As companies adopt remote work and employees travel more frequently, expense management is a big challenge. Traditional paper-based expense reporting is time-consuming and error-prone and often leads to delays in reimbursement and financial reporting.

Enter mobile report apps—a modern solution and digital transformation that uses smartphone technology to simplify and speed up the expense management process, making expense management a much easier process.

What features should you look for in a mobile expense reporting app?

When choosing a mobile expense reporting app, look for expense management solutions designed with the following:

1. Receipt capture

A mobile expense report app should feature easy receipt capture where you can take a photo of the receipt with your phone while on the go.

2. Optical character recognition (OCR)

It should also feature OCR or optical character recognition to extract specific data from the receipt so that there is no manual data entry.

3. Policy and compliance

You should also look for an app that leaves a trail for compliance and auditing purposes.

4. User experience

The expense management platform should have a simple design that’s easy to use and requires minimal training. In other words, people who aren't tech savvy should be comfortable using the mobile app.

5. Security and data protection

Expense management software should feature data encryption with secure transmission and storage of financial data.

6. Reporting

The app should also feature dashboards and custom reports so that expense data is available at a glance and caters to your specific industry.

What is the best app for generating mobile reports?

Mobile expense reporting apps are a must-have for capturing, organizing, and submitting expenses on the go.

Shoeboxed - ideal for businesses looking for the best app for mobile expense reports

Among all the options, Shoeboxed is the top pick for an overall travel and expense management experience.

Easy to use, with advanced features and seamless integrations, Shoeboxed makes the process of managing expenses a snap while saving you time and money.

Here's why it's the best app for mobile expense reports:

1. Effortless receipt capture

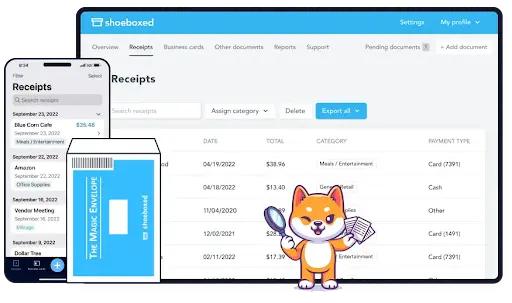

Shoeboxed allows you to scan receipts in seconds with your phone’s camera. Snap a photo of the receipt, and the app will upload a copy to your designated account.

2. Outsourcing for scanning services

Or, if you don't want to do the scanning yourself, you can send your receipts in Shoeboxed's prepaid postage-free Magic Envelope to their processing center, where they will be scanned, human-verified, and uploaded into your account.

Just mail your receipts, and Shoeboxed will take care of the rest!

3. Automatic expense organization and categorization

Shoeboxed's advanced Optical Character Recognition (OCR) technology extracts the critical information from your receipts: date, vendor, amount, and payment method. The app then puts expenses into pre-set or custom categories, so you don’t have to. Customize expense categories, tags, and notes to fit your needs so your expense tracking matches your personal or company policies.

No more physical copies, no more clutter. All your receipts are stored in the cloud.

4. Detailed mobile expense reporting

Create professional, IRS-compliant expense reports with receipts attached in seconds. Shoeboxed compiles your expenses into a neat expense report that can be reviewed and submitted with just the click of a button.

5. Integrates with accounting and financial software

Shoeboxed integrates with QuickBooks, Xero, Wave, and FreshBooks.

Expense data in Shoeboxed syncs automatically with your accounting systems, so you don’t have to enter data manually and keep everything in sync.

Integration makes reconciliation a breeze for you or your finance team to keep books current.

6. Time and cost savings

By automating receipt capture, data entry, and expense report processing, Shoeboxed saves you time.

Automatic data extraction reduces manual entry and errors so your expense records are accurate.

Faster expense report generation and submission means faster approvals and reimbursements.

7. IRS-accepted and audit-ready

Shoeboxed is IRS-approved, and digital copies of your receipts in the app are acceptable for tax purposes.

Keep comprehensive records with original receipt images and extracted data so tax prep and audits are a breeze.

8. Tracks mileage

For those needing to track business mileage, Shoeboxed has a tracker that uses your phone's GPS to track mileage and log trips for tax deductions.

Track mileage with Shoeboxed 🚗

Track mileage using your phone’s built-in GPS for unmatched ease and accuracy. 💪🏼 Try free for 30 days!

Get Started Today9. Secure cloud storage

Shoeboxed uses SSL encryption and strict security protocols to protect your financial data.

Your expense data and receipts are backed up in the cloud, so you don’t lose data if your device fails or is lost.

You can access your expense reports and receipts from any device with the internet, so you have your records whenever and wherever you need them.

10. Comprehensive expense management platform

Even though Shoeboxed stands out because of its customized expense reports that are easy to generate and submit while on the go, the platform does much more.

It's a comprehensive platform that covers all aspects of expense management, such as tracking expenses, automating expenses, and automatically organizing and categorizing expenses.

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic award-winning approach to receipt tracking for tax season. Try free for 30 days!

Get Started TodayWhat are the benefits of mobile reports?

There are many important benefits of mobile reports.

1. Faster

Employees can submit expenses as they happen while they're on the go instead of at the end of a trip or month.

Real-time submission means managers can review and approve expenses quicker for faster reimbursement cycles.

2. More efficient

OCR extracts data from receipts, so you don’t have to, so there's less manual entry and fewer errors. The automation of receipt tracking, organization and categorization, and expense report processing makes mobile reports a very efficient process.

3. More accurate

Digital capture of receipts means fewer lost or damaged documents, and automated data extraction and validation reduce manual entry errors. That means more accurate reports and reimbursements.

4. Better visibility

Finance teams have access to travel and expense management data in real-time to help with budgeting and forecasting.

Reports show you where you can save, and employees can manage expenses on the go, with less admin.

More transparency means better company decisions.

Frequently asked questions

Who can benefit from mobile reports?

Employees and managers should use mobile reports for easy expense tracking and reporting, finance teams for streamlined expense management and approval, business owners and administrators for real-time expense tracking and control, and industry-specific solutions for tailored expense reporting and management needs.

Mobile reports are versatile software for your business, catering to various roles and industry-specific needs.

What are the advantages of mobile expense app downloads?

You can create expense reports with ease using mobile apps. The apps result in savings due to simplified administration, thanks to spend management.

Mobile expense report apps reduce paperwork and administrative costs, improve visibility and control over business expenses, and increase accuracy and reduce errors.

What features should you look for in mobile expense reporting apps?

Mobile expense reporting apps should include easy receipt capture, OCR, and integrations, and the application be user-friendly.

In conclusion

With a complete expense management system like Shoeboxed, employees can track expenses, upload receipts, and submit expense reports in real-time while on the go.

This reduces the admin burden and speeds up the reimbursement process, so employees get paid quicker. An automated expense management system for expense reports also help identify cost savings and prevent fraud, making the business healthier overall.

Caryl Ramsey has years of experience assisting in bookkeeping, taxes, and customer service. She uses a variety of accounting software to set up client information, reconcile accounts, code expenses, run financial reports, and prepare tax returns. She is also experienced in setting up corporations with the State Corporation Commission and the IRS and is a contributing writer to SUCCESS magazine.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple receipt capture methods: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad, and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports, including IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports, and more—with Shoeboxed.

Try Shoeboxed today!