Learning how to organize receipts for taxes is crucial and can save you a lot of stress and potentially money when tax season arrives. Properly organized receipts can lead to a smoother tax filing process, maximize deductions, and provide critical documentation in the event of an audit.

We've compiled a comprehensive guide on effectively organizing your tax receipts.

Why is it essential to know how to organize receipts for taxes?

It's important to understand why keeping receipts is essential for tax purposes. Business receipts are tax documents reflecting proof of expenses that can be deducted when business owners file taxes.

Receipts are the backbone of accurate tax filing. They prove your business expenses, charitable donations, healthcare, and other tax-deductible expenses.

Well-organized receipts can help you:

Maximize deductions: You can quickly identify eligible tax deductions by keeping a detailed account of your expenditures.

Facilitate smooth tax preparation: Organized records streamline the tax preparation process, making filing more manageable for you or your accountant.

Protect against audits: Well-organized receipts can be your best defense against an IRS audit, providing the necessary documentation to support your filings.

Which receipts are considered business expenses for tax season?

Before organizing business receipts, you'll need to know which business receipts are essential to keep. Generally, you should retain any documentation that supports your tax deductions or credits, such as:

Business expenses: If you are self-employed or own a business, keep receipts for office expenses, travel & transportation expenses, utility bills, and other business-related purchases.

Medical expenses: Receipts for doctor visits, prescriptions, and medical equipment may be deductible.

Charitable donations: Keep records of cash or property donations to qualified organizations.

Educational expenses: If you claim education credits or deductions, save receipts for tuition, books, and other school-related expenses.

Property taxes and mortgage interest can be significant deductions for many taxpayers.

What is an effective strategy for organizing business expense receipts?

Traditionally, individuals and small business owners would organize receipts by categorizing them into different envelopes or files based on the type of expense.

While this method is straightforward, it can be time-consuming and prone to human error. Over time, receipts can fade, get lost, or become difficult to manage, leading to potential discrepancies in tax filings.

Here's a strategy we've found to efficiently organize your purchase receipts.

1. Set up a separate business bank account and credit card for your business expenses

Having distinct accounts for business transactions streamlines record-keeping. This separation makes it easier to track business expenses without them getting lost among personal purchases.

You can quickly review credit card statements and bank statements to categorize expenses, calculate deductions, and prepare financial reports, reducing the time and effort required for bookkeeping.

Separate accounts help ensure that only legitimate business expenses are claimed as deductions, reducing the likelihood of errors on your tax return.

This clarity helps maximize your eligible deductions while minimizing the risk of an audit. If the IRS does audit your business, having separate accounts provides clear evidence that supports the legitimacy of your business expenses.

2. Start early and update regularly

Know your tax dates and plan accordingly. Procrastination is the enemy of organization. Start organizing your receipts at the beginning of the fiscal year. To avoid a pile-up of receipts and last-minute organization, update your records regularly.

Dedicate a specific time each week or month to sort through your recent receipts, file them accordingly, and make a digital copy for backups if necessary.

This habit prevents the last-minute rush and reduces the risk of losing receipts. Regular maintenance ensures your receipts are organized and up-to-date, making tax preparation more manageable.

3. Choose your organizational method

There are several methods for organizing your receipts:

Physical organization:

File folders: Use labeled folders to store paper receipts. This traditional method is straightforward, especially if you prefer tangible records.

Expanding files are ideal for categorizing receipts into slots within the same container, offering compact and organized storage.

Envelopes: Label envelopes with categories and store receipts inside. This method is excellent for people who have few transactions.

Digital organization:

Scanning and storing: Convert your paper receipts into digital format by scanning them and storing the files on your computer or cloud storage. Please back up your files to prevent data loss.

Financial software and apps: Utilize financial management software or apps that capture and categorize receipts digitally. These tools often provide additional features like spending tracking and report generation.

In today's digital age, leveraging technology can significantly simplify receipt management. Use mobile apps and scanners to digitize paper receipts, ensuring they are stored safely and are easily accessible. Digital formats are also easier to organize, search through, and share with your tax preparer.

