Saving receipts is part of keeping your business healthy and compliant. Receipts are more than just pieces of paper or digital files; they are for documenting transactions, claiming tax deductions and preparing for audits.

Whether you’re a small business owner or managing a big company, having a system for saving receipts will not only save you time, money, and improve your financial management, but also significantly reduce stress.

Here, we will show you the best method for saving receipts so you can stay on top of your finances and your business, and feel more at ease.

Why save receipts?

Here’s why:

Tax time: Receipts are required for tax deductions and as proof of expenses during audits.

Financial health: Managing expenses gives you a clear view of your business’s financial situation, budgeting, and forecasting and helps you make informed financial decisions.

Audit preparation: Organized and saved receipts are key to audit preparation. They provide the documentation to back up financial transactions and comply with tax laws.

Deductible expenses: Tracking daily expenses and using expense management apps to save all your receipts is key to finding deductible expenses for tax purposes. This will maximize your tax savings and ensure you don’t miss out on any eligible deductions.

What are the benefits of saving and storing receipts for business expenses?

Not saving receipts can lead to financial disorganization, missed tax deductions, and potential audit issues. Therefore, saving receipts is crucial if you want to run a successful business.

Here are the benefits:

Clear financial picture: Organizing receipts gives you a clear view of your business’s financial situation.

Record keeping: Record keeping is for accurate budgeting, forecasting, and financial planning.

Informed decisions: Reviewing expenses regularly means better financial decisions and resource allocation. This empowers you to take control of your business's financial health.

Easy management: Saving receipts digitally, along with business credit card statements and bank statements, means easy access and management of financial documents.

How to choose the most efficient way to save receipts

What is the most efficient way to save receipts?

Let's break it down:

Paper receipts vs electronic receipts

Here are some key differences between paper and electronic receipts:

Paper receipts |

Electronic receipts |

|---|---|

Can fade or get damaged over time. |

Easier to manage and can be accessed and sorted quickly. |

Advantages and disadvantages of paper receipts

Paper receipt pros |

Paper receipt cons |

|---|---|

Tangible, and some just prefer a physical receipt. |

Prone to damage and loss and requires physical storage space. |

Advantages and disadvantages of electronic receipts

Electronic receipts pros |

Electronic receipts cons |

|---|---|

Easy to save and manage, searchable, and less likely to be lost. |

Requires technology. |

How to save physical receipts

Although it is not the most efficient method, here is the best method for saving physical receipts.

1. Use files and folders to create a paper filing system.

2. Categorize by type (e.g., travel, office supplies).

3. Sort by date.

4. Store physical receipts in a dry place to prevent damage.

How to save receipts digitally

Here is the best method to save and organize receipts.

1. Digitize paper receipts using a receipt scanner or mobile app. Apps like Shoeboxed make this process easier by scanning receipts into digital images for organization and easy access.

2. Organize digital files by creating tax or custom categories.

3. Store receipts electronically to save on physical space, reduce clutter, and create a searchable archive.

4. Back up digital receipts regularly to the cloud or an external thumb drive.

How to leverage technology for saving receipts

All small business owners need a receipt management tool to save, organize, and track receipts.

Shoeboxed is a receipt scanner that can convert paper receipts into a digital format so small businesses and individuals can manage expenses efficiently and have accurate tax documents.

Here's how to get started with Shoeboxed:

1. Sign up to Shoeboxed

Create an account on the Shoeboxed website or download the Shoeboxed app from your mobile device’s app store.

