Managing expenses efficiently and accurately is crucial for maintaining budget control and ensuring financial transparency. Expense management automation solutions have become indispensable tools for businesses of all sizes.

What is expense management automation?

Expense management automation refers to using expense management software or online tools to streamline, automate, and manage the processes involved in tracking, approving, and reimbursing employee expenses. This technology replaces traditional, manual ways of controlling and managing employee expenses, typically involving paper receipts, spreadsheets, and manual entry into accounting systems.

What are the top automated expense management systems?

Here is a listicle of the top business expense and management automation software options available on the market, including an overview of their features, pros, cons, pricing, and why each might be the right choice for your business needs.

1. Shoeboxed - ideal for freelancers, small businesses, and anyone needing an efficient way to manage receipts, expense reports, and tax deductions

Shoeboxed is cloud-based expense management software that digitizes and organizes receipts, invoices, and other documents. Shoeboxed simplifies expense tracking and reporting, making preparing for tax season and managing finances quick and easy.

Key features of Shoeboxed

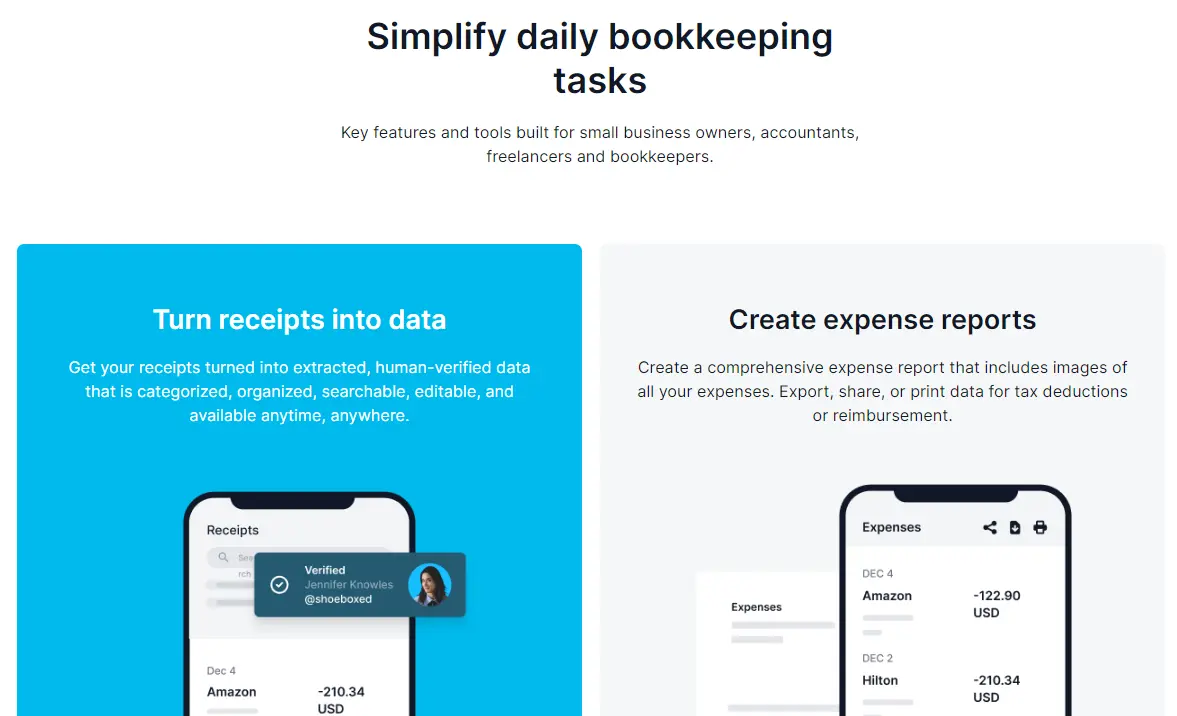

Shoeboxed specializes in turning cluttered piles of receipts into digitized, categorized, IRS-accepted data with minimal user input.

