Whether self-employed, a freelancer, or a small business owner, a detailed mileage log will help you maximize tax deductions, comply with IRS regulations, and simplify the reimbursement process.

A free mileage log template is a straightforward method for maintaining accurate records. It provides a clear format for capturing all the necessary details, instilling confidence in managing and reviewing your business mileage effectively.

What is a mileage log?

A mileage log is a detailed record of the miles you drive for business purposes. It’s proof of the distance you travel for work-related activities and is required to claim tax deductions or get reimbursed for business travel expenses.

A mileage log helps you separate personal and business miles so you only report the correct miles for tax deduction purposes. Keeping an IRS mileage log ensures you comply with IRS requirements for accurate and complete documentation, which is crucial to avoid potential audits and penalties.

What are the benefits of a mileage log?

Using a mileage log has many benefits, especially for individuals and businesses wanting to manage vehicle expenses and get tax deductions.

1. Accurate and maximize tax deductions

A mileage log keeps you accurate on business mileage, which means significant tax deductions. The IRS allows deductions for miles driven for business, and having detailed records means more savings.

By keeping accurate mileage records, you can claim all the miles you’re eligible for and reduce your overall tax bill.

2. Simplified tracking

A mileage log template makes tracking business miles easy. It gives you a format to follow to capture all the details and make managing and reviewing your records a breeze.

3. IRS compliance

The IRS requires detailed documentation for business mileage deductions. An IRS-compliant mileage log means you meet those requirements and reduce the risk of audits and penalties.

4. Straightforward reimbursement process

A mileage log provides a simple method for business mileage reimbursement. Fill out your company’s mileage reimbursement form based on your mileage log and turn your miles back into cash.

5. Personal and business miles separation

A mileage log helps you separate personal and business miles so you won’t have any confusion or errors when you file taxes.

What information should be included in your mileage log?

To log mileage effectively, you need to record:

1. Date of trip

The actual date of your business travel.

2. Odometer readings at the start and end of the trip

Record the odometer reading at the start and end of each trip to calculate the total miles in between.

3. The business purpose of trip

State the business reason for the business driving or trip, e.g., client meeting, business errand, or work event.

4. Miles

Total miles for the trip.

5. Comments (optional)

Any other notes or details, e.g., tolls, specific locations.

What are the IRS rules for business mileage?

To deduct mileage, you must keep the following in mind:

1. Accurate and detailed records

You must keep a log that records each trip's date, mileage, and purpose. Accurate records are key to deducting mileage on taxes and IRS regulations.

2. Separation of personal and business miles

Only business miles are deductible, so you must keep them separate from personal travel.

3. Use of a mileage log

A mileage log is the best way to track business miles and comply with IRS regulations.

4. Deduction methods

The IRS has two methods for deducting business miles: the standard mileage deduction or the actual expenses method.

Standard deduction

The standard mileage deduction and actual expense method are two ways to calculate vehicle-related tax deductions for business use. The standard mileage deduction is simple: You multiply the number of business miles by the IRS standard mileage rate, which covers all operating costs like fuel, maintenance, insurance, and depreciation. It is easy to use, and all you need is a record of business miles.

Actual expense method

The actual expense method tracks and deducts the actual cost of operating the vehicle, including fuel, oil, maintenance, insurance, registration fees, and depreciation. While the actual expense method can give you a larger deduction if you have high vehicle expenses, it requires more record-keeping and documentation for each expense.

The choice between the two depends on which gives you the more significant tax benefit and how much work you want to put into record keeping.

Are there any free mileage tracker templates?

There are some simple mileage trackers that you can access online.

