Since realtors are considered Independent Contractors, the responsibility falls on the shoulders of the real estate agent when tax season rolls around.

This means that, as a realtor, it’s up to you to accurately record your income and tax-deductible expenses, including mileage.

Our guide will list the best mileage tracker app options and their features, as well as answer common questions about the tax liability of realtors and applicable write-offs.

Let’s get started!

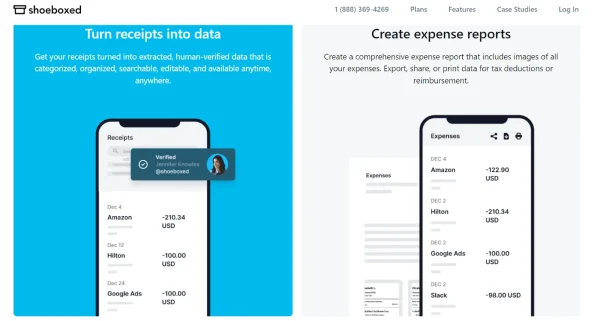

1. Shoeboxed – Best for mileage and tax prep

Shoeboxed is trusted by over 1 million businesses for receipt management.

Shoeboxed is our overall top pick for mileage tracking and tax receipt scanning.

This mileage app is perfect for realtors looking for a way to not only track all the business miles they cover but also the expenses generated by their real estate business.

How does Shoeboxed’s free mileage tracker work?

Shoeboxed’s mileage tracker.

Shoeboxed is one of the easiest-to-use mileage tracker apps out there. It has a user-friendly interface that’s simple to navigate so realtors can start tracking their miles right away.

Once you sign up for Shoeboxed, you can track miles by:

Opening the Shoeboxed app.

Tapping the “Mileage” icon.

Clicking the “Start Mileage Tracking” button.

And driving!

As soon as you click the “start tracking” button, Shoeboxed tracks your location and miles and saves your route as you drive.

(It’s a good idea to drop pins if you make stops along your trip. This helps to keep the mileage tracking precise.)

If you make stops to pay for parking, have lunch with a client, or buy signs for a new listing, you can snap a photo and upload that receipt to your Shoeboxed account without stopping the mileage tracker.

At the end of a trip, tap the “End Mileage Tracking” button.

This will prompt Shoeboxed to create a summary of your drive that includes the date, editable mileage and trip name, as well as your tax-deductible and rate information.

Click “Done” to approve the summary and generate a receipt with your drive information, including a photo of your route on Google Maps.

Shoeboxed will auto-categorize your trip under the mileage category for future reference.

Track mileage with Shoeboxed 🚗

Track mileage using your phone’s built-in GPS for unmatched ease and accuracy. Expense reports don’t get easier than this! 💪🏼 Try free for 30 days!

Get Started TodayReceipt capture, filters, and tax prep

Not only can you use Shoeboxed’s mileage tracker function, but you can also use the app to capture photos of any receipts you get from business purchases.

Some realtor expenses to capture include:

Parking and tolls

Car maintenance

Client lunches

Signs and office supplies

Advertising

…and any other expenses related to your real estate business!

Shoeboxed will digitize all your business expenses and automatically organize them under 15 tax categories to make tax time a breeze.

You can also edit your categories, add tags, and write descriptions for each purchase to further categorize your receipts and separate your personal and business expenses all within an app.

Advanced search and filters

If you ever need to find a specific receipt for a drive or purchase, you can use Shoeboxed’s advanced search and filter features to sort receipts based on date, vendor, payment type, and more.

Expense reports

For taxes, Shoeboxed lets you export the receipts and drives related to your realtor business into a detailed expense report to give to your accountant.

Shoeboxed’s expense reports come with receipts attached so you always have photo proof of the money you spent or the miles you traveled for work.

Shoeboxed’s Magic Envelope service and how it works

Outsource your receipt-scanning with the Magic Envelope!

What really makes Shoeboxed stand out from the other mileage trackers on our list is its Magic Envelope service. This service lets realtors outsource their receipt scanning.

The Magic Envelope is a must for big-city real estate agents who rack up a lot of expenses by tax season.

When you sign up for a plan that includes the Magic Envelope, Shoeboxed will send you a postage-pre-paid envelope each month for you to mail your receipts in.

Once your receipts reach the scanning facility, the team at Shoeboxed will scan your receipts, human-verify the data, and upload them to your account under the tax categories.

You can also request that the team put your receipts under custom expense categories by simply attaching a note.

Let Shoeboxed do the scanning for you! Here’s how.

Break free from manual data entry ✨

Use Shoeboxed’s Magic Envelope to ship off your receipts and get them back as scanned data in a private, secure cloud-based account. 📁 Try free for 30 days!

