Are you looking for that one invoice or receipt and can't find it? Are your invoices and receipts scattered all over your filing cabinet? If so, it's time to put some order back into your life.

In this article, we’ll explore various methods for organizing invoices and receipts to help you manage your finances more efficiently.

Why organize your receipts and invoices?

There are so many reasons why you should organize invoices and receipts. After working in the financial industry for so many years, we've narrowed it down to these key takeaways:

Accurate record-keeping: Maintaining accurate records of all transactions helps monitor financial health, track expenses, and manage cash flow.

Simplified tax preparation: Organized invoices and receipts make tax season easier by ensuring all deductions are claimed, and financial records are complete and accurate.

Financial compliance: Proper documentation ensures compliance with financial regulations and provides proof of transactions during audits.

Expense management: Tracking, organizing, and storing receipts and invoices helps manage and control expenses, prevent overspending, and identify cost-saving opportunities.

How should you organize invoices and receipts?

First, decide which method you prefer, digital or physical, for organizing and storing receipts, invoices, or credit card statements.

a. Digital organization

For digital organization, download a receipt-scanning app to organize and store receipts electronically. These apps typically automatically scan, extract critical information, categorize expenses, and generate detailed reports by transforming physical into digital receipts.

For instance, let's look at Shoeboxed as an example of organizing and transforming physical receipts into digital receipts.

Shoeboxed

Shoeboxed is great for organizing invoices and receipts.

Shoeboxed is a comprehensive tool for scanning, organizing, and managing receipts and paper invoices. It automates data extraction, categorization, and storage, making organizing invoices and receipts effortless.

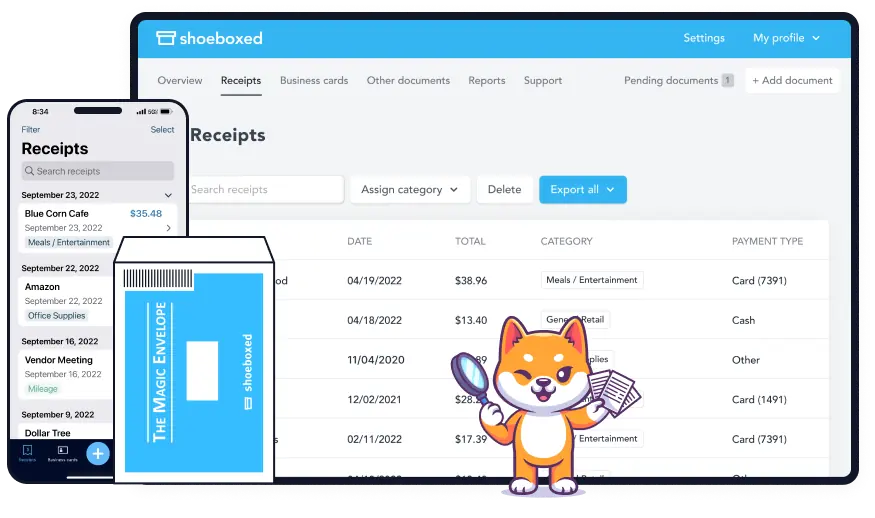

Mobile app

Shoeboxed's mobile app is used to scan while on the go.

One way to use Shoeboxed is to download their receipt-scanning app and use your smartphone's camera to capture images of paper receipts.

Magic Envelope service

Outsource scanning to Shoeboxed with their free Magic Envelope.

The other way to use Shoeboxed to organize invoices and receipts is to outsource the scanning to Shoeboxed. They will provide you with a free prepaid postage Magic Envelope to store receipts.

All you do is fill the envelope with receipts and mail it back to Shoeboxed where all your receipts are scanned, human-verified, and uploaded into an account for you.

Shoeboxed is the only receipt scanner app that will handle both your paper receipts and your digital receipts—saving customers up to 9.2 hours per week from manual data entry!

Hit the road with Shoeboxed 🚗

Stuff receipts into the Magic Envelope while on the road. Then send them in once a month to get scanned. 💪🏼 Try free for 30 days!

