Effective financial management is crucial for personal and business success. Excel has long been hailed as a powerful tool for tracking tax expenses, offering an array of customizable spreadsheets to log business expenses that users can tailor to their specific needs.

By establishing a solid expense tracker in Excel, individuals can gain immediate transparency over their financial habits, and businesses can monitor expenditures, aiding strategic decision-making.

With many expense tracking templates available online for free, using Excel for tracking monthly expenses is a solid option for business owners familiar with using the Excel program.

In today's article, we list our favorite free expense spreadsheets for Excel (plus a note-worthy alternative), and then we dive into how you can create one from scratch!

5 Best Free Excel Expense Spreadsheets

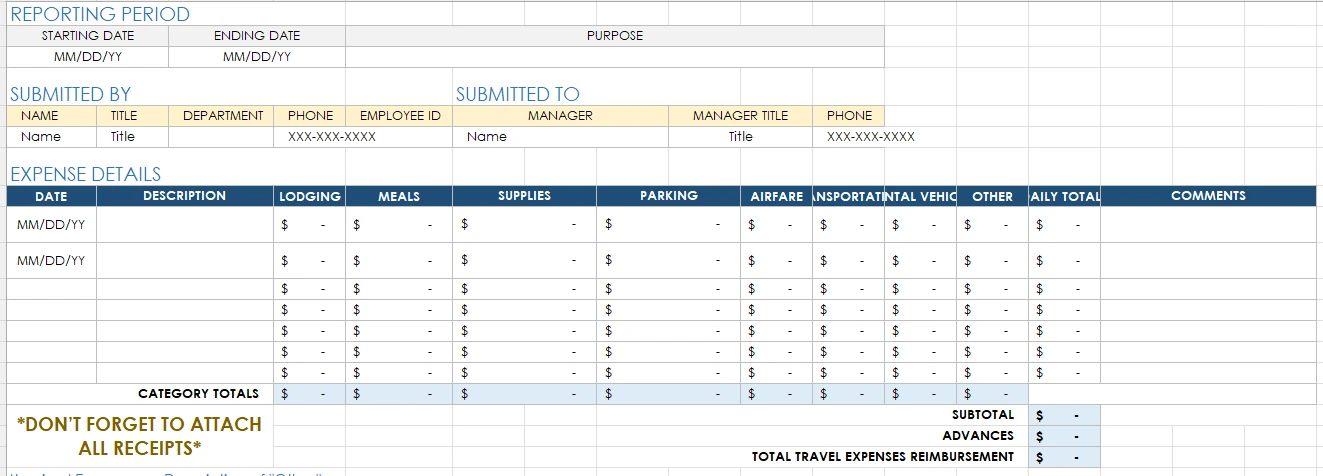

1. Excel Expense Report Template by Smartsheet

Smartsheet's provides many different expense report templates for Excel, designed to accommodate various expense tracking needs. Users can fill out the simple expense report template and submit it to their employer for employee reimbursement and tax deduction tracking purposes.

The ease of use and customization options make it a strong choice for individual and corporate use.