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic award-winning approach to receipt tracking for tax season. Try free for 30 days!

Get Started Today4. Categorize your expenses

Know what counts as a deductible business expense and what is non-deductible. Once you understand which receipts to keep, categorize them based on their purpose.

Categorizing your receipts by expense type (e.g., office supplies, phone calls, travel, meals) is critical to tax savings. You can create different folders, envelopes, or files for each category, such as medical expenses, business expenses, and charitable donations.

This categorization aligns with how you'll report expenses on your tax return, making the filing process more straightforward. Categorizing receipts allows for quicker retrieval and easier reference when preparing your tax return or in case of an audit.

5. Use a dedicated storage solution

Whether you prefer digital or physical storage, dedicate a space solely for your tax-related documents.

For physical copies, use folders or envelopes labeled by category and year. For digital receipts, utilize cloud storage or accounting software with secure backup options, ensuring your data is protected and accessible anywhere.

6. Implement a filing system

Establish a filing system that works for you. Some prefer chronological order, while others might find categorizing by vendor even more intuitive. Consistency is essential, so please choose a system you can use throughout the year.

7. Regularly review and purge

Regularly review your business receipts to ensure they are appropriately categorized and that you're keeping only what's necessary. The IRS recommends keeping records for up to seven years, depending on the situation.

Generally, it's safe to dispose of receipts after three years, which is the period during which the IRS typically can audit your tax returns. However, keep your records for at least six years if you’ve underreported income by 25% or more.

Always check the current IRS guidelines to determine the appropriate retention period for your circumstances. This annual purge prevents unnecessary clutter and ensures your filing system remains manageable and relevant.

8. Seek professional advice

If you ever have any questions, please consult with a tax professional. Tax laws change frequently, and what's deductible can vary. A professional can offer advice tailored to your financial situation, ensuring you maximize deductions and comply with IRS regulations.

How can a business owner integrate Shoeboxed into receipt management?

Shoeboxed revolutionizes how small business owners organize receipts by digitizing the entire process. Here's how you can integrate Shoeboxed into your tax organization routine:

Scan your receipts

Learning how to organize receipts for taxes is easy with Shoeboxed.

You can start by scanning your small business receipts using the Shoeboxed app. The app is designed to capture clear images of your receipts and can even handle bulk scanning for multiple items. This step converts your physical receipts into digital format, making them easier to manage and less likely to be lost or damaged.