Receipt scanning app

Receipt capture: The Shoeboxed app lets users snap pictures of their receipts using smartphones.

Data extraction: Shoeboxed utilizes Optical Character Recognition (OCR) technology to automatically extract critical data from receipts, such as vendor names, dates, and totals.

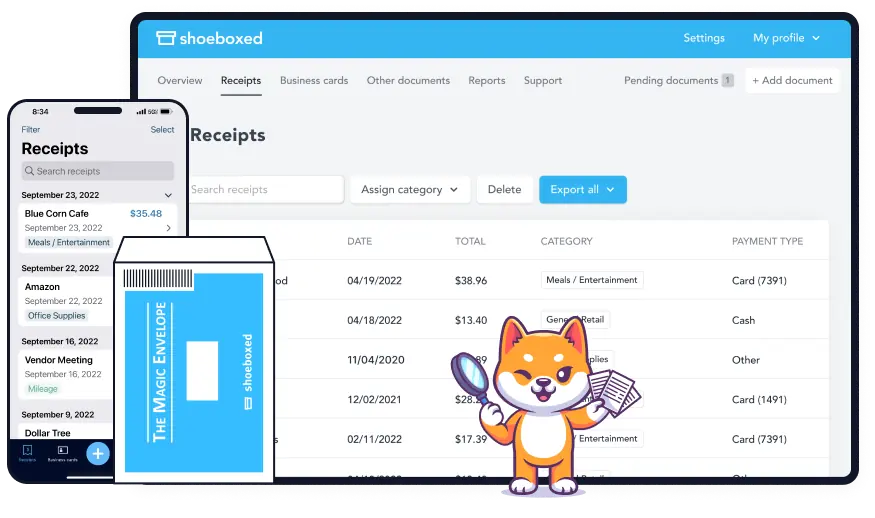

Magic Envelope service

The Magic Envelope service is a prepaid postage envelope that allows users to outsource their scanning by filling the envelope with receipts and mailing it to Shoeboxed, where they will scan, human-verify, and upload receipts on behalf of the users.

Break free from manual data entry ✨

Use Shoeboxed’s Magic Envelope to ship off your receipts and get them back as scanned data in a private, secure cloud-based account. 📁 Try free for 30 days!

Get Started TodayExpense tracking

Categorization: After scanning, receipts are categorized, making tracking and managing expenses more manageable. Users can also customize categories according to their specific needs.

Reporting: Shoeboxed allows users to generate expense reports quickly.

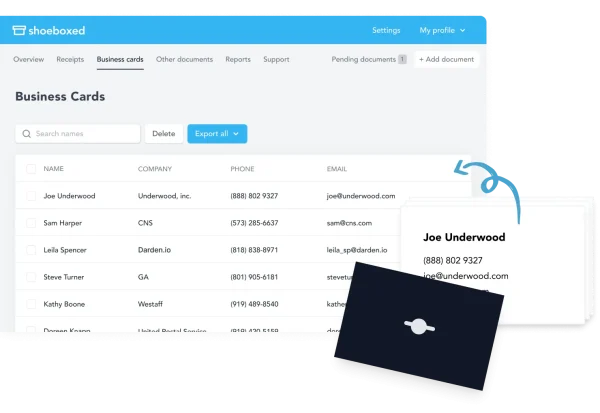

Business card management

Digital conversion: Business cards can be scanned and converted into digital contacts within the Shoeboxed app. This information can then be exported to contact lists or customer relationship management (CRM) systems.

Mileage tracking

GPS features: The Shoeboxed app includes a mileage tracking feature that uses GPS to accurately record distances traveled for business purposes.

Document management

Digital archive: All scanned documents are stored securely in the Shoeboxed cloud, which can be accessed, searched, and managed online from anywhere.

IRS compliance

Audit-ready: The digital versions of receipts created by Shoeboxed are accepted by the IRS and CRA (Canada Revenue Agency), ensuring that users are prepared for audits.

Integration capabilities

Accounting software integration: Shoeboxed integrates with popular accounting software like QuickBooks, Wave, and Xero, facilitating seamless financial reporting and reconciliation.