Here are some popular free mileage tracker templates that you can use to accurately track your business miles:

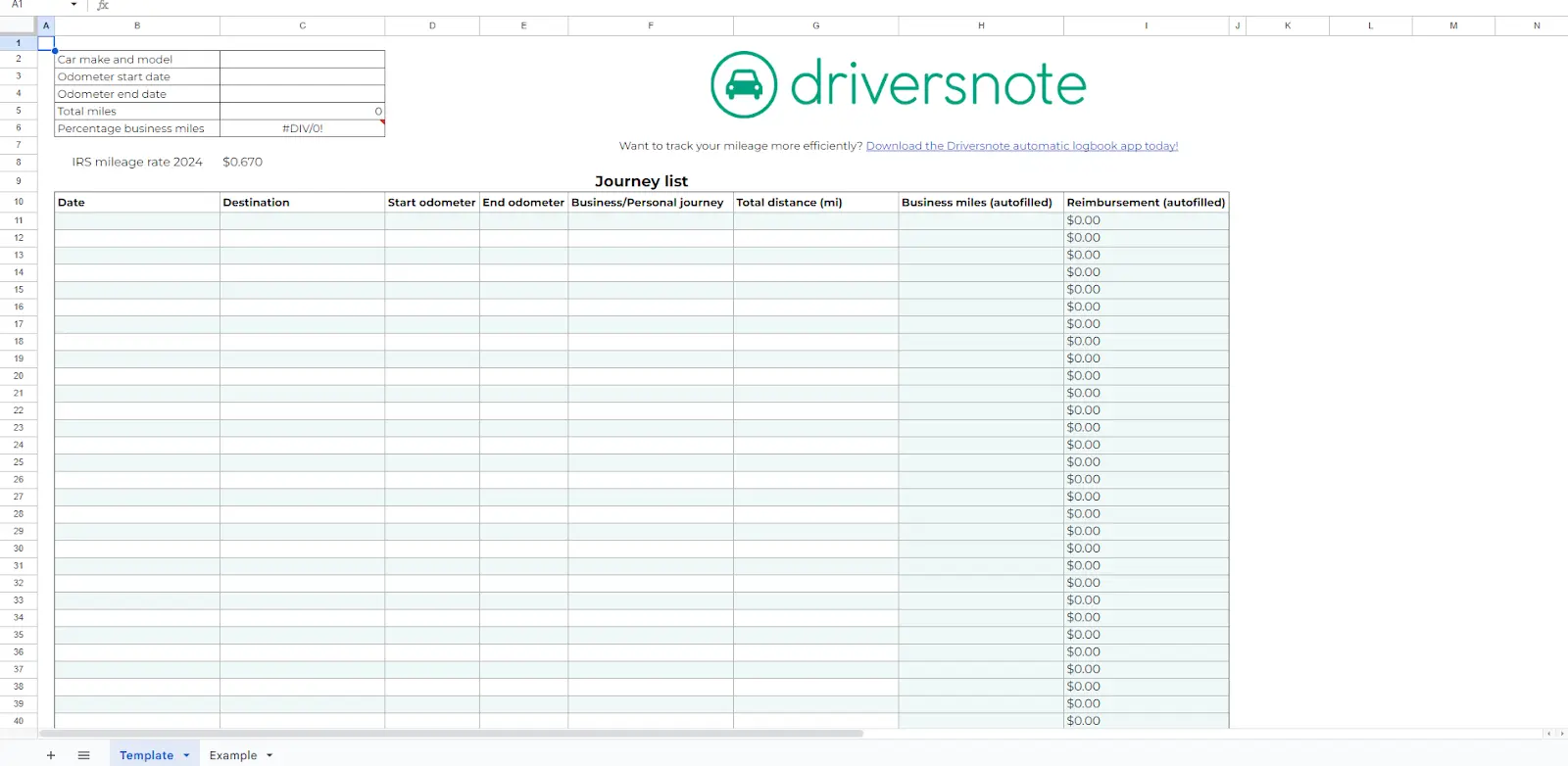

1. IRS Printable Mileage Log Template by Driversnote

This IRS Printable Mileage Log Template by Driversnote uses the standard IRS mileage rate for 2024 which is 67 cents per mile for business-related driving. The tracker is available as a downloadable Excel file, PDF file, or Google Sheet and includes categories for car make & model, start and end date, odometer start and end mileage reading, percent of business miles driven, destination, business or personal, total distance, and reimbursement.

2. IRS-Compliant Mileage Log Template by Everlance

The IRS-Compliant Mileage Log Template by Everlance is downloadable as a printable PDF, Google Sheet, or Excel file. This mileage tracking template includes categories for date, time, business or personal, trip purpose, from, to, total miles, work miles, and deduction amount.

