As tax season approaches, stress starts to creep up on business owners.

Preparations can be taxing, often involving numerous steps. This includes double-checking accounting records, going over tax claims to make sure the final numbers are correct, and sorting through piles of receipts that they’ve hung onto to submit to the IRS.

If you’re looking to streamline this process by digitizing your receipts, you may be wondering—will the IRS accept your receipt scans? Can receipt scans legally support your tax write-offs and tax deductible expenses, the same as original paper receipts and tax receipts?

The quick answer to your worries: Receipt scans are 100% legitimate and approved by the IRS. In fact, the IRS has accepted scanned and digitized receipts as valid tax records for tax purposes since 1997!

However, scanned receipts must meet certain requirements to be eligible.

Read on to find out if your receipt scans have met all of the IRS’s requirements.

What are the requirements for a receipt scan to be accepted by the IRS?

According to the IRS, digital or scanned receipts must meet the following requirements:

Receipt scans are completely identical to their original versions.

Each receipt scan must exhibit a high degree of legibility and readability.

You must be able to provide hard copies (PDF printouts) of the receipt scans in the event of an IRS audit.

Scanned documents must be stored in a secure place.

If you can ensure your receipt scans are properly stored and backed up, and you can reproduce hard copies from them in a legible, readable format, you may dispose of the original receipts.

Source: “Rev. Proc. 97-22 (Recordkeeping – Electronic Storage System),” IRS.gov.

What is the most effective way to scan your receipts?

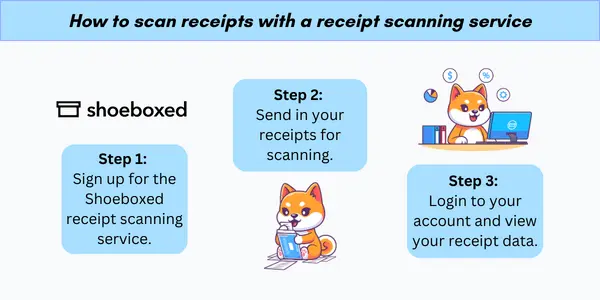

If you’re looking for an easy and convenient way to scan your receipts, Shoeboxed is what you need. Since 2007, Shoeboxed has helped many accountants, freelancers, and businesses scan, digitize, and store their receipts safely in the cloud.

Simply scan your receipts with your phone with just a click, and perfect digital versions of your paper receipts will appear in your Shoeboxed receipt tracker app!

On top of that, Shoeboxed extracts, categorizes, and human-verifies important data from your receipts so that you can go over and check your records anytime with ease.

Turn receipts into data and deductibles with Shoeboxed!Too many receipts and too little time to deal with them? Send your piles of documents using the postage pre-paid Shoeboxed Magic Envelope, and the Shoeboxed team will take care of the rest. Sit back, and let someone else do the tedious job of transforming your receipts into organized digital data.

Outsource your receipt scanning to Shoeboxed!

Quick, reliable, and trustworthy, Shoeboxed guarantees that the digital versions of your receipts are in precise format, audit-ready, and accepted by the IRS in the event of an audit.

Shoeboxed is the only receipt scanner app that will handle both your paper receipts and your digital receipts—saving customers up to 9.2 hours per week from manual data entry!

Never lose a receipt again 📁

Join over 1 million businesses scanning receipts, creating expense reports, and reclaiming multiple hours every week—with Shoeboxed.✨

Get Started TodayWhat else can Shoeboxed do?

Shoeboxed has been voted as the best receipt scanner app for tax season by Hubspot and given the Trusted Vendor and Quality Choice awards by Crozdesk.

