Do you ever wonder what happens to all your receipts when tax time rolls around? Ironically, saving receipts is key to putting some of that money back into your pocket.

A business tax receipt is the documentation you need to claim an expense on your tax return. You’ll need these in case of an audit. Whether office supplies, transportation or medical expenses, every receipt matters for business expenses and deductions.

What are business receipts?

Receipts for taxes are proof of business expenses, charitable donations, healthcare costs, and other tax deductible expenses. They are necessary for accurate tax filing and can be lifesavers in case of an audit.

They come in many forms – paper receipts, digital receipts, bank statements, and credit card statements. The IRS requires business owners to keep these documents to support the expenses claimed on their tax return.

Why should you keep business receipts?

In my experience, keeping receipts and supporting documents is crucial for business owners who want to maximize their deductions, simplify tax preparation, and protect against audits. Receipts give a complete picture of a business’s income and expenses as proof of purchases and sales.

Without proper documentation, business owners may miss out on eligible deductions and end up with a higher tax bill. In case of an audit, receipts are proof of expenses, help resolve any discrepancies, and ensure tax compliance.

What is a business expense?

A business expense is a cost incurred during the ordinary and necessary operation of a business. These expenses are tax-deductible if they are considered necessary and typical for the type of business you operate.

Examples of business expenses:

Office expenses: Includes supplies like stationery, computers, and office rent.

Transportation expenses: Covers fuel costs, vehicle maintenance, and purchases of company vehicles used for business.

Medical expenses: Receipts for doctor visits, prescription medications, and medical equipment may even be deductible.

Why track business expenses?

You need to track these expenses for tax filing, maximizing deductions, financial management, and budgeting. Knowing where your money goes helps you strategize cost reduction and operational efficiency.

What kind of receipts should you keep?

For tax purposes, you must keep various receipts and supporting documents proving your income, deductions, and credits.

Here’s a breakdown of the kind of receipts you should keep to be tax-ready:

1. Income receipts

Sales receipts: If you have a business, keep all receipts related to income and sales. This includes cash and credit card transaction receipts, customer invoices, cash register tapes, and online sales records.

Rental income receipts: For rental property owners, keep receipts for rental payments and any other income-related documents.

2. Expense receipts

Office expenses: Receipts for office supplies, furniture, equipment, and any services that maintain your office.

Travel and meal expenses: Receipts for business travel-related expenses, such as airfare, hotel stays, car rentals, and meals during business trips.

Vehicle expenses: If you use your vehicle for business, keep receipts for gas, maintenance, repairs, and insurance. If you claim the standard mileage rate, you’ll need documentation of the miles driven for business purposes.

Home office expenses: If you have a home office, keep receipts for utilities, homeowners insurance, property taxes, mortgage interest, and repairs related to your home office.

Professional services: Receipts for payments to professionals like accountants, lawyers, or business consultants.

Medical costs: Receipts for medical and dental expenses, doctor visits, prescription medications, and medical equipment if you plan to deduct these expenses.

See also: Expense Receipt Essentials: Valid Proofs & Reimbursement Tips

3. Inventory purchases

If you have a business that requires inventory, keep receipts for purchasing any goods you later sell.

4. Education expenses

Receipts for education expenses related to your work or business, seminars, workshops, and tuition fees that improve or maintain your job skills.

5. Charitable donations

Receipts for charitable donations, cash, and property donations. For any donation of $250 or more, the IRS requires a statement indicating the amount of the cash or a description of any property given and whether the organization provided any goods or services in exchange for the gift.

6. Major purchases and improvements

Keep receipts for major purchases, especially those you depreciate, such as business equipment or vehicles. This also applies to major improvements on property you own for business.

7. Insurance payments

Keep receipts for any business-related insurance premium payments and other paid bills.

Why keep receipts?

Keeping receipts means you have a record of all transactions, so you don't miss any deductions.

