Managing personal or business finances can be daunting, but it doesn't have to be. An income and expense worksheet is a simple yet powerful tool for tracking where money comes from and where it's going.

Using an income and expense worksheet is the first step toward effective budgeting and financial control.

This blog post will explore practical uses and tips for maximizing the benefits of income and expense worksheets. Without further ado, here are my four favorite income and expense worksheets and one handy alternative!

5 top free income and expense worksheets

These worksheets are designed to simplify tracking and managing income and expenses. They offer various features tailored to different financial needs, from personal budgeting to small business finance.

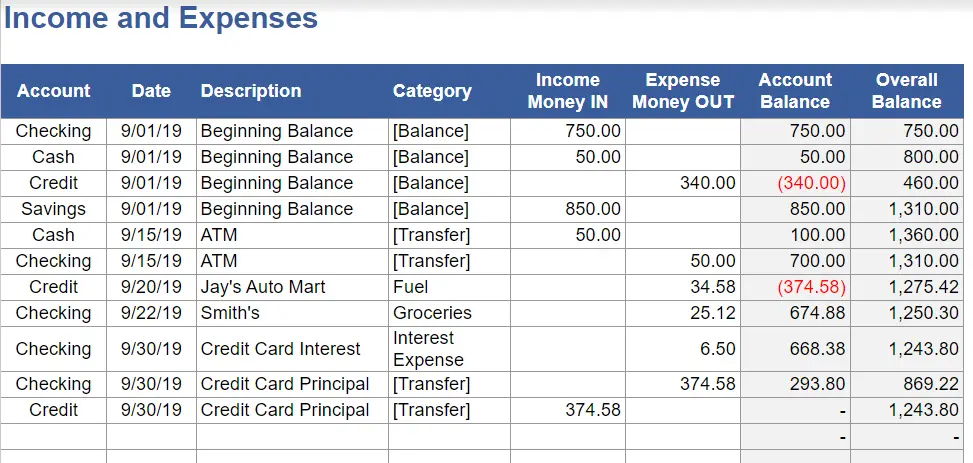

1. Income and Expense Tracking Worksheet - Vertex42

This income and expense sheet by Vertex42 is tailored for individuals seeking to manage personal finances effectively.

Additionally, its print-friendly format caters to those who prefer physical documents.

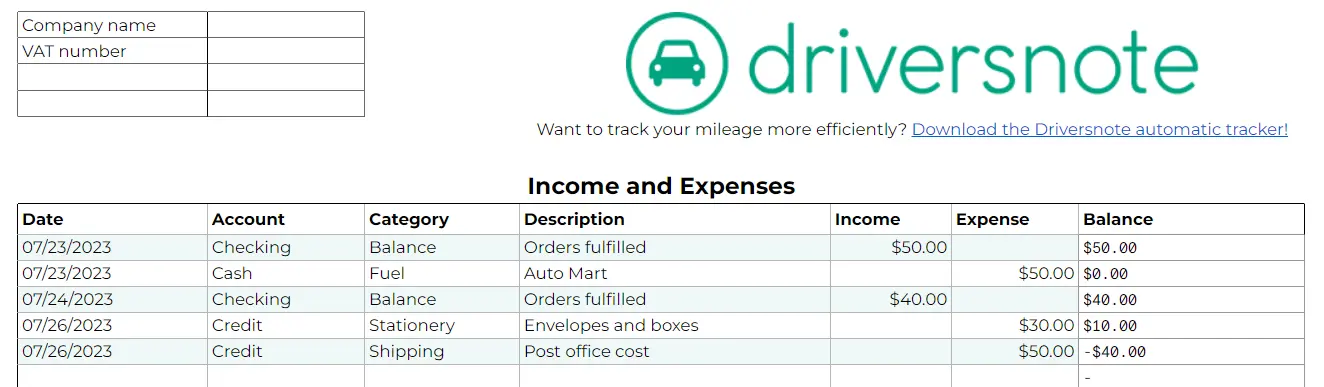

2. Small Business Income and Expenses Spreadsheet Template - Driversnote

The Driversnote template is aimed at business owners who need a straightforward tool to track their small business income and expenses.

It covers critical areas like sales, operational expenses, and other financial activities.

This template is beneficial for its ease of use and comprehensive coverage of small business financial needs.