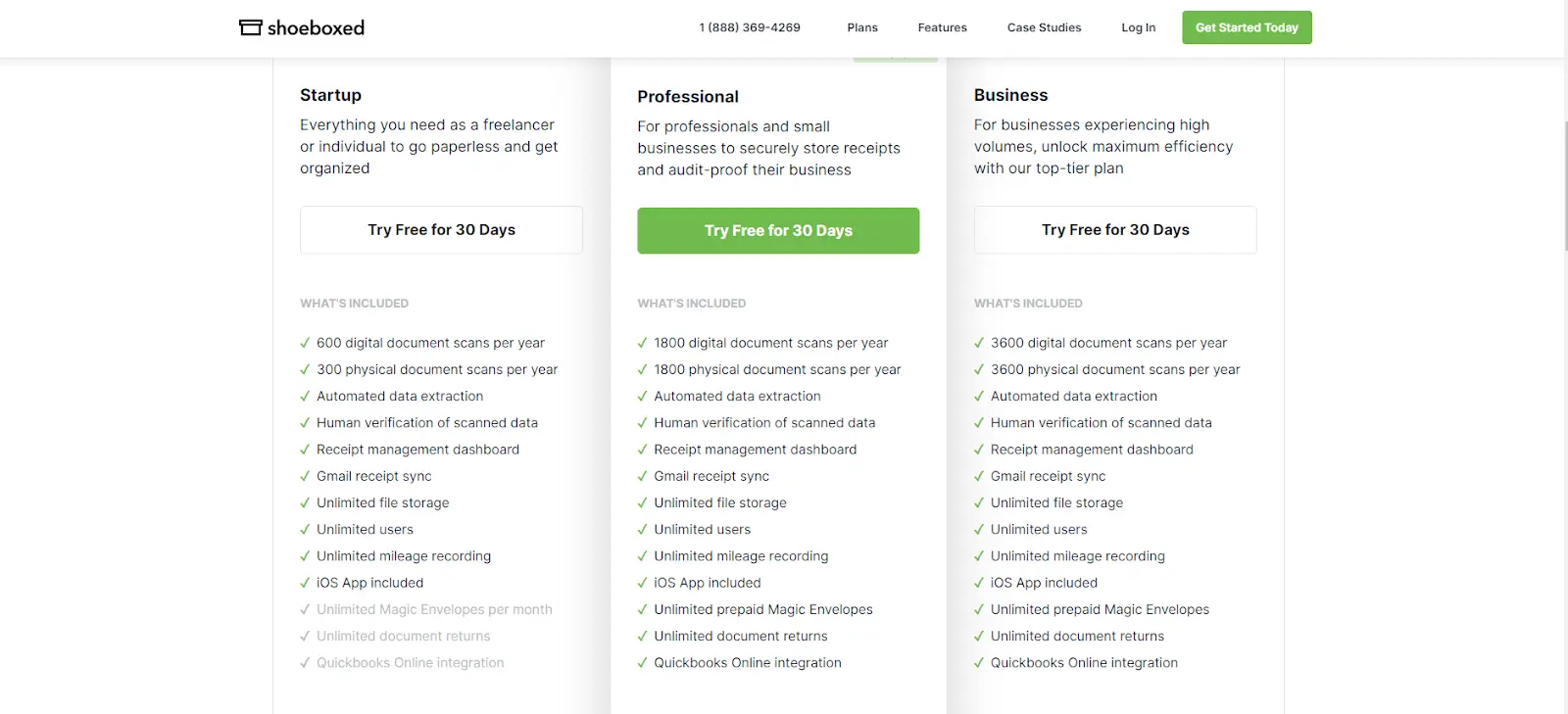

2. Choose a plan

Select a plan that suits you. Shoeboxed has various plans depending on the number of receipts and level of service you need.

With Shoeboxed, you can use the mobile app to scan receipts, outsource the scanning to Shoeboxed, email receipts to your account, or drag and drop receipts into the cloud using your laptop or desktop.

3. Download the mobile app

Take a picture of your receipt using your mobile device's camera and the Shoeboxed mobile app. The app automatically uploads the data into your Shoeboxed account.

4. Use the desktop upload feature

Auto-import digital receipts to your account with Shoeboxed's Gmail plug-in or forward email receipts to your Shoeboxed account. You can also drag and drop multiple receipts into the cloud using your laptop or desktop.

5. Consider the mail-in service option

Or, Shoeboxed offers a mail-in service. Send your receipts in a pre-paid Magic Envelope, and Shoeboxed will scan and upload them for you.