Keeping your receipts means you’ll stress less during tax season and see your spending habits so you can find areas to save and make better financial decisions.

Electronic or paper receipts?

Electronic receipts reduce physical clutter and are easier to search; paper receipts are more tangible. The one you choose affects how you organize, find your financial info, and prepare for audits and tax season.

Electronic receipts offer unparalleled convenience. They reduce physical clutter, are easier to search, and are more accessible for backup and retrieval, making financial management more efficient.

Physical receipts, although still valid, digitizing them makes them more secure and accessible. Scanning and categorizing them for easy retrieval and tracking will help with better financial management.

How to set up a receipt management system

A well-organized system not only facilitates easier tracking and categorization of expenses but also ensures readiness for tax time and compliance audits.

Here's how to set up a receipt management system.

1. Separate business and personal finances

Using a business bank account and credit card makes tracking small business receipts and expenses easier and is required for accurate bookkeeping.

2. Establish a dedicated storage solution

An organized system makes it easier to track and categorize expenses and prepare for tax time and compliance audits.

For digital, use cloud storage or accounting software for digital receipts.

If you prefer physical copies, you can use a secure filing system, a fireproof safe, or an organized binder.

Business tax receipts are critical for tax deductions and compliance, and the IRS requires them for substantiation in case of an audit.

3. Establish a filing system

To organize receipts, categorize by date or vendor, and use a consistent naming convention for digital files.

How to digitize and store receipts with Shoeboxed

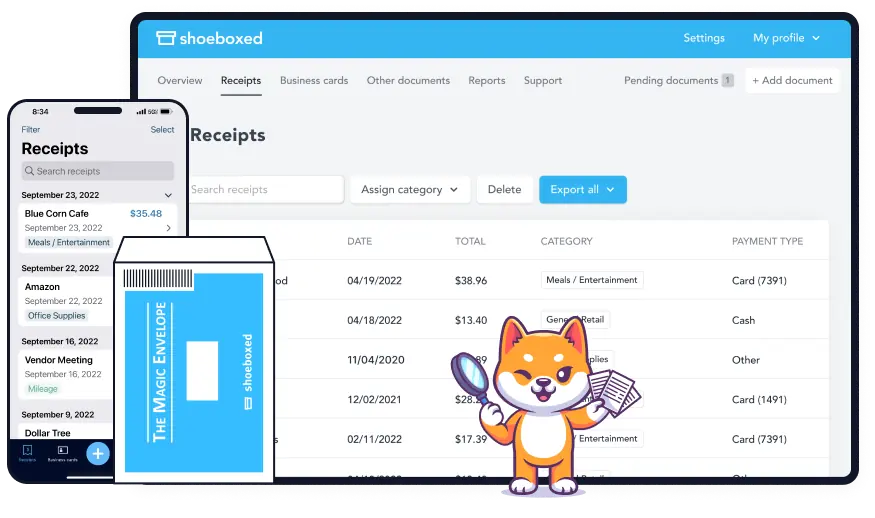

Digitizing and storing receipts with Shoeboxed is easy and fast.

Here’s how to use Shoeboxed to digitize and store your receipts:

Step 1: Digitize receipts

Mobile app scanning

Download the Shoeboxed app on your smartphone. Use your smartphone’s camera to take a picture of the receipt, and the app will upload the data to your Shoeboxed account.

Mail-in service (Magic Envelope):

For those who don’t want to scan themselves or have a large volume of receipts, Shoeboxed has the Magic Envelope service.

Just place your receipts in a pre-paid envelope provided by Shoeboxed and mail it to them. They will scan, digitize, and human-verify the contents of your envelope.

Shoeboxed is the only receipt scanner app that will handle both your paper receipts and your digital receipts—saving customers up to 9.2 hours per week from manual data entry!

Break free from paper clutter ✨

Use Shoeboxed’s Magic Envelope to ship off your receipts and get them back as scanned data in a private, secure cloud-based account. 📁 Try free for 30 days!