Get Started TodayShoeboxed software integrations

Shoeboxed integrates with accounting software you may already use to keep your real estate business up and running.

If you use QuickBooks, Xero, or Wave Accounting to manage your finances, you can integrate Shoeboxed with your account to upload receipts for expense tracking and reporting.

Pros:

Mileage tracker is easy to use and automatically saves your trip as you drive.

Trip miles are editable (in case you accidentally record personal miles).

Miles are turned into receipts for reporting and auto-categorized under mileage.

Filter your receipts for mileage and other realty-related expenses for tax time.

Track mileage and digitize business expenses simultaneously.

Comprehensive PDF and CSV file expense reports with receipts attached.

Integrates with accounting software like QuickBooks and Xero.

Shoeboxed's Magic Envelope service outsources receipt scanning and simplifies the expense management process.

An unlimited number of free sub-users. This is good for adding your accountant or an auditor to your Shoeboxed account to review your expenses.

Cons:

Mileage tracker is manual only. On the bright side, this makes it easier to separate personal and professional trips!

Pricing:

Start Up – $22/month OR $18/month (billed annually) for unlimited users + Magic Envelope service.

Professional – $45/month OR $36/month (billed annually) for unlimited users + Magic Envelope service.

Business Plan – $67/month OR $54/month (billed annually) for unlimited users + Magic Envelope service.

Starter Plan – $4.99/month for unlimited users (Digital Only plan. Doesn’t include Magic Envelope).

Light Plan – $9.99/month for unlimited users (Digital Only plan. Doesn’t include Magic Envelope).

Pro Plan – $19.99/month for unlimited users (Digital Only plan. Doesn’t include Magic Envelope).

Visit Shoeboxed’s pricing page to learn more about what the Digital + Magic Envelope plans offer.

NOTE: The Start Up, Professional, and Business plans are only available on desktop. The Starter, Light, and Pro plans are available on the Shoeboxed mobile app only.

2. Everlance – Best for automated mileage and expense tracking

Everlance app, Apple App Store.

Everlance uses Google Maps to track your location as you drive and create an accurate remapping of your route.

Mileage tracking is automatic or manual, so you have the flexibility to set and forget your mileage tracking or have more control over your trips.

You get 30 free trips with Everlance before you must purchase the Premium plan.

Expense tracking and taxes

Everlance Premium offers expense tracking and tax help for realtors.

You can automatically track your expenses with Everlance by syncing your bank or card to your account or by manually adding an expense with a photo of your receipt.

Everlance calculates the estimated tax deductions for the miles you’ve driven and includes other realty-related expenses in your tax report.

You can then create expense reports, filter your miles and business expenses based on date, and export them via PDF, Excel, or CSV to your accountant.

Pros:

Automatic tracking + manual tracking option.

Classify drives as personal or work-related.

Track expenses and upload images of your receipts.

Get automatic mileage deduction estimates.

Create expense reports for tax time.

Cons:

Only 30 free trips without the Premium version. Other tracking apps offer unlimited miles for free.

You don’t get all of the features unless you have the paid subscription.

Receipt-scanning is sub-par compared to options like Shoeboxed.

Pricing:

Free

Premium: $5/month (billed annually)

3. MileIQ – Best for teams

Track mileage with MileIQ.

MileIQ can be used by individual realtors, but we really like this app for agencies that employ multiple realtors.

MileIQ is an app that simplifies employee management and lets real estate agencies automatically track the mileage of everyone on their team.

With MileIQ, real estate agencies can review reports and download driver data for every agent on their team from a single dashboard.

You can invite realtors to your MileIQ account and they can start tracking miles as soon as they download the app. MileIQ detects when the realtors on your team are on the road and automatically begins tracking the trip.

Managers can also quickly reimburse realtors for company expenses through MileIQ, set custom mileage rates, team locations (such as the office), and more.

Pros:

Modern, easy-to-use interface.

Monitor multiple vehicles from a single dashboard.

The app automatically tracks mileage.

Approve and reimburse realtors for company-related expenses.

Review and create reports.

Download driver data.

Easily add and remove drivers and admins.

Cons:

Costly for small practices.

Pricing:

Teams Lite – $50/user (billed annually).

Teams – $80/user (billed annually).

Teams Pro – $100/user (billed annually).

4. Timeero – Best for time tracking

Timeero time and mileage-tracking app.

Timeero is one of the best mileage tracker apps for tracking billable hours and mileage, making it an excellent tool for realtors that bill hourly.

With Timeero, realtors can accurately track the hours they spend with clients or on the road. It’s an especially promising option for agencies that employ a team of realtors due to the app’s employee management features.