3. Printable Mileage Log Templates by TripLog

TripLog's Mileage Log Template is downloadable in an Excel or PDF file. Categories include time, date, description, purpose, from and to, odometer start and finish, and business mileage.

4. Business Vehicle Mileage Log by Smartsheet

Smartsheet's Business Vehicle Mileage Log is downloadable as an Excel file. It includes information such as the date, the purpose of the trip, odometer start, odometer end, total mileage, and additional comments.

What’s the best alternative to a mileage log template?

In my experience, a mileage-tracking app that uses your phone's GPS is hands down the most efficient way to track business mileage.

Crowned the “#1 best receipt tracking app” of 2024 by Forbes and given the Trusted Vendor and Quality Choice awards by Crozdesk, Shoeboxed is the best alternative to a mileage log template.

Shoeboxed is a mileage and expense tracking app that takes your mileage and receipts for other expenses and turns them into digital data for reimbursements, expense reporting, tax prep, and more.

Shoeboxed is a more efficient, accurate, and convenient way to track business miles.

Mileage tracking app

Unlike a manual mileage log template where you have to record odometer readings and trip details by hand, Shoeboxed's app tracks your mileage using your smartphone's GPS.

Here's how it works:

After you sign up for Shoeboxed, you can start tracking miles in seconds:

Open the Shoeboxed app.

Tap the “Mileage” icon.

Click the “Start Mileage Tracking” button.

And drive!

Shoeboxed tracks your location and miles whenever you start driving and saves your route as you drive.

You can drop pins to make tracking more precise as you make stops along the way.

At the end of a drive, click the “End Mileage Tracking” button to create a trip summary. Each summary will include the date, editable mileage, trip name, tax-deductible miles, and rate information.

Click “Done” to generate a receipt for your drive and get a photo of your route on the map.

Shoeboxed's mileage tracker app automatically categorizes your trip under the mileage category in your account.

Shoeboxed's mileage feature makes it easy to claim deductions during tax season with the miles you log.

Track mileage with Shoeboxed 🚗

Track mileage using your phone’s built-in GPS for unmatched ease and accuracy. 💪🏼 Try free for 30 days!

Get Started TodayTrip details can be added in 'notes'

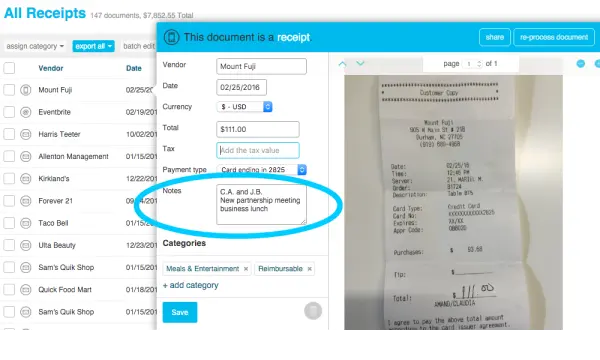

Another great feature is that you can go into Shoeboxed's app and add trip details under the notes section with each mileage receipt, which can be edited whenever needed.

The mobile app scans receipts for other expenses

Shoeboxed allows users to digitize receipts by taking photos with their mobile device’s camera and Shoeboxed’s app. The app extracts the essential data from the scanned documents and receipts and uploads it into the user’s Shoeboxed account. No manual data entry is required.

With the app, you can snap photos of the receipts from parking, tolls, and other deductible expenses.

Outsource with the Magic Envelope service

If you're always on the go and want a more straightforward method, you can use Shoeboxed as a service and outsource your receipt scanning with their Magic Envelope.

Shoeboxed will send you a monthly postage-prepaid envelope to mail your receipts when you buy a plan that includes the Magic Envelope.

The Magic Envelope allows drivers to keep track of fuel costs and expenses while on the road. Drivers can keep the envelope on their car dashboard and fill it with receipts as they pay for gas, meals, etc.

Once your receipts reach Shoeboxed’s scanning facility, they’ll be scanned, human-verified, and uploaded to your account under the associated tax categories (or specific categories of your choosing).

