Giving money to a family member, friend, or charity is often driven by generosity and support. Many people assume once the money leaves their hands, there’s nothing else to worry about. But depending on where you live and how much you give, there may be tax implications to consider.

What is a monetary gift?

A monetary cash gift transfers money or an equivalent financial asset—check, bank transfer, or cash—without expectation of payment, interest, or repayment. A well-presented and personalized cash gift can turn a routine transfer of funds or assets into a meaningful gift.

While small everyday gifts don’t raise gift tax issues, more significant monetary gifts do.

What is the purpose of gift taxes?

In the United States, financial gift taxes were created to ensure fair treatment of wealth transfers. Without a financial gift tax, some people would transfer their entire estate to heirs as “gifts” during their lifetime to avoid estate taxes.

By setting annual and lifetime limits on gifts, the government helps to keep things fair and closes loopholes in the system.

What are the annual exclusions and lifetime limits?

If the total value of gifts given to the same person or recipient in a calendar year exceeds the IRS annual exclusion rate, the gift giver is responsible for paying gift taxes. The annual gift tax limit is $18,000 for 2024. The combined limit for couples is $36,000.

In addition to annual exclusions, there is also a lifetime gift and estate tax exemption. This total includes gifts made during your lifetime and assets transferred at death.

No gift or estate tax will be due as long as the total of your lifetime gifts (beyond annual exclusions) plus your estate’s value at your death is below this lifetime exemption. But if you go over these amounts, the extra is taxable.

A single taxpayer can claim a federal estate and lifetime gift tax exemption of $13.61 million for 2024 and twice that amount for couples making joint gifts.

When do you need to file a gift tax return?

If you give more than the annual lifetime exclusion to one person in a year, you must usually file a gift tax return (Form 709 in the U.S.). Filing the return doesn’t necessarily mean you’ll owe taxes, as the excess gifts first reduce your lifetime exemption before taxes are due.

Why record-keeping matters for monetary gifts

Most smaller gifts (birthday cash in a card or a small donation to a non-profit) don’t require much administrative follow-up.

But when you scale up your giving (regular contributions to a charitable foundation, large gifts to family members as part of estate planning, or year-end bonuses to employees), staying organized becomes crucial.

Good record keeping can help you:

1. Meet tax obligations

In some places, large monetary gifts must be reported to tax authorities to comply with gift tax and estate laws. In the US, for example, gifts over the annual exclusion amount must be filed on a gift tax return. Accurate records support these filings and help you avoid disputes.

2. Maximize deductions and credits

Donations to qualified charities may be tax deductible. Having clear, easily accessible proof of these gifts is key if you want to claim deductions with confidence. Good records will have you prepared in case of an audit.

3. Support financial planning

Recording your monetary gifts helps you plan for the long term. By tracking how much you’ve given, when, and to whom, you can align your giving with future goals (e.g., supporting a grandchild’s education or medical expenses or maintaining a philanthropic presence in the community).

What's the easiest way to keep good records?

Monetary gifts mean you should incorporate an efficient method for organized record-keeping.

Here's where Shoeboxed can help.

