Are you over budget because you can’t keep track of your spending? Managing your money means knowing where it’s going.

One of the best ways to know where your money is going is to track your spending. An expense tracker printable will help you track your spending, stick to your budget, and achieve your financial goals.

Why track expenses?

Tracking expenses is more than just a record of actual expenses—expense tracking gives you the insights to save more and be more financially stable.

1. To achieve your goals

Tracking expenses helps you stick to your budget to achieve your financial goals. Knowing where your money is going is the first step to saving for a big purchase, paying off debt, or building an emergency fund.

2. To make sound financial decisions

Tracking expenses gives you insight to make wise financial decisions. Knowing where your money is going is key to adjusting your spending habits.

3. To save more

Tracking expenses helps you find where to cut back. That means more savings and less overspending.

What are the benefits of using a personal expense tracker?

Using an expense tracker has several benefits that will improve your financial management:

1. Organization

An expense tracker helps you stay organized by keeping all your financial info in one place. That makes it easier to review your spending and budget.

2. Find savings

An expense tracker lets you see bills and all other expenses so you can more easily see where you can cut back on unnecessary expenses.

3. Realistic budgeting

By knowing your spending habits you can create a realistic and achievable budget to help you accomplish your financial goals.

4. Stress reduction

Managing your business or personal finances can be stressful but understanding and analyzing your expenses will reduce anxiety and give you more control over your money.

How to pick the right expense tracker

In choosing the most effective expense tracker, keep the following in mind:

1. How often to track

Do you want to track daily, weekly, or monthly expenses? Your choice will depend on how closely you want to monitor your spending.

2. Features

What features do you need in an expense tracker, categories, data fields, and layout? Choose a free expense tracker printable that suits your business or personal expenses and financial goals.

3. Ease of use

The tracker should be easy to use and access. Whether you like simple or detailed, choose one you’ll most likely use consistently.

What are the types of expense trackers?

Expense trackers come in many forms, each for different needs and preferences.

1. Daily expense trackers

For those who want to track expenses in real time, you should consider a daily expense tracker. A daily free expense tracker helps you monitor your spending and make adjustments quickly.

2. Weekly expense trackers

A weekly spending tracker gives you a broader view of your spending. This allows you to review your finances at the end of the week and make changes.

3. Monthly budget/expense trackers

A monthly budget/expense tracker gives you the overall view to make long-term financial decisions based on a complete picture of your spending.

What to look for?

When choosing an expense tracker, several key features should be considered to make sure it suits your needs and helps you manage your finances effectively.

Here are the main features to look for:

1. Categories

Decide what categories to track: housing, food, transportation, etc. This will help you see where your money is going, how much is going into each category, and where to cut back.

2. Data fields

At the very least, you will want to track each expense's date, amount, and category. The more data fields, the more insight you’ll get.

3. Layout

What’s the design and layout of the tracker? Some like tables and charts, others a simpler format.

How to pick the right expense tracker

Picking the right expense tracker will make a big difference in your financial management.

Here’s how:

1. Financial goals

Choose a tracker that aligns with your financial goals. Whether saving, debt reduction, or budgeting, the right tracker will help you achieve your goals.

2. Ease of use

Make sure the tracker is easy to use and accessible. If it’s difficult to use, you won’t use it consistently.

3. Level of detail

How much detail do you want to track? Some people like a simple overview, others want to see everything.

Top 5 free printable expense log templates

Here are the top 5 free printable expense logs:

1. Daily Expense Tracker by The Savvy Mama

This daily expense tracker tracks your spending in real-time. It includes categories for income, fixed expenses, and variable expenses.