Break free from paper clutter ✨

Use Shoeboxed’s Magic Envelope to ship off your receipts and get them back as scanned data in a private, secure cloud-based account. 📁 Try free for 30 days!

Get Started Today6. Organize your receipts

Shoeboxed’s OCR (Optical Character Recognition) automatically categorizes your receipts based on the extracted data.

You can create custom categories to organize receipts according to your needs, such as travel, office supplies, etc.

7. Integration with accounting software

Shoeboxed integrates with popular accounting software, such as QuickBooks, Xero, and many more, so you can sync your receipts to your accounting system.

Export your receipt data in various formats (PDF, CSV, XLS) to import into other financial tools.

8. Create expense reports

Shoeboxed generates detailed reports that can be customized and are used for internal audits, tax prep, and financial analysis.

Share reports with your accountant or financial team.

The digital versions of receipts created by Shoeboxed are accepted by the IRS and CRA (Canada Revenue Agency).

When tax time rolls around, expenses are already categorized for tax deductions, and business owners are prepared for audits with quick and easy access to their business receipts data.

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic award-winning approach to receipt tracking for tax season. Try free for 30 days!

Get Started TodayWhat are the benefits of Shoeboxed?

Here's why you should use Shoeboxed to save and scan receipts.

1. Shoeboxed saves and organizes receipts for you, which saves time and reduces manual data entry.

2. With OCR technology, Shoeboxed ensures the data extracted from your receipts is accurate and reduces errors in your financial records.

3. You can access your digital receipts anywhere, anytime through the Shoeboxed app or desktop.

4. Shoeboxed saves and stores digital receipts safely and protects your financial info from loss or damage.

See also: How to Upload a Receipt: A Comprehensive Step-by-Step Guide

What are the IRS guidelines for saving receipts?

Here are the IRS's guidelines for receipt storage:

Policy: According to IRS guidelines, electronic records, including scanned images of receipts, are compliant as long as they accurately reflect the original documents and are stored in a secure, accessible format.

Duration: Keep receipts for three years from the date you file your tax return or two years from the date you paid the tax, whichever is later.

What are the best practices for saving receipts and receipt organization?

It's crucial that small businesses establish a consistent system for saving receipts and that everyone is on board.

1. Create clear policies for expense reports and employee reimbursement to be transparent.

2. Update and organize receipts regularly to stay up-to-date and stress-free.

3. Keeping your finances in order during tax season is crucial. Track spending, scan and digitize receipts, and check in regularly to avoid stress. This will keep you organized and make tax prep easier.

Recap

Here's a quick overview:

Saving business receipts efficiently means your records are accurate, so you always know where your business stands.

Organizing receipts digitally saves time, stress, and money.

Digital records mean no paper clutter and easy access to receipts.

Frequently asked questions

Are scanned receipts tax-compliant?

Yes, scanned receipts are tax-compliant and accepted by the IRS as proof of purchase of a business expense as long as they are clear, legible, and an exact copy of the original paper receipt.

According to the IRS, electronic records including scanned images of receipts are compliant as long as they match the original document and are stored in a secure and accessible format. This means businesses can store digitally so it’s easier to organize and access receipts during tax time and audits.

Can I use electronic receipts for personal taxes?

Yes, the IRS accepts electronic receipts as long as they are clear and accessible.

In conclusion

Organizing business receipts is key to keeping your records accurate. Saving receipts digitally saves time, reduces paper clutter, and frees up space. Shoeboxed is the perfect tool for business owners looking to simplify saving and organizing receipts.

Use Shoeboxed to store receipts so that you can keep records accurate, streamline expense tracking, and be tax-ready. Sign up for Shoeboxed today for an efficient receipt management system.

Caryl Ramsey has years of experience assisting in bookkeeping, taxes, and customer service. She uses a variety of accounting software to set up client information, reconcile accounts, code expenses, run financial reports, and prepare tax returns. She is also experienced in setting up corporations with the State Corporation Commission and the IRS.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple receipt capture methods: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad, and Android) to snap a picture while on the go—auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports, including IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports, and more—with Shoeboxed.

Try Shoeboxed today!