Launching and managing a Limited Liability Company (LLC) is a significant step for entrepreneurs aiming for flexibility and protection in their business operations. While LLCs are praised for their simplicity and tax benefits, handling the company's financials, especially the expenses, can be overwhelming.

This comprehensive guide is an LLC Expenses Cheat Sheet to help you understand and manage your business expenses efficiently to make the most out of eligible tax deductions.

What are LLC business expenses?

An LLC's expenses are incurred during the business's routine operation. These can range from startup expenses to operational expenses, taxes, and fees specific to LLCs. It's essential that LLC owners differentiate between one-time costs to start or significantly improve the business and ongoing costs for running the business.

Startup expenses

By differentiating between the one-time costs of establishing your LLC and the recurring expenses of maintaining it, you’ll be better prepared to take advantage of some significant tax write-offs.

Here are some business startup costs that are considered tax deductible:

State filing fees: Costs associated with registering your LLC with the state.

Legal fees: Payments made to attorneys for setting up the LLC.

Licensing and permits: Fees for necessary business licenses and permits.

These are one-time business expenses crucial for getting your LLC off the ground. Accounting for these startup costs is important for your business's financial planning and tax reporting.

Operating expenses

Operational expenses are the ongoing and business-related expenses required to run your LLC.

These expenses include the following:

Rent: Payments for office space or business premises.

Utilities: Costs for electricity, water, internet, and other services.

Salaries and wages: Payments to employees, including benefits.

Supplies and materials: Costs for items needed for daily operations.

Marketing and advertising: Expenses for promoting the business.

Insurance: Premiums for various business insurance policies.

Professional services: Fees for accountants, consultants, etc.

Travel and meals: Costs for business-related travel and meals.

Maintenance and repairs: Costs to maintain or repair business equipment and property.

Understanding these distinctions is vital for proper financial planning and tax reporting. By categorizing your office expenses correctly, you can maximize your LLC's business tax deductions while complying with IRS rules.

What are deductible vs. non-deductible expenses?

According to the Internal Revenue Service (IRS), a tax-deductible business expense is any cost considered necessary and ordinary for operating your business.

In the context of an LLC, these expenses can reduce your company’s taxable income, lowering your overall tax liability. To qualify as deductible, expenses must be directly tied to your business activities, common in your industry, and necessary for your operations.

Understanding which common business expenses are deductible and which are not is critical for tax purposes. Generally, a business expense must be both ordinary (typical in your trade or business) and necessary (helpful and appropriate for your business) to be deductible.

Understanding which expenses are tax-deductible and maintaining proper documentation is essential for maximizing your business's potential tax benefits.

Here are some examples of deductible vs. non-deductible expenses:

Deductible expenses

Rent and utilities

Salaries and employee benefits

Office supplies and materials

Professional services fees

Non-deductible expenses

Fines and penalties

Political contributions

Personal expenses not related to the business

What is capitalizing vs. expensing?

When a business incurs a cost, it must decide whether to capitalize the expense or treat it as an immediate expense.

Capitalizing

Capitalizing spreads the price of a significant purchase over several years, reflecting the asset's use. This is done through depreciation or amortization.

Expensing

In contrast, expensing allows the business to deduct the cost immediately, which can significantly reduce taxable income.

What are some business tax deductions for an LLC?

Remember, a tax-deductible expense in an LLC refers to a business expense that can be subtracted from the company’s income to reduce its taxable income. These expenses must be both "ordinary" and "necessary" according to IRS standards.

Here’s what that means:

Ordinary: A business expense common and accepted in your trade or business.

Necessary: A business expense that is helpful and appropriate for your trade or business.

Use this list as your standard LLC expenses cheat sheet when filing your taxes:

Rent: Costs for leasing a business space.

Utilities: Electricity, water, internet, and phone services used for business purposes.

Supplies and materials: Items and materials used for business purposes.

Salaries and wages: Payments to employees, including benefits, pensions, and bonuses.

Insurance: Premiums for business insurance policies, such as liability insurance or property insurance.

Legal and professional fees: Fees for accountants, lawyers, and other professionals.

Marketing and advertising: Costs associated with promoting the business.

