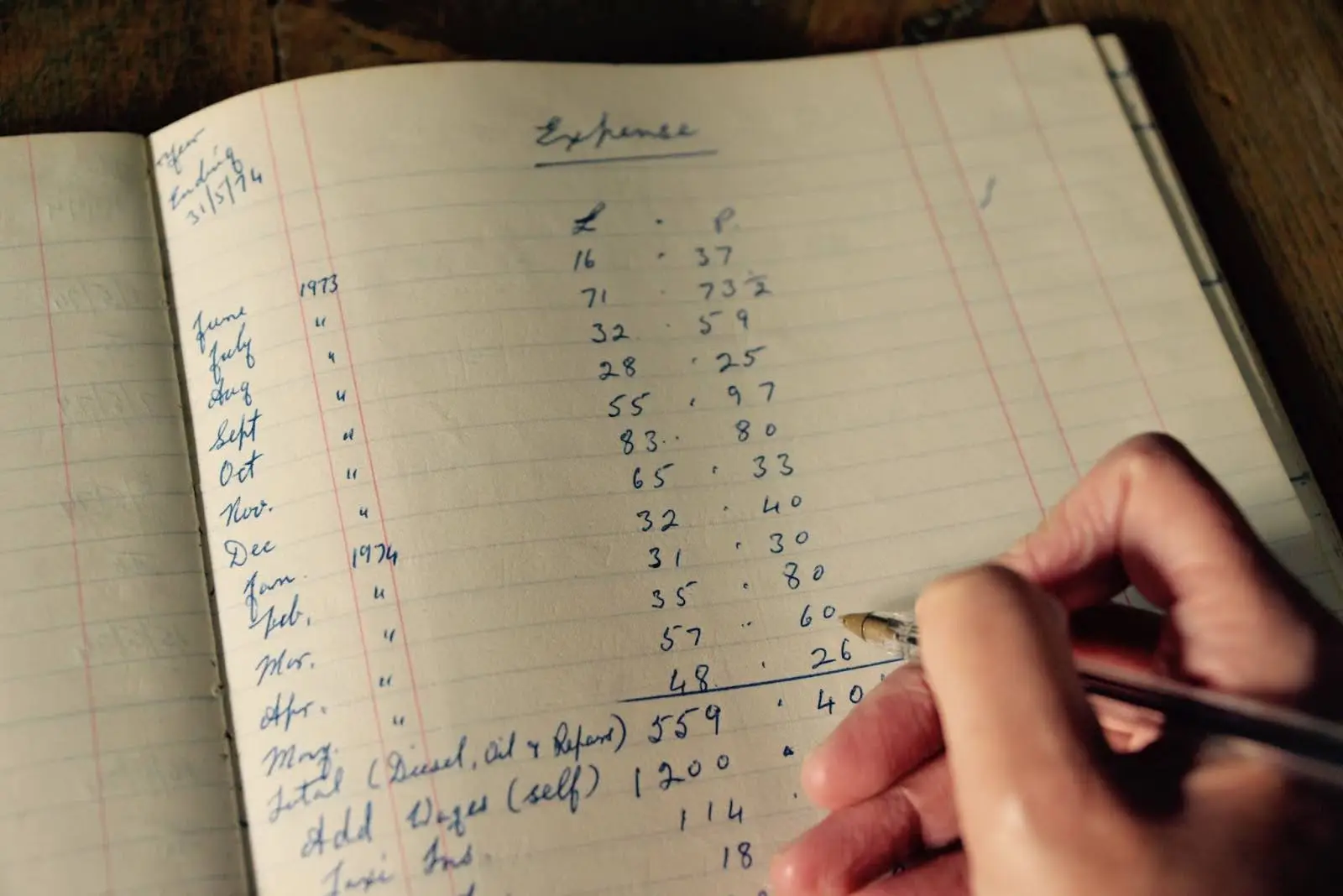

As a small business owner, keeping accurate records is key to making informed decisions, complying with tax laws, and having a clear picture of the business’s financial health. Bookkeeping can be time-consuming and complicated, so many opt to hire a bookkeeper.

But how much does a bookkeeper cost for a small business? It depends on the service, experience, and the business needs.

What do bookkeepers do for small businesses?

Bookkeeping is an important aspect of a small business.

Bookkeepers record financial transactions and create financial statements to help small business owners make informed financial decisions.

