When you’re always on the road, keeping your financial records organized can be hard. You may not always have time to document your transactions, and it can be easy to lose track of receipts.

As a trucking owner-operator, however, bookkeeping is an important part of running your trucking business. Understanding bookkeeping helps to give you a clear picture of your business’ performance and be prepared for when tax time rolls around.

That’s why we’ve put together a few truckers’ bookkeeping tips to simplify your bookkeeping process. Keep reading below for our guide to bookkeeping for truckers.

See also: Accounting for Truckers: Steps, FAQs, Resources

Why is bookkeeping important for trucking companies?

The practice of recording each financial transaction a company entity does from its inception to its closure is known as bookkeeping. Each financial transaction is documented based on supporting paperwork, depending on the type of accounting system the company uses. That’s right—all those little slips of paper you keep in your glovebox are important to your trucking business! And you should be documenting them for your finances on a regular basis.

It may be tedious to record all of your transactions, but come tax season, you’ll thank yourself! By keeping track of every penny you spend and earn, you may be able to find new deductibles and save your business even more money.

Well-organized financial records can also provide a great deal of information about your business. You can use this accounting information to gauge your company’s performance and make decisions about your budget, workflow, investments, and potential growth.

Using bookkeeping software for trucking companies vs. hiring a bookkeeper

There is one major factor you’ll want to consider when deciding how you want to manage your bookkeeping—time.

For trucker drivers who prefer to spend their off-duty time resting up for their next long-haul trip, hiring a bookkeeper can be a great investment. Balancing the books is time-consuming, and time is money! Bookkeepers can be a great source of financial knowledge and may be able to share valuable insight that can improve your business’ overall performance.

If you prefer to manage your financial records on your own, there are several ways to go about it. While some may choose to use the traditional pen and paper, it’s better to digitize your records to avoid risking damage or errors in entries.

One way to digitize your documents is by creating a trucking expense spreadsheet. Check out this guide to creating a trucking accounting spreadsheet:

Trucking accounting spreadsheet by 404 Trucker

Spreadsheets are convenient, but they still take quite a bit of time to build and maintain. They also don’t come with any of the fancy bells and whistles that bookkeeping apps and software do. Many bookkeeping apps and software will generate reports and draw valuable insights based on your data.

We highly recommend using bookkeeping apps and trucker accounting software to simplify your accounting process. Additionally, there is free bookkeeping software for truckers to use.

Top 4 trucker bookkeeping apps

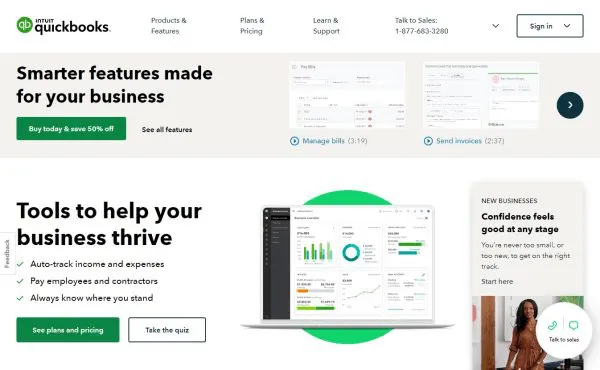

Quickbooks

This is one of the most well-known accounting apps for trucking management software for a reason. It’s a simple-to-use, all-in-one accounting platform that includes many useful features such as income and expense tracking, mileage tracking, and invoicing.

Quickbooks’s home page

It also integrates seamlessly with TruckingOffice, a trucking management system that helps you manage your dispatches and business expenses, as well as prepare your IFTA reports.

Access all these features from your computer or mobile device, so you’re ready for anything on and off the road.

See also: Is QuickBooks for Trucking Business Finances Worth It?

Shoeboxed

Keep your dashboard organized and paper-free with Shoeboxed. Shoeboxed’s scanner and organizer web app takes your physical documents, digitizes them, and saves them to the cloud, so they’re accessible anytime, anywhere.

Shoeboxed’s homepage

Simply use your phone camera to take a photo of any receipts, invoices, business cards, or paper documents. Or, if you don’t find scanning each receipt a tedious task, try out Shoeboxed’s Magic Envelope service. All you have to do is place your receipts into the postage-paid envelope that can sit on your dashboard during long hauls and then send it off to our scanning facility at the end of the month.

Shoeboxed will do all the tedious scanning work for you!

Hit the road with Shoeboxed ⛟

Stuff receipts into the Magic Envelope while on the road. Then send them in once a month to get scanned. Expense reports don’t get easier than this! 💪🏼 Try free for 30 days!

