Does that $60 cab ride you took for a client meeting need a receipt? The IRS has a little known rule that can save you time—and a lot of paper slips.

Let’s take a look at the $75 threshold and see how it makes business expense tracking a breeze.

What are business expenses and why are they important?

Business expenses are costs incurred to make money and run the company efficiently. Tracking these expenses is key to tax compliance and maximizing business deductions.

Business expenses typically include travel, meals, entertainment, and other related costs. An accurate record of expenses will reduce tax liability and prevent audits.

What are the IRS receipt requirements for business expenses?

The IRS requires receipts for business expenses to verify the expense and ensure its legitimacy. Receipts should include the date, amount, and description of the expense.

The IRS recommends keeping business receipts for at least three years in case of an audit.

Business receipts can be physical or digital, but they must be legible and easily accessible.

How to manage business expense receipts

Keeping accurate and organized records of expense receipts is crucial for tax compliance. Businesses can use receipt books, apps, or software to manage and store expense receipts.

Shoeboxed - ideal for business owners looking for the best app to manage and store expense receipts

Shoeboxed is perfect for the $75 receipt requirement because it simplifies the whole process.

The IRS doesn’t require receipts for some travel and business expenses under $75, but you still need to have accurate and organized records to substantiate deductions, defend against audits, and stay tax-compliant.

Here’s why Shoeboxed stands out:

1. Centralized digital storage

Instead of juggling paper deposit slips, receipts, and notes, Shoeboxed scans, uploads, and digitizes all your paper receipts, big or small. Scan the physical receipt with your phone's camera, and Shoeboxed's app will upload the digital version to your designated account.

Or, if you have a lot of receipts and don't want to scan them yourself, you can outsource them to Shoeboxed. Mail them via the free postage-paid Magic Envelope service, and they will scan, human-verify, and upload them to your account for you.

So whether it’s a $5 taxi fare or a $70 meal, everything is stored in one place and is searchable. Having a digital archive means you can retrieve documentation when you need it.

Stop doing manual data entry 🛑

Outsource receipt scanning to Shoeboxed’s scanning service and free up your time for good. Try free for 30 days!✨

Get Started Today2. Easy classification and categorization

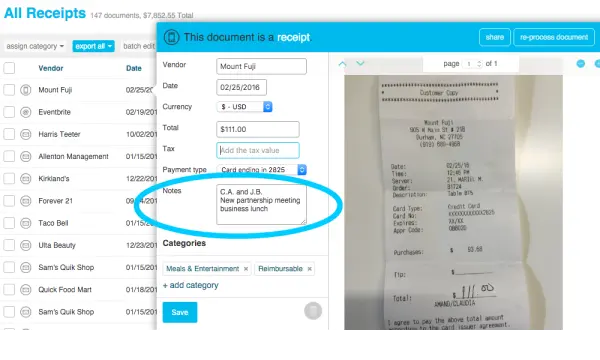

Shoeboxed’s OCR data extraction and categorization tools automatically label and sort business expenses by date, vendor, amount, etc. This makes it easy to see which expenses don’t need a receipt under IRS receipt requirements and which do. This simplifies your recordkeeping. Organized digital records mean you can be confident and prepared for tax season.

3. Audit trails

Even if receipts under $75 aren’t required, tracking who, what, where, and why of each expense is a good idea.

Shoeboxed lets you add notes, categorize expenses by project or client, and store date and location details. This creates a secondary layer of substantiation in case the IRS asks for more information.

4. Saves time and effort

Shoeboxed saves you administrative headaches and the risk of losing documentation by not having to store and dig through paper receipts. You can focus on running your business knowing all your expenses, big or small, are documented and easily accessible anytime, anywhere.

Although the IRS allows some expenses under $75 to go without receipts, Shoeboxed keeps you organized so that you can instantly produce clear and tidy records if the IRS asks about your deductions.

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic award-winning approach to receipt tracking for tax season. Try free for 30 days!

Get Started TodayThe $75 rule and expense reimbursement plans

Documentation is key when claiming expenses on your tax return, especially for business travel, meals, and certain out-of-pocket expenses.

One of the many IRS rules and best practices is simple and easy to follow: no receipt is required for expenses under $75. The $75 rule states that receipts, except for lodging expenses, are not needed for expenses under $75.

Companies should have an expense reimbursement plan to reimburse employees for these expenses. The employer and expense reimbursement plan should outline the detailed guidelines for employees to qualify for reimbursement.

The IRS recommends keeping receipts for all business expenses paid for, even for those under $75.