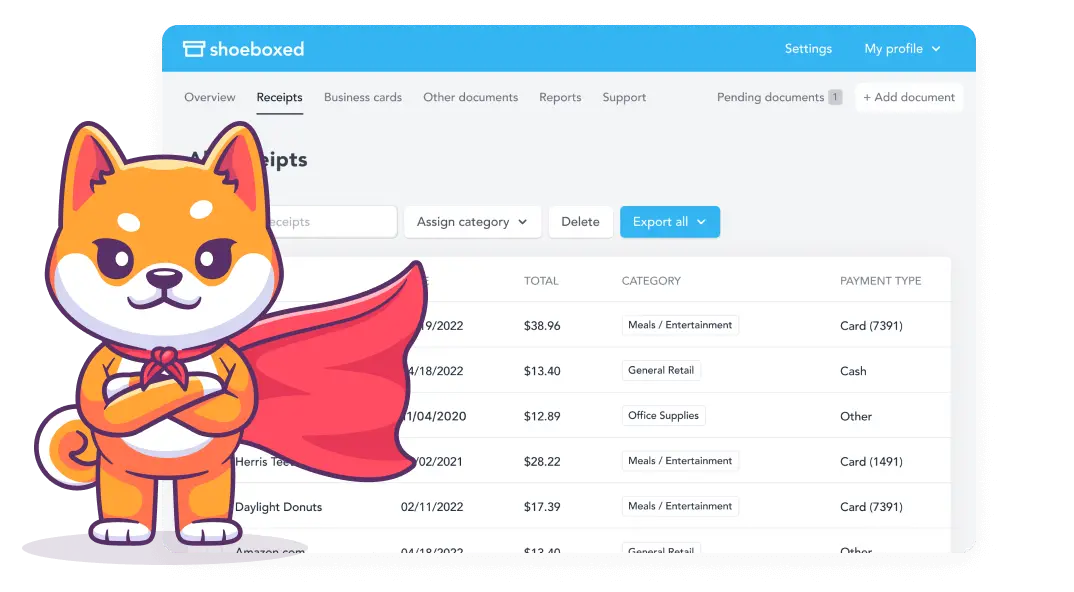

Shoeboxed - ideal for gift-givers looking for an efficient method of record-keeping

When you give a monetary gift (to loved ones, friends, or even charity), your focus is on generosity and support. But behind that thoughtful gesture is a practical side you shouldn’t ignore: record keeping.

Proper documentation of your monetary gifts is key to tax compliance, financial planning, and transparency for more significant or ongoing contributions.

While organizing paper receipts, bank accounts statements, and donation acknowledgments can be a pain, modern tools like Shoeboxed make it easy to enjoy giving with more peace of mind.

Meet Shoeboxed: Your record-keeping sidekick

Shoeboxed is a digital platform to manage and store your important financial documents. While commonly used for business expenses, it’s also super helpful for anyone making regular or large monetary gifts.

By using Shoeboxed you can:

1. Consolidate all your records in one place

Instead of juggling paper receipts, printouts from charitable organizations, and bank statements, you can upload them all into Shoeboxed.

To digitize the monetary value of a gift transaction, photograph the receipt with your phone's camera. The Shoeboxed app will automatically upload the digital copy to your designated Shoeboxed account.

2. Outsource your scanning

Or, if you have a lot of receipts and don't want to scan them yourself, you can outsource them to Shoeboxed. Mail them via the free postage-paid Magic Envelope service, and they will scan, human-verify, and upload them to your account for you.

That way, you have all your monetary gift receipts in one place, making them easier to keep up with and track. They're also automated, eliminating the clutter of paper receipts.

Break free from paper clutter ✨

Use Shoeboxed’s Magic Envelope to ship off your receipts and get them back as scanned data in a private, secure cloud-based account. 📁 Try free for 30 days!

Get Started Today3. Enjoy automatic categorization

The platform’s simple interface lets you categorize gifts (e.g., “Family Gifts,” “Charitable Donations,” or “Estate Planning Distributions”) so you can find what you need later.

Shoeboxed extracts date, vendor, and amount using OCR (Optical Character Recognition), so you don’t have to enter data manually. Their platform automatically categorizes your gifts into tax or expense categories.

Create custom categories to fit your own personal or business needs. This will help you keep accurate records for tax prep.

4. Comply with tax rules easily

If you need to file a gift tax return or substantiate charitable deductions Shoeboxed’s organized digital files will have the documents at your fingertips.

Instead of digging through boxes or file cabinets, you can find what you need in seconds, anywhere, anytime.

5. Have accurate data for future decisions

Regularly uploading documentation related to your monetary gifts gives you a complete real-time view of your giving. This will help you decide how much cash you can afford to give, how to structure those gifts for tax efficiency, and whether you need to adjust your financial priorities.

