Expense receipts are important to hold on to for your business as proof of purchase, IRS documentation, and reimbursements.

But what exactly are they? And what can they be used for?

What is an expense receipt?

An expense receipt is a type of receipt that serves as proof of purchase for your business expenses.

If there was an out-of-pocket purchase for the company, an expense receipt should be submitted for the amount to be reimbursed.

What should an expense receipt include?

A sale receipt (digital or physical receipt) or an invoice can be accepted as a valid expense receipt as long as it has the following:

The date

The vendor

The purchase price

A description of what was purchased

Why does an expense receipt matter?

Expense receipts are important for maintaining financial compliance.

All businesses' spending must be reported and be supported with valid receipts to prove the legitimacy of expenses.

It's up to the employee to prove that a purchase was made on behalf of the business. So, an expense receipt will validate the purchase and help prevent fraud.

Without an expense receipt, you can still submit a reimbursement request; however, it's always best to have a receipt.

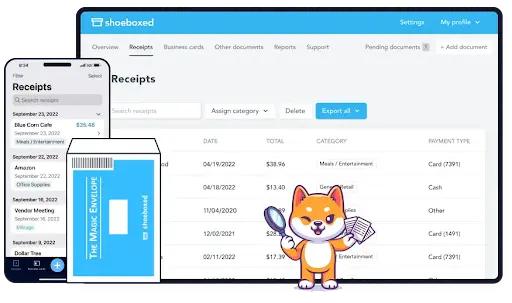

Track your expense receipts with Shoeboxed.

Never lose a receipt again.

Your business and employees can start managing expense receipts more easily than ever.

a. Receipt digitization

Digitize paper receipts into data. There are multiple ways that Shoeboxed keeps your receipts safe.

One of the easiest ways is to take and upload a photo of the receipt. You can email the photo to your Shoeboxed account or sync Shoeboxed with your Gmail. Your receipts sent to your Shoeboxed email address will automatically be in your dashboard.

If you have too many receipts, place them in Shoeboxed's pre-paid Magic Envelope, and their staff will scan them for you.

Never lose a receipt again 📁

Join over 1 million businesses organizing & scanning receipts, creating expense reports, and reclaiming multiple hours every week—with Shoeboxed.✨

Get Started Todayb. Data entry and categorization

Once your receipts are scanned, Shoeboxed's software will extract key details such as the amount, vendor, and payment type. It will even categorize your receipt into one of the 15 common tax categories.

Shoeboxed uses Optical Character Recognition (OCR) to extract and categorize receipt data automatically, so there's less human error and eliminates manual data entry.

c. Reimbursement workflows

Shoeboxed can integrate with QuickBooks, Xero, and FreshBooks, so accounting and reimbursement processes can be completed much faster.

It also supports approval workflows, expense reviews, expense reports, and approval processes, which speed up the reimbursement cycle.

d. Tax readiness

When Shoeboxed stores digital copies of your receipt, they comply with tax regulations for tax season or audits.

This feature makes expense management more efficient and allows the expense claim process to be processed much faster.

Shoeboxed's automated system can have receipt details and expense explanations to avoid disputes or complications with the tax authorities.

What can expense receipts cover for reimbursements?

There are many different types of tax deductions that expense receipts can cover, but here are the main 4:

1. Meals

Meals are among the most common claimable expenses. Since restaurants and cafes provide a proper tax receipt after the meal, proof of payment is always easy to obtain. Meal expenses can include:

Mails with clients and colleagues

Travel meals

Employee-related meals

Business context meals

2. Travel costs

All travel expenses, such as taxis, car rental, public transportation, or ride-share services, can be recorded as expense receipts.

For ride-share, travel apps like Uber and Lyft will provide digital receipts.

3. Mileage

If employees use their vehicles for business, things can get tricky. Mileage logs, which include odometer readings or GPS tracking reports, are the solution.

Shoeboxed's mileage tracking feature lets you track your mileage rates within the app. Once your trip ends, you'll receive a receipt for your drive and a photo, which will be in your account.

Track mileage with Shoeboxed 🚗

Track mileage using your phone’s built-in GPS for unmatched ease and accuracy. 💪🏼 Try free for 30 days!

Get Started Today4. Accommodation

For any business trips, such as a conference or out-of-town client meeting, you can submit a claim for any lodging expenses you may take.

The hotel or Airbnb establishment will provide an invoice or receipt with key information, such as the hotel's name, the date of the stay, and the room rate.

Miscellaneous expenses

There are many commonly missed taxes that businesses may miss as a write-off. They are, but not limited to:

Phone and internet expenses while traveling

Legal and professional fees

Office supplies

Stamps and mailing costs

Storage unit operating expenses

What does the IRS require for expense receipts?

The IRS requires financial records for expense receipts, such as:

Canceled checks

Cash register receipts

Account statements

Credit card receipts and statements

Invoices

These types of expense records should include vendor, amount paid, proof of payment, date, and item description that was purchased.

See also: IRS Receipt Requirements $75 for Stress-Free Tax Filing

Frequently asked questions

Do I need receipts for expenses under $75?

Employees do not need to submit an expense receipt for $75 or less work-related travel expenses. However, keeping with small business record practices, it's best to keep track of all expenses, no matter the amount.

In closing

Expense receipts are one of the best ways to achieve financial compliance and support reimbursement workflows. As proof of purchase, it helps your business validate expenses and streamline tax preparations.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad, and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports, including IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports, and more—with Shoeboxed.

Try Shoeboxed today!