Expense management is a crucial aspect of running a business efficiently. While it can be a time-consuming and complex task, using the right software can help streamline and simplify the process.

Expensify is a well-known and popular solution for expense management; however, some businesses might find it lacking or not suited to their needs.

This article will highlight top alternatives to Expensify that are equally capable and offer unique features that cater to specific requirements.

Evaluating each alternative carefully can assist businesses in finding the perfect solution for their expense management needs and ultimately improving their overall financial management.

So, let’s dive into the various options available in the market to find an expense management tool that fits your business like a glove.

What is Expensify?

Expensify home page

Expensify is a popular expense management software solution that aims to simplify expense tracking, reporting, and reimbursement for businesses of all sizes.

It was launched in 2008 to help organizations automate the entire expense management process, from receipt scanning to expense report submission and approval. The software is available on both desktop and mobile platforms, making it convenient for employees to use on-the-go.

The platform offers a range of features designed to streamline expense tracking and management, such as SmartScan technology, which automatically extracts details from receipts and matches them to expenses.

Additionally, Expensify offers integrations with major accounting software and financial systems, making it easy to sync expense data with existing bookkeeping tools.

Expensify’s real-time expense reporting functionality allows managers and administrators to review and approve employee expenses quickly, reducing the time spent on manual expense report reviews.

The software also supports multi-level approval workflows, ensuring that expenses are reviewed by the appropriate parties before reimbursement.

Another key feature of Expensify is its corporate card management, which helps companies monitor and manage employee spending.

By connecting corporate cards to the platform, organizations can track card transactions and correlate them with the submitted expenses, reducing the risk of fraudulent or unauthorized spending.

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic award-winning approach to receipt tracking for tax season. Try free for 30 days!

Get Started TodayWhat are Expensify’s key features?

Expensify offers a range of features that assist businesses and individuals in managing their expenses efficiently. These key features include:

Expense tracking

Mobile app

Receipt scanning

Approval workflow

Credit card integration

Multicurrency

Travel and expense management

Analytics

What are Expensify’s pricing and plans?

Expensify offers a variety of plans to accommodate different needs and budgets. In this section, we’ll cover the different plans and their pricing, including Freemium, Paid Plans, and Custom Solutions.

Expensify’s pricing page

Freemium

Expensify offers a Free plan suitable for individuals and small businesses looking to try out the platform without any financial commitment.

This Freemium plan includes basic features such as receipt scanning, expense categorization, and mileage tracking. However, the Free plan limits users to a certain number of SmartScans (receipt scanning) per month, which may not be sufficient for users with higher expenses.

Paid plans

For those who require more advanced features and increased capabilities, Expensify offers several paid plans.

The Track plan, designed for individuals and sole proprietors, starts at $4.99 per user per month and includes features like receipt and expense tracking, as well as mileage and time tracking.

Expensify also provides plans for teams and organizations, including the Professional and Enterprise plans. The cost of these plans will depend on factors such as the number of users, the level of customization required, and any additional support needed.

Custom solutions

Expensify understands that some businesses have unique needs and requirements. Therefore, they offer Custom Solutions tailored to specific industries or company sizes.

These custom plans may include specialized integrations, advanced reporting capabilities, and dedicated customer support. Pricing for these plans will vary, as they are specifically designed to meet the unique requirements of each organization.

In summary, Expensify offers a range of pricing options to cater to various user needs, from individuals to large enterprises. Users can choose from the Freemium plan, Paid Plans, or Custom Solutions based on their specific requirements and budget constraints.

How we chose these Expensify alternatives

To identify the best Expensify alternatives on the market, we assessed each platform’s features, pricing, user experience, and customer reviews.

We believe that considering these aspects would allow us to provide a comprehensive list of alternatives that cater to different needs and preferences.

Our first step was to examine the features offered by each of these platforms. We ensured that they provided a combination of functionalities such as expense tracking, receipt scanning, customizable reports, and mobile compatibility.

These features are crucial for effective expense management for businesses of all sizes.

In terms of pricing, we compared the costs associated with each alternative while taking into account the value for money. This enabled us to determine which platforms provided the best overall deal, from affordable entry-level plans to feature-rich offerings for more advanced users.

The user experience played a significant role in our evaluation process. We looked at the ease of use and how intuitive each platform was for both novice and experienced users. Availability of user guides, technical support, and seamless integration with existing software systems also factored into our decision-making.

Moreover, we analyzed customer reviews and ratings from credible sources such as G2 and The Motley Fool, which provided valuable insights into the overall satisfaction levels of real users. This helped us to understand the strengths and potential drawbacks of each alternative, as well as gauge overall satisfaction and reliability.