Get Started TodayStep 2: Data extraction and categorization

Once your receipts are uploaded or received via the Magic Envelope, Shoeboxed will organize receipts.

Automatic data extraction

Shoeboxed uses Optical Character Recognition (OCR) technology to extract data from each receipt, such as date, total amount, tax amount, vendor, and payment method.

Categorization

Shoeboxed will categorize your receipts into tax or custom categories so you can track and manage them throughout the year.

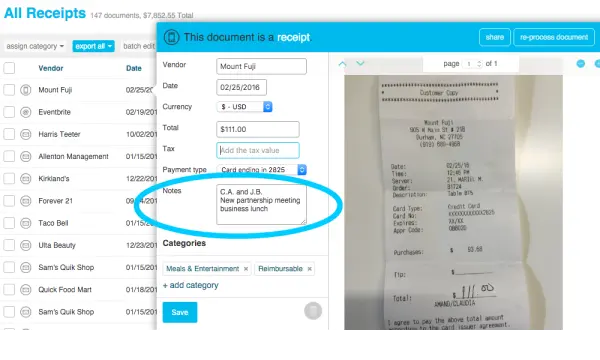

Step 3: Review and edit

After Shoeboxed processes your receipts, you can review the extracted data by logging in to your account via the web or mobile app.

You can edit, if needed, to correct errors or add project codes or notes about the business purpose of the expense.

Step 4: Generate expense reports

Shoeboxed generates tax-ready reports of deductible expenses so you can fill out your tax return accurately and efficiently.

With Shoeboxed, receipts are stored in an IRS-accepted format, so tax time is smoother and more audit-proof.

Step 5: Integrate and export

Software integration

Shoeboxed integrates with popular accounting software like QuickBooks, Xero, and Wave. This lets you sync your digitized receipts and financial data with your accounting records.

Export options

You can export your digitized receipts and data in PDF, CSV, and other formats for tax returns, reimbursements, or financial reporting.

Cloud storage

All digitized purchase receipts are stored in your Shoeboxed account. Shoeboxed uses advanced encryption to keep your data safe and compliant with privacy regulations.

Availability

Your digitized receipts are available anywhere via the Shoeboxed app or website. This is perfect for business owners who need to access their expense records on the go.

How does Shoeboxed make managing business receipts for taxes easier?

Scanning and digitizing paper receipts: You can scan receipts with the Shoeboxed app or send them in via the Magic Envelope service to have them digitized.

Automatic categorization and data extraction: Shoeboxed will automatically extract and categorize information from receipts so you can review it.

Cloud storage: Access your digitized receipts anytime and from anywhere, knowing they are stored safely and backed up in the cloud.

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic award-winning approach to receipt tracking for tax season. Try free for 30 days!

Get Started TodayFrequently asked questions

1. How long should I keep my tax business receipts?

You should keep your tax receipts for at least three years, the IRS's timeframe for auditing tax returns.

2. Are electronic receipts as good as paper receipts for tax purposes?

You can use either for tax purposes, but electronic receipts have advantages. Electronic receipts reduce physical clutter, are easier to search, and are more accessible for backup and retrieval, making financial management more efficient.

In conclusion

By tracking expenses and saving and organizing receipts with accounting software such as Shoeboxed, which digitizes and stores receipts, you can make tax time more straightforward and compliant and enjoy the savings of more deductions.

Stay organized all year round and make tax season stress-free. Try Shoeboxed to see how it can change your receipt management and make every tax season easier and faster. Always consult a tax professional if you have any questions.

Caryl Ramsey has years of experience assisting in bookkeeping, taxes, and customer service. She uses a variety of accounting software to set up client information, reconcile accounts, code expenses, run financial reports, and prepare tax returns. She is also experienced in setting up corporations with the State Corporation Commission and the IRS.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple receipt capture methods: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad, and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports, including IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports, and more—with Shoeboxed.

Try Shoeboxed today!