Receipts are an essential part of businesses' financial records. They are proof of transactions, tax deductions, and business expenses.

Whether you’re a small business owner or managing a large company, having a clear and organized receipt system is key to a smooth financial process.

What receipts should business owners save?

As a business owner, here are the types of receipts you should save:

1. Expense receipts

Office supplies: Receipts for paper, pens, printer ink, and other office essentials.

Utilities: Bills for electricity, water, internet, and phone services used for business.

Travel expenses: Receipts for airfare, hotel stays, car rentals, and meals while traveling for business.

Meals: Receipts for business meals when entertaining clients or potential business partners.

Professional services: Receipts for services rendered by accountants, lawyers, consultants, and other professionals.

See also: Expense Receipt Essentials: Valid Proofs & Reimbursement Tips

2. Purchase of goods

Inventory: Receipts for products or raw materials sold to customers.

Equipment: Receipts for business equipment like computers, printers, machinery, and other operational tools.

Software: Receipts for software purchases or subscriptions used in business.

3. Operational costs

Rent: Receipts for office or retail space rental payments.

Insurance: Receipts for business insurance premiums, general liability, property, and employee health insurance.

Licenses and permits: Receipts for fees paid to obtain or renew business licenses and permits.

4. Employee expenses

Payroll: Records of employee payroll and related expenses.

Reimbursements: Receipts for expenses reimbursed to employees, such as travel, meals, and office supplies. It’s important to keep physical receipts for documenting and reimbursing employee expenses.

Training and development: Receipts for courses, workshops, and other professional development activities for employees.

5. Marketing and advertising

Advertising: Receipts for online ads, print ads, and other marketing campaigns.

Promotional materials: Receipts for business cards, brochures, and other promotional materials.

6. Miscellaneous receipts

Bank fees: Receipts for bank charges and fees for business accounts.

Shipping costs: Receipts for postage and courier services used to send products or documents.

Subscriptions: Receipts for industry-related magazine subscriptions, memberships, and online services.

How do you keep track of business receipts?

Efficient receipt organization is key to financial management, tax compliance, and expense tracking.

Here are the best ways to keep track of business receipts:

1. Use receipt scanning apps

Receipt scanning apps can convert physical receipts into digital receipts.

These apps usually have features like auto data extraction, categorization, and integration with accounting software.

2. Use cloud storage solutions

Store receipts electronically using cloud storage solutions so that you can organize and categorize digital receipts easily. This way your receipts are accessible anywhere and backed up.

Create a folder structure with categories and subcategories for easy access.

3. Incorporate expense management software

Get accounting software that has receipt management features. These tools will automate the categorization and integration of receipts into your financial records.

4. Update regularly

Set a schedule to scan, upload, and organize receipts. This typically should be weekly or monthly. Regular update prevents a backlog of paper receipts and makes sure your financial records are always up to date.

5. Try a physical filing system

For those who prefer or need to keep paper receipts organized, create a physical filing system to organize and store receipts:

Use labeled folders or envelopes for different categories (e.g. travel, office supplies, utilities).

Store receipts in chronological order within each category.

Store the filing system in a safe and easily accessible place.

6. Backup files digitally if you aren’t using cloud storage

Even if you have a physical filing system, it’s a good idea to have digital receipts as backups. Scan receipts and save important receipts for backup in case of loss or damage.

7. Create expense reports

Generate expense reports regularly to summarize and review all your receipts. This will help you track your expenses and prepare for tax filing. Use templates in spreadsheet software like Excel or Google Sheets to automate part of the reporting process.

8. Use email folders for e-receipts

For e-receipts, create folders in your email account for receipt organization:

Forward or move e-receipts to these folders.

Use email rules or filters to automate it.

9. Get a business credit card

Use a business credit card for all business expenses. A credit card statement and bank statement will simplify tracking. It will help small businesses to match receipts with their expenses more easily. Most credit card statements categorize expenses which can be cross-referenced with receipts.