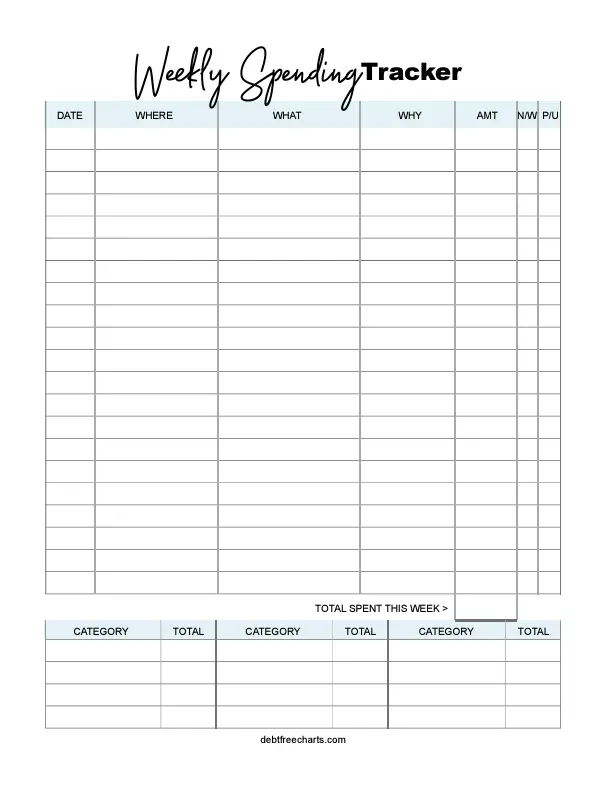

2. Weekly Expense Tracker by Debt-Free Charts

The weekly expense tracker offers a broader view of your finances. This weekly expense tracker includes income, personal or business expenses, and savings categories.

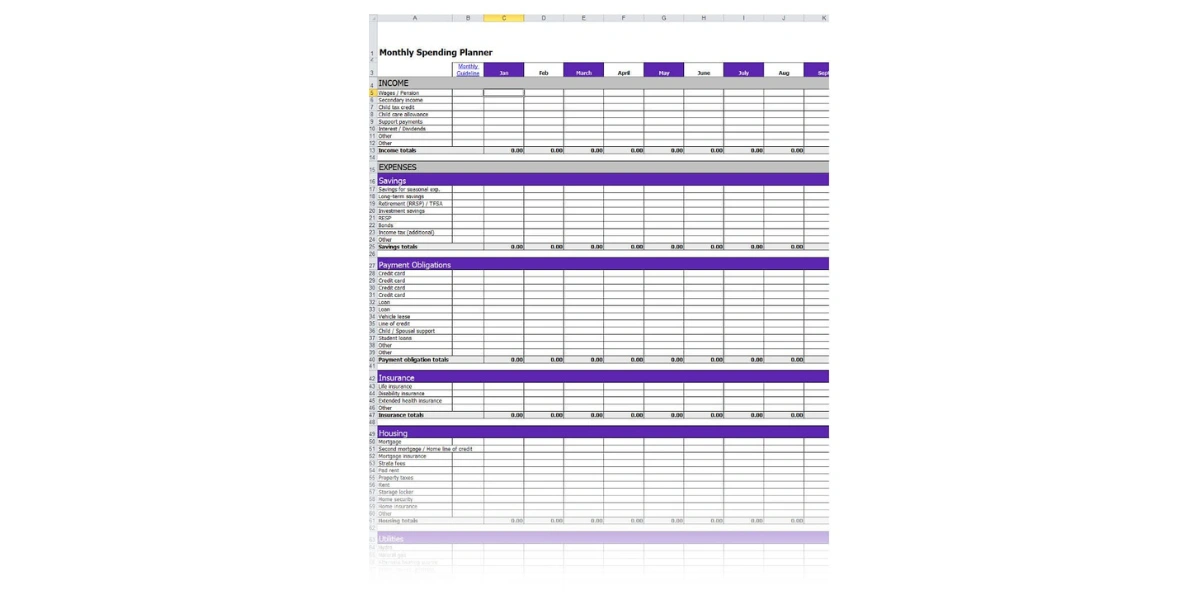

3. Monthly Expense Tracker by No More Debts

For long-term planning, this monthly expense tracker includes categories for income, fixed expenses, and variable expenses. It helps you make informed financial decisions based on a comprehensive overview.

