Are most of your receipts fading, damaged, or lost? Preserving receipts is a crucial aspect of financial management for both individuals and businesses.

With technology there are many ways to save your receipts, from physical storage systems to digital solutions.

Knowing and using receipt saving strategies can simplify financial processes, keep important documents safe, and maximize your tax deductions.

What kind of paper are most receipts printed on?

Thermal paper is the most common paper used for receipts. It’s a special paper coated with a material that changes color when heat is applied. This coating is a mixture of a dye and a matrix.

When heat is applied to the layer, it reacts chemically to produce a clear, high-definition image without ink or toner, which is why it’s the most popular paper for receipts.

Advantages of thermal paper

Speed: Thermal printers print fast and efficiently, perfect for high-volume printing.

No ink or toner: Thermal paper eliminates the need for ink cartridges or toner and reduces the maintenance and complexity of the printing process.

Durability: Properly stored thermal paper can last many years without fading, which is good for long-term records.

Disadvantages of thermal paper

Heat sensitive: Thermal paper is heat and light-sensitive. The image will fade over time or if exposed to high temperatures. This often results in faded thermal receipt paper and hard-to-read information.

Chemical sensitive: Certain chemicals and oils can also damage the thermal coating and degrade the printed image quality. This chemical reaction will further fade the thermal receipt paper and make it hard to restore or enhance the printed information.

What is the best way to preserve thermal receipt paper?

One of the best ways we’ve found to preserve thermal paper receipts is to store them digitally.

One of the best ways to create digital copies of your receipts is to use Shoeboxed.

Here are several reasons we have found Shoeboxed to be the best method for saving thermal paper receipts:

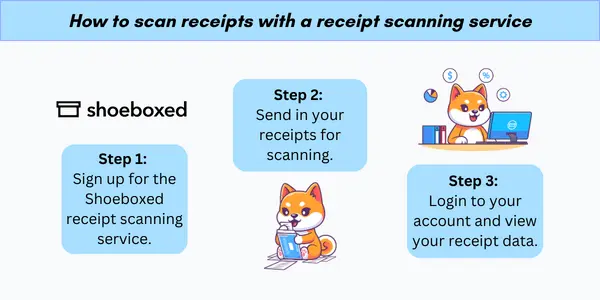

1. Digitization

Shoeboxed simplifies the process of digitizing receipts. You can either use their mobile app to snap a photo of the receipt or opt for their scanning service, where Shoeboxed takes care of the scanning for you.

This ensures that all the details from the thermal receipt paper are captured before they fade.

Shoeboxed allows users to scan thermal paper receipts using high-quality mobile apps, desktops, or laptops. This captures all the details before the receipts fade.

To scan receipts using a mobile device and Shoeboxed’s app, just snap a photo of the receipt with your mobile device’s camera and upload it to your Shoeboxed account using the app.

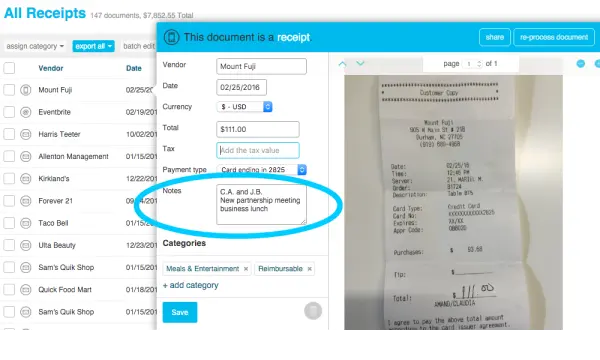

2. Optical character recognition (OCR) technology

Shoeboxed uses OCR technology to extract data from scanned thermal receipt paper so you can categorize and search for specific information later.

This technology preserves the details from the thermal receipt paper in digital format.

The extracted data from the thermal receipts automatically categorizes into 15 tax or custom categories.

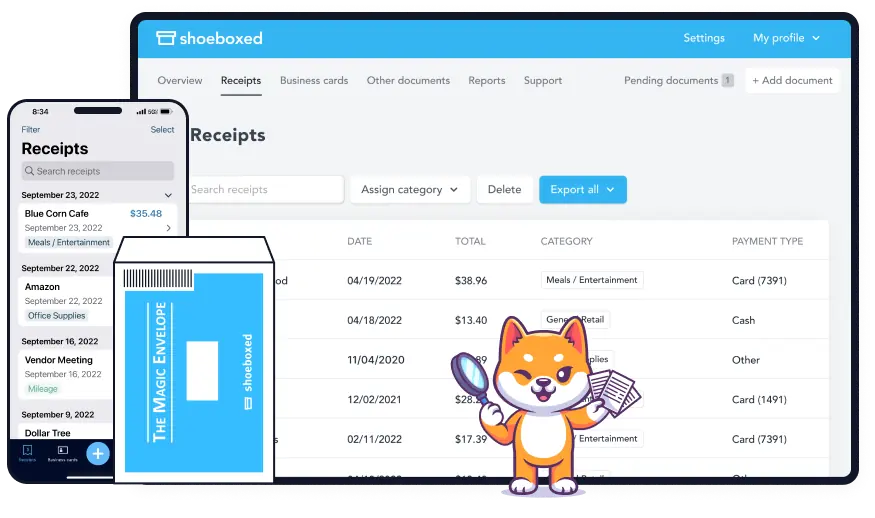

3. Cloud storage

Once digitized, receipts are stored in the cloud. This prevents physical degradation; you can access your receipts anytime and anywhere.

