In the world of nonprofit organizations, tracking and acknowledging donations is an essential aspect of maintaining transparency and accountability.

As a leader in your nonprofit, you need to be aware of the importance of having a reliable donation receipt template for your organization.

This template will not only help you keep records of charitable contributions but also serve as a written acknowledgment of the donations received, which is crucial for tax deduction purposes.

By providing accurate and timely receipts, you can maintain good relationships with your donors, ensuring that they receive the necessary documentation for their tax returns, and foster a sense of trust in your organization’s commitment to transparency.

What is the importance of donation receipts?

1. Keep accurate records and tax purposes

Donation receipts are crucial for both your nonprofit organization and your donors.

As a nonprofit, issuing donation receipts helps you maintain accurate records and comply with legal requirements.

For your donors, these receipts serve as a confirmation of their contribution and enable them to claim tax deductions for their charitable donations.

Make sure your receipt template includes important details like the donor’s name, donation amount, date, and a statement that no goods or services were provided in exchange for the donation.

For in-kind donations, remember that donors must determine the value of their donation, and the nonprofit organization should include the donor’s name, the nature of the gift, and the received date on the receipt.

Keep in mind that some donations, like intangible religious benefits, may not be tax-deductible, and hence, you don’t need to issue a receipt with a good faith estimate of the value.

Never lose a receipt again 📁

Join over 1 million businesses organizing & scanning receipts, creating expense reports, and reclaiming multiple hours every week—with Shoeboxed.✨

Get Started Today2. Track donation history

Donation receipts are also a great way for nonprofits to identify and target key donors for campaigns or to send acknowledgment letters.

3. An opportunity to engage with donors

Apart from fulfilling legal requirements and assisting donors with their tax deductions, donation receipts can also be an opportunity to engage with your donors.

By providing timely and heartfelt acknowledgments of their donations, you can strengthen connections with your regular donors and encourage their continuous support of your nonprofit’s cause.

What are the best donation receipt templates for nonprofits?

As a nonprofit organization, issuing donation receipts is crucial in maintaining good relationships with your donors and ensuring proper record-keeping for tax deductions.

To create a donation receipt that complies with tax regulations, you’ll want to use a cash donation receipt template or a customizable receipt template.

We’ll share our top 5 favorite donation receipt templates for nonprofits below.

These templates will help you include crucial elements, such as the donor and organization’s information, donation date, amount or description of the contribution, and any goods or services provided in exchange.

1. eForms Donation Receipt Template

The eForms Donation Receipt Template is an excellent choice for creating tax-deductible receipts for cash and non-cash contributions.

This template is easily customizable and includes fields for donor information, donation date, and a description of the goods or services provided.

You can use this template to maintain accurate records while maintaining a professional appearance.

2. LovetoKnow Editable Donation Receipt Template

The LovetoKnow Editable Donation Receipt Template is another great option for nonprofits to manage their charitable contributions.

This user-friendly template allows for easy editing to meet your organization’s needs.

This donation receipt template includes logical sections for donation information and tax-exempt status, enabling your donors to claim their deductions with ease.

3. Goods Donation Template

For nonprofits that receive in-kind donations, such as goods or services, the Goods Donation Template is an ideal choice.

This donation receipt template helps you accurately record noncash contributions for tax deduction purposes and provides space to describe the donated items.

Managing your non-monetary donations becomes simpler with a template designed specifically for this purpose.

4. Formstack Donation Receipt Template

The Formstack Donation Receipt Template is a versatile option that offers customizable fields and sections for various types of donations, such as cash, goods, or services.

This template is perfect for organizations with varying fundraising activities or offerings.

Using this donation receipts template will help streamline your donation acknowledgment process and ensure that all required information is included.

5. Jotform Donation Receipt Template

Lastly, the Jotform Donation Receipt Template is an easy-to-use solution for nonprofits seeking to issue donation receipts for both cash and non-cash gifts.