10. Be consistent

Consistency is key. Develop a habit of managing receipts and stick to it. Regularly organizing and updating your receipts will save you time and stress in the long run.

How should small business owners keep business receipts?

Here's our step-by-step process to organize business receipts.

1. Create a filing system

Categorize: Divide receipts into categories (e.g., travel, office supplies, meals, client entertainment). Use folders or envelopes for each category.

Chronological: Organize business receipts within each category by date. This will make it easier to track expenses over time and simplify record keeping.

2. Use a receipt scanner

Digital copies: Scan paper receipts to create digital copies. Scanned receipts reduce physical clutter and provide backup copies for small business owners if originals are lost or damaged.

Organization: Save scanned receipts in named folders on your computer or cloud storage. For example, you might have a folder called “2024 Receipts” with subfolders for each category.

3. Update regularly

Weekly: Set aside time to scan and organize receipts each week. Regular updates will prevent backlog and keep your records up to date.

Monthly: Review your receipts monthly to make sure everything is in order.

4. Cloud storage

Backup: Store digital copies of your receipts on cloud storage services like Google Drive, Dropbox, or OneDrive. Cloud storage provides an extra layer of security, and you can access your receipts anywhere.

Sharing: Share receipts with your accountant or financial team as needed.

5. Expense reports

Templates: Use templates to create monthly or quarterly expense reports from your business transactions. Include date, vendor, amount, and category. This will help you track your expenses and prepare for tax season.

Automation: Consider automating part of the reporting process using software like Shoeboxed.

6. Keep receipts for the required period

Tax compliance: Keep your business receipts for at least seven years to comply with IRS guidelines. This will make sure that documentation is available in case of an audit.

Record disposal: Develop a system to securely dispose of no longer needed receipts, such as shredding paper copies.