These features include managing users, seeing who’s working, managing jobs and tasks, tracking time and mileage across your team, mileage reports, and the time your employees spent off of work during the workday.

Time tracking is manual and starts and stops with the click of a button.

At the end of a route, realtors can snap photos of the property they visited or add notes about the work they did.

Pros:

Reasonable cost for a solo realtor.

Detailed mileage reports.

App tracks time and miles both online and offline.

Replay the routes you took.

Integrates with QuickBooks.

Geofencing to alert when realtors leave a certain area.

Add notes and take photos of your whereabouts for future reference.

Cons:

May be better suited for teams (employees) than individuals in the long run.

Pricing:

Basic – $4/month per user.

Pro – $8/month per user.

Premium – $11/month per user.

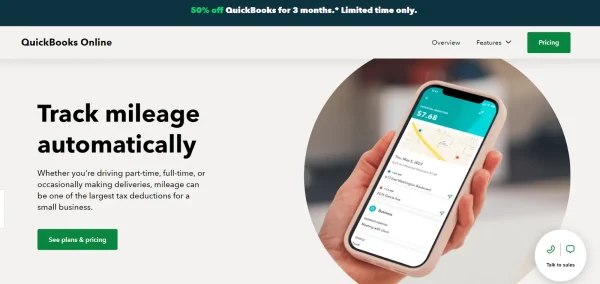

5. QuickBooks Self-Employed – Best for all-in-one accounting

Track mileage with QuickBooks Self-Employed

If you’re an independent realtor just getting started in your practice, you may be on the lookout for an all-in-one solution to your expense and tax preparation needs.

QuickBooks Self-Employed is an accounting software solution for realtors that organizes your expenses, prepares you for tax season, and even tracks your miles automatically with its built-in mileage tracker.

With QuickBooks’ GPS-enabled automatic mileage tracking, you can have all of your business trips automatically recorded and uploaded to your QuickBooks account.

Or, you can manually add a trip if you want to be selective about the drives you track.

The QuickBooks mileage tracker creates detailed reports for each of your trips and lists potential tax deductions to prepare you for tax season.

With QuickBooks Self-Employed, you’ll always have a mileage log and record of business expenses to maximize your tax write-offs.

See how QuickBooks can track mileage for youPros:

Tracking mileage can be done manually.

Tracks and organizes your trips in real time.

Creates reports with detailed information on your drives.

All-in-one accounting solution for independent realtors.

Mileage reports are easy to export to your accountant.

Integrates with Shoeboxed for receipt management.

Cons:

Pricier than the other picks on our list.

Pricing:

Simple Start – $30/month*

Essentials – $55/month*

Plus – $85/month*

Advanced – $200/month*

*Get 50% off for the first 3 months when you sign up.

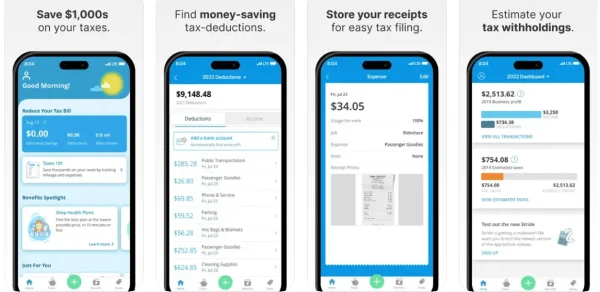

6. Stride – Best free tracker

Stride app, Apple App Store.

Based on our experience, Stride is the best free mileage tracker app for real estate agents. All of Stride’s features are free to use and extend beyond just tracking your miles.

Mileage tracking

When it comes to mileage tracking, Stride’s interface is easy to use and navigate.

Though the app only tracks manual miles, drives start and end with a simple click of a button.

After your drive, Stride automatically calculates your approximate tax deduction for the distance traveled and logs the time you spent on the road.

Insurance help

Besides mileage tracking, Stride also offers realtors:

Resources for finding health plans, including dental, vision, and life insurance.

Receipt scanning.

The insurance resources are helpful for realtors who are new to self-employment and are actively looking for ways to support themselves or their families.

Receipt scanning

Stride also allows you to take photos of your receipts for taxes.

When you take pictures of your business receipts, you get the option to edit the job and expense fields and add any notes about the realty purchase.

The downside is that expenses aren’t super customizable and the features are basic compared to other receipt scanners, like Shoeboxed.

Pros:

An unlimited number of free drives.

Find insurance that meets your needs as a realtor.

Estimated tax deductions on the miles you drive.

Link your bank account and automatically find write-offs.

User-friendly app.

Simple start-and-stop tracking.

Cons:

Doesn’t automatically track mileage.

The receipt scanning feature is limited.

Pricing: Free

What should you look for in a mileage tracker app for realtors?

