The financial accounting department focuses on collecting and analyzing financial information. In the end, this department disseminates all of its collected accounting data to the individuals that need it the most.

There are plenty of ways how accounting helps in decision-making, and every single one plays an important role in the overall picture.

So let’s explore exactly who needs this information and for what reason.

1. Best practices

Accounting principles govern companies’ gathering, analyzing, and disseminating financial data.

GAAP, generally accepted accounting principles, dictate how most publicly traded companies complete their financial statements.

Outside of the United States, companies adhere to international standards, which could vary based on their country of origin.

Knowing companies abide by certain standards helps with further decision-making.

Accounting for Decision-making: 2. the Role of Accounting by Learning with ZN2. Statistical knowledge

The financial information generated by the company and compiled by the accounting department can help provide further knowledge of movement over time.

In addition, year-over-year comparisons provide a more in-depth understanding of the company’s financial health and how the company is doing in the market.

3. Resource utilization

Well-kept financial records with detailed financial transactions help companies determine where resources are getting used.

Misuse will come to light during these types of reviews, assisting companies in staying on the right track.

4. Lending decisions

Debtors find financial information put together by companies as one of the most important pieces of their decision-making process.

Whether the debtor is a bank or bondholder, they use a company’s financial statements to decide if the company is creditworthy.

A lending institution uses various accounting ratios to make informed business loan decisions, such as debt-to-equity and time-interest earned ratios.

Even privately held companies are asked to provide documentation of their current creditworthiness by producing financial statements for the debtor to review.

5. Capital investing decisions

The balance sheet, income statements, and cash flow statements are all extremely important supporting documents for any investment decision.

Aside from debtors using the information to perform a credit analysis and determine a company’s creditworthiness, individuals within the company use them in much the same way.

Managers and higher-ups review those documents as a part of their daily business operations.

They can decide the best time to grow and invest in the business from their review, for example, by expanding or investing in new machinery.

Accounting for Decision-making: 10. Strategic Capital Investment Decisions by Learning with ZN6. Shareholders

Like debtors, shareholders use financial statements to determine whether they should supply a company with more equity.

By their nature, shareholders have a stake in the future of the company in which they invest.

Financial statements become the basis for decision-making before a shareholder commits.

7. Auditing

An important process for any company is internal and external auditing.

Companies are promptly subjected to such a review to ensure they comply with all regulations.

Auditing also helps decision-making since it ultimately helps determine if all financial rules were followed and if generated statements can be trusted.

Never lose a receipt again 📁

Join over 1 million businesses scanning receipts, creating expense reports, and reclaiming multiple hours every week—with Shoeboxed.✨

Get Started Today8. Budgeting

Company management is always presented with budgeting decisions to preserve the future of the business and help it thrive. Financial statements are the key to making good decisions and providing the right individuals with a company snapshot.

9. Control

Financial statements provide company management with a current view of the company’s well-being.

Based on this information, business management can make well-informed decisions surrounding timeframes regarding implementing new processes.

10. Management efficiency

Cumulatively speaking, well-formed and presented financial statements allow business owners and managers to become more efficient at their roles.

In addition, rather than making arbitrary decisions concerning the business and its employees, there is a certain level of stability when using financial statements to inform business decisions.

11. Incremental decision-making

Also known as Marginal Analysis, incremental decision-making has business owners focusing on financial information from different perspectives.

The current financial statements are reviewed under the guise of different decisions to determine the best route for the company’s future.

12. Costs and behavior

A review of financial information allows companies to understand costs incurred and how they change over time.

This market trend will help companies prepare for the future, making better predictions about future cash flow.

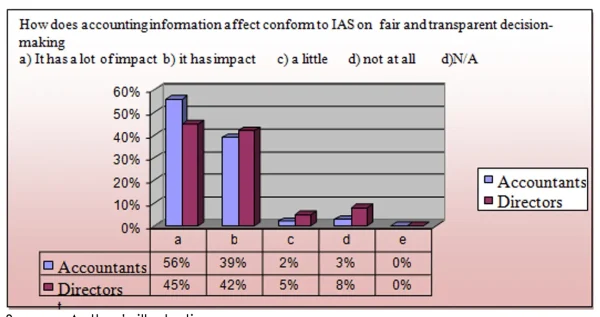

13. Fairness and transparency

Using financial information as the basis for all decisions involving the company is one way to ensure fairness and transparency.

Companies prove that nothing remains hidden regarding their current and future situations.

Importance of fairness and transparency in how accounting helps in business decision making, ENTRENOVA

14. Marketing decisions

Marketing and advertising help grow the business by attracting new customers.