Travel expenses: Costs for business-related travel expenses, excluding lavish expenses.

Education and training: Costs for improving skills or professional development.

Depreciation: The deduction of the cost of business assets spread over the asset's life.

Office expenses: Office supplies and small items used within the year for business purposes.

Repairs and maintenance: Costs to fix and maintain business property and equipment.

Home office expenses: If part of your home is used regularly and exclusively for business, you can take advantage of the home office deduction, which allows you to deduct a percentage of mortgage interest, rent, utilities, insurance, and property taxes.

Vehicle expenses are costs associated with business use of a vehicle, which can be deducted as actual vehicle expenses or using the standard mileage rate.

Retirement plan contributions: Retirement contributions to employees' retirement plans.

Interest: Interest on business loans, business credit card interest, or other bank fees.

It's essential to maintain accurate and detailed records of all business expenses to substantiate tax deductions in case of an IRS audit. Also, while many costs are tax deductible, the specifics can vary based on the context and current tax laws, so it's often beneficial to consult a tax professional to ensure compliance and maximize business tax deductions.

How are LLC tax deductions calculated to reduce tax liability?

Business tax deductions for LLCs (Limited Liability Companies) are calculated based on the company's eligible business expenses. These deductions are used to lower the LLC's taxable income, thus potentially reducing the amount of a company's tax liability.

Here’s how the tax-deductible process generally works:

1. Identify tax-deductible expenses

First, separate personal expenses from business expenses. Only business expenses can be considered for deductions. Examples include rent for office space, employee salaries, business and office supplies, mortgage interest, professional fees, property taxes, bank fees, business trip expenses, professional services fees, and startup costs if you are starting the business.

2. Ensure business expenses are ordinary and necessary

The IRS requires that business expenses be "ordinary" and "necessary" to be deductible. "Ordinary" means common expenses accepted in your business, while "necessary" means helpful and appropriate for your business, though not necessarily indispensable.

3. Gather documentation

Collect all receipts, invoices, business bank account statements, and financial records documenting each expense. This documentation will support your deductions if the IRS requires verification.

4. Determine the type of tax deduction

Some business expenses are fully deductible, while others may be partially deductible or depreciated over time.

For example:

Fully deductible expenses include rent, office supplies, and wages.

Partially deductible expenses: Some costs, like business meals or vehicle expenses, might only be partially deductible.

Depreciation: Large purchases, such as equipment or vehicles, must usually be depreciated over their useful life rather than deducted fully in one year.

5. Calculate tax deductions

Add up all eligible expenses to calculate your total deductions. For expenses that are only partially deductible, apply the correct percentage. For example, if business meals are 50% deductible, only add half of these expenses to your total deductions.

6. Apply deductions to taxable income

Subtract the deductions from your LLC’s gross income to determine the taxable income. This is the amount that will be subject to income taxes due. If your LLC is taxed as a pass-through entity (which most LLCs are), the taxable income is reported on the member's personal tax return, and the deductions reduce each member's share of the taxable income.

7. Special considerations

Home office tax deduction: If you use part of your home for business, calculate this deduction based on the size of the space used for business activities compared to the total size of your home, or use the simplified method prescribed by the IRS.

Vehicle use: If using your car for business, keep a log of business-related mileage to calculate the tax-deductible amount, or use the standard mileage rate defined by the IRS.

8. Consult with a tax professional

Tax laws and regulations can be complex and subject to change. It may be beneficial to consult with a tax professional or accountant to ensure all deductions are correctly calculated and legitimately claimed according to current tax laws.

Remember, the goal is to report your expenses accurately to reduce your taxable income. Overstating deductions or deducting personal expenses as business expenses can lead to penalties and audits.

What's different about LLC taxes for the 2024 tax season?

Tax laws change from year to year.

Here are some expected LLC changes for the 2024 tax season.

Corporate Transparency Act (CTA)

According to the Financial Crimes Enforcement Network, this act came into effect on January 1, 2024. It mandates new federal reporting requirements for LLCs, corporations, and other business entities. Specifically, companies formed or registered before January 1, 2024, must report their beneficial ownership information to the Financial Crimes Enforcement Network (FinCEN) by January 1, 2025.