Automatically categorizes expenses

Shoeboxed digitizes and automatically organizes receipts and expenses under 15 tax categories.

The tax categories are editable; add tags and descriptions for each expense to further categorize your purchases.

Shoeboxed also has advanced search and filters to sort and find receipts based on date, vendor, payment type, and more.

Generates detailed expense reports

When it’s tax season, you can use Shoeboxed’s automatic expense reporting feature to create a detailed report of your expenses (including your mileage log) for your accountant.

Shoeboxed’s expense reports come with receipts attached, so you always have proof of purchase for your business expenses.

Integrates with popular accounting software

Shoeboxed seamlessly integrates with significant accounting software and bookkeeping platforms, such as QuickBooks, enhancing the overall workflow for financial management.

This integration allows for real-time, monthly income and expense tracking and financial reporting, which can be more cumbersome when using spreadsheets that require manual updates and imports.

IRS-compliant logs

Shoeboxed ensures that all mileage logs comply with IRS standards, making them valid for tax reporting purposes. This compliance is crucial for users who rely on accurate mileage tracking to claim business expense deductions on their tax returns.

Mileage tracking made easy

Along with tracking other expenses, Shoeboxed has a mileage-tracking feature that makes recording and managing business mileage a breeze. With Shoeboxed, you can track your miles, categorize trips, generate detailed reports that tie in with your other financials, stay organized, maximize your deductions, and stay compliant with the IRS.

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic award-winning approach to receipt tracking for tax season. Try free for 30 days!

Get Started TodayWhat are the perks of a mileage app?

Using a mileage app has many benefits that can make tracking business miles more efficient and accurate.

Benefits:

Convenience: Mileage apps like Shoeboxed track your miles using GPS, so you don’t have to enter them manually.

Accuracy: Digital apps are more precise, so all business miles are accounted for.

Ease of use: The apps are easy to use and integrate with other financial tools to make expense management a breeze.

What are some mileage tracking tips?

The best practices for mileage logging are to be consistent, accurate, and detailed so you can maximize your deductions and stay compliant with the IRS.

1. Use a mileage log

A template or app makes recording all the details for each trip easier. It keeps you consistent and complete.

2. Log miles daily

Ideally, you should log your miles at the end of each day. Daily updates will keep you accurate and prevent you from forgetting trips.

3. Record everything

Accurate and complete records are crucial to getting the most deductions and compliance with the IRS.

4. Personal and business miles

Make sure to separate yearly business miles and personal miles to avoid errors.

5. Review often

Please look over your mileage log regularly to make sure everything is correct.

What to avoid when tracking mileage?

When tracking for business purposes, you want to avoid common mistakes that can lead to inaccurate records and missed tax deductions.

1. Inaccurate or incomplete records

Not recording all the details can disallow deductions.

2. Not separating personal and business miles

Mixing these miles can lead to inaccuracies and IRS issues.

3. Not keeping records for the required time

You must keep records for at least three years after filing your tax return.

4. Not using a log or app

Memorizing or using notes will lead to mistakes and missed deductions.

Frequently asked questions

Can I use multiple methods to track my miles?

Many people use a combination of methods, such as a manual logbook and a mileage tracking app like Shoeboxed to ensure accuracy and convenience in tracking business miles.

How does Shoeboxed help with mileage tracking?

Shoeboxed tracks your miles, categorizes your trips, and generates detailed reports. This ties in with other expense management features to keep you organized and ensure all your business miles are recorded for tax purposes.

In conclusion

Tracking business miles accurately is key to maximizing deductions and staying compliant with the IRS. A free mileage log template is a simple and structured way to record your miles.

While a mileage log template helps track business miles, Shoeboxed is a more advanced, automated, and comprehensive solution. By eliminating manual entry, being accurate, and generating detailed reports, Shoeboxed makes mileage tracking easy and helps you maximize your deductions.

Caryl Ramsey has years of experience assisting in different aspects of bookkeeping, taxes, and customer service. She uses a variety of accounting software for setting up client information, reconciling accounts, coding expenses, running financial reports, and preparing tax returns. She is also experienced in setting up corporations with the State Corporation Commission and the IRS.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!