Get Started TodayRigbooks.com

This cloud-based truck management software allows you to track fuel mileage, expenses, trips, and orders. While it’s not as well-rounded as the other options on this list, its most popular feature can help improve your bottom line.

Rigbooks’ homepage

Rigbooks analyzes each of your loads to let you know its true cost per mile. That way you can choose the most profitable loads and avoid wasting time and money.

Q7

If you’re experienced in bookkeeping and are managing a small or medium-sized trucking company, consider Q7.

Q7s’ homepage

Q7 is a fleet management software (https://gofrontline.com/q7-software/) that also acts as full double-entry accounting software. Alongside its standard accounting features, Q7 offers a number of useful functions for owner-operators including dispatch software and a freight billing component. That means you’ll be able to manage all areas of your business from one place.

There is a steep learning curve with Q7 and it can be pricey, but if you are looking for a software that does it all, Q7 is definitely worth it.

See also: 45+ Bookkeeping Resources You Shouldn’t Ignore

Bookkeeping best practices for truckers

As you hop off your rig after a long, cross-country drive, bookkeeping is likely the last thing on your mind. It’s tedious work, and even if you employ a bookkeeper, you still need to hold onto and organize your documents, cash receipt journals, and receipts book on a regular basis.

Keep reading below for some useful tips to simplify your accounting process.

1. Keep an online copy of your bills

Avoid missed payments and stay on top of the money going out of your bank account by switching to electronic billing. That way, all of your bills can be accessed through any computer or mobile device, no matter where you are in the world.

For any bills that don’t have an option to go digital, you can use Shoeboxed to scan your paper copies and save them to the cloud.

2. Learn about tax deductibles

Don’t “tip” the taxman. Make sure you research any and all deductibles your owner-operator trucking business could be eligible for. For self-employed truck drivers, all of your trucking business expenses are likely deductible—even your vehicle expenses like fuel, tolls, and parking.

This is where your trucking management software comes in handy. The data your software collects from your bills, invoices, and receipts can all be used to help find and prove eligibility for your deductibles.

3. Organize your receipts

One of your most powerful trucking bookkeeping resources comes in the form of a tiny slip of paper—receipts! Without them, you run the risk of losing hundreds, even thousands, in taxes. You also miss out on valuable information on your business’ spending.

To learn more about organizing your receipts, check out our ultimate receipt organization guide. It’s long but thorough and makes a great truck-stop read!

Never lose a receipt again 📁

Join over 1 million businesses scanning receipts, creating expense reports, and reclaiming multiple hours every week—with Shoeboxed.✨

Get Started Today4. Get a business credit card/bank account

How many times do you fill your tank while you’re on the road? Those charges add up and can certainly make a large dent in your credit card bill.

Save yourself the trouble at the end of every month by applying for a business credit card and bank account. That way, you won’t have any mix-ups between personal and business expenses. The last thing you want is to end up paying a business expense out of your own pocket.

You’ll also have an easier time tracking and documenting your spending, as most accounting software can integrate with your bank account.

5. Update your books daily

What does taking the garbage out and recording expenses have in common? They’re both chores! You may dread them, you may forget to do them, but they’re necessary and have to be done eventually.

We recommend updating your books on a daily basis so you can make sure all the details of your transactions are fresh in your mind. The accounting software recommended in this article comes with mobile apps, so even if you’re not at your desk, you have no excuse! If you find it difficult to find time to update your books daily, at least aim to update them weekly.

Check out this video for some great tips on an accounting system to simplify your record-keeping:

Simple Record Keeping Tips For Truck Drivers by Smart Trucking

Frequently asked questions

What are the top bookkeeping apps for truckers?

Rigbooks—cloud-based truck management software allows you to track fuel mileage for taxes, expenses, trips, and orders.

Q7—Q7 is a fleet management software that also acts as full double-entry accounting software. There is a steep learning curve with Q7 and it can be pricey, but if you are looking for accounting software that does it all, Q7 is definitely worth it.

Quickbooks—integrates seamlessly with TruckingOffice, a trucking management system that helps you manage your dispatches and expenses, as well as prepare your IFTA reports.

Shoeboxed—keep your dashboard organized and paper-free with Shoeboxed’s Magic Envelope. All you have to do is place your receipts into the postage-paid envelope and send it off to our processing facility. We’ll do all the digitizing work for you!

What are the best practices when it comes to bookkeeping for truckers?

Keep an online copy of your bills

Get a business credit card/bank account

Update your books daily

Final thoughts

We hope this guide helps you on your journey to efficient bookkeeping for truckers! Bookkeeping is a tedious but essential task that will help your trucking business thrive and prepare you for tax time. It’s not the easiest road to drive on, but you’ll definitely reap the rewards when you reach your destination—financial success!

You might also like:

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!