Companies formed in 2024 must report within 90 days of their registration. The information required includes legal names, residential addresses, birth dates, and identification numbers of the beneficial owners. This act aims to prevent illicit activities through complex ownership structures. Companies must comply with these new requirements to avoid substantial penalties.

Tax law changes

According to Avalara, Inc., while specific LLC-oriented changes weren't explicitly detailed, general tax trends for 2024 include states refining economic nexus laws and marketplace facilitator laws, which may affect LLCs conducting sales across state lines.

Additionally, new taxes and fees, such as retail delivery and bag fees, may impact LLCs in the retail sector. Sales tax holidays and changes in tax rates and exemptions could also affect business operations and financial planning.

LLCs should be particularly vigilant about these changes, ensuring compliance with the new reporting standards of the Corporate Transparency Act and staying informed about state-specific tax changes that may impact their business operations. Consulting with a tax professional can help you navigate these changes effectively.

What are some strategies for managing LLC expenses?

Effective expense management is crucial for maintaining your LLC’s financial health.

Here are some strategies that we have found effective for managing LLC expenses:

Create a budget: Establish a clear budget based on historical data and future projections. Review and adjust it regularly as necessary.

Use accounting software: Implement accounting software to track expenses, generate reports, and provide insights into your financial status.

Reduce unnecessary expenses: Regularly review your business expenses to identify and eliminate unnecessary costs.

Negotiate with vendors: Don’t hesitate to negotiate better terms or prices with your suppliers and service providers.

By adopting these strategies, you can maintain better control over your finances, helping your LLC save money.

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic award-winning approach to receipt tracking for tax season. Try free for 30 days!

Get Started TodayHow can you track and organize LLC expenses?

Meticulous tracking and organization of expenses simplify the tax filing process and provide insights into your business's financial health.

In our experience, we have found that the best tips and practices for expense tracking and organizing expenses include the following.

Tips for effective expense tracking

Use expense tracking software: Leverage technology to categorize and store information about each business expense.

Keep receipts and records: Maintain organized files of all business expense receipts and documents, digitally or physically.

Regularly update records: Update your expense records regularly to avoid a backlog and ensure accuracy.

Best practices for organizing expenses

Categorize expenses: Categorize your business expenses for easier tracking and reporting.

Review bank statements: Regularly review your bank statements to ensure all expenses are recorded and categorized correctly.

Schedule regular reviews: Set aside time weekly or monthly to review your financials and ensure everything is in order.

Organizing and keeping your business expenses current will streamline your financial management and set a strong foundation for your LLC’s growth.

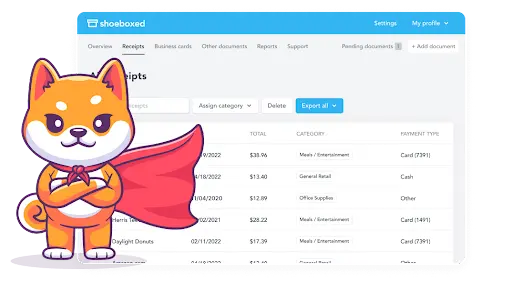

How can you leverage Shoeboxed for expense management?

Shoeboxed is a tool that can benefit LLCs looking to track expenses and maximize tax deductions. Their platform can simplify this aspect of your business, turning a time-consuming chore into a manageable one.

Shoeboxed will track your LLC business expenses so that you can maximize your deductions.

Shoeboxed is an app and a service designed to help users scan, organize, and store receipts and other documents. The platform is primarily used for managing receipts, creating expense reports, and preparing for taxes by digitizing physical paper documents into searchable, categorized, and exportable data.