See also: Company Expenses Template: 4 Free Expense Templates + Bonus

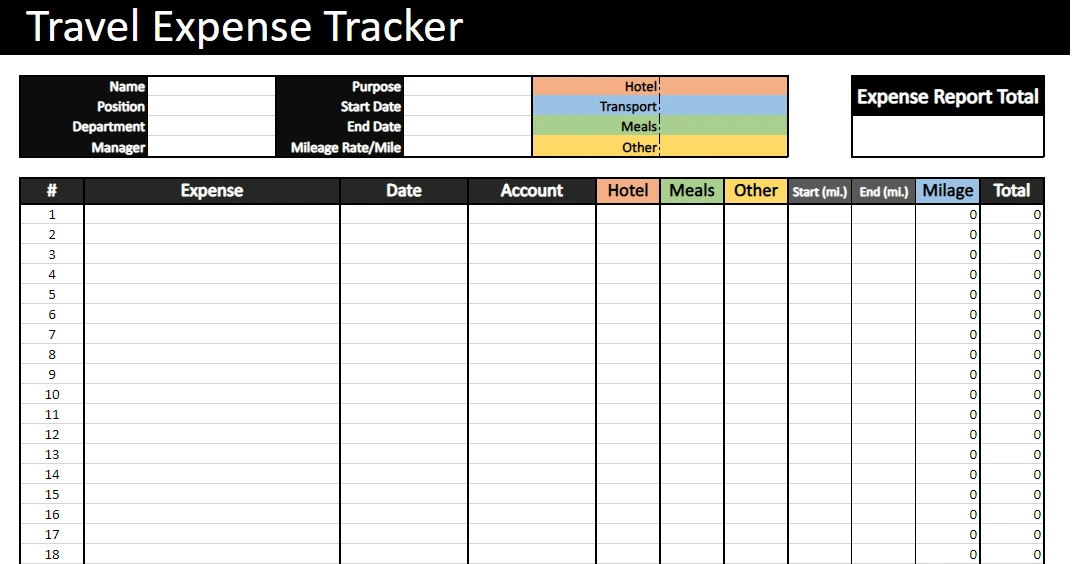

2. Excel Travel Expense Tracker by SpreadsheetPoint

SpreadsheetPoint provides a variety of templates, including simple trackers and business or travel-specific versions. We're highlighting their travel expense tracker, but there are many more.

This business expenses spreadsheet for Excel includes categories for Hotel, Meal, or Other, and a mileage tracking column. To use this Excel spreadsheet, go to "File" then "Save as."

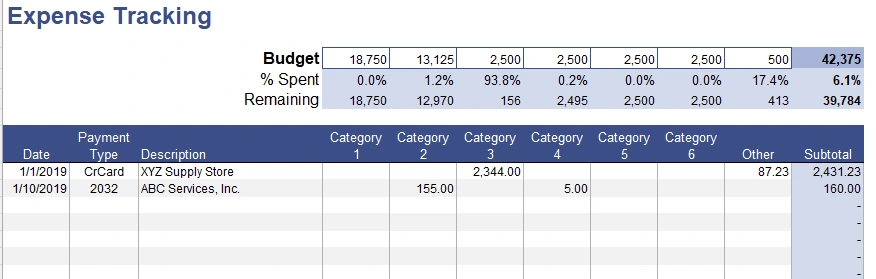

3. Vertex42 Expense Templates

Vertex42 is known for its wide array of business expense templates and expense reports that are highly functional and easy to use right out of the box for tracking business expenses.

We chose this one because it has a budget section at the top of the expense report template, allowing you to see how much of your budget you've spent and how much remains.

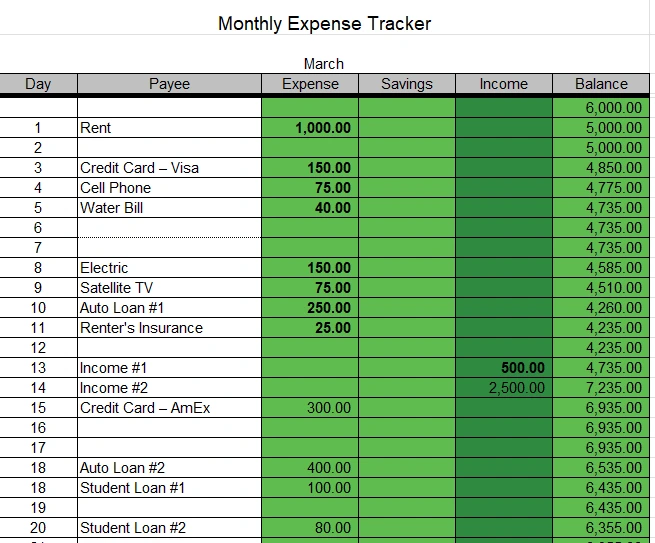

4. Monthly Expense Tracker Excel template by Part Time Money

Part-Time Money has created a monthly business expense spreadsheet for Excel that allows you to log daily expenses. There's also an Income and a Balance tab so that you can keep an eye on your inflow and overall money health simultaneously.