A quick overview of Shoeboxed's award-winning features:

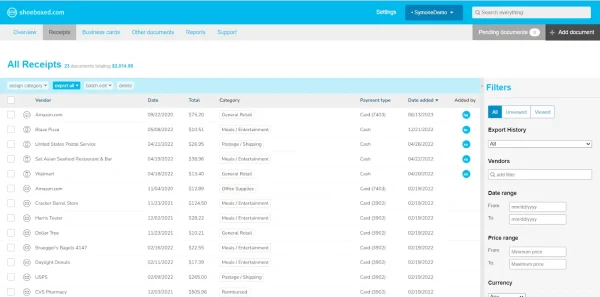

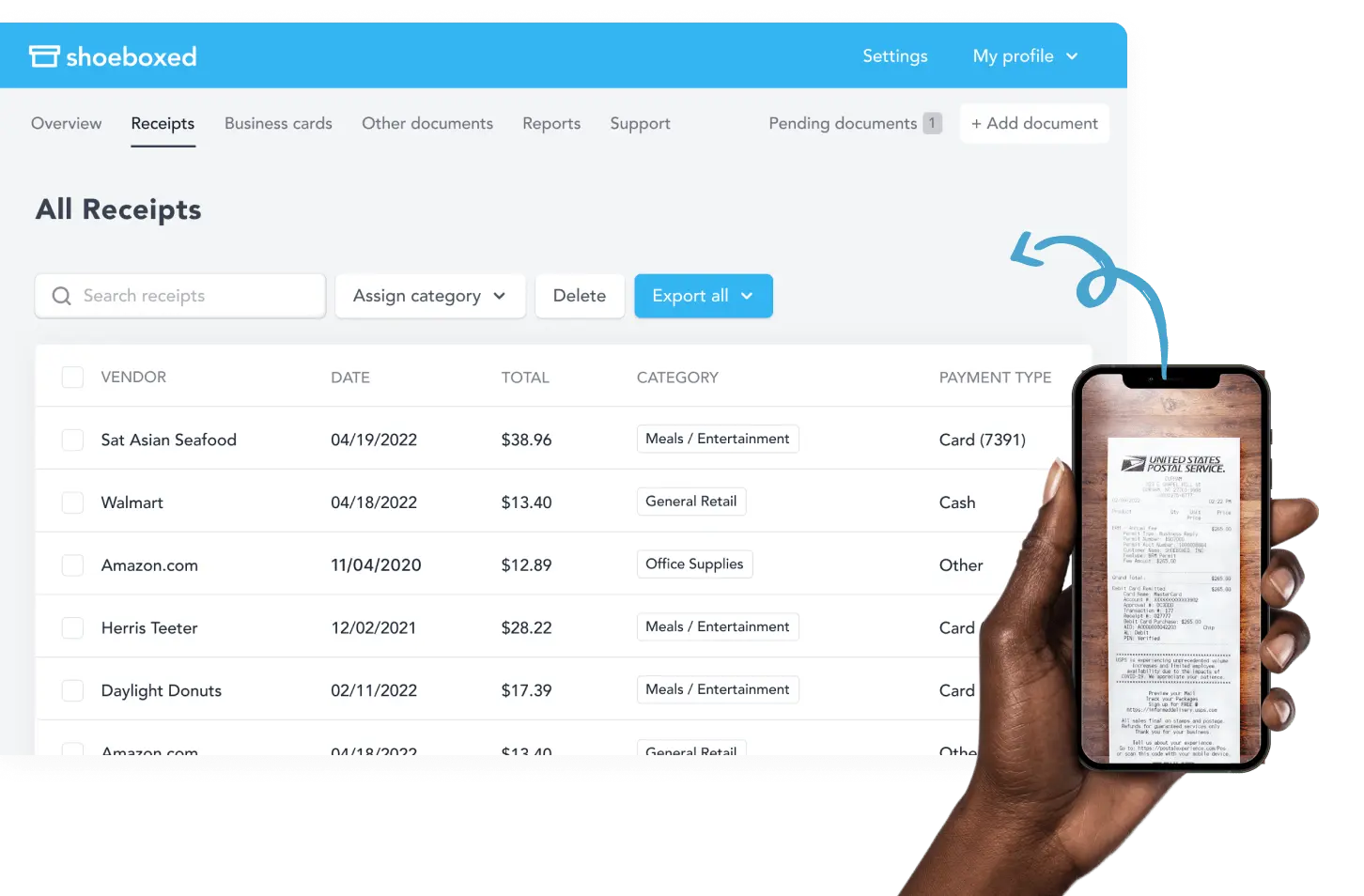

a. Mobile app and web dashboard

Shoeboxed’s mobile app lets you snap photos of paper receipts and upload them to your account right from your phone.