See also: Shoeboxed vs. Expensify Email Receipts: Which One is Better?

Top Expensify alternatives in 2023

When looking for expense management software, there are several top alternatives to Expensify that can serve your needs. Here’s a brief recap of them below, and then we’ll dive into options tailored to specific needs and demographics.

1. Shoeboxed

Shoeboxed is the go-to app for business receipt management. It helps small businesses track expenses by converting paper receipts into organized digital data. Its features include a receipt scanning service where they scan your backlog of receipts on your behalf, robust receipt categorization, and reimbursement tracking.

Shoeboxed’s home page

Price starts at: 4.99 for their Digital Only Starter Plan and $18 a month to outsource paper receipt scanning to their scanning facility.

How does Shoeboxed compare to other receipt scanner apps?

Shoeboxed |

Expensify |

Dext |

Rydoo |

Neat |

Wave |

Quickbooks |

|

|---|---|---|---|---|---|---|---|

Capterra rating |

4.4 |

4.5 |

4.2 |

4.4 |

4 |

4.4 |

4.3 |

Physical receipts |

✔️ |

❌ |

❌ |

❌ |

❌ |

❌ |

❌ |

Digital receipts |

✔️ |

✔️ |

✔️ |

✔️ |

✔️ |

✔️ |

✔️ |

Document storage |

✔️ |

❌ |

✔️ |

✔️ |

✔️ |

❌ |

✔️ |

Unlimited free users |

✔️ |

❌ |

✔️ |

❌ |

❌ |

❌ |

❌ |

Mileage tracker |

✔️ |

✔️ |

❌ |

✔️ |

❌ |

❌ |

✔️ |

Expense reports |

✔️ |

✔️ |

✔️ |

✔️ |

✔️ |

❌ |

❌ |

Human verification |

✔️ |

❌ |

❌ |

❌ |

✔️ |

❌ |

❌ |

Automatic categorization |

✔️ |

✔️ |

✔️ |

✔️ |

✔️ |

✔️ |

✔️ |

Business contacts organizer |

✔️ |

❌ |

❌ |

❌ |

❌ |

✔️ |

✔️ |

iOS app |

✔️ |

✔️ |

✔️ |

✔️ |

✔️ |

✔️ |

✔️ |

Android app |

✔️ |

✔️ |

✔️ |

✔️ |

✔️ |

✔️ |

✔️ |

Free version |

✔️ |

✔️ |

❌ |

❌ |

❌ |

✔️ |

❌ |

Free trial |

✔️ |

✔️ |

✔️ |

✔️ |

✔️ |

❌ |

✔️ |

Credit card reconciliation |

❌ |

✔️ |

❌ |

✔️ |

✔️ |

✔️ |

✔️ |

Starting price per month |

$18 |

$5 |

$30 |

$9 |

$200 |

$16 |

$18 |

Break free from manual data entry ✨

Use Shoeboxed’s Magic Envelope to ship off your receipts and get them back as scanned data in a private, secure cloud-based account. 📁 Try free for 30 days!

Get Started Today2. Zoho Expense

Zoho Expense is a comprehensive expense management tool that simplifies and automates expense tracking, making it easier for organizations to manage expenses and reimbursement processes. It includes features such as auto-scanning of receipts, automated expense report creation, and approval workflows.

Prices start at: $5 for their Standard plan

3. Sage Intacct

Sage Intacct home page

Prices start at: Request pricing.

4. Certify

Certify is an expense management solution that streamlines the process of submitting, approving, and reimbursing employee expenses. It offers features such as customizable expense categories, receipt auto-scanning, simplified expense report creation, and an easy-to-use mobile app.

Prices start at: $12 per user/per month

5. ExpensePoint

ExpensePoint is a powerful expense management solution that enables businesses to streamline expense reporting and reimbursement processes. It offers features such as receipt scanning, customizable expense categories, approval workflows, and integrations with accounting systems.

Expense Point home page

Prices start at: $7.50 user/month

6. Fyle

Fyle is an intuitive expense management software designed to simplify and efficiently track employee expenses. It offers features such as receipt scanning, auto-categorization of expenses, and intelligent approval workflows.

Prices start at: $6.99 per user/per month, minimum billing: 5 users

7. SAP Concur

SAP Concur is a robust expense management solution offering a wide range of features, including automated expense tracking, receipt auto-scanning, and integration with various accounting and travel management systems.

