The move from a paper receipt to a digital one has changed many aspects of business. This trend originated with the Apple Store, which started sending digital receipts to customers back in 2005.

Digital receipts are a modern, efficient alternative to paper-printed receipts. They speed up the transaction process, save time, reduce costs, and improve customer experience.

What are digital receipts?

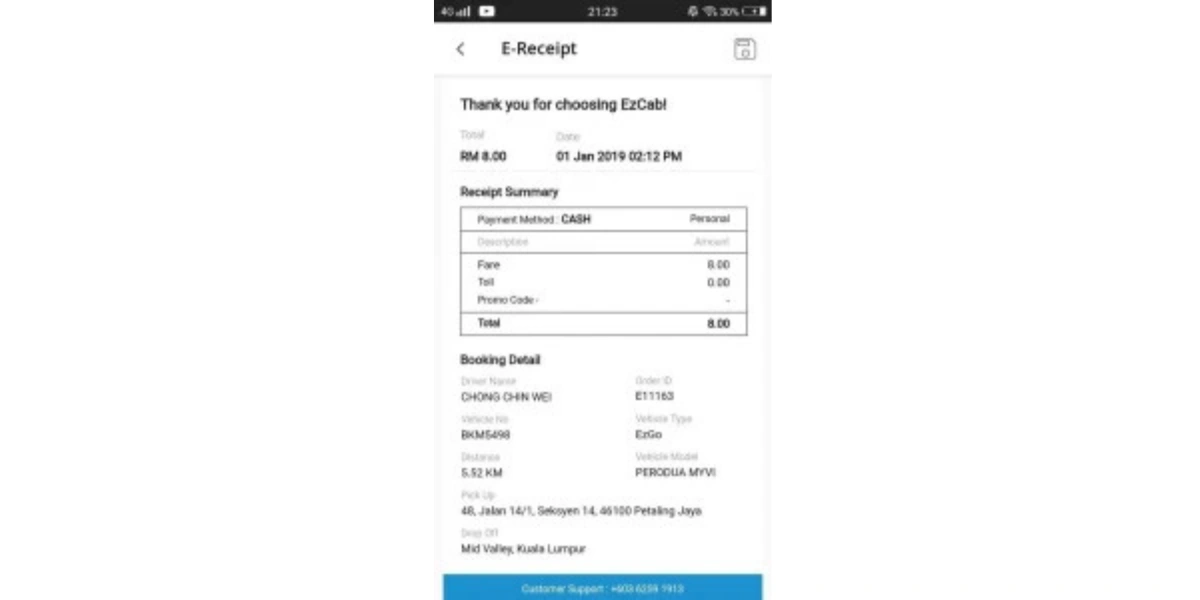

Digital receipts are digital records of transactions sent to customers via email, text message, or mobile app; this requires no paper receipts. They are a secure and organized way to store transactional data.

Storing receipts digitally is easily accessible for both businesses and customers. Electronic receipts can be used for all types of transactions, online and in-store.

How to enable digital receipts at the point of sale

Enabling digital receipts in your business is easy when you have the right tools and systems.

Here’s how:

1. Integrate with POS

Most modern point-of-sale (POS) systems have digital receipt functionality. You can integrate digital receipt solutions with your existing POS system.

2. Customer opt-in

Customers can opt-in to receive digital receipts by giving you their email or phone number at checkout. You can send receipts electronically instead of generating a printed receipt.

3. How it works

Digital receipts work by collecting the customer’s email or phone number at the point of purchase. Once the transaction is complete, the POS system generates the digital receipt.

The digital receipt is then sent to the customer via SMS or email. The integration with POS systems makes it a seamless process for both retailers and customers, a convenient and eco-friendly alternative to paper receipts.

4. Customization

Digital receipts can be customized with personalized business branding, promotional offers, and links to social media, or loyalty programs to engage customers post purchase. This customization enhances the customer experience and provides more marketing opportunities.

What are the benefits for businesses?

Digital receipts have many benefits:

1. Cost savings

No paper, no ink, no printing equipment = cost savings. Especially for high-volume businesses.

2. Environmental impact

Less paper waste and less solid waste in the receipt process = more sustainable business. And a better brand for eco-conscious customers.

3. Transactional data

Digital receipts store transactional data securely and keep it organized so businesses can track sales, manage returns, perform audits, and use for business analysis.

What’s in it for customers?

Customers get the convenience and benefits too:

1. Easy to store and access

Digital receipts are stored online or on a mobile device. No more physical copies to keep. Plus, digital receipts can be connected to money management apps like QuickBooks so you can manage your books and budget easier.

2. Easy returns and exchanges

Digital receipts make returns and exchanges a breeze. No more digging through papers.