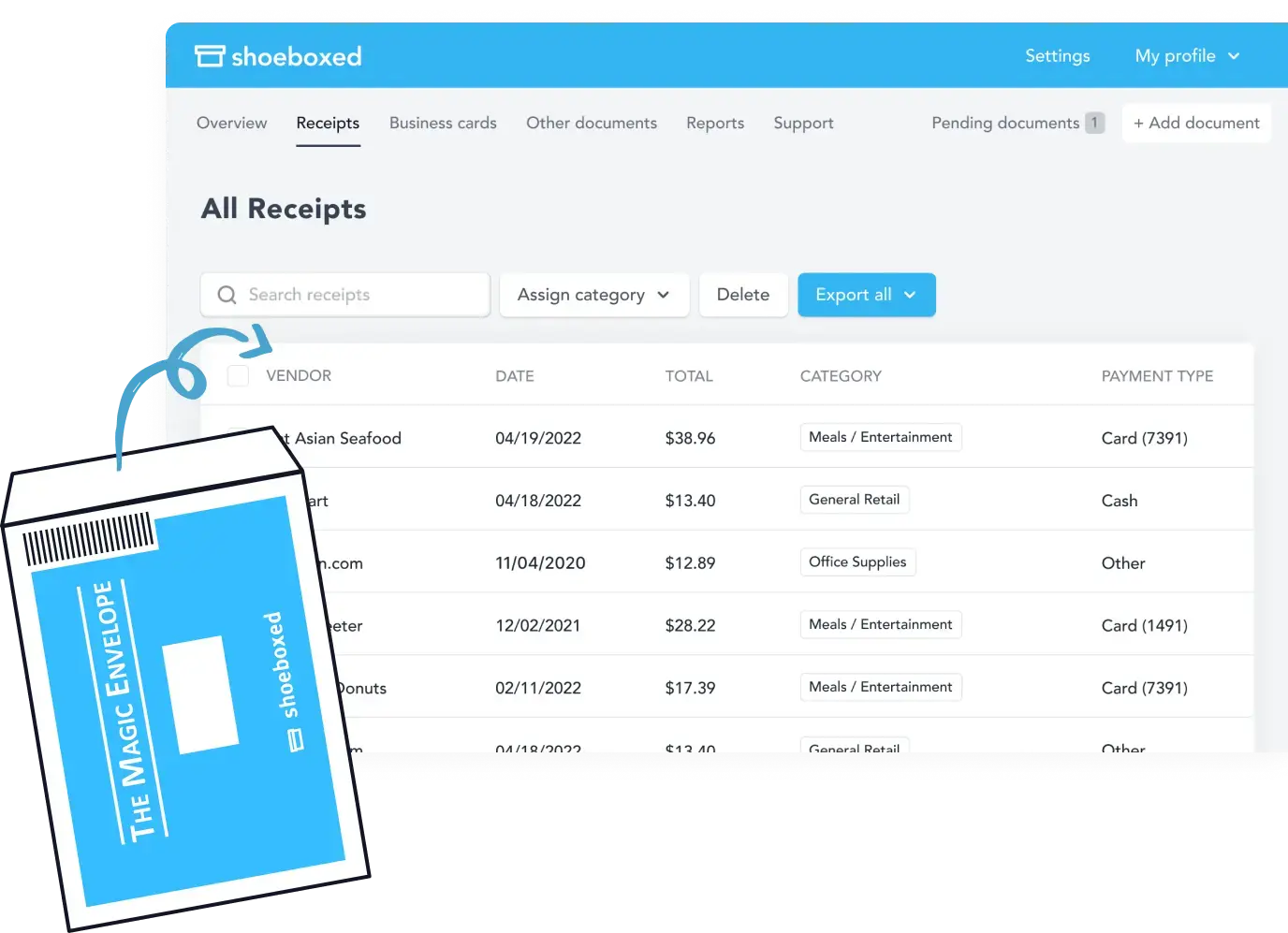

The Magic Envelope service

Shoeboxed can be used as a receipt scanning app or service.

A Magic Envelope is a service Shoeboxed provides to simplify digitizing and organizing your receipts and other supporting documents. Collect all your paper clutter, such as receipts, business cards, and other documents you need to digitize and manage for your business or personal finance records.

Shoeboxed provides these pre-paid, pre-addressed envelopes. Place your gathered documents into the Magic Envelope. You don't need to sort or organize them before sending them.

Send your filled Magic Envelope to Shoeboxed through the mail. The pre-paid aspect means you don't need to worry about postage; drop it in a mailbox or take it to your local post office.

Once your Magic Envelope reaches Shoeboxed, their team scans and digitizes all the enclosed documents.

The Magic Envelope service by Shoeboxed is designed to make managing paper clutter and organizing financial documents as seamless and hassle-free as possible. This ultimately saves time and improves efficiency, especially when preparing for tax season or managing business expenses.

Keep a Magic Envelope by your desk, in your purse, or on your car's dashboard.

Break free from paper clutter ✨

Use Shoeboxed’s Magic Envelope to ship off your receipts and get them back as scanned data in a private, secure cloud-based account. 📁 Try free for 30 days!