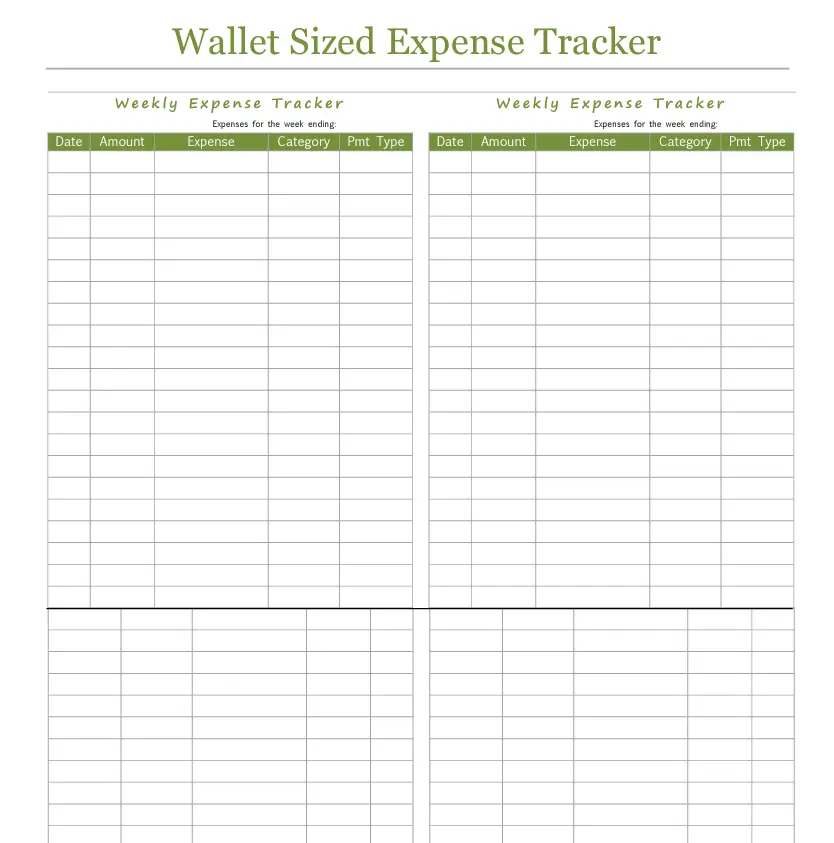

4. Wallet-sized Printable Expense Tracker by Frugal and Thriving

This wallet-sized tracker includes income, personal or business expenses, and savings categories. It’s for on-the-go use since it is so compact.

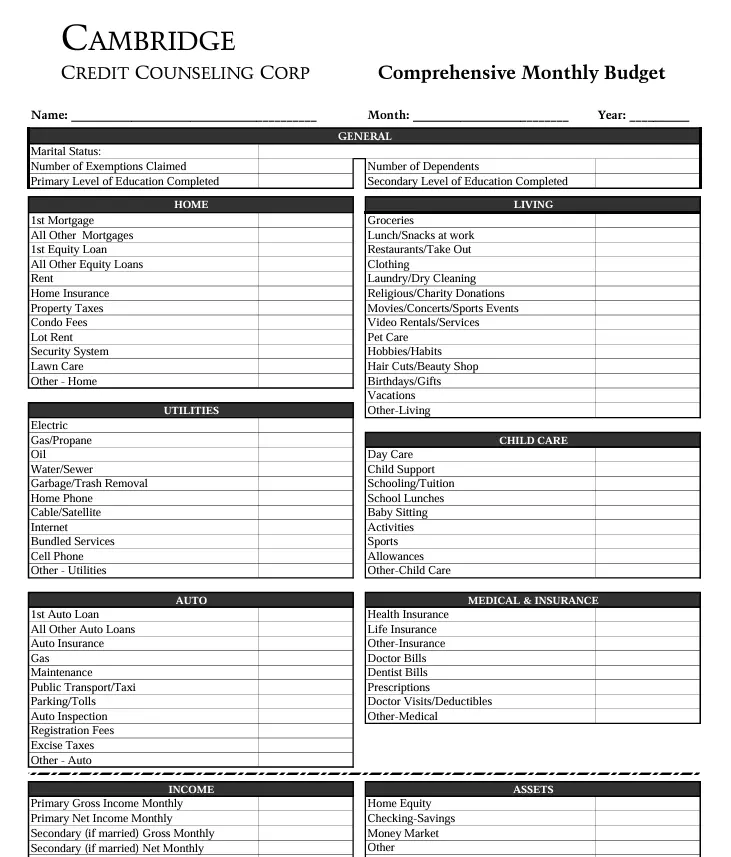

5. Printable Budgeting Worksheets by Cambridge Credit Counseling Corporation

This comprehensive budgeting worksheet helps you track your expenses and create a budget. It provides a clear picture of your financial situation with categories for income, fixed expenses, and variable expenses.