How to store and manage digital receipts

Both businesses and customers can benefit from storing and managing digital receipts:

1. Online accounts

Businesses and customers can store digital receipts in online accounts, which are easy to access and manage. This means a single place to manage all receipts, which reduces the risk from lost, damaged, or misplaced receipts.

2. Receipt management solutions

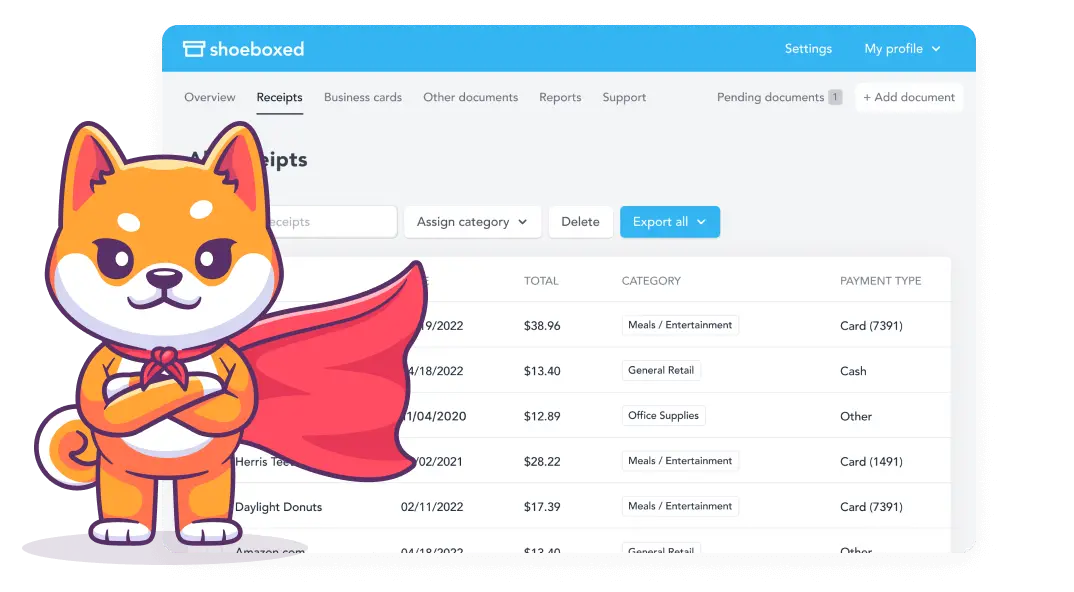

Solutions like Shoeboxed have features to organize and manage digital receipts. Shoeboxed lets you categorize receipts, generate expense reports, and integrate with accounting software. It's a powerful tool for small businesses and individuals.

3. Find and access

Digital receipts are securely stored and easily accessible. Customers and businesses can find and access their digital receipts by keywords, dates, or other filters, knowing that their data is safe and organized.

How do digital receipts work with Shoeboxed?

Shoeboxed is a tool designed to make managing digital receipts easy. Whether you’re a small business owner, freelancer, or individual looking to get your finances in order, Shoeboxed has features to make managing electronic receipts a breeze.

Here’s how Shoeboxed manages digital receipts:

1. Receipt scanning and uploading

Shoeboxed has multiple ways to scan and upload your receipts, making it easy to digitize and organize your financial records:

Mobile app scanning

Shoeboxed allows you to scan receipts from your smartphone using our mobile app. Simply take a photo of the receipt, and Shoeboxed will process and store it as a digital receipt.

Magic Envelope service

Shoeboxed has the Magic Envelope service. You can send your physical receipts, business cards, and other documents to Shoeboxed in a pre-paid envelope. They'll scan, process, and categorize the receipts for you, so you don’t have to spend time scanning them yourself.

The Magic Envelope service is great for businesses or individuals who have a large volume of paper receipts and need a way to digitize them. Shoeboxed will handle everything, so your receipts are safely stored and easily accessible online.

Shoeboxed is the only receipt scanner app that will handle both your paper receipts and your digital receipts—saving customers up to 9.2 hours per week from manual data entry!

Email integration

You can forward receipts to Shoeboxed via email or use their Gmail plugin, which automatically recognizes receipts in your Gmail inbox and sends them directly to your Shoeboxed account. They’ll process and add the receipts to your account; no manual entry is required.

Drag and drop upload

You can upload receipts from your computer to Shoeboxed by dragging and dropping the files into the platform.