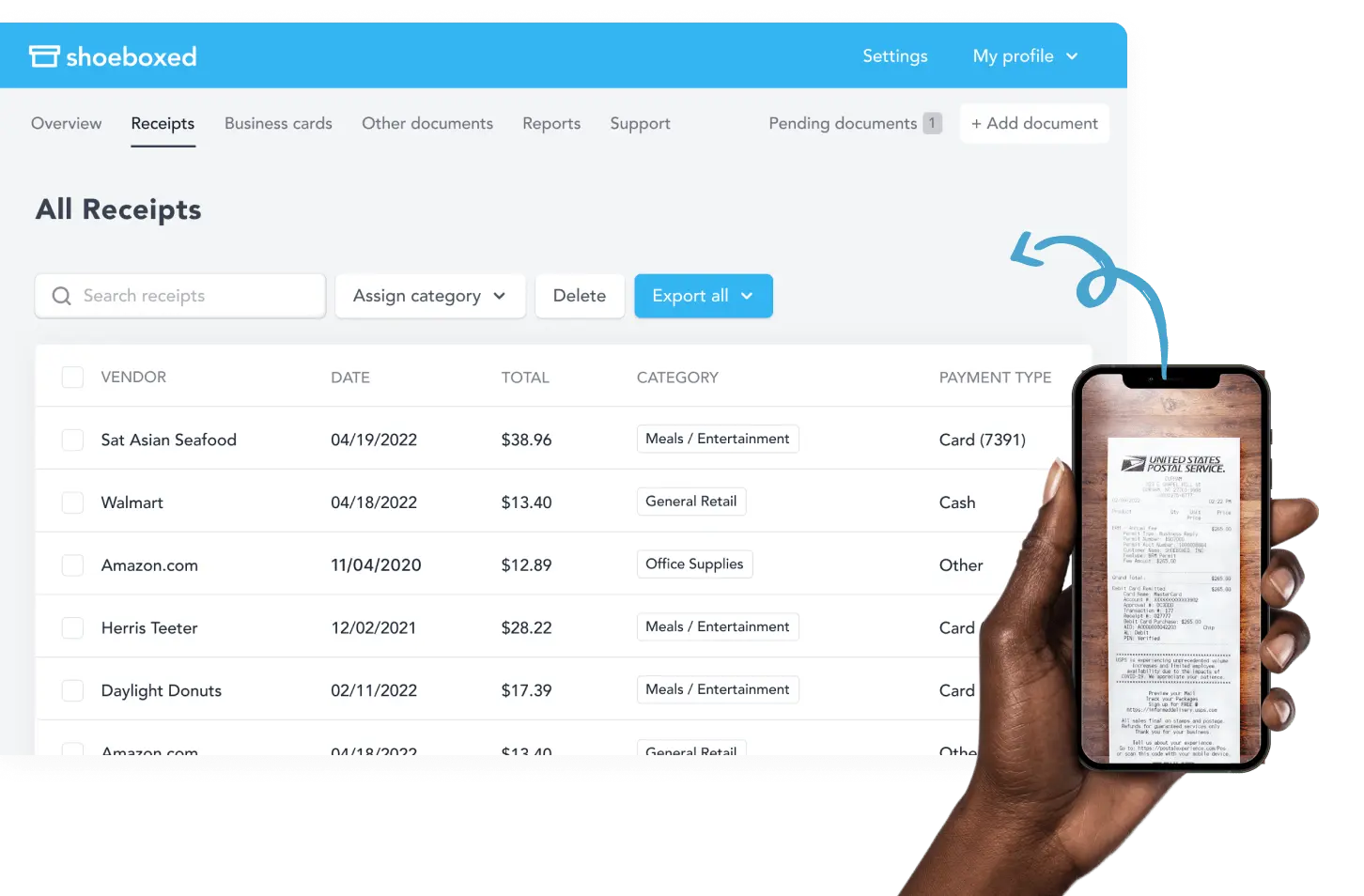

Receipt scanning

Shoeboxed's app is an easy way to scan receipts while on the go.

Users can scan their receipts using Shoeboxed's mobile app or mail them directly to Shoeboxed using pre-paid envelopes (Magic Envelope™). Shoeboxed processes these receipts, extracting critical information for easy management and reporting.

As an app, small business owners can use their phone's camera to snap a picture of the receipt. Shoeboxed then transforms your physical receipts into digital data, categorizing and storing them securely online for easy access.

Fill Shoeboxed's Magic Envelope full of receipts and let Shoeboxed do the rest.