They perform data entry, record financial transactions, and create financial reports.

Bookkeepers also perform smaller tasks daily or weekly, such as managing accounts payable and accounts receivable.

Bookkeepers do different things depending on your business needs.

Here are some standard services:

Data entry for financial transactions.

Bank reconciliation to make sure records match bank statements.

Financial reporting includes profit and loss statements, balance sheets, and cash flow reports.

Organize financial records for tax time.

Track money owed to and by the business.

A small business's success depends on an efficient bookkeeping process.

What factors affect bookkeeping rates?

From what I've experienced, here are the average bookkeeping costs and their factors.

1. Type of bookkeeper

Here are the typical rates for freelance, firms, and virtual services:

Freelance bookkeeper

Hourly rates range from $25 to $50 per hour, depending on experience and location.

Bookkeeping firms

Monthly fees range from $350 to $3,000, depending on the scope of work.

Virtual bookkeeping services

For basic packages, virtual bookkeeping services typically range from $250 to $500 monthly.

2. Bookkeeping tasks

Typical tasks include:

Recording transactions.

Reconciling bank statements.

Managing payroll.

Preparing financial reports.

Overseeing accounts payable/receivable.

The more complex and volume of bookkeeping tasks, the more expensive they will be.

A business with simple financial transactions will pay less than one with more complex needs, such as inventory management or multi-channel sales tracking.

3. Frequency of service

Costs will vary depending on how often you need bookkeeping services:

Monthly services

From $250 to $500 per month, these services are for small businesses with low transaction volume.

Daily or weekly services

For high transaction volume businesses, costs can easily go up to $1,500 or more monthly.

4. Experience and qualifications

Rates will depend heavily on the experience and qualifications of a bookkeeper.

Entry-level bookkeepers

They may charge lower rates but need more expertise for more complex tasks.

Certified bookkeepers

With certifications like CPB or QuickBooks ProAdvisor, bookkeepers often charge higher fees because of their skills and reputation.

5. Location

The geographical location of the bookkeeper plays a significant role in the cost of the service.

Bookkeeping costs vary by region. Urban areas with higher cost of living will have higher rates than rural areas or small towns.

Bookkeeping rates are affected by business size and complexity, the scope of services required, the frequency of services, location, bookkeeper experience, and additional services.

What are the different rate structures?

Bookkeepers will either charge hourly, monthly, by a set package of services, or project-based.

1. Hourly

For occasional bookkeeping or one-time tasks, bookkeepers typically charge an hourly rate.

2. Monthly

For ongoing services, bookkeepers will charge a monthly fee.

3. Packages based on set services

Some bookkeepers offer flat monthly fees for a set package of services.

The monthly fee depends on scope of services, experience level, and an estimation of hours.

Monthly packages provide a predictable cost for small businesses.

4. Project-based pricing

Some bookkeepers offer project-based pricing for one-off jobs.

This involves accounting performed for a per-project basis, with costs ranging from $500 to $7,500 per project.

Project-based pricing can be a good option for small businesses with specific bookkeeping needs.

What is the role of accounting software?

Accounting software can help small businesses streamline their bookkeeping tasks and reduce costs.

Cloud-based accounting software can provide real-time financial data, track expenses, and automate invoicing and reconciliations.

Accounting software can also help small businesses maintain accurate financial records and ensure financial health.

How Shoeboxed can be used with or without bookkeeping services

Shoeboxed is a great tool for working with a bookkeeper or even reducing the need for full-service bookkeeping by streamlining expense management and financial organization.

Here’s how Shoeboxed fits into the bookkeeping costs for small businesses:

1. Lower bookkeeping costs

Shoeboxed automates digitizing and categorizing receipts, so bookkeepers have less to no manual data entry. This means lower bookkeeping fees since professionals spend less time sorting and organizing raw data.

To digitize receipts and documents, photograph them using your phone's camera. The Shoeboxed app will automatically upload a digital copy to your Shoeboxed account.

If you are overwhelmed with a large volume of receipts and don’t want to scan them yourself, Shoeboxed offers an outsourcing option.

You can mail your receipts or documents to Shoeboxed using their free pre-paid Magic Envelope. They will scan, human-verify, and upload them to your account for you.

Shoeboxed is the only receipt scanner app that will handle both your paper receipts and your digital receipts—saving customers up to 9.2 hours per week from manual data entry!