If you're looking for a basic business expenses spreadsheet with a daily and monthly cadence, this is one way to do it.

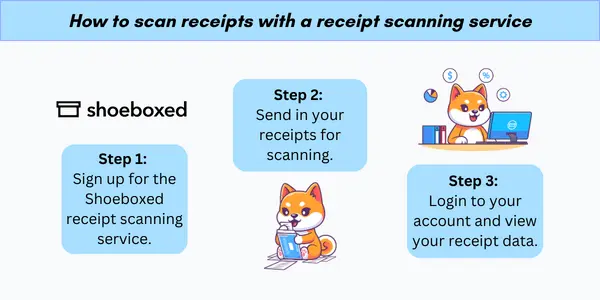

5. Shoeboxed, a receipt scanning service

For small business owners who are always on the go, a notable alternative to spreadsheets and Excel templates would be to use Shoeboxed’s Magic Envelope service to outsource manual entry of receipts and expenses.

The Magic Envelope Service

Starting from $18 per month, you receive a postage-prepaid Magic Envelope that you can keep on your car’s dashboard. Simply stuff receipts into the envelope as you pay for gas, meet clients for lunch out, and purchase supplies.

At the end of the month, send the Magic Envelope to us, and we’ll get all your data scanned and categorized into 15 common tax categories. Easy peasy.

Shoeboxed is the only receipt scanner app that will handle both your paper receipts and your digital receipts—saving customers up to 9.2 hours per week from manual data entry!

Stop doing manual data entry 🛑

Outsource receipt scanning to Shoeboxed’s scanning service and free up your time for good. Try free for 30 days! ✨

Get Started TodayWhat else can Shoeboxed do?

Shoeboxed has been voted as the best receipt scanner app for tax season by Hubspot and given the Trusted Vendor and Quality Choice awards by Crozdesk.

A quick overview of Shoeboxed's award-winning features:

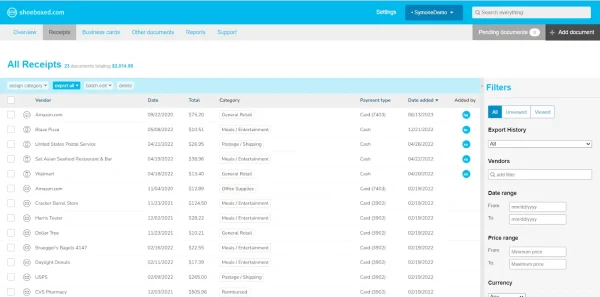

a. Mobile app and web dashboard

Shoeboxed’s mobile app lets you snap photos of paper receipts and upload them to your account right from your phone.

Shoeboxed also has a user-friendly web dashboard to upload receipts, warranties, contracts, invoices, and other documents from your desktop.

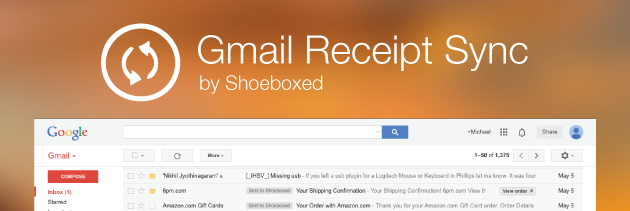

b. Gmail receipt sync feature

Importing e-receipts to your Shoeboxed account is as easy as syncing your Gmail with Shoeboxed, using Shoeboxed's special Gmail Receipt Sync feature.

Shoeboxed’s Gmail Receipt Sync grabs all receipt emails and sends them to your account for automatic processing! These receipts are then marked as Sent to Shoeboxed in your Gmail inbox.

In short, Shoeboxed pulls the receipt data from your email, including the vendor, purchase date, currency, total, and payment type, and organizes it in your account.