The Shoeboxed Magic Envelope™ is a part of Shoeboxed's unique service designed to simplify digitizing and organizing physical receipts and other documents for individuals and businesses.

Here’s how it works:

Receiving the envelope: When you sign up for a Shoeboxed account that includes the Magic Envelope service, Shoeboxed sends you pre-addressed, prepaid envelopes. You can request these envelopes directly from your Shoeboxed dashboard.

Filling the envelope: You collect all your paper receipts, business cards, and other documents and fill the Magic Envelope with them. You don't need to sort or organize the records before sending them; Shoeboxed will handle that.

Mailing the envelope: Once the Magic Envelope is filled, send it back to Shoeboxed. Since the envelopes are prepaid, you don't need to worry about postage.

Processing: After Shoeboxed receives your Magic Envelope, it scans and digitizes all the enclosed documents. It extracts critical data from each item, such as vendor names, dates, amounts, and payment types. This information is then human-verified, categorized, and uploaded to your Shoeboxed account.

Access and organization: Once the documents are processed, you can access them online through the Shoeboxed platform. You can review, categorize further, download, or export the data to your preferred accounting software. Shoeboxed also ensures that digitized receipts are accepted by the IRS and other tax authorities, which can be crucial for tax reporting and audits.

Return: If requested, Shoeboxed can return your original documents to you, or they can securely shred and dispose of them, depending on your preference.

Break free from paper clutter ✨

Use Shoeboxed’s Magic Envelope to ship off your receipts and get them back as scanned data in a private, secure cloud-based account. 📁 Try free for 30 days!

Get Started TodayMileage tracking

Another feature of Shoeboxed is its mileage tracker. Small business owners can use their smartphone’s GPS to automatically track and log miles driven for business purposes or manually enter mileage as part of their expense tracking.

Shoeboxed's app features a 1-click mileage tracker.

To track your business miles, perform the following steps:

Go to the 'Trips' area of the app.

Click 'Start Mileage Tracking' and start driving.

Click 'Stop Trip' when you arrive at your destination.

Check the trip summary, which includes the date, destination, editable mileage, route, and deductible rate information.

Once the data is edited and approved, click 'Done.'

The business trip information will then be submitted to Shoeboxed as a receipt, and the category for mileage will be automatically assigned.

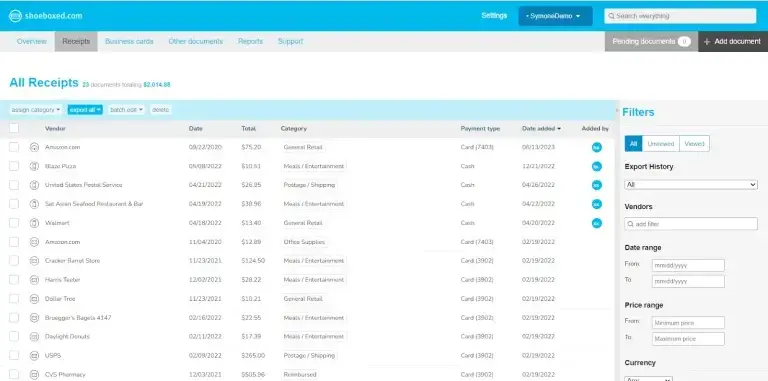

Organizing receipts

Receipts are categorized and stored securely online.

Once your receipts are digitized, Shoeboxed organizes them within your account. You can sort these expenses by category, date, vendor, or other criteria. This organization is essential for creating accurate and comprehensive expense reports.

Properly categorized expenses can help maximize deductions and streamline the tax return filing process, reducing the likelihood of errors and issues with tax authorities.

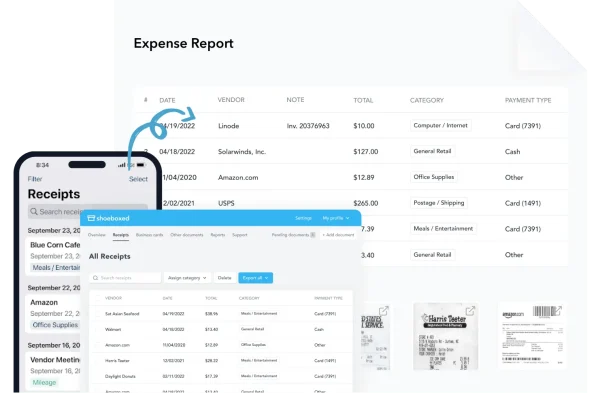

Expense reporting

Shoeboxed creates comprehensive expense reports that will follow along with the LLC expenses cheat sheet.