Sap Concur home page

Prices start at: Request pricing

See also: Concur Alternatives: Top 4 for Efficient Expense Management

8. Rydoo

Rydoo is a travel and expense management solution that streamlines business expense processes and enhances financial visibility. It offers features such as receipt scanning, real-time expense tracking, and approval workflows.

Prices start at: $10 per user/per month

9. Abacus

Abacus.com is a real-time expense management tool that aims to eliminate the need for traditional expense reports. This solution provides features such as receipt scanning, automated expense categorization, and direct deposit reimbursements.

Abacus’s home page

Prices start at: Request pricing

10. Webexpenses

Webexpenses.com is a comprehensive expense management software that simplifies expense reporting and reimbursement processes. It offers features like receipt scanning, customizable expense categories, and approval workflows, helping businesses to better manage and control employee expenses.

Prices start at: Request pricing

What choice is best for ease of use?

User-friendly interface: Freshbooks and Certify

When considering Expensify alternatives, it’s essential to look for a platform with a user-friendly interface. One such alternative is Freshbooks, which offers ease-of-use combined with comprehensive features.

Freshbooks is suitable for small to medium-sized businesses and takes financial management to a new level. With streamlined time-tracking and client-invoicing processes, it ensures that users can easily navigate and manage expenses.

Another Expensify alternative with an intuitive interface is Certify. Certify is top-rated for its features and user experience, making it a strong competitor for companies looking for accessible and efficient expense management software.

Customer service: Shoeboxed

According to a comparison of Expensify vs. Shoeboxed on TrustRadius, Shoeboxed is the best alternative to Expensify if you’re concerned about customer service.

This is because Shoeboxed has received consistently high ratings for customer support, with users praising the company’s responsiveness and helpfulness. In contrast, some users have criticized Expensify’s customer service, citing long wait times and unhelpful responses.

Additionally, with Shoeboxed, you can offload all your manual receipt scanning to the Shoeboxed team, and they’ll scan up boxes of your paper receipts and other paper documents on your behalf. This is a unique service that other expense management software do not offer.

Sending your paper receipts to Shoeboxed’s team to scan them in for youThey are also known for human data verification, where each receipt is verified by a data entry specialist as it is input into your account, reducing data entry errors down to near zero.

What choice is best for integrating with accounting software?

When searching for an Expensify alternative, integration with accounting software is a crucial factor to take into consideration.

In this section, we’ll examine the compatibility and benefits of using some popular accounting software with well-known Expensify alternatives: Xero, Sage Business Cloud Accounting, and FreshBooks.

Xero: Zoho Expense

For businesses using Xero as their accounting software, Zoho Expense stands out as a reliable Expensify alternative.

Zoho Expense offers a comprehensive suite of expense management features, and its integration with Xero ensures smooth data synchronization between the two platforms. It helps businesses efficiently manage costs with a clean and intuitive interface.

Sage Business Cloud Accounting: Certify

When it comes to using Sage Business Cloud Accounting, Certify serves as a viable Expensify alternative.

Certify offers a wide range of features, including receipt capture, mileage tracking, and expense report creation. Its integration with Sage Business Cloud Accounting allows users to synchronize expense data directly into their accounting platform, ensuring accurate financial records with minimal effort.

FreshBooks: Rydoo

FreshBooks users can turn to Rydoo as an efficient Expensify alternative. Rydoo offers an intuitive platform that simplifies expense management while simultaneously integrating smoothly with FreshBooks.

It provides a user-friendly interface and an array of features like automatic expense categorization, receipt scanning, and expense policy compliance.

What Expensify alternative is best for business size and type?

Understanding the needs of small businesses now and then is essential to understand why certain alternatives may be better suited for different stages of growth and changing market dynamics.

Small businesses: Certify and Shoeboxed

For small businesses, Certify and Shoeboxed can be an excellent choice as an Expensify alternative.

Certify offers all the features a small business might need for effective expense management.

And Shoeboxed allows you to outsource all your data entry to Shoeboxed’s data entry team. Both are attractive options for businesses that need a simple yet sophisticated solution for their expense reporting needs.

Freelancers: FreeAgent

FreeAgent is a perfect alternative to Expensify for freelancers and solo business owners. It has been designed specifically with freelancers and small businesses in mind.

FreeAgent’s home page

FreeAgent offers a wide variety of built-in tools, meaning smaller businesses and individual professionals have access to everything they need to keep their accounts organized and accurate.

Growing businesses: Zoho Expense

For growing businesses, Zoho Expense can be an ideal choice. This Expensify alternative is focused on providing a scalable solution that can grow alongside a business.