What are the downsides of printable expense logs?

Printable expense trackers are super popular and easy to use, but they have some limitations that may make them not so great for financial management.

Here are the downsides:

1. Manual entry

You have to manually enter every transaction, which can be time-consuming and prone to mistakes. Over time, maintaining a paper log can lead to inconsistencies and gaps in your records.

2. Limited access

Printable logs are physical documents, so you have to carry them, such as the wallet expense tracker, or remember to update them later. If you forget or lose your log, it can disrupt your tracking process and make it harder to stay on top of your expenses.

3. Organizational challenges

Tracking paper logs can get messy, especially over time. You may need to store multiple pages or notebooks, which can quickly get disorganized, lost, or take up too much space.

4. No integration

Printable expense logs don’t integrate with other financial tools. This means you have to manually analyze your spending, generate reports, and incorporate them into your accounting software, which increases the risk of errors and inefficiencies.

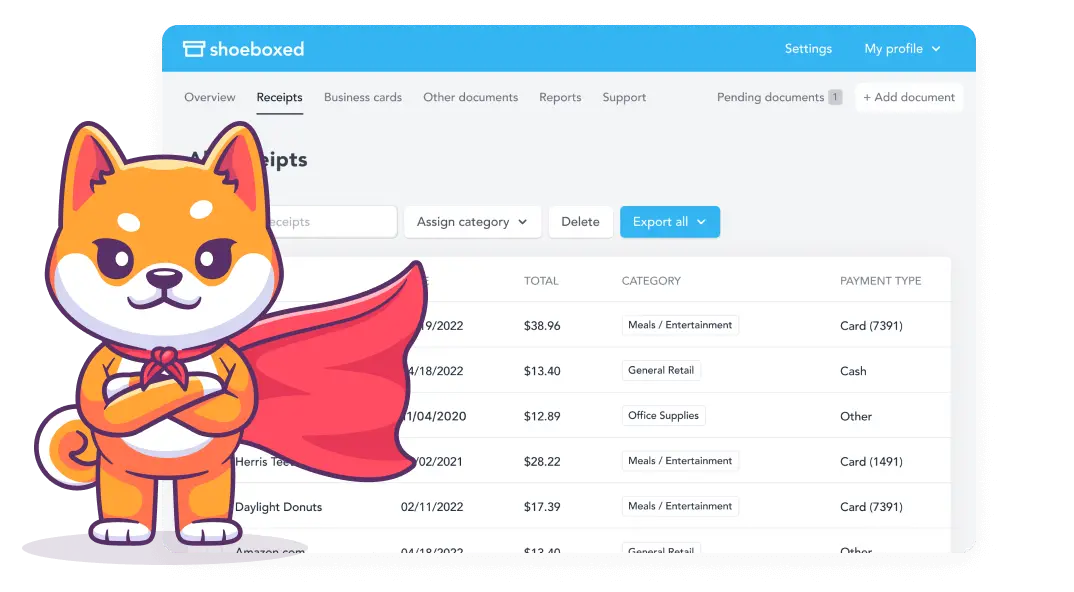

Shoeboxed—the best alternative to printable expense logs

If you want a more efficient solution, Shoeboxed is the digital alternative to expense tracking. Shoeboxed lets you scan and digitize receipts, categorize expenses, and generate reports. It integrates with popular accounting software, so you don’t have to enter anything manually.

For those looking for a more efficient and effective way to manage expenses, Shoeboxed is the best alternative to free printable expense trackers.

Here’s why:

Digital receipt management

Shoeboxed transforms the way you manage receipts and expenses. It turns receipts into digital data.

Accessibility and security

Instead of carrying a wallet-sized printable expense tracker and filling it out manually while on the go, Shoeboxed has a mobile app that will scan receipts, extract data, and categorize expenses for you.

With Shoeboxed's receipt scanner app, simply snap a picture and upload it to your Shoeboxed account,

Magic Envelope service

For those who want an even easier way to get receipts into their accounts, Shoeboxed’s Magic Envelope service does just that.

Just stuff your receipts into Shoeboxed’s postage-paid envelopes and outsource receipt scanning to the pros.