Pros

Ease of use: The app is straightforward, making it easy for anyone to digitize their receipts and manage expenses.

Efficient document management: Offers a practical solution for clutter reduction by converting physical documents into organized digital data.

Compliance: Ensures that all digitized receipts are stored in compliance with IRS guidelines, providing peace of mind for audit preparedness.

Cons

The mileage tracker is manual, so the app won’t automatically log your drives. However, this makes it easier to separate personal from business trips on your mileage log

Pricing

The startup plan starts at $18 monthly, and the professional and business plans offer additional features.

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic award-winning approach to receipt tracking for tax season. Try free for 30 days!

Get Started Today2. SAP Concur - ideal for larger enterprises with complex needs, offering extensive customization and integration with various software systems

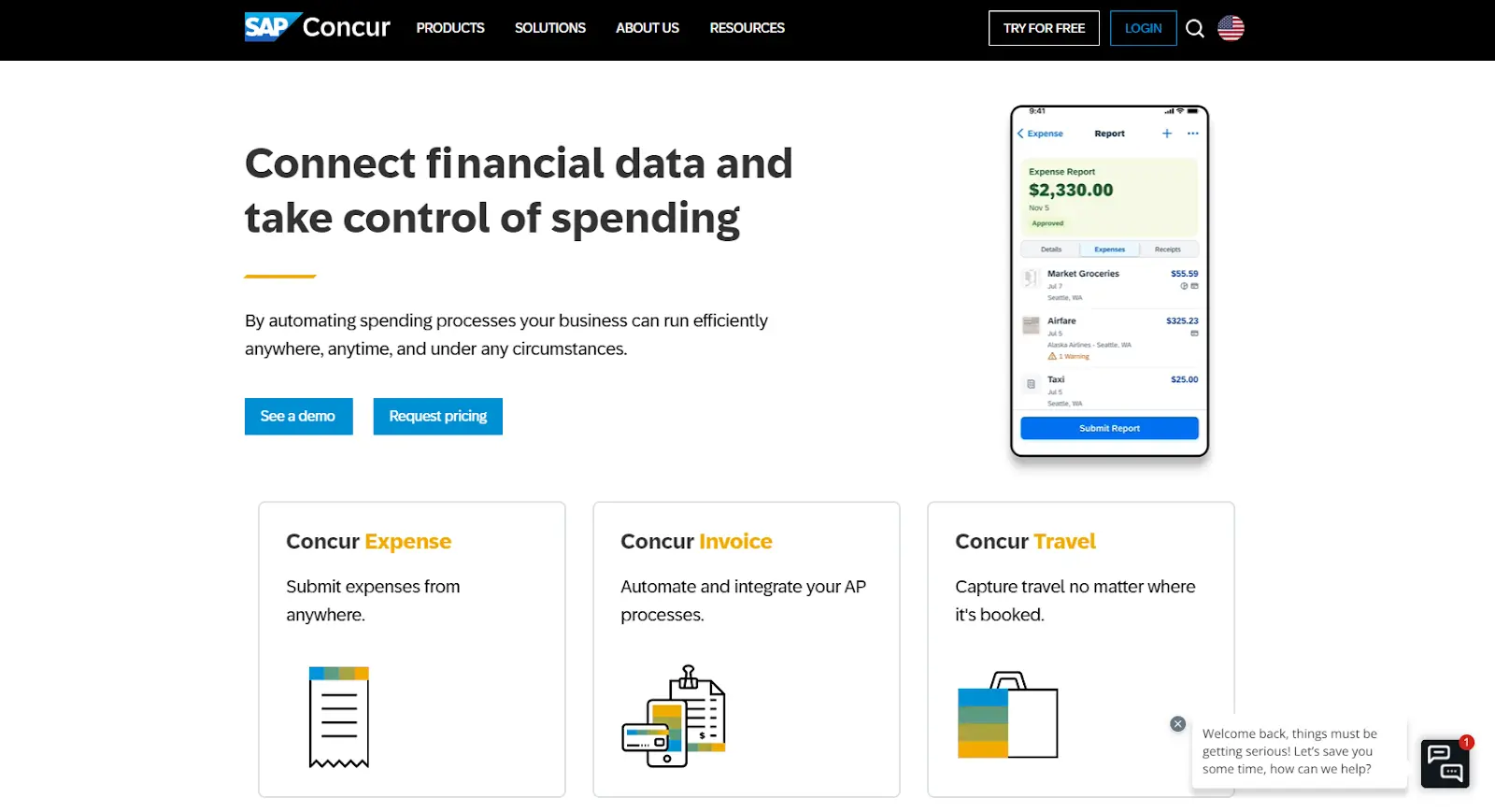

SAP Concur is expense management automation software designed to streamline and integrate travel, invoice, and expense management into a single platform. It is well-suited for medium—to large enterprises or businesses with extensive travel and expenditures.

Key features of SAP Concur

Concur is a comprehensive expense management system that includes automated expense reporting, integration with ERP systems, and real-time expense tracking.

Expense management

Automated expense reporting: Concur automates the expense reporting process. Employees can capture receipts using mobile devices, and the software automatically populates expense reports.

Policy compliance: The system enforces company policies, automatically detecting violations and notifying managers, which helps maintain compliance and control costs.

Travel management

Integrated travel booking: Concur Travel offers a complete travel booking solution within the same platform, allowing employees to plan, book, and manage their travel.

Itinerary management: Concur automatically generates travel itineraries that integrate with mobile calendars.

Invoice processing

Automated invoicing: Concur automates the capture and payment process.

Vendor payments: The system facilitates vendor payments and manages the workflow from invoice receipt to payment.

Mobile app

Concur mobile: The SAP Concur mobile app allows users to manage expenses, invoices, and travel from their smartphones. This includes photographing receipts, adding them to expense reports, and approving or booking travel arrangements.

Integration capabilities