Financial statements advise business owners, management, and marketing teams on the available funds for this endeavor.

15. Constraint analysis

Even companies have their limits.

Financial information from management accounting allows management to view company limits, such as in the sales process or production line.

Knowing these constraints will help calculate the impact on financial statements and the well-being of the business.

16. Trend analysis

Knowing the trend of costs and prices is an important part of maintaining and growing a small business.

In addition, decisions surrounding the future are made with vital information gleaned from the past, such as historical pricing, location, and customer trends.

17. Valuation

The valuation of a company is a huge deal, especially for companies that want to attract the right investor and expand.

Financial statements drive this information, allowing business owners and managers to make informed decisions when asking for potential investors.

17 ways how accounting helps in business decision making

Questions to ask when evaluating business finances

If you’re a small business owner new to managerial accounting concepts, the questions below can give you an idea of where to start when analyzing your finances:

Are you making consistent profits or losses?

What is the cost of your sales? Are they up or down?

What isn’t selling? Should you remove it from your business?

What are your most profitable goods or services?

What issues, if any, do you have with your services or goods? Is pricing not competitive? Is your marketing, delivery, or customer service lackluster?

Are vendor and supplier costs reasonable? Can you negotiate better prices?

Do you have any clients preventing business growth? Are reasonable efforts made to reach higher-paying or producing clients?

Are you staying within your budget? Is your budget accurately distributed among your company’s most profitable or necessary areas?

Are your employees working productively and efficiently? Could anyone be costing you money?

How are your competitors doing? Are they profiting in areas you could improve?

Asking the right questions can help you put your best foot forward, improve your productive day operations, have a better plan for the future, and cut out what’s holding your company back.

How does accounting software help in decision-making?

For those just starting out, record keeping and compiling your books into a comprehensive report and evaluation of your financial activities can be a challenge.

An accounting information system gives you more accurate financial information than manual accounting data.

Not only can you input your finances into the system, but the software will also generate reports to give you the bigger picture and help you determine your business’s prospective financial health.

Top 3 accounting software options

Let’s take a brief look at the top accounting software, their features, and how they can assist in your accounting endeavors.

1. Zoho

Zoho’s home page

Zoho Books is an online accounting software that can help you manage every aspect of your accounting cycle process, from invoicing to preparing audit reports.

Get detailed profit and loss statements, inventory summary reports, sales tax reports, and over 70 other business reports necessary to keep your business running smoothly.

Prices start at$20/month OR $15/month billed annually

2. Quickbooks

Quickbooks’s home page

QuickBooks Online is one of the most popular accounting software options on the market today.

With QuickBooks, you can automatically track income and expenses, pay contractors or your employees, organize your bills, track your inventory, see where you’re making the most (and losing the most) money, and more!

Prices start at $15/month.

3. FreshBooks

Freshbooks’s home page

FreshBooks is designed with businesses in mind and helps business owners keep their finances organized for tax time and receive valuable insights into their financial standing.

You can reconcile your accounts, pay your bills, create accounting reports, and more!

Prices start at $8.50/month.

Turn receipts into data with Shoeboxed ✨

Try a systematic approach to receipt categories for tax time. Try free for 30 days!

Get Started TodayFrequently asked questions

What is accounting for decision-making?

Accounting for decision-making uses accounting concepts to make informed business decisions concerning financial transactions and the overall financial health of a company.

What is the use of accounting for management decision-making?

Management accounting, or managerial accounting, refers to when companies record financial information to evaluate cash flows, economic activity, the connection between sales and profit, and more to create long term strategies for the company’s health.

In closing

As listed above, there are many reasons behind how accounting helps in decision-making.

Business owners and managers use a variety of financial reports to make the best financial decisions surrounding the current and future state of the company.

Some of the financial statements include:

Income statement

Cash flow statement

Together, these documents disclose the current state of financial affairs and well-being within a company, helping determine if they are worthy of investment.

From valuation to investing, to marketing, and everything in between, the accounting department and the financial information they put together are indispensable to a well-running company.

Aside from the individuals in the business, external parties such as governments, auditors, investors, and shareholders also want to know this information.

Therefore, this information is key for a company to thrive and continue its presence in the market.

To further hone your understanding of accounting topics, check out our mammoth list of accounting and bookkeeping resources!

Agata Kaczmarek has held a passion for writing since early childhood. A professional writer for many years, Agata specializes in writing articles and blogs focused on finance as someone who holds a Masters Degree in Accounting and Finance.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!