Shoeboxed is a tool that can significantly streamline the expense reporting process for individuals and businesses.

Expense reports can be exported and shared.

Compiling expense reports becomes much more straightforward with all your receipts stored and organized in Shoeboxed. You can create reports directly within Shoeboxed, grouping expenses as needed for business trips, client meetings, or daily operations. These reports can include digital copies of your receipts, ensuring that every expense is verifiable.

Exporting and sharing

Shoeboxed allows you to export your expense reports into various formats suitable for accounting software, spreadsheets, or PDFs. This flexibility makes it easy to share reports with accountants and business managers or for reimbursement processes within your company.

Accessibility

All your expense data and reports are accessible online through your Shoeboxed account, which means you can access your financial information anytime, anywhere. This ease of access is particularly beneficial for business travelers or those needing to compile expense reports regularly.

By using Shoeboxed for expense reporting, businesses and individuals can reduce the time and effort spent on manual entry, decrease the risk of lost receipts, ensure accurate financial reporting, and stay prepared for tax season.

Tax-ready

Shoeboxed makes sure all business expenses are tax-ready deductions.

With comprehensive and detailed expense reports, business owners can easily see the amount of a business expense to write off in each tax category when filing their taxes.

Since Shoeboxed keeps detailed records of your expenses and organizes them effectively, it also aids in tax preparation. When your receipts and other financial documents are scanned and processed by Shoeboxed, they are digitized and organized in a manner that complies with IRS requirements. This means they are suitable for use in tax filing and audits.

Here’s how Shoeboxed's special process helps make your documents tax-ready:

a. Categorization

The service categorizes your expenses, which can be customized to align with IRS-accepted expense categories. This makes it easier to identify potential deductions and prepare for tax filings.

b. IRS compliance

Shoeboxed ensures that the IRS and other tax authorities accept the digitized versions of your receipts. This means they maintain the necessary details and clarity required for tax purposes. You can use these digital versions as evidence for tax deductions and credits without keeping the physical copies.

c. Secure storage

All your documents are stored securely in the cloud with Shoeboxed. This secure, digital archive of your financial documents is crucial if the IRS ever requests proof of an expense or if you need to access past tax information for audits.

d. Easy access and sharing

You can access your organized, tax-ready documents from anywhere at any time. This makes it simple to share them with your accountant or tax preparer, streamlining the tax filing process.

e. Report generation

Shoeboxed allows you to generate reports based on your scanned and categorized documents. These reports can be customized for the specific needs of your tax filings, such as total expenses incurred within a specific category or period.

f. Integration

Shoeboxed can integrate with accounting software like QuickBooks, making it easier to transfer your tax-ready data directly to your accounting system for tax preparation and filing.

By providing these features, Shoeboxed facilitates a more streamlined, organized approach to tax preparation, helping to ensure that you’re ready for tax season with minimal stress. It simplifies the process of gathering and organizing the documentation needed to support tax filings and deductions, ultimately saving time and potentially reducing your tax liabilities.

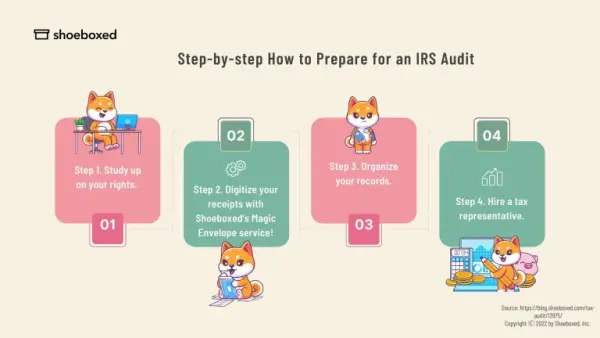

Audit-ready

Shoeboxed will make sure you are always audit-ready.