With its robust tools, comprehensive reporting options, and integration capabilities, Zoho Expense helps growing businesses streamline their expense management processes and maintain control over their finances even as they expand.

Large enterprises: Dext Prepare

When it comes to large enterprises, Dext Prepare stands out as a top alternative to Expensify. This solution is designed to handle the complex expense management needs of large organizations, offering a seamless user experience, advanced automation features, and extensive integration options.

Its scalability and powerful functionality make it suitable for large enterprises that require an efficient and comprehensive solution for their expense management processes.

Self-employed: BQE CORE

For self-employed individuals, BQE CORE can be the best Expensify alternative. This software is designed for individuals and businesses that require a simple yet powerful expense management solution, offering an easy-to-use interface and essential expense-tracking features.

BQE CORE allows self-employed professionals to manage their expenses effectively, without getting bogged down in complicated systems or unnecessary features.

What Expensify alternative is best for financial planning and compliance?

Budgeting: Ramp

If budgeting is a feature you’re looking for when it comes to Expensify alternative, among the options, Ramp stands out as the best option for businesses concerned with budgeting.

Ramp’s home page

Ramp offers real-time budgeting tools that allow companies to gain insights into their spending habits and make smarter financial decisions.

By providing comprehensive analytics and visualization features, businesses can easily monitor their budget and track expenses in one place.

See also: Ramp Alternatives: A Comprehensive Spend Management Guide

Policy enforcement: SAP Concur

Policy enforcement is another essential aspect of expense management, ensuring that employees adhere to company policies when filing expenses.

In this regard, SAP Concur emerges as the top solution for policy enforcement. SAP Concur offers customizable policy compliance checks that flag non-compliant expenses before they are processed.

This significantly reduces the risk of improper expense claims and ensures that company policies are followed consistently.

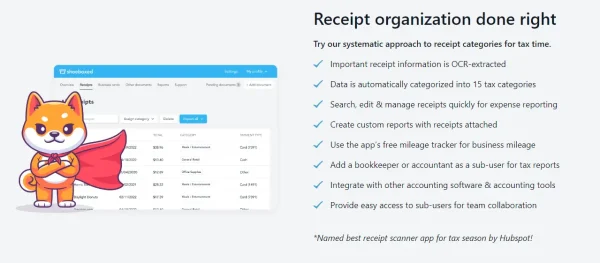

Tax write-offs: Emburse Certify Expense and Shoeboxed

Maximizing tax write-offs is a crucial financial aspect for businesses, and having an expense management solution that streamlines this process is essential.

Emburse Certify Expense is an alternative that allows businesses to organize their tax write-offs efficiently as it integrates with tax compliance tools, ensuring accuracy and maximizing tax deductions.

Named the best receipt scanner for tax season by Hubspot, Shoeboxed allows you to tag each receipt with one of 15 common tax categories, simplifying expense reports, reimbursements, and tax season prep.

By comparing various Expensify alternatives for different financial planning and compliance aspects, we’ve identified Ramp as the best for budgeting, SAP Concur for policy enforcement, and Emburse Certify Expense for tax write-offs.

These tools provide essential features for businesses to achieve effective financial planning and compliance management.

In closing

Expensify, despite being a popular expense management platform, has its share of limitations. This is where its alternatives come into play, offering tailored features and pricing structures, catering to diverse business needs. A few such alternatives include Shoeboxed, Certify, Ramp, and Divvy.

Certify is a top-rated solution that offers a range of features for seamless expense management. Users appreciate its user-friendly interface and customized approval workflows, making it a strong contender for those seeking an Expensify alternative.

Another option is Ramp, which provides companies with the right tools for better spend management and expense tracking. Ramp offers corporate credit cards with an attractive cashback of 1.5%, saving businesses money and enabling fast bill payments.

Divvy is also worth considering, as it caters to businesses of different sizes with flexible pricing plans that suit various budgets.

Shoeboxed is the best choice for those who are looking to completely outsource their receipt management and expense tracking needs.

On average, Expensify alternatives range in cost from $0 to $54 per user per month, while offering similar or even advanced features that suit different business requirements.

Lastly, a comprehensive comparison of these alternatives can be found on platforms such as G2 and Gartner, where potential buyers can find real user reviews and insights on the most suitable solution for their business.

By carefully considering the features, pricing, and user reviews of these Expensify alternatives, businesses can make a well-informed decision and optimize their expense management processes.

Tomoko Matsuoka is managing editor for Shoeboxed, MailMate, and other online resource libraries. She covers small business tips, organization hacks, and productivity tools and software.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!