Get Started TodayScan while on the go

Use either Shoeboxed's mobile app or their Magic Envelope to scan receipts.

The mobile app is a great way to scan and store receipts while on the go, and the Magic Envelope is ideal for outsourcing your scanning.

Receipt scanning and data extraction

Shoeboxed uses the latest technology.

Once the receipt is scanned, Shoeboxed uses OCR technology to turn receipts into electronic receipts by extracting critical information such as date, amount, and vendor from the paper receipt.

Organizes receipts electronically

Shoeboxed automatically categorizes business expenses.

Shoeboxed then uses this data to organize receipts electronically. It sorts the small business receipts and expenses into 15 tax or customized categories.

Generates detailed reports

Shoeboxed automatically turns the categories into detailed reports.

Then, with just the click of a button, Shoeboxed automatically generates detailed expense reports for reimbursements and tax purposes, along with IRS-accepted receipt images.

Shoeboxed has been voted as the best receipt scanner app for tax season by Hubspot and given the Trusted Vendor and Quality Choice awards by Crozdesk.

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic award-winning approach to receipt tracking for tax season. Try free for 30 days!

Get Started TodayAccessibility and security

Shoeboxed is accessible and secure from anywhere.

Store your digital documents in cloud storage services. This ensures your receipt files are accessible from anywhere and protected against physical damage, such as lost or faded receipts.

Never lose a receipt again 📁

Join over 1 million businesses organizing & scanning receipts, creating expense reports, and reclaiming multiple hours every week—with Shoeboxed.✨

Get Started Today

Mileage tracking

Shoeboxed will also track and organize your business miles.

Shoeboxed is also a mileage tracker app that uses your phone's built-in GPS.

Shoeboxed's mileage tracker is valuable for tracking and organizing business miles.

Shoeboxed will auto-categorize the data, making it efficient for tracking and organizing small business mileage for expense and tax purposes.

Track mileage with Shoeboxed 🚗

Track mileage using your phone’s built-in GPS for unmatched ease and accuracy. 💪🏼 Try free for 30 days!

Get Started TodayIntegration with accounting software

Shoeboxed integrates with Wave, Xero, and Quickbooks.

Shoeboxed will integrate your receipts and invoices with accounting software like QuickBooks or Xero so that all your invoices and receipts remain consistent across your accounting software.

b. Physical organization

If you're not quite ready to store and organize your receipts electronically, here's the best method we've found to store and organize your paper receipts:

Use file folders and binders: Organize your paper receipts and invoices in labeled folders or binders. Use dividers to separate different categories or months.

Categorize by date and type: Sort documents or paper receipts by date and type. This makes locating specific paper receipts and tracking expenses over time easier.

Label everything: Clearly label each folder or binder with its contents. Include dates, categories, and other relevant information from your paper receipts or invoices.

Use receipt envelopes: For small paper receipts, use envelopes labeled by month or category. This keeps them from getting lost or damaged.

Regular maintenance: Review and clean out your physical files regularly. Discard any unnecessary documents and ensure everything is categorized correctly.

Use the same filing system for all invoices and receipts to ensure everything is clear and easy to find.

What are the benefits of digital over physical receipts?

Storing invoices and receipts electronically offers numerous advantages over traditional paper-based methods. This approach leverages technology to enhance organization, efficiency, and accessibility.

Here are some of the key benefits we've found to storing invoices and business receipts electronically:

Enhanced organization

Electronic storage systems allow for easy categorization of documents and business receipts by type, date, vendor, or other relevant criteria. This makes it simple to locate specific business receipts and invoices when needed.

Digital receipts and documents can be easily searched using keywords, dates, or other metadata. This saves time compared to manually sifting through physical files.

Improved accessibility

Electronic storage solutions, particularly those based in the cloud, allow you to access your documents from any location with an internet connection. This is especially useful for remote work or when traveling.

Space savings

Storing documents electronically eliminates the need for bulky filing cabinets and storage boxes, freeing up valuable office space.

Environmental benefits

According to Kashmir Observer, electronic receipts can save 10 million trees. Storing invoices and receipts electronically reduces the need for paper, contributing to environmental sustainability by lowering paper consumption and waste.