The Shoeboxed team will scan, human-verify, and upload receipts to your account.

Shoeboxed is the only receipt scanner app that will handle both your paper receipts and your digital receipts—saving customers up to 9.2 hours per week from manual data entry!

With digital receipts, you can access your expense data from anywhere, anytime. Shoeboxed uses secure cloud storage to ensure your financial data is safe and always accessible.

Expense reports

With Shoeboxed, you can automatically generate detailed expense reports to get a summary or overview of your personal or business expenses.

Integration

Integrate Shoeboxed with accounting software like QuickBooks, Xero, and many others so you can automatically sync your expense data for accounting and tax purposes. That way, your data is consistent and up-to-date across all platforms.

IRS compliance

Shoeboxed ensures all digital copies of receipts are legible and categorized according to IRS guidelines for tax preparation and audit protection.

An Overview of Shoeboxed

While a free printable expense tracker is good for those who like paper-based methods, it’s a lot of work.

Shoeboxed offers a powerful and efficient alternative. It automates the expense tracking process and provides added benefits such as secure storage, easy integration, and compliance with tax regulations.

For professionals and businesses looking for a streamlined approach to finance management, Shoeboxed is undoubtedly the best choice.

Break free from manual data entry ✨

Use Shoeboxed’s Magic Envelope to ship off your receipts and get them back as scanned data in a private, secure cloud-based account. 📁 Try free for 30 days!

Get Started TodayWhat are the advantages of Shoeboxed over expense log printables?

Shoeboxed has several advantages over printable expense logs:

1. Automation of data entry

Shoeboxed lets you scan and digitize receipts with your phone. Optical Character Recognition (OCR) technology extracts date, amount, and merchant, so you don’t have to enter it manually.

2. More accessible

Shoeboxed stores your digitized receipts and expense data in the cloud so you can access it from any device with the internet. You can update and review expenses at home, work, or on the go without carrying physical documents.

3. More organized

Shoeboxed automatically organizes your expenses for you so you can see spending patterns and review financial data. You can search for specific transactions, sort by date or category, and add notes or tags for extra context.

4. Integrates with financial tools

One of Shoeboxed’s best features is integration with accounting software like QuickBooks, Xero, and many more. This means your expenses are automatically synced to your financial records, so you save time and effort in bookkeeping.

5. Secure and durable

Unlike paper logs that can get lost or damaged, Shoeboxed stores your financial data in the cloud. With Shoeboxed, you have a permanent digital record of your expenses that’s safe from physical loss or damage.

6. Reports

Shoeboxed lets you automatically generate detailed expense reports to see where you’re spending the most. You can customize it to meet your budgeting, tax prep, and financial planning needs.

Why Shoeboxed?

While printable expense logs are easily accessible, they have many limitations that hinder good financial management. Shoeboxed solves those problems by offering a more complete, automated, and secure solution to expense tracking and financial management.

With its features, ease of use, and integration with other financial tools, Shoeboxed is the best alternative to printable expense logs.

Turn receipts into data with Shoeboxed ✨

Try a systematic approach to receipt categories for tax time. Try free for 30 days!

Get Started TodayFrequently asked questions

How do I start to track expenses?

Start expense tracking by choosing a method that will be the most efficient for you so you will stick with it. Begin by recording all your expenses, categorizing them, and reviewing your spending habits regularly.

How does Shoeboxed make expense tracking easier?

Shoeboxed makes expense tracking easier by digitizing and organizing your receipts, and automatically categorizing expenses and generating accurate financial records and reports. It integrates with other accounting software, so it’s a comprehensive financial management tool.

In conclusion

Tracking your expenses is key to budgeting and financial management. While free printable expense trackers are easily accessible and simple, digital tools like Shoeboxed are more comprehensive, accurate, and efficient.

Expense tracking is a powerful way to manage finances, cut overspending, and achieve financial goals. By being more aware of your spending habits and making sound financial decisions, you’ll be more in control of your budget and more financially secure.

Caryl Ramsey has years of experience assisting in different aspects of bookkeeping, taxes, and customer service. She uses a variety of accounting software for setting up client information, reconciling accounts, coding expenses, running financial reports, and preparing tax returns. She is also experienced in setting up corporations with the State Corporation Commission and the IRS.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!