Understanding the $75 threshold

The IRS requires taxpayers to have documentary evidence—like receipts, invoices, or canceled checks—to support their business expenses. This evidence is needed to ensure deductions are accurate and the expenses are indeed business-related.

However, the IRS knows keeping a paper trail for every small expense can be a pain. So, they have an exception: receipts for most expenses under $75 are not required.

This makes record keeping more manageable, especially for frequent travelers with small expenses like taxi fares, public transportation, or low-cost meals on the road.

What’s exempt?

The $75 receipt exemption applies to travel and meal expenses, which are:

1. Taxi or rideshare fares

You don't need a receipt to deduct if you paid $50 for a taxi from the airport to your hotel.

2. Meals while traveling for business

You don't need a receipt for a $60 meal while traveling for business.

3. Parking and tolls

Minor parking fees or road tolls for business travel are also exempt.

Note: The minimum $75 threshold isn’t limited to these examples. Other business-related incidental expenses that are hard to get receipts for may also qualify.

Exceptions

While the $75 rule is helpful, it’s not an all-encompassing exemption.

There are some important exceptions and additional rules:

1. Lodging expenses

Even for amounts under $75, the IRS requires documentation for lodging expenses. For example, hotel bills always need a receipt—no matter how small the expense.

2. Gift expenses

Small, business-related gift expenses may need more documentation. There are specific IRS rules for business gifts and documentation regardless of the amount.

3. Credit card statements are not enough

While the lack of a receipt or payment amount may be allowed for small out-of-pocket expenses, using a credit card statement for larger expenses or those that require receipts is not ideal. Statements only show the amount charged, not the details that prove the expense.

Substantiation

Even though the IRS doesn’t require a receipt for expenses under $75, they don’t eliminate the need to prove business purpose. Without a receipt, other forms of documentation are still required.

Acceptable substantiation includes:

1. Written notes or expense logs

A travel diary, calendar entries, bills, or business notes of when, where, and why the expense was incurred will help your case if your spending is audited.

2. Mileage logs and maps for transportation costs

If you claim a small vehicle expense or toll payment, a detailed mileage log will help establish your business.

3. Consistent documentation

The best is to record each business transaction and expense as soon as possible. Waiting weeks or months increases the chances of errors.

Best practices for taxpayers and businesses

Here are some of the best practices for taxpayers and business owners.

1. Use a system

Even though receipts under $75 are not required for specific expenses, having a consistent process is a good idea. Electronic expense tracking apps like Shoeboxed can help.

A consistent system ensures adequate records of business expenses, which is crucial for tax compliance. Implementing an expense reimbursement plan can help ensure employees are reimbursed correctly.

2. Better safe than sorry

If you can get a receipt, get one even if the expense is under $75. Having a receipt for as many expenses as possible creates a more substantial audit trail.

3. Save digital copies

Scan or photograph small paper receipts and store them in a secure digital folder. This is especially helpful if the IRS asks about a specific expense. Many businesses use expense management software with receipt imaging.

4. Train your employees

If you have employees who travel or incur business expenses, educate them on the $75 rule and your company’s documentation requirements for deductions. Clear guidelines will reduce confusion and problems that come with tax time.

5. Review and reconcile

Businesses should regularly review and reconcile expense receipts to identify areas for cost savings.

6. Hold on to receipts

Keeping receipts for at least three years can help prevent audits and ensure tax compliance.

Frequently asked questions

Do I still need to document the business purpose for expenses under $75 if no receipt is required?

Yes. Even if the IRS doesn’t require a receipt for expenses under $75, you still need to show the expense was business-related.

Does the $75 receipt threshold apply to all business expenses?

No. The $75 rule applies to travel, meals, and certain miscellaneous expenses. Lodging, for example, always requires a receipt, no matter the amount.

In conclusion

The $75 receipt threshold is a practical rule: not every little expense needs the same level of documentation.

This rule makes keeping records for small expenses easier—especially when you travel frequently—but it’s not a “no documentation needed” rule. Not having a receipt doesn’t mean you’re off the hook for substantiating the business purpose of the expense.

By understanding this rule, keeping good notes, and having a thoughtful documentation strategy, taxpayers and businesses have a smoother compliance process and reduce the risk of an audit.

Caryl Ramsey has years of experience assisting in bookkeeping, taxes, and customer service. She uses various accounting software to set up client information, reconcile accounts, code expenses, run financial reports, and prepare tax returns. She is also experienced in setting up corporations with the State Corporation Commission and the IRS and is a contributing writer to SUCCESS magazine.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go—auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!