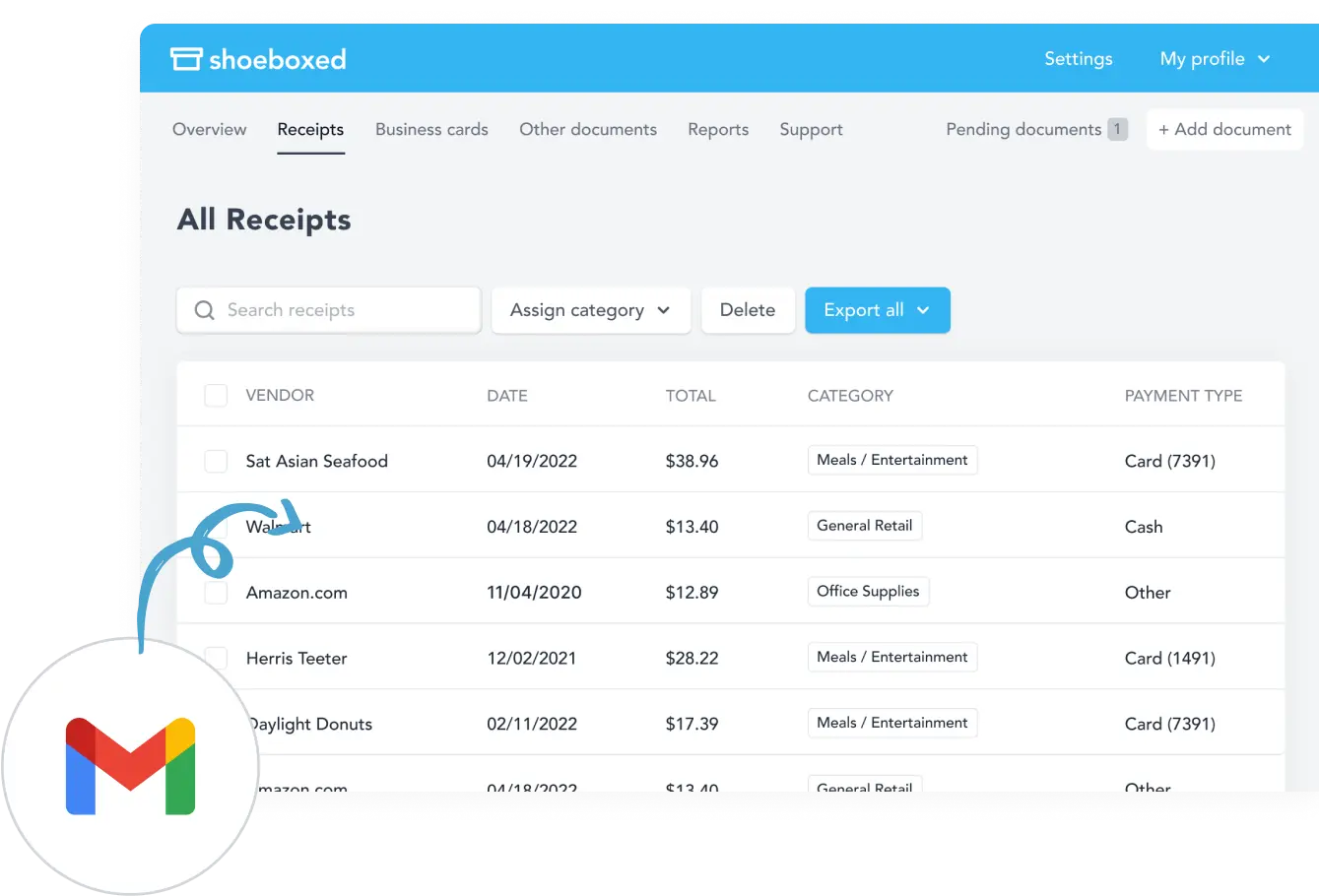

Get Started TodayAutomatic extraction and organization

Turn your receipts into tax-deductible expenses with automatic data extraction.

Shoeboxed uses OCR (Optical Character Recognition) technology to extract essential data from your scanned receipts, such as vendor names, dates, and amounts.

Shoeboxed automatically organizes this information, allowing you to categorize your expenses effectively. You can also create custom categories to match your specific tax filing needs.

The digitized data is organized and made available in your Shoeboxed account. You can review, categorize, and manage your documents online. Shoeboxed also ensures that the digital versions are clear, legible, and correctly categorized, making them suitable for tax filing and expense tracking.