Your purchases will even come with images of the receipts attached!

c. Expense reports

Expense reports let you view all of your expenses in one cohesive document. They also make it simple to share your purchases with your accountant.

You can also choose certain types of receipts to include in your expense report. Just select the receipts you want to export and click “export selected.”

d. Search and filter

Call up any receipt or warranty in seconds with advanced search features.

Filter receipts based on vendors, date, price, currency, categories, payment type, and more.

e. Accounting software integrations

Export expenses to your accounting software in just a click.

Shoeboxed integrates with 12+ apps to automate the tedious tasks of life, including QuickBooks, Xero, and Wave Accounting.

f. Unlimited number of free sub-users

Add an unlimited number of free sub-users to your account, such as family members, employees, accountants, and tax professionals.

g. Mileage tracker for logging business miles

After you sign up for Shoeboxed, you can start tracking miles in seconds:

Open the Shoeboxed app.

Tap the “Mileage” icon.

Click the “Start Mileage Tracking” button.

And drive!

Whenever you start a trip, Shoeboxed tracks your location and miles and saves your route as you drive.

As you make stops at stores and customer locations, you can drop pins to make tracking more precise.

At the end of a drive, you’ll click the “End Mileage Tracking” button to create a summary of your trip. Each summary will include the date, editable mileage and trip name, and your tax deductible and rate info.

Click “Done” to generate a receipt for your drive and get a photo of your route on the map. Shoeboxed will automatically categorize your trip under the mileage category in your account.

h. The Magic Envelope for outsourcing receipt scanning

Outsource your receipt scanning with the Magic Envelope!

The Magic Envelope service is one of Shoeboxed's most popular features, particularly for businesses, as it lets users outsource receipt management.

When you sign up for a plan that includes the Magic Envelope, Shoeboxed will mail you a pre-paid envelope for you to send your receipts in.

Once your receipts reach the Shoeboxed facility, they’ll be digitized, human-verified, and tax-categorized in your account.

Have your own filing system?

Shoeboxed will even put your receipts under custom categories. Just separate your receipts with a paper clip and a note explaining how you want them organized!

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic award-winning approach to receipt tracking for tax season. Try free for 30 days!

Get Started TodayGetting started with Excel

When launching Microsoft Excel, users are greeted with a grid of rows and columns, the building blocks of any spreadsheet. Each row and column intersection is called a "cell" and is where data is entered.

The top of the interface contains the Ribbon, which groups all the tools and functionalities of Excel into tabs such as Home, Insert, and Page Layout.

Entering data

To begin inputting data, simply select a cell and begin typing. Data can include numbers, text, or dates. They can follow a consistent structure using techniques like copy-pasting or dragging the fill handle—a small square at the bottom-right corner of the selected cell—to duplicate values across adjacent cells.

Users can organize their data by:

Labeling columns and rows appropriately.

Formatting cells to differentiate between types of data, such as currency or percentages.

Utilizing Table structures for better management and analysis of the information.

Basic formulas

One of Excel's powerful tools is its ability to calculate using formulas. Every formula starts with an equals sign (=) followed by numbers, cell references, and mathematical operators (such as +, -, *, /).

For instance, to sum two numbers, enter =A1+B1 where A1 and B1 are cells containing the numbers to be added. Some essential formulas include:

=SUM(range): Adds up all numbers within the specified range.

=AVERAGE(range): Calculates the mean of the numbers in the range.

=MIN(range) and =MAX(range): Find the smallest and largest numbers in the range, respectively.

By leveraging these basics, users can create a strong foundation for mastering Excel's more complex tools.

How to create your own expense spreadsheet in Excel

A well-designed expense spreadsheet helps users track their financial activities with precision. It should be intuitive and tailored to individual needs to support effective budget management.

1. Start with columns and rows

Columns and rows form the backbone of an expense spreadsheet. Each column typically represents a different category of information, such as the date, expense description, category of expense, amount spent, and payment method. Rows correspond to individual financial transactions or occurrences.