Enhanced security

Digital documents can be encrypted and stored securely, protecting them from unauthorized access. Many cloud storage providers offer robust security features to safeguard your data.

Electronic documents are less susceptible to physical damage from fires, floods, or other disasters. Cloud storage solutions often include data backup and recovery options, ensuring your documents are safe.

Efficiency and time savings

Electronic storage systems can automate many tasks, such as data entry, categorization, and retrieval. This reduces manual labor and increases efficiency.

Finding and retrieving electronic documents is much faster than searching through physical files, saving valuable time.

Cost savings

Electronic storage can lead to significant cost savings over time by reducing the need for physical storage space and materials.

Automation and improved efficiency can lower administrative costs associated with managing and retrieving documents.

Better collaboration

Electronic documents can be easily shared with team members, accountants, or other stakeholders, facilitating collaboration and improving workflow.

Document changes can be made and viewed in real-time, ensuring all parties can access the most current information.

Compliance and audit readiness

Many industries have specific regulations regarding document retention and access. Electronic storage systems can help ensure compliance by providing secure, organized, and easily accessible records.

Digital records often include metadata such as timestamps and user actions, creating an audit trail that can be useful during financial reviews or audits.

Integration with other tools

Electronic storage systems can integrate seamlessly with accounting and financial software, streamlining the process of tracking expenses, generating reports, and preparing for taxes.

Mobile apps for receipt scanning and expense tracking (e.g., Shoeboxed) can directly upload documents to your electronic storage system, further enhancing efficiency.

When should you organize invoices and receipts?

Here are some of the best times we have found to organize invoices and receipts:

Immediately after a transaction: Organize your invoices and receipts immediately after each transaction to prevent paper clutter and documents from piling up and getting lost. This ensures that all details are recorded accurately when filing receipts.

Regularly scheduled intervals: Set a weekly or monthly schedule to organize and store receipts and documents. Consistency helps maintain order and prevents a filing system backlog.

Before tax season: Review and organize business receipts in the months leading up to tax season. This will make tax preparation smoother and make tax time less stressful.

Frequently asked questions

What is the best app to organize receipts electronically?

The best app to organize and store receipts electronically is Shoeboxed. Shoeboxed takes physical receipts and transforms them into digital records.

Shoeboxed is the best app for organizing receipts electronically due to its comprehensive features, automation capabilities, ease of use, and robust functionality.

By leveraging advanced OCR technology, cloud storage, and seamless integration with accounting software, Shoeboxed simplifies the process of managing receipts and expenses.

Can I use electronic receipts for tax purposes?

Yes, you can use electronic or digital receipts for tax purposes. The Internal Revenue Service (IRS) and tax authorities in many countries accept electronic receipts as valid documentation for expenses, provided they meet certain criteria.

Shoeboxed automatically generates detailed reports for reimbursements and tax purposes with IRS-accepted receipt images.

How can I store and organize receipts so they don't fade?

The best way to store and organize receipts so they don't fade is to use the digital method. Receipts, especially those printed on thermal paper, are prone to fading over time. Use a scanner or a receipt scanning app like Shoeboxed to digitize your receipts.

These apps have features that automatically extract key information and categorize expenses. Save digital copies in cloud storage services. Create a file folder and subfolder to categorize receipts by type, date, or vendor.

In conclusion

Organizing invoices and receipts is essential for effective financial management. Whether you choose to organize business receipts using a digital or physical method, consistency, and regular maintenance are critical. Using tools like Shoeboxed to organize receipts electronically, you will simplify your financial tracking, ensure compliance, and make tax preparation a breeze.

Caryl Ramsey has years of experience assisting in different aspects of bookkeeping, taxes, and customer service. She uses various accounting software to set up client information, reconcile accounts, code expenses, run financial reports, and prepare tax returns. She is also experienced in setting up corporations with the State Corporation Commission and the IRS.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad, and Android) to snap a picture while on the go, auto-import receipts from Gmail, or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports, including IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports, and more—with Shoeboxed.

Try Shoeboxed today!