ERP and accounting integration: Concur integrates with various ERP systems and accounting software.

Data and analytics

Reporting and insights: Concur offers reporting tools and dashboards that provide insights into spending trends.

Pros

Integration of travel, expense, and invoice management.

Customization options to fit various business processes.

Cons

It can be expensive, particularly for smaller businesses or those not leveraging the full suite of features.

The extensive features present a steep learning curve for new users.

It can be complex to set up.

Pricing

SAP Concur offers custom pricing based on the specific needs and scale of the organization. Businesses need to contact SAP Concur directly to obtain a tailored quote.

3. Expensify - good option for small to medium-sized businesses that need straightforward expense management

Expensify is an expense management system that simplifies how businesses and individuals track and manage expenses, reimbursements, and business travel. Known for its user-friendly interface and extensive features, Expensify is popular among small to medium-sized businesses, freelancers, and mobile professionals.

Key features of Expensify

Expensify automates expense reporting from receipt scanning to complete reimbursement requests. Its SmartScan technology automatically reads receipt details, and the app can synchronize with accounting software like QuickBooks.

SmartScan technology

Receipt scanning: Users can take photos of their receipts using their mobile devices. Expensify’s SmartScan technology automatically reads and imports expense data from the receipts, eliminating the need for manual entry.

Expense reports

Automated reports: Expensify automatically generates expense reports from scanned receipts and categorizes them based on predefined rules.

Multi-level approval workflows: The expense management software supports customizable approval workflows, allowing businesses to set up a straightforward process for reviewing and approving expense reports.

Corporate card reconciliation

Card transactions: Expensify syncs with users’ corporate cards, pulling transactions directly into the platform for easy reconciliation.

Travel integration

Concierge travel: Expensify includes a feature called Concierge Travel, which helps users book travel and accommodations directly within the app, often at discounted rates.

Multi-currency and international support

Global compatibility: The platform supports automatic currency conversion based on real-time exchange rates and can handle expenses from anywhere in the world, making it ideal for international travelers.