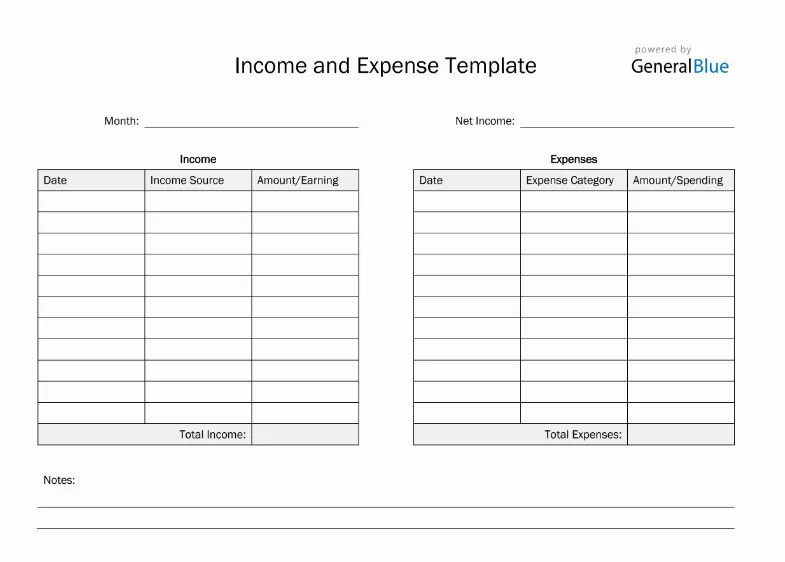

3. Income and Expense Template - General Blue

General Blue offers a no-nonsense monthly template suitable for either personal income and expense tracking or small business use.

This printable income and expense template is meant to be filled out by hand and used every month. If you're looking for an expense template with no frills, this one checks that box.

4. Small Business Income and Expense Template - Smartsheet

Smartsheet provides a robust template that can be used for personal finance tracking or small businesses.

The sheet covers the year's revenue and expenses, giving you a bird's eye view of how much you spend on fixed, variable, and more expenses. Lots of premade categories make it easy to fill out.

Available both as an Excel template or for Google docs.

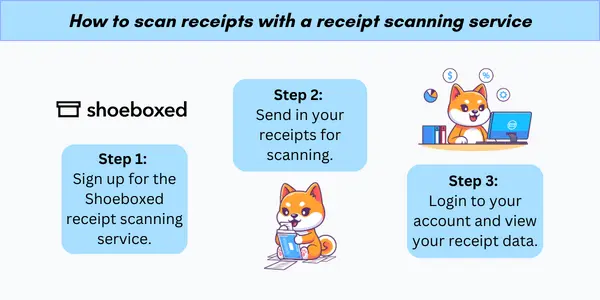

5. Shoeboxed, an income and expense worksheet alternative

Don't want to track income and expenses manually? We hear you. While some people thrive on using business expense tracking spreadsheets, others prefer a more automated method.

If you'd like to forgo manual entry entirely, consider Shoeboxed!

With Shoeboxed's receipt scanner app, simply snap a picture and upload it to your Shoeboxed account, and Shoeboxed's team will extract and verify the expense data from your receipts, assigning the expense one of 15 common tax categories.

For those who want an even easier method for getting receipts in their accounts, Shoeboxed's Magic Envelope service does just that.

Simply stuff your receipts into Shoeboxed's postage-prepaid envelopes and outsource receipt scanning to the pros.

Shoeboxed is the only receipt scanner app that will handle both your paper receipts and your digital receipts—saving customers up to 9.2 hours per week from manual data entry!

Stop doing manual data entry 🛑

Outsource receipt scanning to Shoeboxed’s scanning service and free up your time for good. Try free for 30 days!✨

Get Started TodayWhat else can Shoeboxed do?

Shoeboxed has been voted as the best receipt scanner app for tax season by Hubspot and given the Trusted Vendor and Quality Choice awards by Crozdesk.

A quick overview of Shoeboxed's award-winning features:

a. Mobile app and web dashboard

Shoeboxed’s mobile app lets you snap photos of paper receipts and upload them to your account right from your phone.

Shoeboxed also has a user-friendly web dashboard to upload receipts or documents from your desktop.

b. Gmail receipt sync feature for capturing e-receipts

Importing e-receipts to your Shoeboxed account is as easy as syncing your Gmail with Shoeboxed, using Shoeboxed's special Gmail Receipt Sync feature.

Shoeboxed’s Gmail Receipt Sync grabs all receipt emails and sends them to your account for automatic processing! These receipts are then labeled as Sent to Shoeboxed in your Gmail inbox.

In short, Shoeboxed pulls the receipt data from your email, including the vendor, purchase date, currency, total, and payment type, and organizes it in your account.

Your purchases will even come with images of the receipts attached!

c. Expense reports

Expense reports let you view all of your expenses in one cohesive document. They also make it simple to share your purchases with your accountant.

Shoeboxed makes it easy to export your yearly expenses into a detailed report. All expenses come with receipts attached.

You can also choose certain types of receipts to include in your expense report. Just select the receipts you want to export and click “export selected.”

d. Search and filter

Call up any receipt or warranty in seconds with advanced search features.

Filter receipts based on vendors, date, price, currency, categories, payment type, and more.

e. Accounting software integrations

Export expenses to your accounting software in just a click.