6. Collaborate with professionals

If you work with financial advisors, accountants, or estate attorneys, Shoeboxed makes it easy to share relevant records with them. Collaborative access will help you fine-tune your giving strategy to integrate your generosity with the rest of your financial plan.

By using Shoeboxed, you’re being thoughtful and diligent in your giving. You’re not just handing over money; you’re ensuring your generosity is recorded, compliant with tax laws, and aligned with your financial goals.

How to get started

New to Shoeboxed or digital record keeping?

Getting started is easy:

1. Sign up and get organized

Create a Shoeboxed account and start categorizing your monetary gifts. Consider creating folders or tags for different types of recipients (e.g., “Family,” “Friends,” “Charity,” etc.) or purposes to give money (e.g., “Education,” “Holiday Giving,” “Special Occasions,” Medical Bills," etc.).

2. Upload documentation

Add canceled checks, bank transfer confirmations, charitable receipt letters, or any other proof of your gift. Shoeboxed’s mobile app lets you snap photos of paper documents and receipts and upload them directly from your phone.

3. Be consistent

Make it a habit to record new gifts as you make them. This way, you’ll never scram for documents at tax time or when reviewing your finances.

4. Consult professionals

Consider working with a financial planner or tax professional if you have complex giving strategies or significant estate planning concerns. You can grant them view-only access to Shoeboxed so they can better advise you.

Giving a monetary gift is a great way to support someone’s future or help organizations financially. However, this financial generosity comes with responsibilities, especially when large sums of money are involved.

With Shoeboxed for accurate and easily accessible documentation, you can focus on what really matters—making a positive impact—knowing the administrative side of your generosity is taken care of and under control.

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic award-winning approach to receipt tracking for tax season. Try free for 30 days!

Get Started TodayHow are monetary gifts to charities treated?

Charitable donations receive more favorable tax treatment.

In the US, monetary gifts to qualified charities can be tax deductible for the giver, reducing taxable income, and effectively making large donations cheaper. However, these deductions are subject to certain limits and documentation requirements.

What are some financial gift-giving strategies?

Consider giving monetary gifts under the gift tax exclusion to avoid tax implications.

Married couples can give gifts on their spouse's behalf or as a unit, doubling the exclusion of taxable gifts.

Also note, one advantage to giving monetary gifts to help someone with tuition or medical bills is it's tax-free.

A cash gift for special occasions

Giving monetary gifts is a popular alternative to traditional wedding gifts, with many couples opting for cash registries.

In some cultures, money is given as a gift to brides and grooms, and sometimes in addition to other gifts.

Consider monetary gifts' cultural and personal significance when giving cash for special occasions.

Frequently asked questions

Do I have to pay taxes on the monetary gifts I receive?

In many countries, the gift receiver doesn't owe taxes on their gifts, but the giver may need to consider gift tax rules and reporting requirements. Check local regulations or a tax pro if the amount is large.

Is it impersonal or inappropriate to give money as a gift?

Opinions vary. Some people think giving money is a great gift and love the freedom money gives, while others prefer a more personal, handpicked item. To add a personal touch, many recommend a heartfelt note or presenting the gift in a way that shows you put thought into it.

In conclusion

Monetary gifts are a great way to support loved ones and further philanthropic goals. Tax laws vary by country of residence and recipient’s location, but the principles are the same: Small gifts rarely trigger tax issues, but larger ones require reporting and may use up your estate and gift tax exemptions.

Educate yourself on the rules, consult professionals when needed, and plan ahead so your monetary gifts are a gesture of generosity without creating tax headaches.

Caryl Ramsey has years of experience assisting in bookkeeping, taxes, and customer service. She uses a variety of accounting software to set up client information, reconcile accounts, code expenses, run financial reports, and prepare tax returns. She is also experienced in setting up corporations with the State Corporation Commission and the IRS and is a contributing writer to SUCCESS magazine.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple receipt capture methods: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad, and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports, including IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports, and more—with Shoeboxed.

Try Shoeboxed today!