Integration with accounting software

Broad compatibility: Expensify integrates with major accounting packages such as QuickBooks, Xero, Sage, and more, allowing data synchronization and financial reporting.

Mobile app

Full functionality: The Expensify mobile app offers all the features available on the desktop version, enabling users to manage their expenses on the go.

Advanced-data security

Secure data handling: Expensify uses security measures to protect user data, including secure servers and data encryption, ensuring that sensitive financial information is safe.

Pros

User-friendly interface: Expensify is known for its clean and intuitive interface.

Automation features: Expensify automates most expense management processes, from receipt scanning to report generation.

Versatile integration options: The ability to integrate with a wide range of accounting software and financial systems adds to its flexibility.

Cons

Pricing: It can be considered pricey for smaller businesses or individuals who might not need all its capabilities.

Customer support: Some users report that customer service can be slow, especially during peak times, which might concern businesses needing immediate support.

Receipt scanning: Some users find the receipt scanning feature occasionally inconsistent.

Pricing

Expensify offers several pricing tiers, starting with a basic free plan with limited scans. Paid plans begin at $5 per user per month for the Collect plan and $9 per month for the Control plan, including advanced features and integrations.

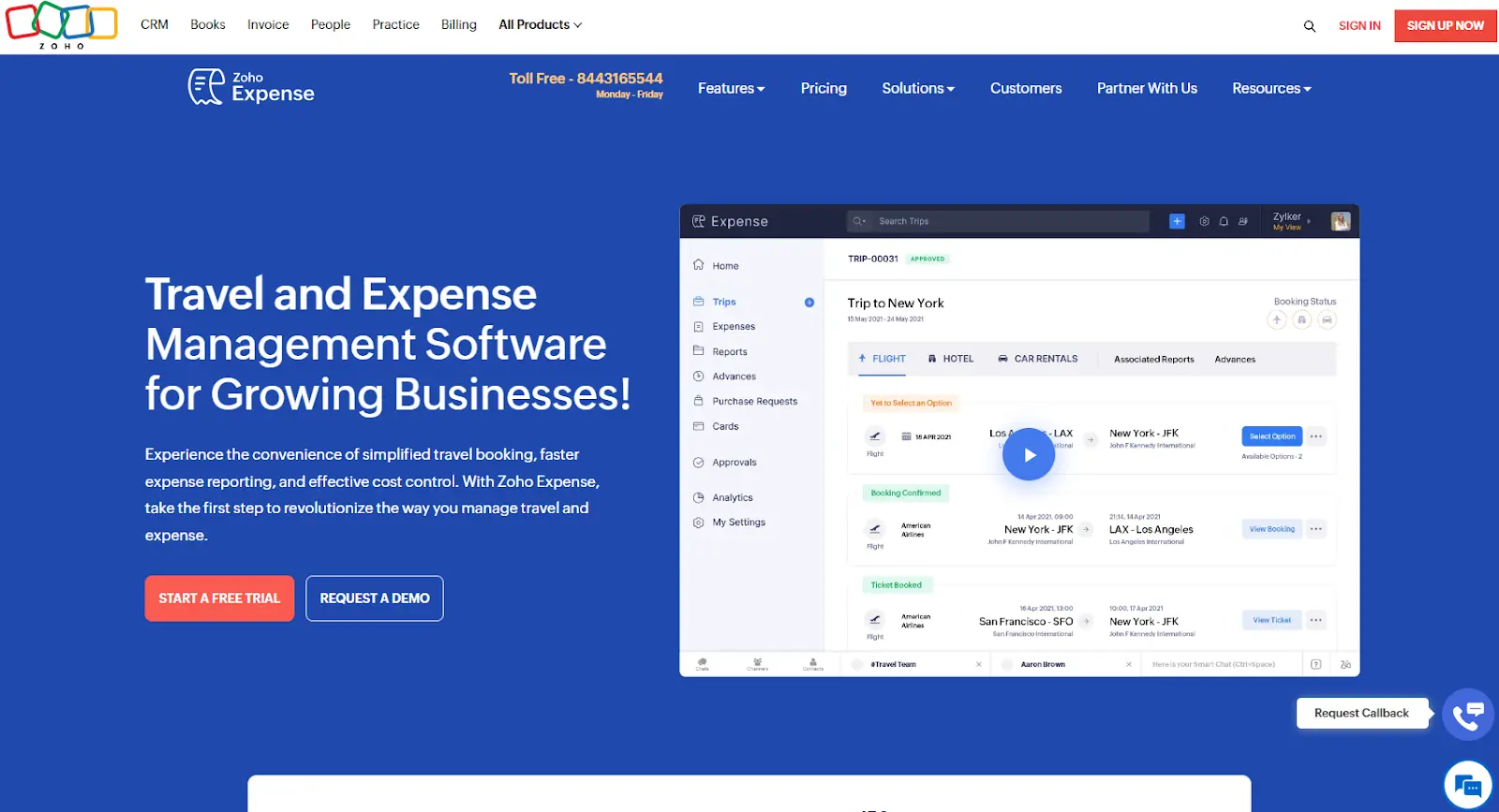

4. Zoho Expense - economical for small businesses

Zoho Expense is a cloud-based expense management system that forms part of the extensive suite of Zoho applications designed for businesses. It is geared for small to medium-sized businesses due to its feature set, ease of use, and integration with other Zoho products.

Key features of Zoho Expense

Zoho Expense offers automatic expense recording, receipt scanning, and analytics.

Automated receipt scanning

OCR technology: Users can snap photos of their receipts, and Zoho Expense's OCR (Optical Character Recognition) technology automatically extracts pertinent data such as date, amount, vendor, and category.

Expense reporting

Easy report generation: Employees can create expense reports, bundle related expenses, and submit them for approval. Managers can then review and approve reports directly within the app.

Customizable approval workflows: Zoho Expense allows custom approval workflows to fit the company’s hierarchy and processes.

Multi-currency and global compliance

