The best accounting software specifically tailored for insurance agents is designed to alleviate the burden of complex accounting tasks, allowing you to focus more on the core of your insurance business.

Insurance companies face unique accounting challenges. Choosing software for the insurance industry isn’t just a better option, it’s a tailored solution that understands and caters to your specific needs.

How to choose insurance accounting software

You should look for these features in your insurance accounting software if you want to run a more efficient business.

1. Cloud-based

Cloud-based is easy to access from anywhere, even on the go.

2. User-friendly

The ideal insurance accounting system should be a breeze to set up, train on, and maintain. It should also offer robust customer support. This user-friendliness empowers you to take control of your accounting processes with ease.

The easier the software is to use, the more it will be used, and the more efficient your business will run.

3. Industry-specific features

Insurance accounting software should simplify your industry’s workflow by having features designed for the insurance industry. These could be automated policy management, claims processing, and premium calculations.

Features useful in the insurance industry are billing, invoicing, quoting, expense tracking, revenue recognition, insurance payment calculations, and preparing insurance documents and policy information.

4. Integrations

You should connect with other apps and insurance systems your business uses to further automate its workflow, such as your CRM or ERP systems, creating a fully integrated solution that combines different functionalities into a unified system.

5. Batch invoicing

Batch invoicing, automatic invoicing, recurring payments, late payment reminders, and tracking unpaid invoices are just some of the billing and invoicing features you should have.

6. Reporting

You’ll also want to generate reports on expense ratios, revenue by policyholder, and various reports on different policy information. For example, a reporting feature could give you a detailed breakdown of your company’s expenses so you can see where to cut costs.

Robust reporting will give you more visibility to make better decisions for your business.

7. Tax compliance

The best software will calculate taxes and automatically comply with taxes across multiple states.

What are the top picks for insurance accounting software in 2024?

As a former insurance agent and staff accountant, here are my top picks for insurance accounting software in 2024.

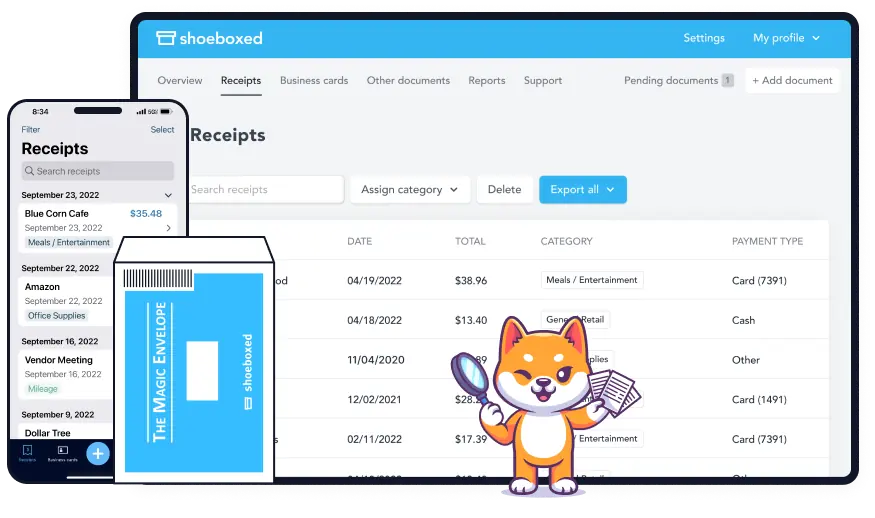

1. Shoeboxed - Best for expense management

Shoeboxed simplifies accounting with tools and features designed for the insurance agency, allowing agents to streamline bookkeeping tasks and focus more on business growth.

Here’s how Shoeboxed does this:

Receipt and document management

Shoeboxed allows insurance companies to digitize physical receipts quickly. One way to do this is to use the camera on your mobile device to take a photo of the receipt. Shoeboxed’s app will then extract critical data from the receipt and send it to a designated account. There will be no more manual entry and physical storage of paper documents.

Another way to digitize receipts or documents is to outsource to Shoeboxed by sending a batch of receipts in a pre-paid Magic Envelope provided by Shoeboxed. Once the envelope is mailed to their processing facility, the receipts will be scanned, human-verified, and uploaded to your account, where they will be stored in the cloud.

This provides secure, cloud-based storage for receipts and financial documents, making them safe and accessible whenever you need them.

Once uploaded, the platform will categorize receipts and documents into 15 tax or custom categories so you can easily find and access them when you need to.

Shoeboxed will extract critical information from receipts, such as vendor names, dates, and amounts, and populate the system with this data.

Turn receipts into data with Shoeboxed ✨

Try a systematic approach to receipt categories for tax time. Try free for 30 days!

Get Started TodayExpense tracking and reporting

Shoeboxed will generate detailed expense reports automatically, so you don’t have to spend time and effort preparing financial statements.