Generate reports and export data

You can create comprehensive expense reports with just a few clicks.

One of the key features of Shoeboxed is its ability to generate comprehensive reports based on your categorized receipts. These reports can be directly used for tax preparation or sent to your accountant.

Additionally, you can export your receipt data to accounting software like QuickBooks, seamlessly integrating your financial data.

Store and access any time

You can access your receipts anytime, anywhere.

With all your receipts stored securely in the cloud, you can access your digitized receipts and documents anytime from anywhere via the Shoeboxed app or website.

You can also integrate this data with other software applications like accounting or bookkeeping platforms to streamline your financial processes.

This is particularly useful for retrieving specific receipts or reports in case of an IRS audit. Shoeboxed ensures that your digital receipt copies are IRS-accepted, which can give you peace of mind during tax season.

Keep a Magic Envelope by your desk, in your purse, or on your car's dashboard.

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic award-winning approach to receipt tracking for tax season. Try free for 30 days!

Get Started TodayHow long should I keep receipts and records for tax filing purposes?

The time you should keep receipts and records for tax filing purposes can vary depending on the action, expense, or event that the document records. According to the Internal Revenue Service (IRS) guidelines, here is a general outline:

Three years: Keep all records, including income, deductions, and credit-related receipts, for three years from the date you filed your original return or two years from the date you paid the tax, whichever is later. This timeframe covers the period during which the IRS can generally audit your tax return or that you can file an amended return.

Six years: If you underreported your income by more than 25%, keep your records for at least six years from the date you filed the original return. This extended period is due to the time the IRS has to audit a return when substantial income is omitted.

Seven years: Keep records related to a claim for a loss from worthless securities or a bad debt deduction for seven years.

Indefinitely: If you filed a fraudulent or did not file a return, you should keep records indefinitely since there is no statute of limitations for these situations.

Property records: For records related to real property or assets, keep documents for as long as you own the asset plus at least three years after you sell the property or report the transaction on your tax return (some advise keeping these records for seven years after selling or disposing of the property to account for any capital gains tax).

It is crucial to organize and store these documents efficiently so that they are readily available in case of an audit or if you need to file an amended return. Digital storage solutions, like cloud services or specialized software, can help keep these documents safe and accessible while reducing physical clutter. However, if you use digital storage, ensure it is secure and backed up regularly to prevent data loss.

Frequently asked questions

Do I need to keep paper receipts?

You are not required to keep paper receipts for tax purposes if you can produce accurate and readable digital copies. The IRS accepts digital formats as long as they are a true and accurate representation of the paper originals and are readily accessible if needed.

Even though digital receipts are acceptable, some people prefer keeping digital and paper copies for extra security, especially for significant expenses or complicated tax situations. It never hurts to keep the paper receipts as backup.

Should I keep receipts for medical expenses?

You should keep receipts for medical treatments, prescriptions, insurance premiums (if not deducted from your salary pre-tax), and other health-related expenses. These expenses can be used as deductibles on your tax return.

Are pictures of receipts ok for taxes?

Pictures of receipts are acceptable for tax purposes, provided they are clear, detailed, and accurately represent the original documents. Apps like Shoeboxed make ensuring that your digital copies meet these requirements easier, offering a convenient and compliant way to manage your receipts digitally.

In closing:

Getting organized for tax time will make your life easier. Organizing receipts for taxes might seem tedious, but it's an integral part of managing your financial health. Implementing a consistent organization system, categorizing expenses, and maintaining regular maintenance can transform a potentially overwhelming task into a manageable routine.

This will not only help streamline your tax preparation process, but it will also provide peace of mind, knowing that your financial documentation is in order and ready for whatever tax season brings.

Caryl Ramsey has years of experience assisting in different aspects of bookkeeping, taxes, and customer service. She uses a variety of accounting software for setting up client information, reconciling accounts, coding expenses, running financial reports, and preparing tax returns. She is also experienced in setting up corporations with the State Corporation Commission and the IRS.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports, and more—with Shoeboxed.

Try Shoeboxed today!