This template allows you to collect donor information, donation details, and any additional notes, making it simple to provide donors with the appropriate acknowledgments for their contributions.

Choosing the right donation receipt template for your nonprofit not only ensures compliance with legal requirements but also helps build lasting relationships with your donors.

Explore these options to find the template that best suits your organization’s needs, and keep accurate records for tax purposes.

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic award-winning approach to receipt tracking for tax season. Try free for 30 days!

Get Started TodayWhat should DIY donation receipts include?

When creating a donation receipt for your nonprofit organization, it’s important to include the necessary details to comply with tax regulations and maintain transparency with your donors.

Here are a few key elements to consider when creating a donation receipt template for your organization.

1. Donor details

First and foremost, include details of the donor, such as their name, address, and contact information.

This allows you to maintain accurate records of your donations and can help build relationships with your supporters.

2. Nonprofit details

Be sure to clearly indicate the name of your nonprofit organization and its tax-exempt status, as donors may require this information for their own tax purposes.

3. Donation date

The date of the donation is another crucial component, as it can impact the donor’s tax deduction and helps keep accurate records.

4. Donation amount or value of goods and services

Specify the donation amount or the value of the goods or services provided if it was a noncash contribution.

If your organization offered intangible religious benefits as a result of the donation, mention this without assigning a monetary value.

For noncash contributions, include a description of the items donated and a good faith estimate of their value, if applicable.

5. Disclaimers

Finally, include a statement that confirms no goods or services were provided in exchange for the donation, except for intangible religious benefits.

This is important as it indicates that the donation is tax-deductible.

If goods or services were provided as a part of the donation, mention the description and fair market value of these items, as it alters the tax-deduction eligibility.

In summary, a donation receipt template for nonprofits should cover donor and organization details, donation information, tax-exempt status, and necessary disclaimers.

By implementing these best practices and utilizing charitable donation receipt templates tailored to your nonprofit organization, you will simultaneously enhance your fundraising activities, comply with tax regulations, and foster goodwill with your donors.

Need help managing receipts for your nonprofit? Try Shoeboxed!

Charitable organizations already have their hands full with all they do to further their cause and help the communities around them without having to battle mounds of charitable contribution receipts.

If you need help managing all of the paper you generate from expenditures or sending donation receipts, Shoeboxed is your go-to solution.

What is Shoeboxed?

Shoeboxed has been trusted by over 1 million businesses for receipt management.

Shoeboxed is a receipt-scanning app and service that allows you to digitize your paper receipts, categorize them, and easily access them in the event of an audit.

Shoeboxed is trusted by over 1 million businesses (including charitable organizations) to organize their expenses for accurate record keeping and proof of tax-deductible expenses.

How can Shoeboxed help nonprofit organizations?

Shoeboxed can help nonprofits in a few ways: receipt management, expense reports, and the Magic Envelope service.

Let’s go over each of these options below.

1. Receipt management

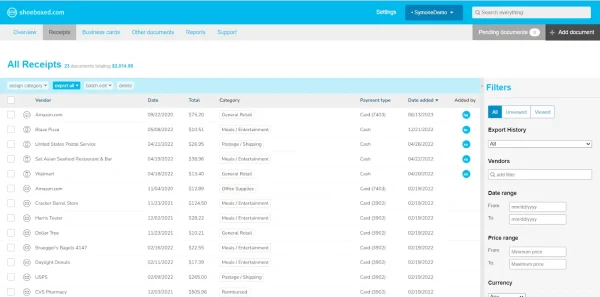

Shoeboxed receipts dashboard on demo account.

Shoeboxed is a receipt-scanning app that allows users to scan receipts on the go.

When you scan receipts, the data is extracted using OCR technology, human-verified, and uploaded to your account under 15 editable tax categories.

This is great news for nonprofits looking for a way to manage their expenses from repairs, marketing and advertising, licensing and training, and other deductible expenses.