1. GPS tracking

Realtors can burn a lot of rubber making stops at different properties, mortgage lender offices, or when meeting with clients.

Having a mileage tracker that uses GPS to keep tabs on your location can ensure that you always have an accurate record of your stops and trips for business deductions.

The app should also show the trip you took on maps so you can accurately bill clients and deduct mileage from your taxes.

2. Automatic and manual tracking options

Automatic mileage tracking apps can be super convenient if you’re a “set and forget” type of person.

A mileage app with auto-tracking automatically starts and stops your trips as you drive so you won’t have to worry about missing out on deductible miles.

Automatic tracking can be a time-saver, but with most apps, you will still have to classify drives as business or personal trips.

On the flip side, manual mileage tracking apps can give you more control over your drives and help you differentiate personal miles from real estate miles.

3. Notes

A mileage tracker app should let you leave notes on your trip to detail any specifics.

This can be helpful to remember what exactly you were doing during a particular drive in case you’re ever audited.

TIP: Use Shoeboxed to name your trips and customize them with notes detailing your drive.

4. Reporting features

A reliable mileage tracking app should give you an overview of your drives and create a report with the date, miles driven, and time after each trip.

Shoeboxed, for example, lets you generate reports of the miles driven for a specific date or the entire tax year. You can even create expense reports for business-related receipts incurred during your trips for tax deductions.

5. Affordability

If you’re a budding realtor with a beginner’s budget, you may not be too keen on spending heaps of money each month to track your mileage.

Knowing how much you’re willing and able to spend on a mileage-tracking app can help narrow down your options.

Just keep in mind that free apps offer basic features, while those with paid subscriptions could be more helpful in the way of advanced functionalities such as tax prep and reports.

Why should real estate agents track mileage?

Tracking mileage allows realtors to reduce their tax liability.

Real estate professionals are considered Independent Contractors, which means the IRS allows them to deduct mileage from their end-of-year taxes.

Every mile that’s driven for business purposes can be deducted, including the following:

Property showings and open houses.

Meetings with clients.

Property inspections.

Setting up “for sale” signs.

You can even write off other vehicle-related expenses such as parking fees, fuel, tolls, vehicle purchases, car registration and insurance, and maintenance.

You might also like: Top 9 Apps for Realtors for Closing Deals in 2024

What other types of expenses can realtors write off?

Whether you work from home, travel out of the city, or meet clients at your favorite authentic Italian restaurant, there’s a write-off for that.

Besides mileage and vehicle expenses, the following real estate expenses can also be deducted:

Meals with clients.

Property promotion (e.g. signs and ads).

Seminars and workshops.

Website fees.

Licensing fees.

Office supplies.

Business cards.

Phone bills.

Transportation for travel (e.g. plane tickets).

Hotels and lodging.

Home office supplies.

Real estate agents may even be able to partially deduct their home utilities, such as water, electricity, and even WiFi from their tax bill!*

*For your information only. Discuss your finances with a tax professional to get advice for your situation.

Check out this video for more information on tax write-offs for realtors:

Tax deduction and tax strategies for real estate agentWhat is typical mileage for a realtor?

While mileage for a realtor can reach 20,000 miles, the average mileage driven by real estate agents per year is between 7,000 and 10,000 miles.

If we use the current standard business mileage rate of 65.5 cents per business mile, that could mean saving $8,000 to $12,000 annually on your taxes!

What is the best way to track mileage for taxes?

While some realtors prefer the old-fashioned way of tracking their mileage with a pen and paper, the best way to track mileage for taxes is with an app.

Mileage-tracking apps negate the need for manual data entry and create a digital mileage log for you to report on during tax season.

Frequently asked questions

Can realtors write off mileage?

Realtors can write off their mileage if they have an accurate, detailed log of the miles they spent traveling for business. Agents can use the standard IRS mileage rate or vehicle expense to calculate their applicable deductions.

How do realtors keep track of mileage?

Mileage and expense tracking apps, like Shoeboxed, make it easy for realtors to keep track of their business mileage and spending for tax purposes.

In conclusion

Tracking mileage as a realtor has never been easier with these top mileage tracker apps.

If you ask us, the best mileage tracker apps fall down to the QuickBooks mileage tracker, Shoeboxed, and Timeero for their user-friendly interfaces and features that help realtors reduce their tax liability, track miles, and keep up with business expenses with ease.

Regardless of the app you choose, a mileage tracking app is one way to make the road to realty success a little less rocky!

Hannah DeMoss is a staff writer for Shoeboxed covering organization and digitization tips for small business owners. Her favorite organization hack is labeling everything in her kitchen cabinets, and she can’t live without her mini label maker machine.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!