7. Use Shoeboxed to organize receipts

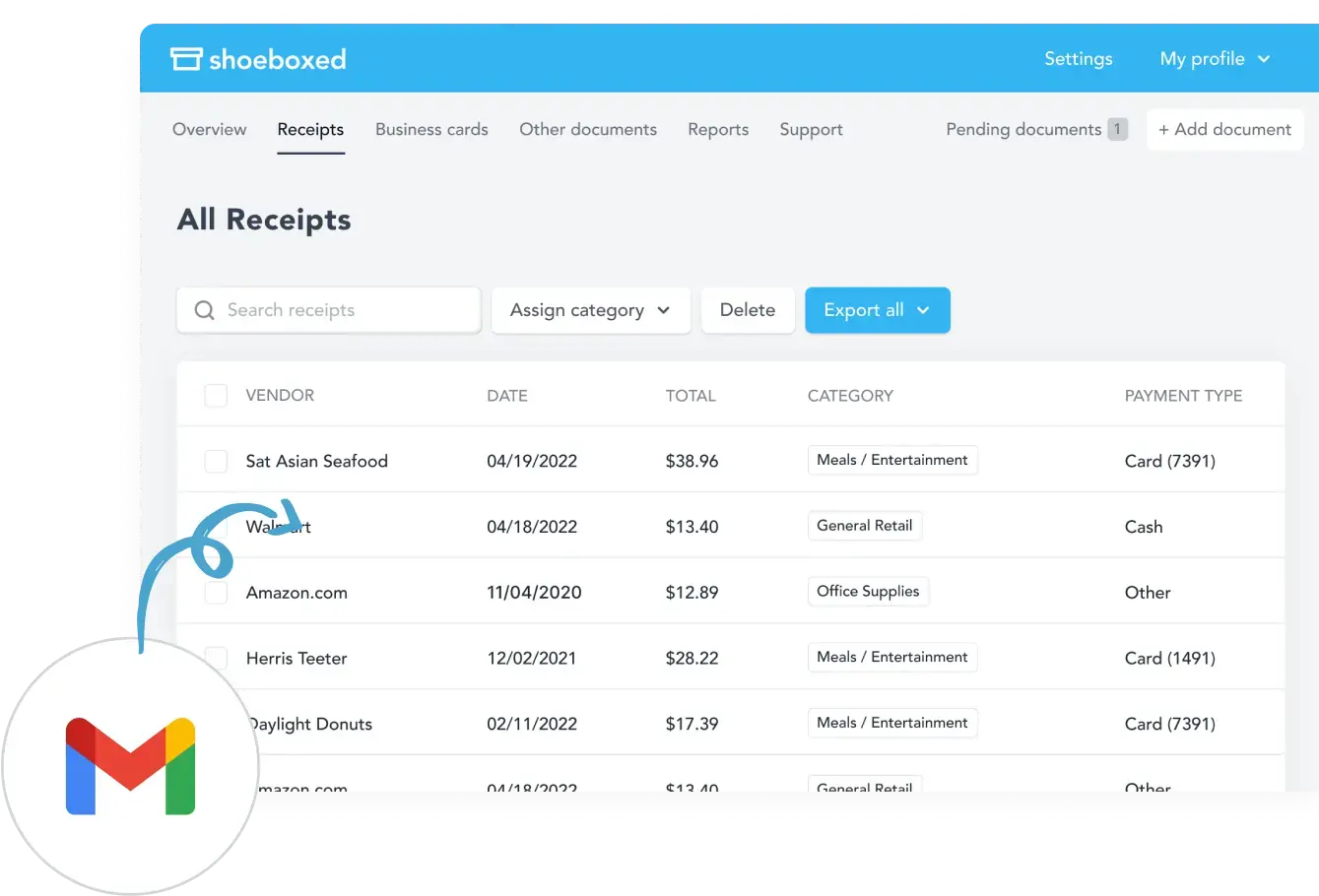

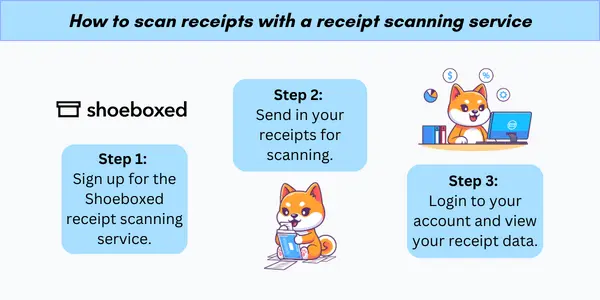

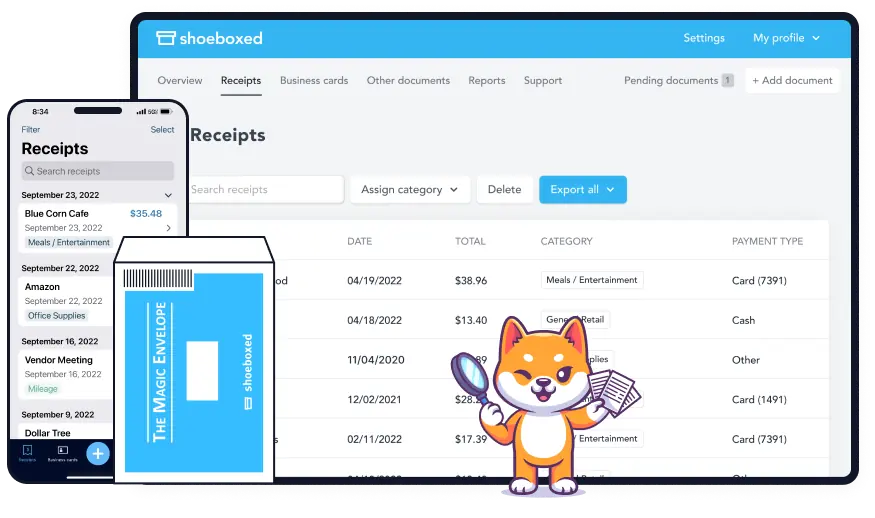

Shoeboxed is a digital tool to simplify receipt management.