Global usage: It supports multiple currencies and is compliant with international tax regulations, making it suitable for businesses with global operations or employees who travel internationally.

Integration with central financial accounting and finance software

Seamless integration: Zoho Expense integrates with major accounting software like Zoho Books, QuickBooks, and Xero, ensuring that expense data flows directly into financial records without requiring manual re-entry.

Corporate card reconciliation

Card integration: Automatically imports transactions from corporate credit cards and matches them with receipts to keep track of all expenses and ensure they are fully accounted for.

Advanced analytics and reporting

Insightful dashboards: Provides analytics on spending patterns.

Customizable reports: Users can generate custom reports to track specific expense metrics important to the business.

Travel and advance management

Travel booking integration: This feature facilitates travel planning and booking, allowing for an easy transition from travel expenses to report submission.

Advance management: This feature manages employee cash advances, tracking how much is spent and reconciling any remaining amounts.

Mobile application

Mobile functionality: A full-featured mobile app that allows users to capture receipts and manage reports on the go.

Pros

User-friendly interface: Known for its intuitive design, it makes navigation and operation straightforward.

Affordability: Offers competitive pricing.

Integration with Zoho Suite: This integration is especially beneficial for companies already using other Zoho products, as it is well within the Zoho ecosystem.

Cons

Customization limits: While highly configurable, it may not offer as much depth in customization as some larger, more specialized systems.

Dependent on the Zoho Ecosystem: The best advantages are realized when used with other Zoho applications.

Pricing

Zoho Expense offers a free plan for up to three users, which includes basic features. Paid plans start at $4 per user per month (billed annually) for the Premium plan, which includes advanced features such as integration capabilities and sub-user policies.

What is the traditional expense management process?

Traditional expense management involves several manual steps that can be time-consuming and prone to errors. Understanding these steps can highlight the inefficiencies many businesses experience and the advantages of automating expense management and moving to automated systems.

Step 1. Incurring the expense

The process begins when an employee incurs an expense related to business activities. These various business expenses could include travel, office supplies, client entertainment, etc.