Shoeboxed also has a user-friendly web dashboard to upload receipts or documents from your desktop.

b. Gmail receipt sync feature for capturing e-receipts

Importing e-receipts to your Shoeboxed account is as easy as syncing your Gmail with Shoeboxed, using Shoeboxed's special Gmail Receipt Sync feature.

Shoeboxed’s Gmail Receipt Sync grabs all receipt emails and sends them to your account for automatic processing! These receipts are then labeled as Sent to Shoeboxed in your Gmail inbox.

In short, Shoeboxed pulls the receipt data from your email, including the vendor, purchase date, currency, total, and payment type, and organizes it in your account.

Your purchases will even come with images of the receipts attached!

c. Expense reports

Expense reports let you view all of your expenses in one cohesive document. They also make it simple to share your purchases with your accountant.

Shoeboxed makes it easy to export your yearly expenses into a detailed report. All expenses come with receipts attached.

You can also choose certain types of receipts to include in your expense report. Just select the receipts you want to export and click “export selected.”

d. Search and filter

Call up any receipt or warranty in seconds with advanced search features.

Filter receipts based on vendors, date, price, currency, categories, payment type, and more.

e. Accounting software integrations

Export expenses to your accounting software in just a click.

Shoeboxed integrates with 12+ apps to automate the tedious tasks of life, including QuickBooks, Xero, and Wave Accounting.

f. Unlimited number of free sub-users

Add an unlimited number of free sub-users to your account, such as family members, employees, accountants, and tax professionals.

g. Mileage tracker for logging business miles

After you sign up for Shoeboxed, you can start tracking miles in seconds:

Open the Shoeboxed app.

Tap the “Mileage” icon.

Click the “Start Mileage Tracking” button.

And drive!

Whenever you start a trip, Shoeboxed tracks your location and miles and saves your route as you drive.

As you make stops at stores and customer locations, you can drop pins to make tracking more precise.

At the end of a drive, you’ll click the “End Mileage Tracking” button to create a summary of your trip. Each summary will include the date, editable mileage and trip name, and your tax deductible and rate info.

Click “Done” to generate a receipt for your drive and get a photo of your route on the map. Shoeboxed will automatically categorize your trip under the mileage category in your account.

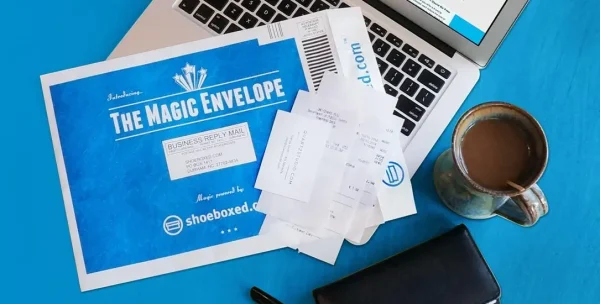

h. The Magic Envelope

Outsource your receipt scanning with the Magic Envelope!

The Magic Envelope service is the most popular Shoeboxed feature, particularly for businesses, and lets users outsource their receipt management.

When you sign up for a plan that includes the Magic Envelope, Shoeboxed will mail you a pre-paid envelope for you to send your receipts in.

Once your receipts reach the Shoeboxed facility, they’ll be digitized, human-verified, and tax-categorized in your account.

Have your own filing system?

Shoeboxed will even put your receipts under custom categories. Just separate your receipts with a paper clip and a note explaining how you want them organized!

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic award-winning approach to receipt tracking for tax season. Try free for 30 days!

Get Started TodayYou might also be interested in:

How to Track Mileage for Tax Deductions with the Shoeboxed App

How to Scan Receipts With the Shoeboxed App: A Step-By-Step Guide

About Shoeboxed!

Shoeboxed supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed for free today!