Integration with accounting software

Shoeboxed integrates with popular accounting software like QuickBooks, Xero, and Wave, so data will transfer and sync smoothly, reducing the chance of errors and discrepancies in your financial records.

The integration will simplify the workflow by allowing you to import categorized expenses directly into accounting software so you don’t have to enter data manually.

Compliance and audit preparedness

Shoeboxed will organize and store receipts and expenses in a way that’s helpful for tax preparation and compliance so that insurance companies won’t miss any deductible expenses.

The platform will organize and store documents to be easily accessible and audit-ready. This is especially important for insurance companies that comply with multiple regulations.

Mileage tracking

For insurance agents who travel often, Shoeboxed has mileage tracking required for expense reporting and reimbursement.

Shoeboxed will create a trip summary with date, editable mileage, trip name, tax-deductible, and rate and add it to the categorized expenses.

Track mileage with Shoeboxed 🚗

Track mileage using your phone’s built-in GPS for unmatched ease and accuracy. 💪🏼 Try free for 30 days!

Get Started TodayFree sub-users

With a Shoeboxed account, insurance agents can add unlimited free sub-users so colleagues and accountants can access the platform and work on bookkeeping and accounting tasks.

Different levels of access and permissions can be set for each user so sensitive financial data is protected.

Cost management

Shoeboxed will give you insights into your spending so insurance companies can manage costs and find areas to save.

Shoeboxed will help insurance companies manage their budgets and forecasts by keeping accurate records of expenses.

By using these features, Shoeboxed will help insurance companies streamline their accounting processes, reduce manual work, comply with regulations, and maintain organized and audit-ready financial records.

Pros:

Digital receipt capture: Insurance agents can take photos of receipts with their mobile devices or email digital receipts to their Shoeboxed account. The app also supports scanning paper receipts with pre-paid envelopes sent to Shoeboxed for processing.

Auto categorization: Receipts will be auto-categorized into expense categories so expenses are easy to organize and track.

Data extraction: Shoeboxed will extract critical information from receipts, such as vendor name, date, amount, and payment method, so you don’t have to enter data manually.

Expense reports: Generates detailed expense reports that can be customized and exported for insurance accounting purposes.

IRS-accepted: Receipts will be stored in an IRS-accepted format so tax time is smoother and audit-proof.

Deductible tracking: Keeping a record of deductible expenses, is a feature of Shoeboxed that can help insurance companies maximize their tax deductions. It will ensure all eligible costs are accounted for.

Seamless syncing: Integrates with popular accounting software like QuickBooks, Xero, and Wave to transfer and sync data.

Collaboration: Multiple users can access and manage the account so team members can work on bookkeeping tasks.

Cons:

Mileage tracking: Mileage tracking is not automatic. You have to start and stop the tracker manually, so keeping business and personal miles separate is easier.

Pricing:

Shoeboxed has plans to fit your needs:

Startup plan: $18/month (billed annually)

Professional plan: $36/month (billed annually)

Business plan: $54/month (billed annually)

Never lose a receipt again 📁

Join over 1 million businesses organizing & scanning receipts, creating expense reports, and reclaiming multiple hours every week—with Shoeboxed.✨

Get Started Today2. FIS Insurance Accounting Suite - Best scalable software

FIS Insurance Accounting Suite, formerly Enterprise Accounting System, is accounting and reporting in one.

Their platform is focused on insurers growing their insurance business while remaining profitable, so their software considers geographic expansion and new product lines.

It is suitable for small to midsize accounting firms and companies in industries such as retail, insurance, manufacturing, and professional services.

With their Insurance Accounting Suite, you have all the advanced accounting features plus:

Add and track new product lines

Monitor each business line

Monitor geographic expansion

Monitor each region

The software will give you tools to test budgets and forecasting by providing insight into current and historical trends in the insurance industry.

You can create multiple forecasts to test different scenarios with product lines and geographics.

With these features, you can make better, more informed business decisions as you grow and expand.

Pros:

Industry-specific features: Insurance industry-specific features such as policy management, claims processing, and regulatory compliance.

Compliance and regulatory support: Helps insurance companies comply with industry-specific regulations and standards, such as IFRS 17 and GAAP.

Comprehensive financial management: General ledger, accounts payable/receivable, and financial reporting.

Scalability: Scalability for insurance companies of all sizes, from small firms to large enterprises.

Advanced analytics and reporting: Advanced analytics and reporting to provide insights into financial performance, risk management, and operational metrics.

Cons:

Complexity: The software is complex to implement and use. Staff will require significant training to use all the features.

Implementation time: Implementation is time-consuming and requires much time and resources.

Technical support: Technical support quality and response time varies depending on the service level agreement. Some users may need more support.

Customization challenges: While customizable, extensive customization will lead to longer implementation time and higher cost. It can also complicate future upgrades and maintenance.