Step 2. Collecting receipts

Employees are responsible for all expense claims and collecting and keeping physical receipts to document each expense claim.

Step 3. Filling out expense reports

Employees on business trips must then fill out expense reports, a process that typically involves manually entering the details of each expense into a form or spreadsheet. This includes the expense's date, amount, and purpose, and often a categorization of expense categories based on the nature of the expense (e.g., meals, lodging, transportation).

Step 4. Submitting reports for approval

Once the expense report is completed, it’s submitted to a manager or the finance department for approval. This usually involves physically handing over the expense report and the collected receipts or emailing them if the initial entry was digital.

Step 5. Review and approval

The manager or finance team reviews the submitted expense report and the accompanying receipts to verify that all expenses are legitimate, necessary, and comply with the company’s expense policy.

Step 6. Processing and reimbursement

Once an expense request or report is approved, it moves to the company's accounting system or payroll department for processing. The reimbursement amount is calculated, and funds are disbursed to the employee, typically through a paycheck or as a separate bank transfer.

Step 7. Archiving for record-keeping and tax compliance

Finally, completed and approved expense reports and receipts must be archived for record-keeping.

Challenges of traditional expense management

Time-consuming: Each step involves manual intervention, making the process slow and labor-intensive.

Error-prone: Manual data entry and physical handling of receipts and forms increase the likelihood of errors.

Lack of real-time visibility: It’s difficult for management to get real-time insights into spending patterns or enforce compliance proactively.

Delayed reimbursements: The lengthy process can delay reimbursing employees, impacting morale and cash flow.

How do you automate your expense management system?

To implement effective automated expense management systems, choose the software that aligns with your business needs and follow these steps.

Step 1. Evaluate needs

Assess your business's specific needs and challenges to choose a solution that best fits.

Step 2. Plan integration

Ensure the tool integrates smoothly with your existing accounting software and workflows.

Step 3. Train staff

Educate employees on using the new system effectively to ensure a smooth transition.

Step 4. Monitor and adjust

Continuously monitor the system’s performance and adjust as needed to maximize benefits.

Why automate expense management?

There are many benefits to automating expense management.

Increased efficiency

Automation significantly speeds up all aspects of the expense management process, from receipt capture to reimbursement, saving time for employees and finance and accounting teams.

Reduced errors

Automatic data extraction and pre-defined rules minimize human errors common in manual processes.

Improved compliance

The system can automatically enforce corporate, expense, and reimbursement payment policies.

Enhanced visibility

With real-time data and analytics, businesses gain better visibility into their spending and growth.

Cost savings

Efficient processing reduces administrative costs and expense fraud; better policy enforcement reduces inappropriate spending.

Employee satisfaction

Faster processing and reimbursement improve employee satisfaction and reduce their administrative burden.

Frequently asked questions

What are the benefits of expense management automation?

Expense management automation effectively transforms a traditionally cumbersome process into a streamlined, efficient, and user-friendly system. It not only saves time and costs but also provides strategic benefits through improved data accuracy and financial insights.

Why is Shoeboxed considered a top expense management automation solution?

Shoeboxed provides a valuable service for individuals and businesses looking to automate expense management. With its features like receipt scanning, fully automated expense management reports and tracking, and IRS-compliant digital storage, Shoeboxed is an excellent tool for financial organization, especially useful for tax preparation and expense reporting.

In conclusion

Expense management automation transforms the traditionally labor-intensive and error-prone manual expense management and reporting process into a streamlined, efficient, and accurate system. It facilitates financial and improved expense management and contributes to strategic budgeting and financial planning.

Caryl Ramsey has years of experience assisting in different aspects of bookkeeping, taxes, and customer service. She uses various accounting software to set up client information, reconcile accounts, code expenses, run financial reports, and prepare tax returns. She is also experienced in setting up corporations with the State Corporation Commission and the IRS.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple receipt capture methods: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad, and Android) to snap a picture while on the go—auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports, including IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports, and more—with Shoeboxed.

Try Shoeboxed today!