxed today!