Shoeboxed integrates with 12+ apps to automate the tedious tasks of life, including QuickBooks, Xero, and Wave Accounting.

f. Unlimited number of free sub-users

Add an unlimited number of free sub-users to your account, such as family members, employees, accountants, and tax professionals.

g. Mileage tracker for logging business miles

After you sign up for Shoeboxed, you can start tracking miles in seconds:

Open the Shoeboxed app.

Tap the “Mileage” icon.

Click the “Start Mileage Tracking” button.

And drive!

Whenever you start a trip, Shoeboxed tracks your location and miles and saves your route as you drive.

As you make stops at stores and customer locations, you can drop pins to make tracking more precise.

At the end of a drive, you’ll click the “End Mileage Tracking” button to create a summary of your trip. Each summary will include the date, editable mileage and trip name, and your tax deductible and rate info.

Click “Done” to generate a receipt for your drive and get a photo of your route on the map. Shoeboxed will automatically categorize your trip under the mileage category in your account.

h. The Magic Envelope

Outsource your receipt scanning with the Magic Envelope!

The Magic Envelope service is one of Shoeboxed's most popular features, particularly for businesses, as it lets users outsource receipt management.

When you sign up for a plan that includes the Magic Envelope, Shoeboxed will mail you a pre-paid envelope for you to send your receipts in.

Once your receipts reach the Shoeboxed facility, they’ll be digitized, human-verified, and tax-categorized in your account.

Have your own filing system?

Shoeboxed will even put your receipts under custom categories. Just separate your receipts with a paper clip and a note explaining how you want them organized!

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic award-winning approach to receipt tracking for tax season. Try free for 30 days!

Get Started TodayHow to create an income and expense worksheet

Creating an income and expense worksheet involves selecting a suitable tool, defining the timeframe, identifying income sources, and categorizing expenses. Doing so ensures accurate tracking and better financial management.

1. Select a template or tool

Choose a template or tool that meets your specific needs.

Free online platforms like Google Sheets allow you to get started for free, while more advanced users might prefer building spreadsheets in Excel.

Consider tools that provide features such as auto-calculations, visual charts, and ease of data entry.

Many tools offer free downloads, but ensure they are customizable and user-friendly. A good template should seamlessly allow for both one-time setup and ongoing updates.

2. Determine a timeframe

Decide if the worksheet should track finances weekly, monthly, or annually.

This decision impacts the accuracy and utility of the data. Monthly timeframes are standard as they align with regular billing cycles and income payments.

Weekly tracking may suit those with fluctuating expenses, while annual tracking provides broader financial trends.

Define a start date and be consistent with data entry to maintain the accuracy of the worksheet.

3. Identify sources of income

List all potential sources of income, including regular salaries, freelance income, rental income, investments, and any other earnings. For some, it may involve more than wages, such as dividends or side gigs.

Enter these into the worksheet categorized by type and frequency.

Review and update this information consistently to reflect any changes. Accurate tracking of income is essential for effective budgeting and expense management.

4. Categorize expenses

Break down expenses into categories for better clarity.

Typical categories include housing, utilities, food, transportation, healthcare, entertainment, and savings.

Use subcategories if needed to provide a more detailed picture.

Consistency in categorizing expenses ensures a clear view of spending habits.

See also: Home Expenses Template: Top 3 Free Templates + Bonus Service

Frequently asked questions

What is an income and expense worksheet?

An income and expense worksheet is a tool used to track and manage personal or business finances. It helps record monthly or yearly earnings and expenditures to ensure proper budgeting.

Why should someone use an income and expense worksheet?

An income and expense worksheet helps individuals and businesses to monitor financial health, plan budgets, and identify spending patterns. It can clearly show where money is going and where it can be saved.

Can income and expense worksheets be used for personal and business finance tracking?

Absolutely. These worksheets are adaptable for personal use, such as household budgets, and business applications.

Do you need special software to use these worksheets?

No, most income and expense worksheets are available in Excel format. You can use them with Microsoft Excel, Google Sheets, or other spreadsheet software.

How often should the worksheet be updated?

It is advisable to update the worksheet regularly. Ideally, you should update it weekly or monthly to keep track of ongoing expenses and income accurately.

What categories are typically included in the worksheet?

Common categories include income, housing, utilities, food, transportation, entertainment, and savings. Businesses include sales, salaries, rent, supplies, and other operational costs.

In closing

Income and expense worksheets are essential in personal and business finance management. These worksheets help track earnings and expenditures, providing a clear financial picture.

A well-maintained income and expense worksheet enables individuals and organizations to make informed financial decisions. Monitoring these sheets regularly ensures financial stability and clarity.

Tomoko Matsuoka is the managing editor for Shoeboxed, MailMate, and other online resource libraries. She covers small business tips, organization hacks, and productivity tools and software.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!