Here’s how Shoeboxed helps you organize receipts:

Digital storage

You can digitize all your paper receipts by snapping a photo with your mobile device and uploading them into your Shoeboxed account with the app. This eliminates physical storage and reduces clutter and the risk of losing important documents.

Or, you can outsource the scanning to Shoeboxed. With Shoeboxed’s Magic Envelope service, you can mail in large batches of receipts. Shoeboxed will scan and digitize them for you, saving you the time and effort of scanning each one individually. It's perfect for managing a large volume of receipts without the hassle of manual data entry.

Break free from paper clutter ✨

Use Shoeboxed’s Magic Envelope to ship off your receipts and get them back as scanned data in a private, secure cloud-based account. 📁 Try free for 30 days!

Get Started Today

Shoeboxed also has a plugin that automatically forwards email receipts from your Gmail inbox to your Shoeboxed account. For other browsers, you can just manually forward email receipts to your Shoeboxed account.

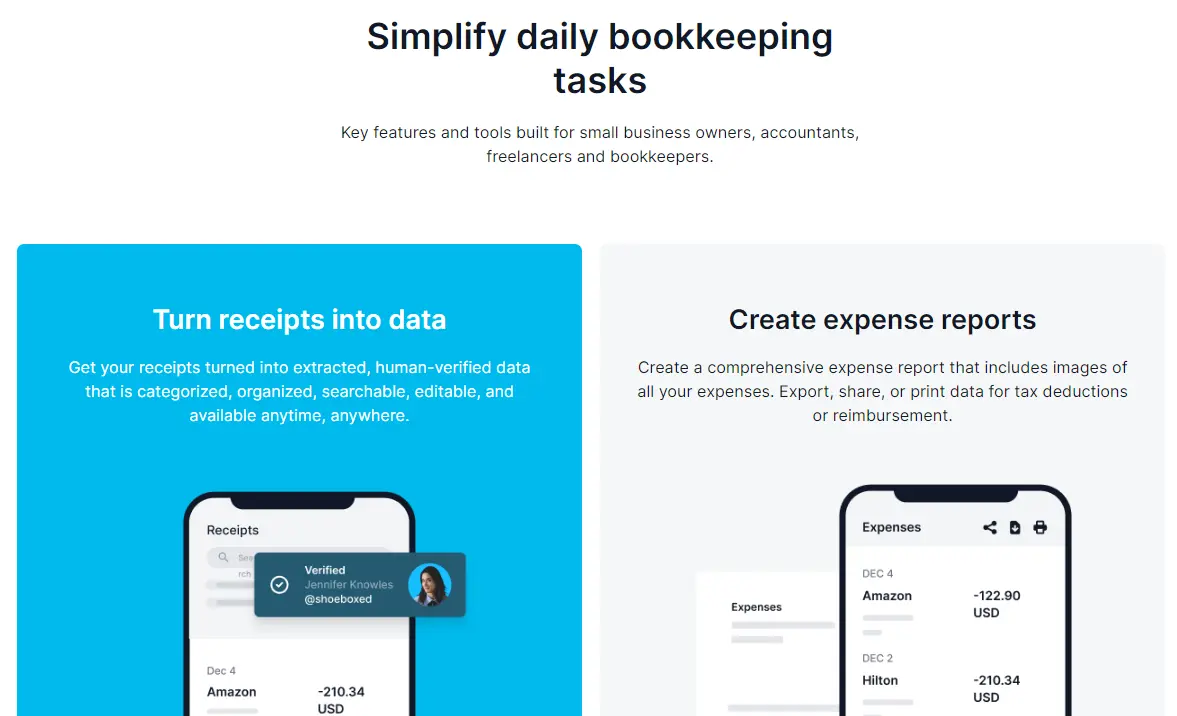

Automatic data extraction

Once you upload a receipt, Shoeboxed’s OCR (Optical Character Recognition) extracts the date, vendor, and amount.