Cloud storage has automatic backups and redundancy, so your receipts are safe from hardware failure or other unexpected circumstances.

4. Integration with accounting software

Shoeboxed integrates with popular accounting software like QuickBooks and Xero. This lets you sync digitized receipts with your financial records and keep your accounting current.

By integrating with accounting software, Shoeboxed makes expense tracking, reporting, and tax preparation more efficient.

5. Physical receipt paper management

Shoeboxed has a mail-in service for businesses who want to outsource the digitization process.

You can send your receipts in a prepaid Magic Envelope, and Shoeboxed will scan and digitize them for you.

This is perfect for businesses with a large receipt volume.

Physical receipts method—Give your team a Magic Envelope per month and simply have them send in their receipts for scanning and data validation and extraction. Physical + Digital plans start from $18 per month for 600 digital document scans + 300 physical document scans.

Break free from manual data entry ✨

Use Shoeboxed’s Magic Envelope to ship off your receipts and get them back as scanned data in a private, secure cloud-based account. 📁 Try free for 30 days!

Get Started Today

6. Long-term preservation

Digital copies of thermal paper receipts result in long-term preservation.

This is important for tax purposes, claims on rebates, extended warranties, and protection from unauthorized charges.

Preserving receipt paper digitally with Shoeboxed ensures they will last and be legible over time.

7. Tax and audit ready

Long-term digital records are key to tax compliance and audit preparedness.

Shoeboxed will keep all your receipts organized and accessible when you need them.

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic award-winning approach to receipt tracking for tax season. Try free for 30 days!

Get Started TodayWhy save receipts?

Saving receipts is essential for individuals and businesses for several reasons:

1. Tax compliance

Receipts are required to substantiate the expenses you claim on your tax returns. The IRS and other tax authorities need documentation to support business expenses, charitable contributions, and other write-offs.

Properly saved receipts will justify these deductions during tax season and reduce the risk of audits and penalties.

2. Financial accuracy

Accurate financial records are key to budgeting, forecasting, and planning. Receipts give you detailed information about your spending habits so you can track expenses and monitor cash flow better. This will help businesses manage their budget and make informed financial decisions.

3. Audit preparation

In the event of an audit, having organized and preserved receipts is priceless. Auditors need detailed documentation to verify your financial statements and tax filings.

By keeping detailed records, you can provide the necessary evidence for your financial transactions and make the audit process smoother.

4. Expense reimbursement

For businesses and employees, receipts are required for expense reimbursement. Employers need receipts to validate business expenses before processing reimbursements. This is to ensure transparency and accountability in financial transactions and prevent fraudulent claims.

5. Warranty and returns

Receipts are proof of purchase for warranty claims and product returns. If you need to return a defective product or claim a warranty, the receipt is often required to validate the transaction and process your request.

6. Fraud

Saving detailed records of receipts will help you identify discrepancies or unauthorized expenses and prevent fraud. Reviewing and reconciling receipts with bank statements regularly will help you detect and address fraudulent activities sooner.

Can I restore a faded receipt?

Restoring faded receipt paper is difficult, especially if the thermal paper has already degraded. However, there are ways to make faded receipts more readable.

Here are some methods to restore faded receipts:

1. Physical restoration methods

a. Apply heat

Place the receipt paper between two plain white sheets of paper and iron it on low heat. Gently applying heat can sometimes reactivate the thermal paper ink and make the text readable.

b. Use your freezer

Put the faded receipt paper in the freezer for a few hours. This can sometimes make the text on thermal paper more visible.

2. Digital restoration methods

a. Scan and edit

Scan the faded thermal receipts using a high-resolution scanner. Use the scanner settings to adjust contrast and brightness.

b. Use a mobile app

Use an app like Shoeboxed with built-in features to enhance scanned receipt paper.

Preserve so you don’t need to restore faded receipts

It’s best to digitize thermal paper receipts as soon as possible so you won’t need to restore a faded receipt. Thermal paper receipts fade due to light, heat, and other factors, so digitization is key.

An app or service like Shoeboxed keeps a permanent digital copy of all your receipts that will remain legible and accessible for future reference.

Frequently asked questions

How do you prevent thermal paper receipts from fading?

Here's how to prevent receipts from fading:

Store receipts in plastic-free sleeves.

Keep receipts in a small enclosed space, not exposed to heat, direct sunlight, or water. Filing receipts in a cool, dark, and dry place is key to preserving them for a long time.

Clean and non-oily hands also reduce the chance of fading receipt paper.

High-quality thermal paper rolls and a reliable thermal printer can reduce fading.

Digitize receipts.

What is the best way to preserve receipts?

The best way to preserve thermal paper receipts is to store them digitally with a receipt management tool like Shoeboxed. This way, the receipts won't fade, get damaged, or become lost.

In conclusion

Preserving receipts requires a combination of physical and digital storage. You can keep your thermal paper receipts safe and accessible by using organized filing systems, digitizing them with scanners or mobile apps, and using cloud storage and expense management tools like Shoeboxed.

Regular updates and reviews will make your financial records more accurate and reliable. This method will help with tax preparation, auditing, and financial management.

Caryl Ramsey has years of experience assisting in bookkeeping, taxes, and customer service. She uses a variety of accounting software for setting up client information, reconciling accounts, coding expenses, running financial reports, and preparing tax returns. She is also experienced in setting up corporations with the State Corporation Commission and the IRS.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!