2. Automatic data extraction

OCR technology

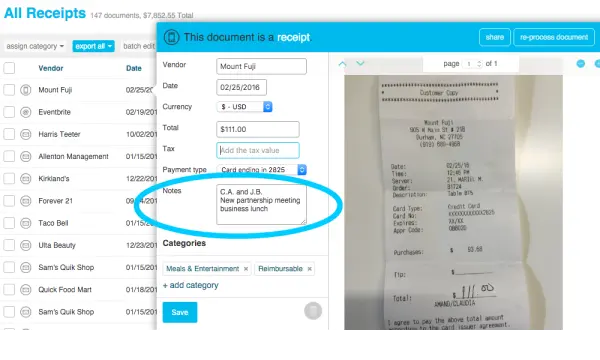

Shoeboxed uses Optical Character Recognition (OCR) to extract key information from your digital receipts, such as date, amount, merchant name, and payment method. This automatic data extraction saves you time and reduces manual entry errors.

Manual review

For extra accuracy, Shoeboxed’s team of data experts manually review the extracted data to ensure it’s correct and complete.

3. Categorization and organization

Custom categories

Shoeboxed allows you to categorize your digital receipts to meet your specific needs. You can create custom categories to organize your receipts, whether you’re tracking business expenses, personal purchases, or project costs.

Tags and notes

You can add tags and notes to individual receipts for extra tracking. This is great for labeling expenses for specific clients, companies, projects, or tax categories.

4. Secure cloud storage

Cloud storage

All digital receipts uploaded to Shoeboxed are stored in the cloud. So, your receipts are accessible from any device with an internet connection and are safe from loss or damage.

Searchable archive

Shoeboxed has a searchable archive of all your receipts, so you can find specific receipts by keyword, date, company or other filters.

5. Expense reports and summaries

Detailed reporting

Shoeboxed can generate reports summarizing details of your spending by category, date range, or merchant. Reports are customizable and can be exported in PDF, CSV, or Excel format so you can share them with others or import them into other financial tools.

Receipts archive

Shoeboxed keeps an archive of your digital receipts to access past expenses for tax, reimbursement, or business analysis.

6. Integration with accounting software

Seamless integration

Shoeboxed integrates with popular accounting software like QuickBooks, Xero, and many more. This integration allows you to sync your digital receipts with your accounting records so your books are up-to-date and error-free.

Export options

You can export your digital receipts and expense data in formats compatible with other financial tools so that your financial records are complete, consistent, and accurate.

7. Mileage tracking and document management

Mileage tracking

In addition to digitizing receipts, Shoeboxed has a mileage tracking feature that logs business miles using your phone's GPS. This is great for freelancers and small business owners who need to track miles for tax or reimbursement purposes.

Document management

You can also manage other important documents like invoices and business cards, alongside your digital receipts. This document management solution keeps you organized and has all your records in one place.

Track mileage with Shoeboxed 🚗

Track mileage using your phone’s built-in GPS for unmatched ease and accuracy. 💪🏼 Try free for 30 days!

Get Started Today8. IRS-accepted documentation

Tax compliance

The digital copies of Shoeboxed receipts are IRS-accepted so they can be used as proof during tax filings and audits. This gives you peace of mind and ensures your records are tax-compliant.

9. Mobile app

On-the-go management

The Shoeboxed mobile app lets you manage your digital receipts on the go. You can scan receipts, track mileage, and view your expense history from your smartphone or tablet to stay organized wherever you are.

10. Support and resources

Support team

Shoeboxed has a support team to help with any questions or issues with digital receipts. Support is available via email, chat, and phone.

Turn receipts into data with Shoeboxed ✨

Try a systematic approach to receipt categories for tax time. Try free for 30 days!

Get Started TodayFrequently asked questions

Are digital receipts secure?

Yes, digital receipts are secure when businesses use proper encryption and follow data protection regulations like PCI DSS. This means customer info is protected during transmission and storage, reducing the risk of data breaches and fraud.

How does Shoeboxed verify digital receipt data?

Shoeboxed uses OCR to extract info from a digital receipt and then a team of experts reviews it for accuracy.

In conclusion

A digital receipt is a modern, convenient, and eco-friendly alternative to a paper receipt. It benefits businesses and customers, offering cost savings, a better customer experience, and less paper waste.

Shoeboxed covers all digital receipt management needs – scan, store, organize, and analyze expenses. Shoeboxed makes digital receipt handling a breeze, saving time and ensuring accuracy.

Caryl Ramsey has years of experience assisting in different aspects of bookkeeping, taxes, and customer service. She uses a variety of accounting software for setting up client information, reconciling accounts, coding expenses, running financial reports, and preparing tax returns. She is also experienced in setting up corporations with the State Corporation Commission and the IRS.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple receipt capture methods: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad, and Android) to snap a picture while on the go—auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports, including IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports, and more—with Shoeboxed.

Try Shoeboxed today!