This stores all your bookkeeping, tax info, and expenses in one place without any manual entry.

Small businesses can use Shoeboxed to handle basic bookkeeping tasks like tracking expenses and generating reports. This reduces the scope of bookkeepers' work, making their services more affordable.

Stop doing manual data entry 🛑

Outsource receipt scanning to Shoeboxed’s scanning service and free up your time for good. Try free for 30 days!✨

Get Started Today2. Working with bookkeepers

Shoeboxed organizes receipts and expense data in a cloud-based system so you can share detailed reports directly with your bookkeeper.

Shoeboxed uses OCR (Optical Character Recognition) to extract key data from invoices, such as purchase date, vendor, and amount. Then, it automatically categorizes the receipt based on your predefined or tax categories, saving you time.

By categorizing expenses and providing IRS-accepted receipt scans, Shoeboxed makes tax prep easier for bookkeepers so they spend less time (and money) on year-end reconciliation.

3. Instead of hiring a bookkeeper

For businesses with simple financial needs, Shoeboxed can be a cheaper alternative to hiring a bookkeeper. It tracks expenses, categorizes transactions, and provides detailed financial reports.

You can create professional, IRS-compliant expense reports with receipts attached in seconds. Shoeboxed compiles your expenses into a neat expense report with just the click of a button.

Shoeboxed automates most of the bookkeeping process so small businesses can focus elsewhere.

Real-life example

A small business spends $1,000 per month on bookkeeping services. By using Shoeboxed to manage receipts and expenses, they reduce the time their bookkeeper spends on data entry and organization. This could drop the cost to $700-$800 per month so they can use the savings for other business needs while still having professional financial management.

A Bookkeeper’s Best Friend ✨

Professional bookkeepers use Shoeboxed’s scanning service to scan receipts and stay on top of client accounts. Try free for 30 days!

Get Started TodayOutsourcing vs. in-house bookkeeping

Small business owners must decide whether to hire an in-house bookkeeper or outsource bookkeeping tasks.

Outsourcing costs less than hiring a full-time employee, ranging from $500 to $2,500 monthly.

In-house bookkeepers require additional costs such as benefits and healthcare.

Outsourced bookkeeping services can also provide customized services and expertise.

What are some tips for finding a cost-effective bookkeeper?

Here are some tips that I've found to be helpful when looking for an affordable bookkeeper:

Define your bookkeeping needs and get multiple quotes from different bookkeepers.

Check references and reviews to ensure the bookkeeper has experience working with small businesses, especially in your industry.

Inquire about any hidden fees or limitations upfront.

Consider hiring a virtual bookkeeper to handle your bookkeeping needs remotely.

Discuss how bookkeepers leverage software, automation, and AI tools to maximize efficiency and minimize manual work.

How to minimize bookkeeping costs

Here are some tips I've also found to help minimize bookkeeping costs.

1. Automate financial tasks

Use Shoeboxed to simplify and reduce manual bookkeeping time. Shoeboxed automates expense tracking and reporting with little to no manual entry.

2. Outsource virtual bookkeeping

Virtual bookkeeping is cheaper than hiring an in-house bookkeeper since you don't have to pay salaries, benefits, etc.; it still gets you professional expertise.

3. Organize records

Keep financial documents and receipts organized so bookkeepers don’t have to spend time and money digging through your data.

Frequently asked questions

Can I do bookkeeping myself to save money?

Small business owners with basic financial knowledge can do bookkeeping using Shoeboxed.

Is a bookkeeper the same as an accountant?

No. Bookkeepers record and organize financial data, while accountants analyze the data, provide financial advice, and file taxes. Some bookkeepers offer basic accounting services, but an accountant is recommended for complex needs and tax filings.

In conclusion

The cost of a bookkeeper for a small business depends on your needs, your financial complexity, and the type of service you choose. There's something for everyone, from $25 an hour for essential freelance services to $3,000 a month for full-service bookkeeping firms.

Investing in a professional bookkeeper will save you time, provide accurate data, and give you the financial insights you need to make sound business decisions.

Caryl Ramsey has years of experience assisting in bookkeeping, taxes, and customer service. She uses a variety of accounting software to set up client information, reconcile accounts, code expenses, run financial reports, and prepare tax returns. She is also experienced in setting up corporations with the State Corporation Commission and the IRS and is a contributing writer to SUCCESS magazine.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!