Shoeboxed helps make your financial documents tax-ready and prepares you to be audit-ready. Being audit-ready means having all your financial transactions documented, organized, and easily accessible in case the IRS or other tax authorities decide to review your accounts.

Shoeboxed makes sure that receipts are easily searchable and accessible.

Here’s how Shoeboxed assists in making your documents audit-ready:

a. Digitization and organization

Shoeboxed converts your physical receipts, bills, and other financial documents into digital format, ensuring they are not lost or damaged over time. Each document is categorized and organized within your Shoeboxed account, making it easy to find specific items when needed.

b. Detailed record-keeping

Shoeboxed extracts critical information such as date, vendor, amount, and category when processing your documents. This level of detail is crucial during an audit when you must prove the validity of expenses or income.

c. IRS compliance

The digital copies created by Shoeboxed are compliant with IRS regulations for digital record-keeping. This compliance is vital during an audit, as the IRS requires specific information to be maintained for each financial transaction.

d. Secure storage

Shoeboxed stores your digitized documents securely in the cloud. This secure, organized storage method ensures that your financial records are preserved for the duration required by tax laws (typically seven years for tax documents).

e. Accessibility

Since your documents are stored online, you can access them anytime and anywhere. This immediate access is invaluable during an audit, allowing you to quickly provide any requested documentation without sifting through boxes of paper records.

f. Sharing capabilities

If you are undergoing an audit, you may need to share documents with your accountant, tax preparer, or auditors. Shoeboxed allows you to easily share your organized digital records without handing over physical copies.

g. Reporting tools

Shoeboxed offers reporting tools that compile relevant financial information into comprehensive reports. These can clearly and concisely showcase your expenses, income, and other financial transactions during an audit.

h. Integration

For further financial management, Shoeboxed can integrate with accounting software, enabling seamless transfer of your organized data into your central accounting system. This can help ensure consistency across your financial records, a crucial element during audits.

By using Shoeboxed, you can maintain an audit-ready stance, significantly reducing the stress and workload associated with preparing for and undergoing a financial audit. The service’s ability to keep your financial documents organized, accessible, and compliant with tax regulations makes it an invaluable tool for personal and business financial management.

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic award-winning approach to receipt tracking for tax season. Try free for 30 days!

Get Started TodayFrequently asked questions

Can I deduct the cost of setting up my LLC?

You can deduct up to $5,000 of your start-up costs from your tax bill in the first year of business. Any remaining costs can be amortized over 180 months.

What is the difference between a deductible expense and a capital expenditure?

A deductible expense is an operating cost that can be subtracted from a company’s income to reduce its taxable income. A capital expenditure, however, is a significant purchase that a company makes to improve or acquire long-term assets and is capitalized and amortized over its useful life.

Are home office expenses fully deductible for my LLC?

Home office expenses are deductible if the space is used regularly and exclusively for business purposes. The tax deduction is based on the percentage of your home used for business activities.

How can an LLC save on taxes?

Beyond filing business taxes and deducting expenses, an LLC can save on taxes by choosing the right tax classification, contributing to a retirement plan, and taking advantage of tax credits for which it’s eligible.

In conclusion

Remember, the key to managing your LLC’s finances effectively lies in understanding the nature of your expenses, maximizing tax deductions, maintaining meticulous financial records, and staying up to date with current tax regulations. By implementing the strategies discussed in this guide, you can ensure your business's economic health and position it for growth and success in the competitive market.

We encourage you to revisit this guide periodically, especially as your business grows and evolves. The financial landscape can change, and staying informed will enable you to make the best decisions for your LLC. Don’t hesitate to seek professional advice, especially regarding tax matters and financial planning.

Caryl Ramsey has years of experience assisting in different aspects of bookkeeping, taxes, and customer service. She uses a variety of accounting software for setting up client information, reconciling accounts, coding expenses, running financial reports, and preparing tax returns. She is also experienced in setting up corporations with the State Corporation Commission and the IRS.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple receipt capture methods: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports, and more—with Shoeboxed.

Try Shoeboxed today!