Categorization

Shoeboxed allows you to auto-categorize receipts into 15 tax or customized expense categories. This is useful for tracking business expenses and ensuring they are recorded correctly for tax purposes.

Integration

Shoeboxed integrates with various accounting software like QuickBooks, Xero and many more. This allows you to sync your receipt data with your accounting system and simplify your bookkeeping.

Expense reports

You can create detailed expense reports with Shoeboxed. Reports can be customized and exported in various formats for internal audits and tax filing.

IRS-accepted

The digital versions of receipts created by Shoeboxed are accepted by the IRS and CRA (Canada Revenue Agency).

When tax time rolls around, expenses are already categorized for tax deductions, and employees are prepared for audits with quick and easy access to their expense data.

Turn receipts into data with Shoeboxed ✨

Try a systematic approach to receipt categories for tax time. Try free for 30 days!

Get Started TodayWhy do you need to keep business receipts?

Here are some reasons why you should keep and organize receipts electronically:

1. Tax deductions and compliance

One of the main reasons for organizing receipts is for accurate tax deductions. The IRS and other tax authorities require businesses to keep detailed records of their expenses to support deduction claims.

Organized receipts will provide small businesses with proof to back up those claims, reducing the risk of audits and penalties. You may miss out on legitimate deductions on your tax return without proper receipts and end up paying more tax.

2. Expense tracking and budgeting

When organizing and filing receipts, you can better track your business finances and transactions. By categorizing and regularly updating your receipts, you can see where your money is going. This is key to creating and maintaining a budget, identifying spending habits, and making informed financial decisions. It also helps you identify areas to cut costs or allocate more resources.

3. Audits and compliance

In the event of an audit, having organized receipts will make the process less painful. Auditors will ask for detailed records to verify your financial statements, and having everything in order will speed up the audit process. Organized receipts will keep you compliant with legal and regulatory requirements and help you avoid fines and legal issues.

4. Financial visibility and decision-making

Organizing your receipts will give you a clear and accurate view of your financial position. You can review past transactions, track cash flow, and make sure all expenses are accounted for. This visibility is key to making sound business decisions, getting funding, and planning for growth.

5. Proof of purchase and warranty claims

Receipts are proof of purchase for business expenses. This proof is required for warranty claims, returns, and exchanges. Organized receipts will help you find the documentation you need when you need it and save time and a lot of hassle.

6. Reimbursement and reporting

For businesses with employee expenses, organized receipts are key to accurate reimbursement. Employees need to submit receipts for their expenses. Having a system to manage those receipts will make sure that reimbursements are processed quickly and accurately. It also helps generate detailed expense reports required for internal audits, spend management, and financial analysis.

Frequently asked questions

Why do you need to organize and store receipts?

Organizing receipts is for:

Tax deduction: Properly organized receipts will help you claim tax deductions accurately.

Business expense tracking: To track business expenses and budget.

Audits: In case of an audit, organizing and storing receipts will provide proof of transactions and compliance.

Financial clarity: To have clear and accurate financial records for better decision-making.

How long should I keep my business receipts?

You should keep small business receipts for at least seven years. This is in line with IRS guidelines and will give you enough documentation in case of an audit. Organizing receipts electronically will help small businesses manage this long-term storage without taking up too much physical space.

In conclusion

By having a system that uses receipt scanners and cloud storage like Shoeboxed, you can reduce paper clutter and make receipt organization easy.

Proper receipt management will not only make bookkeeping efficient but also give you peace of mind during tax season and audits. Start organizing your receipts today for a financially healthy successful business.

Caryl Ramsey has years of experience assisting in different aspects of bookkeeping, taxes, and customer service. She uses a variety of accounting software for setting up client information, reconciling accounts, coding expenses, running financial reports, and preparing tax returns. She is also experienced in setting up corporations with the State Corporation Commission and the IRS.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!