Volunteers and employees in your organization can add notes to expenses detailing where and why money was spent and create custom tags so that you can filter for all of the related receipts in a particular expense category.

The receipts you upload to your account can be accessed from the mobile app or online dashboard and you can add an unlimited number of free users to your account.

Just keep in mind that each user added to an account will be able to see all of the expenses uploaded to Shoeboxed.

You can also upload receipts from your computer or sync your nonprofit’s Gmail with Shoeboxed to automatically upload digital receipts to your account.

2. Expense reports

Shoeboxed CSV file expense report example.

When your nonprofit reaches the predetermined expense threshold, you will be audited by the IRS.

If you’d rather not add the auditor as a user to your Shoeboxed account to check proofs of purchase, you can simply export the expenses called into question as an expense report.

Shoeboxed allows users to create PDF or CSV file expense reports with images of each receipt attached. This makes audits much less stressful and time-consuming for everyone involved.

On the expense report, you’ll see the date of purchase, vendor name, amount, link to the image, category, and other relevant details.

3. The Magic Envelope

Shoeboxed’s Magic Envelope service.

Shoeboxed’s Magic Envelope is a receipt-scanning service.

The Magic Envelope allows you to outsource and automate your receipt scanning so you and other team members don’t have to spend time manually scanning receipts.When you opt for the Magic Envelope, Shoeboxed will send you a postage-pre-paid envelope in the mail every month for you to stuff your receipts inside.

Sending Shoeboxed’s Magic Envelope

When they reach the scanning facility, your receipts will be scanned, human-verified for accuracy, and uploaded to your account in the “Receipts” tab and under 15 default tax categories.

You can also bundle your receipts and attach a note to each pile to have the team at Shoeboxed add them to custom categories.

If you have too many receipts and they won’t fit in one Magic Envelope, you can simply request more for free or pile your receipts in a box, tape the Magic Envelope to the top, and Shoeboxed will cover the postage.

To keep a record of the donation receipts you give to donors, simply send copies of the receipts in your Magic Envelope.

Donation receipts will be processed in the same manner as expense receipts and uploaded to your account under the “Other Documents” tab of your Shoeboxed account.

How much does Shoeboxed cost?

Shoeboxed’s pricing plans.

Shoeboxed offers 6 plans:

Start Up – $22/month OR $18/month (billed annually) for unlimited users + Magic Envelope service.

Professional – $45/month OR $36/month (billed annually) for unlimited users + Magic Envelope service.

Business Plan – $67/month OR $54/month (billed annually) for unlimited users + Magic Envelope service.

Starter Plan – $4.99/month for unlimited users (Digital Only plan. Doesn’t include Magic Envelope).

Light Plan – $9.99/month for unlimited users (Digital Only plan. Doesn’t include Magic Envelope).

Pro Plan – $19.99/month for unlimited users (Digital Only plan. Doesn’t include Magic Envelope).

Visit Shoeboxed’s pricing page to learn more about what all of the Digital + Magic Envelope plans offer.

NOTE: The Start Up, Professional, and Business plans are only available on desktop. The Starter, Light, and Pro plans are available on the Shoeboxed mobile app only.

Does Shoeboxed offer custom plans for nonprofits?

Yes!

If the plans don’t seem to quite fit your organization, you can request a demo or get in touch and the team at Shoeboxed will help you create a personalized plan to fit the needs of your nonprofit.

In closing

Now that you know the importance of donation receipts and have access to the best donation receipt templates for nonprofits, it’s time to ensure your organization is well-prepared to handle its donors’ contributions.

Providing a well-designed donation receipt not only helps your donors claim tax deductions but also showcases your organization’s professionalism and helps build trust among your supporters.

Don’t forget to use Shoeboxed to manage, organize, and prepare your receipts for tax time!

Hannah DeMoss is a staff writer for Shoeboxed covering organization and digitization tips for small business owners. Her favorite organization hack is labeling everything in her kitchen cabinets, and she can’t live without her mini label maker machine.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!