Users should ensure the columns are logically ordered to make data entry and analysis straightforward.

2. Categorize expenses

Proper categorization within an expense spreadsheet enables detailed financial analysis. Users can create specific expense categories such as housing, utilities, groceries, and entertainment. This allows for a segmented view of where money is going each month and aids in spotting trends over time.

Customizing expense categories can help you tailor your spreadsheet to specific industries. For example, here are some great template options for truckers, Airbnb hosts, lawn care service professionals, realtors, etc.

3. Incorporate budget goals

An expense spreadsheet might also include fields for users to input their budget goals.

By setting up columns for budgeted versus actual expenses, individuals can compare their financial targets against real-world expenditure, track their saving goals, and adjust their spending habits accordingly. This helps users stay on target for short- and long-term financial objectives.

See also: Expense Log Printable: 5 Free Templates to Budget Better

Advanced Excel functions

In managing expenses on a spreadsheet, mastery of advanced Excel functions and features will elevate your spreadsheet's efficiency and analytical power.

1. Use conditional formatting

Conditional Formatting is a potent tool that allows users to apply formatting to cells depending on the cell's value.

For example, expenses that exceed a certain threshold can be highlighted in red, providing a quick visual cue that can alert users to potential overspending. Additionally, it can be used to create color scales, helping to identify trends in spending over time.

2. Validate your data

Data Validation ensures that the data entered into an Excel spreadsheet meets specific criteria, thereby maintaining the integrity of the dataset.

For financial records, it is crucial as it can restrict entries to certain numeric ranges, limiting the possibility of entry errors. A common application might be to ensure that expense entries are categorized correctly, using a drop-down list to select expense types.

3. Use pivot tables and charts

Pivot Tables and Pivot Charts are sophisticated functions designed for summarizing, analyzing, exploring, and presenting data in various ways.

They become invaluable when dealing with extensive financial data, allowing users to quickly consolidate and compare expenses. They can reorganize data by categories and subcategories and produce summarized tables, which can then be visualized using Pivot Charts for more effective reporting on financial conditions.

4. Use macros

An effective business expenses template in Microsoft Excel can be significantly enhanced through automation. Automation streamlines repetitive tasks, ensuring both accuracy and efficiency.

Macros in Excel are a powerful tool to automate repetitive tasks.

Users can record a sequence of actions to create a macro, which can then be executed to perform the task automatically.

For instance, when managing expenses, users might create a macro to format cells, insert formulas, and categorize expenses. This helps maintain consistency across reporting and data management.

5. Create drop-down lists

Drop-down lists simplify data entry, reducing errors and standardizing entries.

To create a drop-down list in an expense spreadsheet:

Select the cell where the drop-down list is needed.

Go to the Data tab and click Data Validation.

In the Data Validation dialog box, choose List under Allow.

Input the desired list of items or reference a range of cells containing the options.

By using drop-down lists, businesses can classify expenses effortlessly, helping with sorting and analysis later on.

See also: Printable Expense Tracker: Top 5 Free Templates

In closing

The cornerstone of an effective expense spreadsheet is its up-to-dateness.

Users should establish a routine to update their spreadsheet with new expenses as they occur. For businesses, this could be daily or weekly; for personal use, weekly or immediately after incurring an expense might be sufficient.

Additionally, to safeguard against unexpected data loss or corruption, users should employ robust data backup strategies. One approach could be using Excel's built-in AutoRecover function, which periodically saves a copy of the spreadsheet.

For anyone who wants to move beyond a Microsoft Excel spreadsheet or a Google expense tracker, consider using Shoeboxed to outsource receipt scanning and expense management!

Tomoko Matsuoka is the managing editor for Shoeboxed, MailMate, and other online resource libraries. She covers small business tips, organization hacks, and productivity tools and software.

Break free from manual data entry ✨

Use Shoeboxed’s Magic Envelope to ship off your receipts and get them back as scanned data in a private, secure cloud-based account. 📁 Try free for 30 days!

Get Started TodayAbout Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!