Integration issues: Integration with existing systems can be tricky and require additional middleware or customization to achieve seamless integration.

User interface: Some users may find the interface less intuitive than that of more modern and user-friendly software available on the market.

Pricing:

Pricing not available on website

The FIS Insurance Accounting Suite is a good solution for insurance companies looking for industry-specific accounting features, but it comes with cost, complexity, and implementation time.

3. Flexi - Best functionality

Flexi is the best insurance accounting software for functionality because it has all the features and more to meet the industry’s needs, including robust inventory management capabilities.

Their full-featured enterprise platform includes:

Real-time reporting

Global currency conversion

Multi-company consolidation

Multi book accounting

Daily close

Audit controls

Built-in compliance

Integration with third-party systems

Workflow automation

Flexi integrates with your claims, policy, and billing to transfer data into your accounting system, supporting various business processes such as procurement, production planning, and sales management.

These features also cover performance, scalability, security, and flexibility.

Flexi Software can be customized to your insurance needs.

Pros:

Flexibility and customization: Highly customizable to different industries and businesses. Users can tailor the software to their specific accounting processes and workflows.

Comprehensive financial management: Full suite of accounting features, including general ledger, accounts payable, accounts receivable, and fixed assets. Robust financial reporting and analytics tools.

Integration: It integrates with other business systems, such as ERP, CRM, and industry-specific software. It supports data import/export with various formats and third-party applications.

Cons:

Complexity: Despite the user-friendly interface, the customization and features can overwhelm some users. Staff will require significant training to use all the features effectively.

Implementation time: Implementation can be time-consuming, especially for highly customized setups. It requires careful planning and resource allocation to ensure a smooth rollout.

Performance issues: Some users have reported performance issues, especially when handling a high volume of transactions or complex data processing.

Pricing:

Not available on the website

Flexi is a flexible accounting solution with extensive customization and full financial management features. However, cost, complexity, and integration issues may be a drawback for some businesses.

4. FreshBooks - Most user-friendly financial management solution

While FreshBooks is considered generic accounting software, it is designed for businesses and professional services, such as the insurance industry.

With FreshBooks' motto of 'no accounting experience necessary, no math required', it is one of the market's most user-friendly insurance accounting software.

You can access FreshBooks anytime, anywhere. It is easy to set up and navigate, and the dashboard gives you an overview of all the reports.

Along with its user-friendly design, FreshBooks also has some great features, such as:

Invoice creation

Expense monitoring

Generate financial reports

Time track projects

Collaborate on projects

Payment reminders

Secure online payment processing.

Expense report

Recurring payment processing

Pros:

Ease of use: It is simple for insurance professionals to manage finances.

Invoicing and time tracking: Good for client invoices and billable hours.

Cons:

Limited features: It may have fewer features than other options.

Scalability: Better for smaller businesses and may not scale well for larger insurance companies.

Pricing:

Lite: $7.60/month

Plus: $13.20/month

Premium: $24.00/month

Select: Contact FreshBooks

What are the benefits of using insurance accounting software?

There are many benefits of using accounting software specifically for the insurance industry.

1. Meets compliance standards for the insurance industry

Insurance companies operate in a highly regulated and complex environment governed by local, state, and national governments.

By using software specific to the insurance industry and its workflow, the software will consider these standards and help you stay compliant and up to date with the changing requirements.

2. Simplifies insurance industry workflows

Some unique accounting challenges in the insurance industry are claim reimbursements, premiums, recurring billing, compensation calculations, and revenue recognition.

Software that tracks claims, manages recurring billing, records insurance premiums, manages client accounts, and generates reports will save you time and money.

3. Keeps documentation in order when dealing with multiple insurance companies

Agencies, in particular, support multiple carriers with constant quoting, ACORD forms, payments, and amendments.

A software solution that uses one cloud-based interface to sort, organize, and store all this information will save you time, money, and stress.

Frequently asked questions

What are the insurance accounting software options?

Some accounting software options for the insurance industry are Shoeboxed for expense management, FIS Insurance Accounting Suite, Flexi, and FreshBooks.

What are the unique accounting challenges of the insurance industry?

Some unique accounting challenges in the insurance industry are claim reimbursements, premiums, recurring billing, compensation calculations, and revenue recognition.

In conclusion

Agencies and companies must use accounting software that caters to the insurance industry.

This is especially true when it comes to keeping up with the strict insurance regulations that vary from state to state and are constantly changing.

Insurance accounting software will keep you compliant, simplify your operations, and increase your productivity.

Caryl Ramsey has years of experience assisting in different aspects of bookkeeping, taxes, and customer service. She uses a variety of accounting software for setting up client information, reconciling accounts, coding expenses, running financial reports, and preparing tax returns. She is also experienced in setting up corporations with the State Corporation Commission and the IRS.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!